Concerns Over Cess and Surcharges in India - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Concerns Over Cess and Surcharges in India

Medium⏱️ 8 min read

economy

📖 Introduction

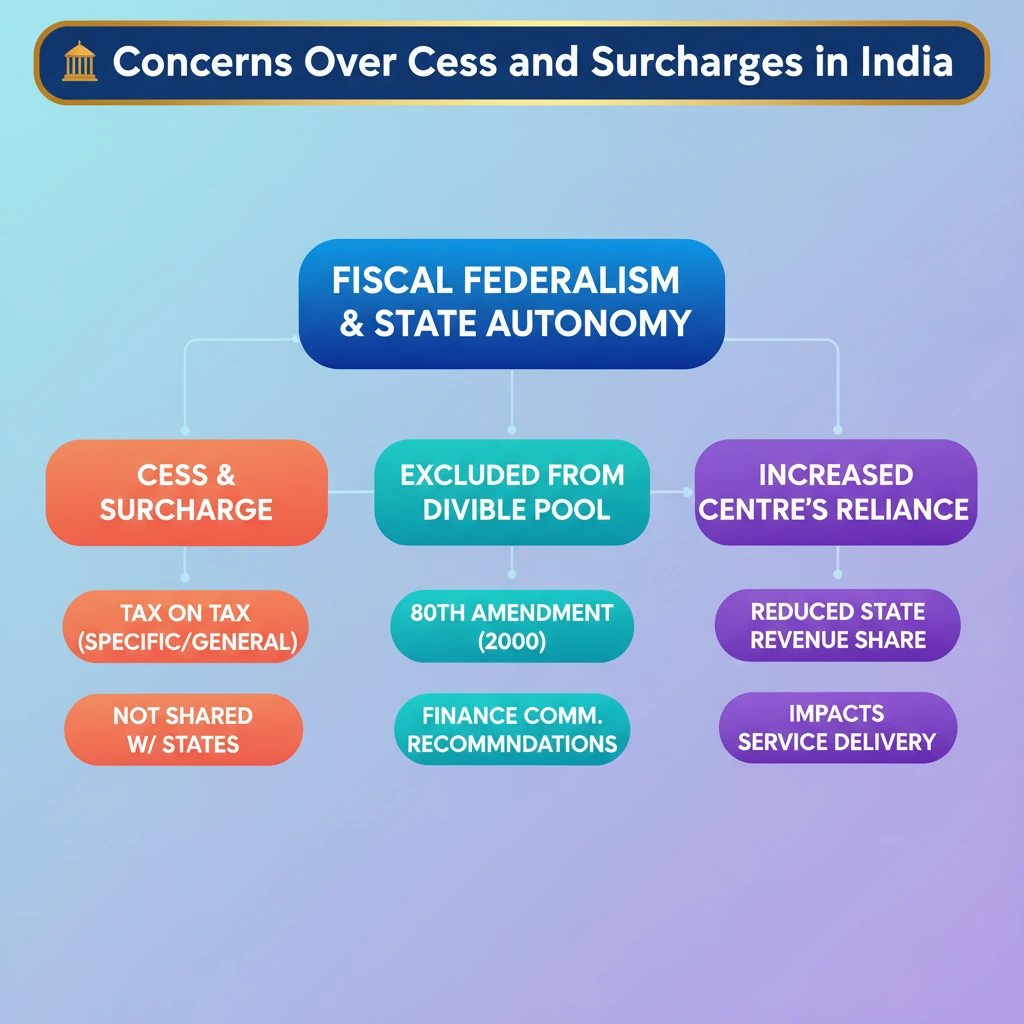

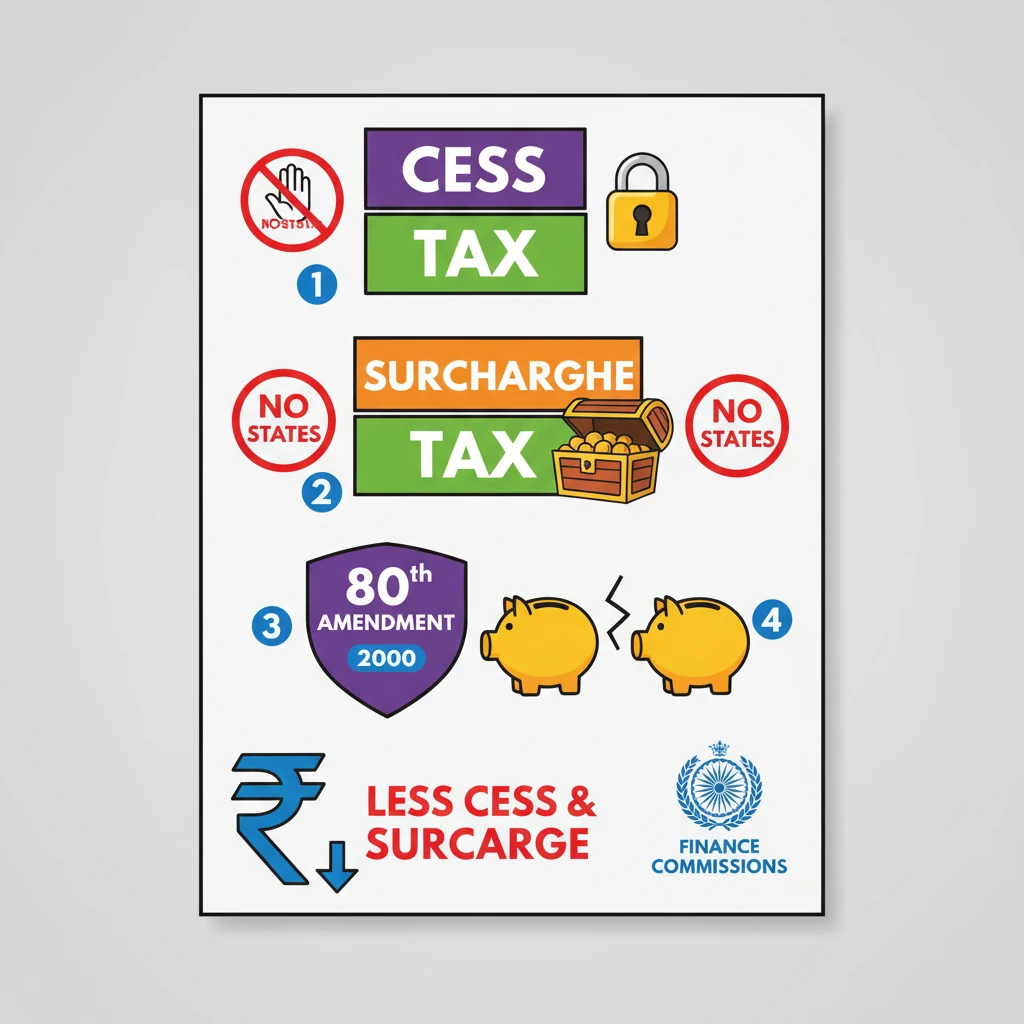

<h4>Introduction to Cess and Surcharges</h4><p>The issue of the <strong>Centre's increasing reliance on cesses and surcharges</strong> has recently been highlighted by <strong>Arvind Panagariya</strong>, the Chairman of the <strong>16th Finance Commission</strong>. He described this as a "complicated issue" due to its implications for fiscal federalism.</p><h4>Understanding Cess</h4><p>A <strong>Cess</strong> is a specific type of tax levied for a designated purpose. It is essentially a <strong>tax on tax</strong>, imposed in addition to existing taxes like excise or income tax.</p><div class='info-box'><ul><li><strong>Earmarked Revenue:</strong> The revenue collected from a cess is strictly earmarked for a particular use, meaning it cannot be used for any other purpose.</li><li><strong>Temporary Nature:</strong> Cesses are typically charged for a specific time period or until the government accumulates sufficient funds for its intended objective.</li></ul></div><p>An example of this is the <strong>Education Cess</strong>, which was levied to fund educational initiatives.</p><h4>Constitutional Basis for Cess</h4><p>Cesses are recognized under <strong>Article 270</strong> of the <strong>Indian Constitution</strong>, which outlines the revenue-sharing framework between the Union and States.</p><div class='key-point-box'><p>The <strong>80th Amendment</strong> formally amended <strong>Article 270</strong>. This amendment explicitly excludes <strong>cesses and surcharges</strong> from the <strong>divisible pool</strong> of taxes. Consequently, revenue from cesses is <strong>not shared with states</strong>.</p></div><h4>Understanding Surcharge</h4><p>A <strong>Surcharge</strong> is another form of additional tax or levy imposed on existing duties or taxes. Similar to a cess, it functions as a <strong>"tax on tax"</strong>.