What are Payment Banks? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are Payment Banks?

Medium⏱️ 7 min read

economy

📖 Introduction

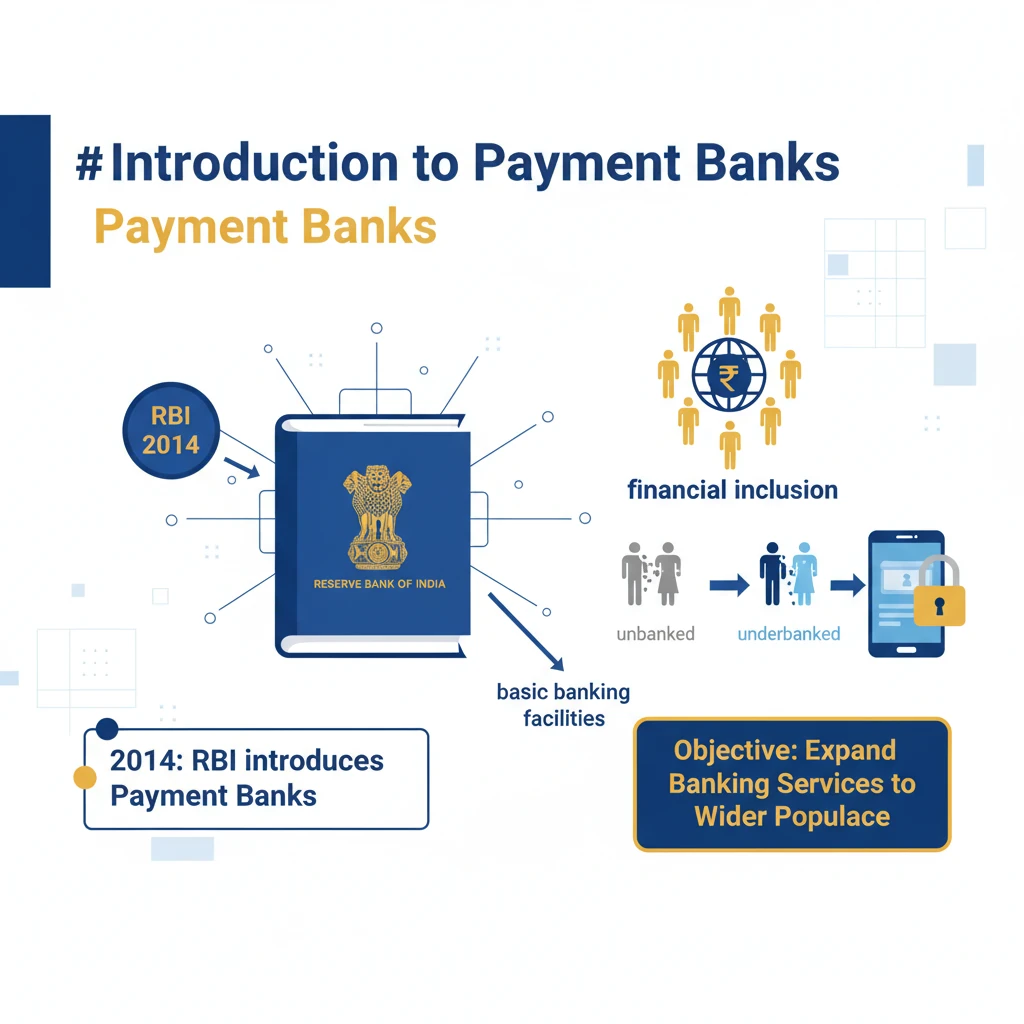

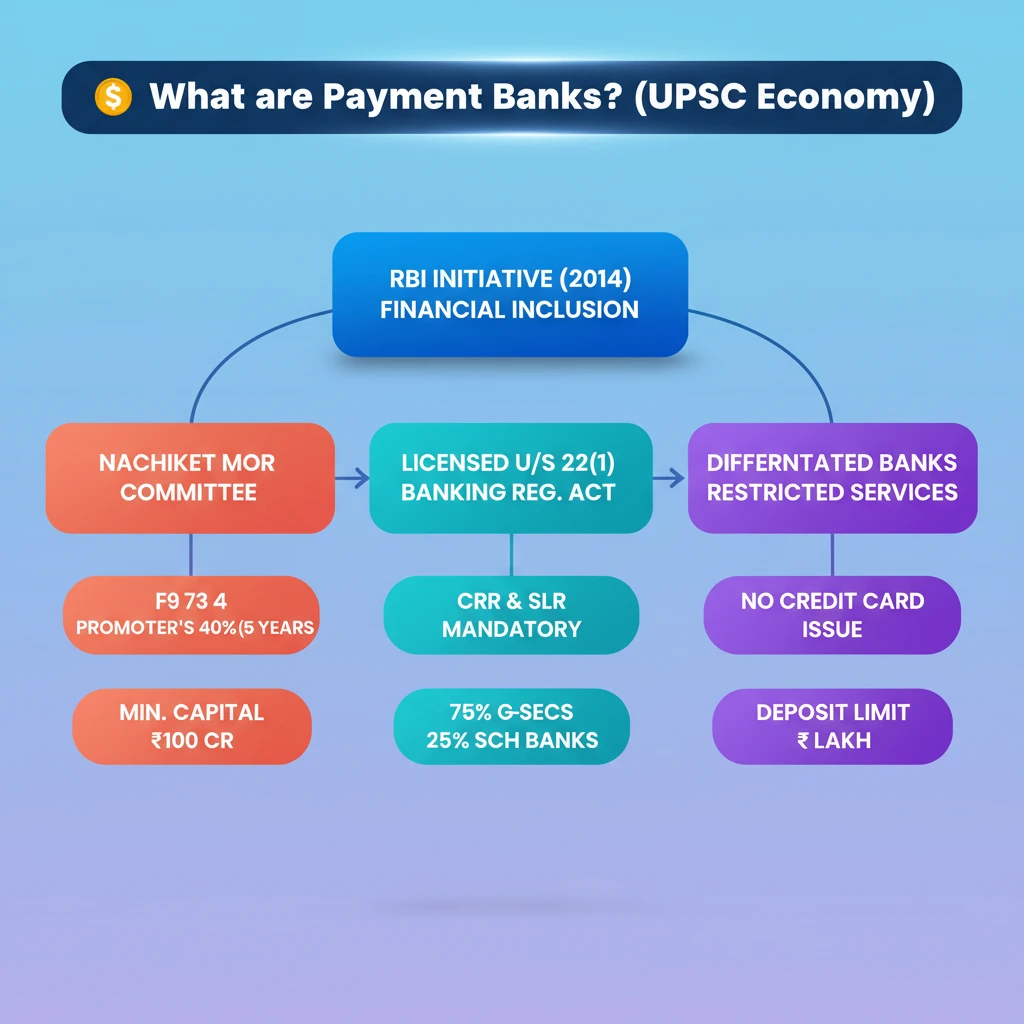

<h4>Introduction to Payment Banks</h4><p><strong>Payment Banks</strong> are a specialized category of financial institutions introduced by the <strong>Reserve Bank of India (RBI)</strong> in <strong>2014</strong>. They represent a unique model designed to expand banking services to a wider populace.</p><p>Their primary objective is to foster <strong>financial inclusion</strong> by providing basic banking facilities to the <strong>unbanked</strong> and <strong>underbanked</strong> segments of society, especially in remote and rural areas.</p><h4>Origin and Recommendations</h4><p>The establishment of <strong>Payment Banks</strong> was a direct outcome of the recommendations put forth by the <strong>Nachiket Mor committee</strong>. This committee was constituted by the <strong>RBI</strong> to comprehensively examine financial services for <strong>small businesses</strong> and <strong>low-income households</strong>.</p><div class='key-point-box'>The committee's insights highlighted the need for a differentiated banking approach to cater specifically to these underserved groups, leading to the creation of Payment Banks.</div><h4>Licensing Framework</h4><p><strong>Payment Banks</strong> are officially licensed under <strong>Section 22 (1) of the Banking Regulation Act, 1949</strong>. This legal framework grants them the authority to operate within India's banking system.</p><p>They fall under the <strong>differentiated bank license</strong> category, which means they are restricted from offering the full spectrum of services provided by conventional commercial banks. The <strong>RBI</strong> grants two main types of banking licenses: <strong>universal bank licenses</strong> and <strong>differentiated bank licenses</strong>.</p><div class='exam-tip-box'>Understanding the 'differentiated' nature is crucial for <strong>UPSC</strong>. It implies a focused mandate and specific operational limitations compared to universal banks.</div><h4>Key Features: Reserve Requirements</h4><p>Like other banks, <strong>Payment Banks</strong> are mandated to adhere to certain reserve requirements to ensure financial stability and liquidity. They are required to maintain both the <strong>Cash Reserve Ratio (CRR)</strong> and the <strong>Statutory Liquidity Ratio (SLR)</strong>.