RBI Guidelines Related to Microfinance Lending (2022) - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

RBI Guidelines Related to Microfinance Lending (2022)

Medium⏱️ 8 min read

economy

📖 Introduction

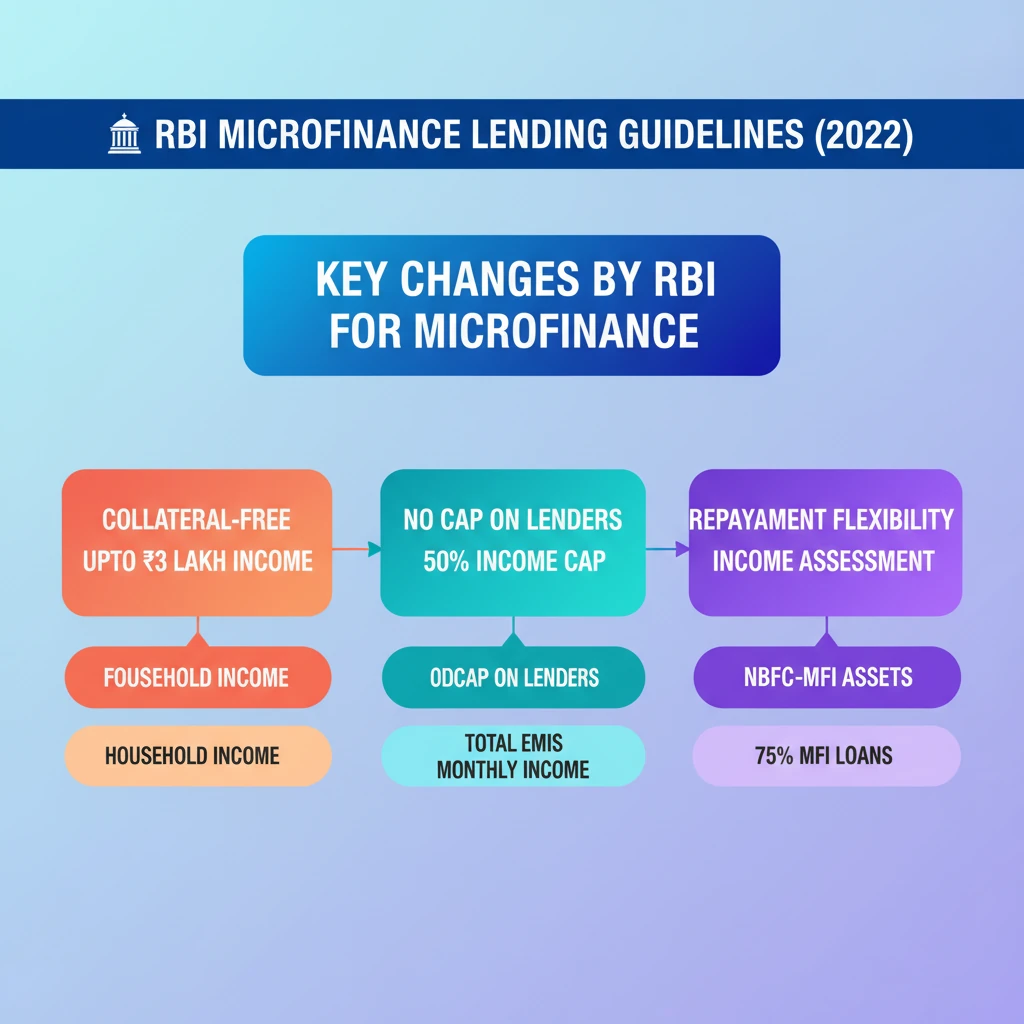

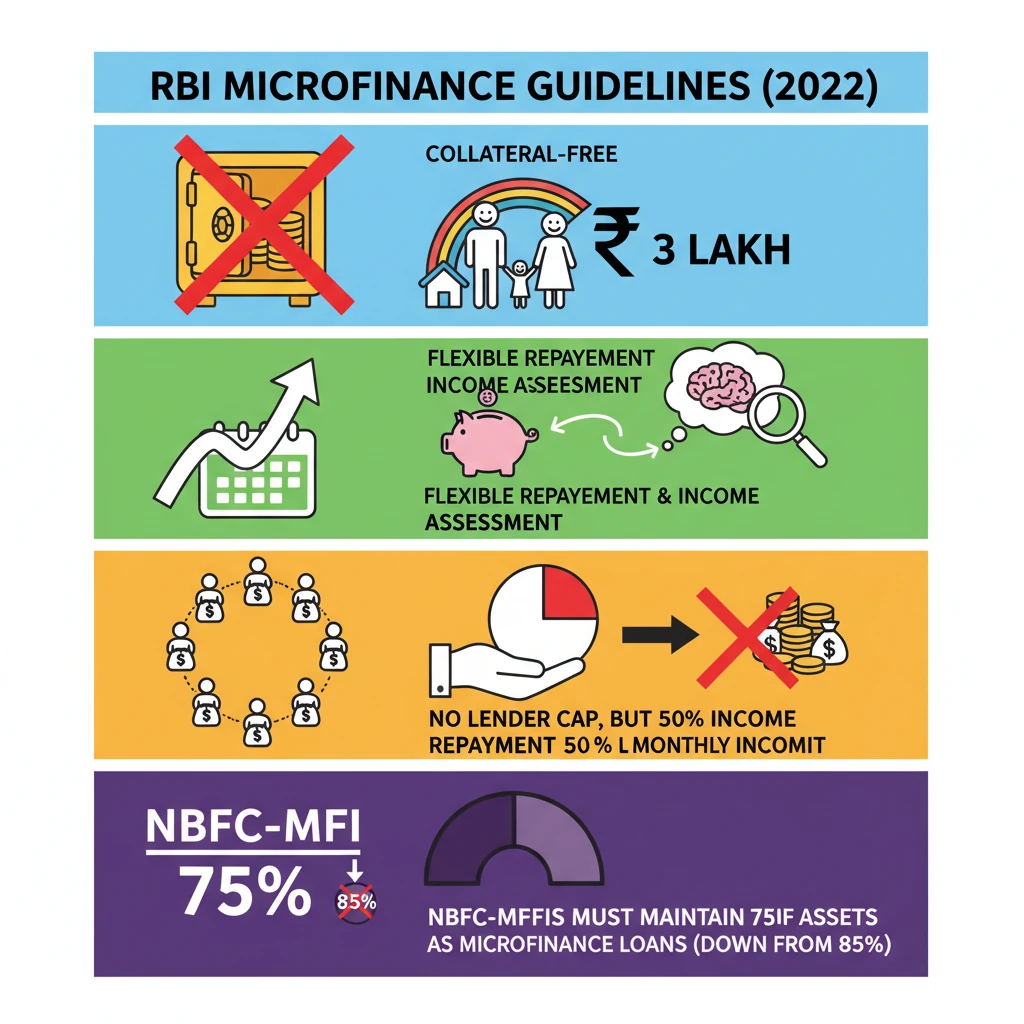

<h4>Introduction to RBI Microfinance Guidelines 2022</h4><p>The <strong>Reserve Bank of India (RBI)</strong> introduced comprehensive guidelines for <strong>microfinance lending</strong> in <strong>March 2022</strong>. These guidelines aimed to create a harmonized regulatory framework for all regulated entities involved in microfinance, promoting greater transparency and borrower protection.</p><p>The objective was to ensure a level playing field across different types of lenders, including <strong>NBFC-MFIs</strong>, banks, and other financial institutions, while safeguarding the interests of vulnerable borrowers.</p><div class='exam-tip-box'><p><strong>UPSC Relevance:</strong> These guidelines are crucial for <strong>GS Paper III (Indian Economy)</strong>, particularly topics related to <strong>financial sector reforms</strong>, <strong>financial inclusion</strong>, and the <strong>role of regulatory bodies</strong> like the RBI.</p></div><h4>Eligibility for Collateral-Free Loans</h4><p>The 2022 guidelines specify clear criteria for classifying a loan as <strong>microfinance</strong>. A key provision is that loans extended to households with a specific income ceiling are considered <strong>collateral-free</strong>.</p><div class='info-box'><p><strong>Income Threshold:</strong> Microfinance loans are defined as <strong>collateral-free</strong> loans extended to households with an annual income of up to <strong>Rs 3 lakh</strong>.</p></div><p>This threshold ensures that low-income households, who often lack traditional collateral, can access credit, thereby promoting <strong>financial inclusion</strong>.</p><h4>Flexible Repayment and Income Assessment</h4><p>Regulated entities are mandated to establish robust policies regarding <strong>repayment flexibility</strong> and thorough <strong>household income assessment</strong>. This ensures that repayment schedules are tailored to the borrower's capacity.