What is the Legal Status of Cryptocurrency in India? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is the Legal Status of Cryptocurrency in India?

Medium⏱️ 5 min read

economy

📖 Introduction

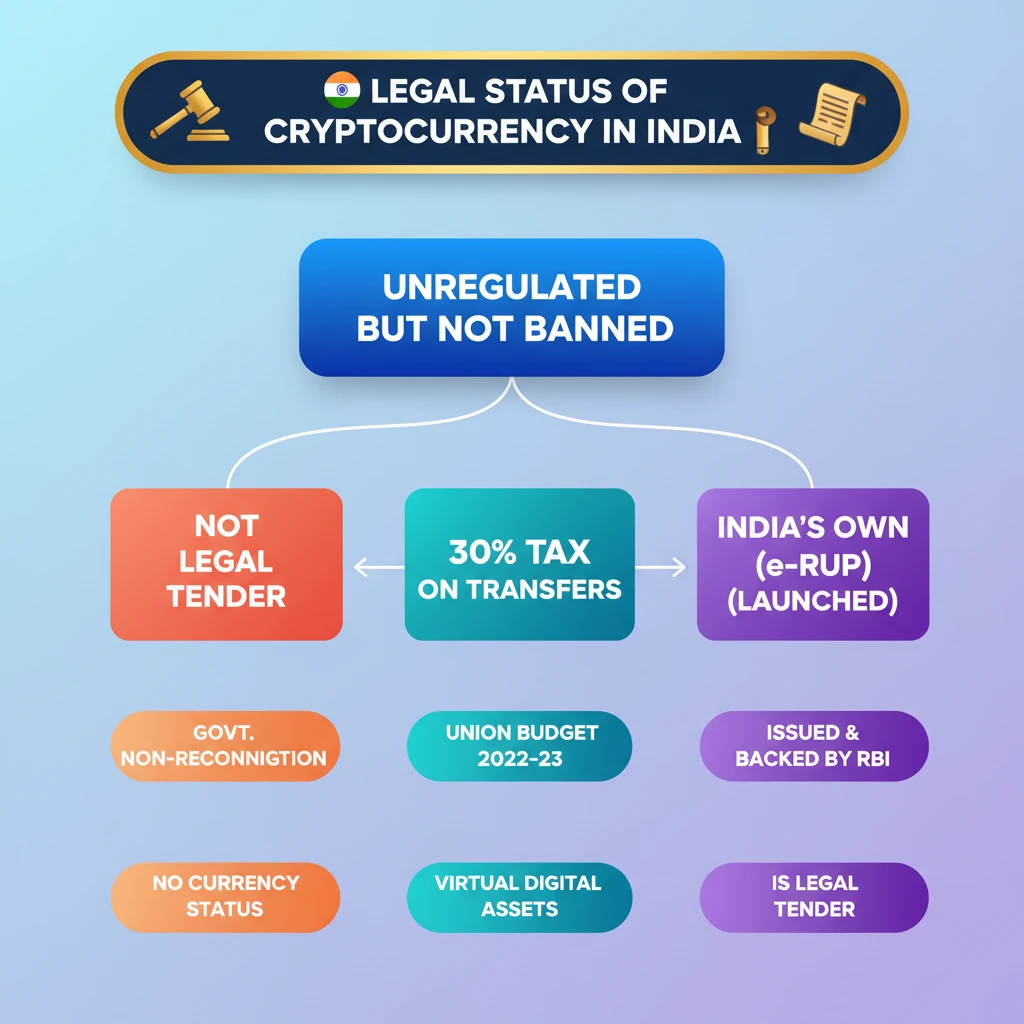

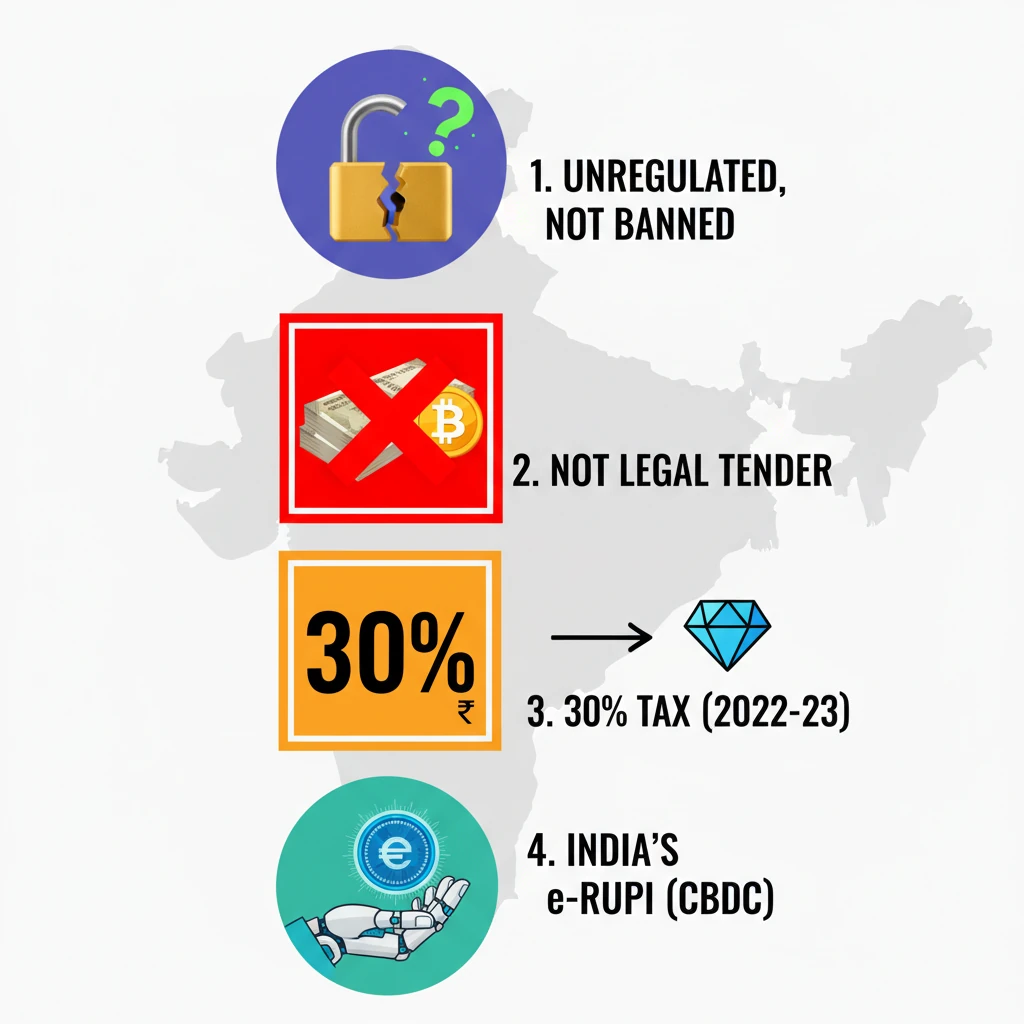

<h4>Legal Status of Cryptocurrency in India</h4><p>In <strong>India</strong>, the legal status of <strong>cryptocurrencies</strong> is characterized by a nuanced approach. They are currently <strong>unregulated</strong> but are <strong>not specifically banned</strong>. This means while there isn't a dedicated legal framework governing them, their existence and certain activities are not outright prohibited.</p><h4>Government Stance and Recognition</h4><p>The <strong>Government of India</strong> maintains that <strong>cryptocurrencies</strong> are <strong>not recognized as legal tender</strong>. This distinction is crucial, as it implies they cannot be used to discharge debts or make payments with statutory backing. The government also intends to address their potential use in <strong>financing illegal activities</strong>, treating such instances as a payment method for illicit transactions.</p><div class='key-point-box'><p><strong>Key Point:</strong> Cryptocurrencies are <strong>unregulated</strong>, <strong>not banned</strong>, but <strong>not legal tender</strong> in India.</p></div><h4>Taxation of Virtual Digital Assets</h4><p>A significant development occurred in <strong>2022</strong>. During the <strong>Union Budget 2022-23</strong>, the government announced a specific tax regime for <strong>Virtual Digital Assets (VDAs)</strong>, which include cryptocurrencies. This move effectively acknowledges their existence for taxation purposes.</p><div class='info-box'><p><strong>Taxation Rule:</strong> The transfer of any <strong>virtual currency/cryptocurrency asset</strong> is subject to a <strong>30% tax deduction</strong>.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> The introduction of taxation, while not conferring legal tender status, signifies a de facto recognition of <strong>cryptocurrencies</strong> as assets. This can be a point of discussion in <strong>GS Paper III (Economy)</strong> questions.