</p><div class='info-box'><ul><li><strong>Constitutional Basis:</strong> Surcharges are discussed under <strong>Articles 270 and 271</strong> of the <strong>Indian Constitution</strong>.</li><li><strong>Impact:</strong> Surcharges increase the overall tax liability, particularly for higher-income earners or specific sectors already subject to taxation.</li></ul></div><h4>Cess vs. Surcharge: Key Differences</h4><p>While both <strong>cess and surcharge</strong> are additional levies and go into the <strong>Consolidated Fund of India (CFI)</strong>, their usage differs significantly.</p><div class='info-box'><table class='info-table'><tr><th>Feature</th><th>Cess</th><th>Surcharge</th></tr><tr><td><strong>Purpose</strong></td><td>Earmarked for a specific purpose (e.g., education, infrastructure).</td><td>Can be spent like other general taxes for any government expenditure.</td></tr><tr><td><strong>Divisible Pool</strong></td><td>Excluded from the divisible pool; not shared with states.</td><td>Excluded from the divisible pool; not shared with states.</td></tr><tr><td><strong>Constitutional Articles</strong></td><td>Primarily <strong>Article 270</strong>.</td><td><strong>Articles 270 and 271</strong>.</td></tr></table></div><div class='exam-tip-box'><p>Understanding the distinction between <strong>cess and surcharge</strong> is crucial for <strong>UPSC Mains GS Paper 3 (Indian Economy)</strong>. Pay attention to their constitutional backing and impact on fiscal federalism.</p></div>

💡 Key Takeaways

- •Cess is a "tax on tax" for specific purposes, not shared with states.

- •Surcharge is also a "tax on tax," for general purposes, not shared with states.

- •The 80th Amendment (2000) formally excluded cesses and surcharges from the divisible pool.

- •Finance Commissions have recommended reducing the Centre's reliance on these levies.

- •Increasing reliance on cesses/surcharges raises concerns about fiscal federalism and state autonomy.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Indian Constitution (Articles 270, 271)

•Reports of 13th, 14th, 16th Finance Commissions