</p><div class='key-point-box'><p><strong>Key Requirement:</strong> Lenders must formulate policies for <strong>flexible repayment options</strong> and undertake a comprehensive <strong>assessment of household income</strong> to prevent over-indebtedness.</p></div><p>Such policies are vital for maintaining the sustainability of microfinance operations and protecting borrowers from undue financial stress.</p><h4>Lender Cap and Repayment Limit</h4><p>A significant change introduced by the 2022 guidelines was the removal of the previous cap on the number of lenders a single borrower could access. However, a crucial limit on total repayment was introduced.</p><div class='info-box'><p><strong>New Norms:</strong></p><ul><li>The <strong>cap on lenders per borrower has been removed</strong>.</li><li>The total repayment obligation for all loans of a household <strong>cannot exceed 50% of its monthly household income</strong>.</li></ul></div><p>This <strong>50% repayment cap</strong> acts as a crucial safeguard against multiple lending and potential over-indebtedness, ensuring responsible lending practices.</p><h4>NBFC-MFI Portfolio Qualification</h4><p>The guidelines also revised the criteria for <strong>Non-Banking Financial Company - Microfinance Institutions (NBFC-MFIs)</strong> regarding the percentage of their loan portfolio that must qualify as microfinance.</p><div class='info-box'><p><strong>Portfolio Requirement:</strong> At least <strong>75%</strong> of an <strong>NBFC-MFI's total assets</strong> (excluding cash, bank balances, and money market instruments) must qualify as <strong>microfinance loans</strong>. This is a reduction from the previous requirement of <strong>85%</strong>.</p></div><p>This adjustment provides NBFC-MFIs with slightly more flexibility in managing their asset portfolios while still ensuring their primary focus remains on microfinance activities.</p><h4>Reporting Requirements</h4><p>To enhance transparency and data accuracy, regulated entities are now required to report specific financial information related to their borrowers.