</p></div><h4>Introduction of Central Bank Digital Currency (CBDC)</h4><p>In parallel to its stance on private cryptocurrencies, India has launched its own <strong>Central Bank Digital Currency (CBDC)</strong>. This initiative is a significant step towards modernizing the country's financial infrastructure.</p><div class='info-box'><p><strong>India's CBDC:</strong> Known as the <strong>Digital Rupee</strong>, which the source text also refers to as <strong>‘e-RUPI’</strong>. It was launched by the <strong>National Payments Corporation of India (NPCI)</strong> in collaboration with various government bodies and partner banks.</p><ul><li><strong>Collaborating Entities:</strong> <strong>Department of Financial Services (DFS)</strong>, <strong>National Health Authority (NHA)</strong>, <strong>Ministry of Health and Family Welfare (MoHFW)</strong>, and partner banks.</li></ul></div><h4>CBDC vs. Cryptocurrencies: Key Distinctions</h4><p>While the concept of <strong>CBDCs</strong> was inspired by decentralized digital currencies like <strong>Bitcoin</strong>, they are fundamentally different. <strong>CBDCs</strong> are a digital form of a country's fiat currency, issued and backed by the central bank.</p><div class='key-point-box'><p><strong>Core Difference:</strong> <strong>CBDCs</strong> are <strong>legal tenders</strong>, issued and backed by a <strong>central bank</strong>. <strong>Cryptocurrencies</strong> operate in a <strong>regulatory vacuum</strong> and lack state backing or legal tender status.</p></div><p>The <strong>Digital Rupee</strong> or <strong>e-Rupee</strong> can be transacted using wallets, often leveraging <strong>blockchain technology</strong>. This provides a secure and efficient medium for digital transactions.</p>

💡 Key Takeaways

- •Cryptocurrencies in India are unregulated but not banned.

- •They are not recognized as legal tender by the government.

- •A 30% tax is levied on the transfer of virtual digital assets since Union Budget 2022-23.

- •India has launched its own Central Bank Digital Currency (CBDC), the Digital Rupee (e-RUPI).

- •CBDCs are legal tender, issued and backed by the central bank, unlike private cryptocurrencies.

🧠 Memory Techniques

95% Verified Content