</p><div class='info-box'><ul><li><strong>SLR Investment:</strong> A minimum of <strong>75%</strong> of their <strong>demand deposit balances</strong> must be invested in <strong>Statutory Liquidity Ratio (SLR) eligible G-securities/T-bills</strong> with a maturity period of up to <strong>one year</strong>.</li><li><strong>Other Deposits:</strong> A maximum of <strong>25%</strong> of their demand deposit balances can be held in <strong>current and time/fixed deposits</strong> with other <strong>scheduled commercial banks</strong>, in addition to maintaining their <strong>CRR</strong> requirements.</li></ul></div><h4>Key Features: Capital Requirements</h4><p>To ensure a robust financial foundation, specific capital requirements have been stipulated for <strong>Payment Banks</strong>.</p><div class='info-box'><ul><li><strong>Minimum Paid-up Capital:</strong> The minimum required <strong>paid-up equity capital</strong> for a <strong>Payment Bank</strong> has been fixed at <strong>₹100 crore</strong>.</li><li><strong>Promoter's Contribution:</strong> The promoter's minimum initial contribution to the paid-up equity capital must be at least <strong>40%</strong>, and this contribution needs to be maintained for the <strong>first 5 years</strong> of the bank's operations.</li></ul></div>

💡 Key Takeaways

- •Payment Banks are specialized banks introduced by RBI in 2014 to promote financial inclusion.

- •They were established based on the recommendations of the Nachiket Mor committee.

- •Licensed under Section 22 (1) of the Banking Regulation Act, 1949, as differentiated banks with restricted services.

- •Required to maintain CRR and SLR; 75% of demand deposits in G-secs/T-bills (up to 1 year), 25% in other scheduled commercial banks.

- •Minimum paid-up equity capital is ₹100 crore; promoter's initial contribution is 40% for the first 5 years.

- •They cannot undertake lending activities, issue credit cards, or accept large deposits (currently capped at ₹2 lakh per customer).

- •Primary focus is on deposits, remittances, and payment services, often leveraging digital platforms.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) website - Guidelines for Licensing of Payments Banks

•Reports of the Nachiket Mor Committee (Committee on Comprehensive Financial Services for Small Businesses and Low-Income Households)