</p><div class='key-point-box'><p><strong>Mandatory Reporting:</strong> Entities must report any <strong>income discrepancies</strong> identified during their assessment and regularly update records of the <strong>household income</strong> of their borrowers.</p></div><p>This reporting mechanism helps the RBI monitor the sector effectively and ensures that lending practices remain aligned with the spirit of the guidelines.</p><h4>Pre-payment and Late Fee Norms</h4><p>Borrower protection is further strengthened by specific rules regarding pre-payment penalties and late fees. These norms aim to make microfinance more borrower-friendly.</p><div class='info-box'><p><strong>Borrower-Friendly Norms:</strong></p><ul><li>There shall be <strong>no pre-payment penalties</strong> on microfinance loans.</li><li><strong>Late payment charges</strong>, if any, shall be applicable only on the <strong>overdue amount</strong> and not on the entire outstanding loan amount.</li></ul></div><p>These provisions reduce the financial burden on borrowers, encouraging timely repayments without punitive charges for early closure or excessive fees on partial delays.</p>

💡 Key Takeaways

- •Microfinance loans are now collateral-free for households with annual income up to Rs 3 lakh.

- •Lenders must implement policies for flexible repayment and robust household income assessment.

- •The cap on the number of lenders per borrower is removed, but total repayment cannot exceed 50% of monthly income.

- •NBFC-MFIs must maintain 75% of their assets as microfinance loans (down from 85%).

- •Entities are mandated to report income discrepancies and household income.

- •No pre-payment penalties are allowed, and late fees apply only to the overdue amount.

- •The guidelines aim for regulatory harmonization and enhanced borrower protection across all regulated entities.

🧠 Memory Techniques

100% Verified Content

📚 Reference Sources

•Economic Survey of India (relevant chapters on financial sector)

•Reputable financial news outlets (e.g., The Economic Times, Livemint) for policy analysis.