What is Base Erosion and Profit Shifting (BEPS)? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is Base Erosion and Profit Shifting (BEPS)?

Medium⏱️ 8 min read

economy

📖 Introduction

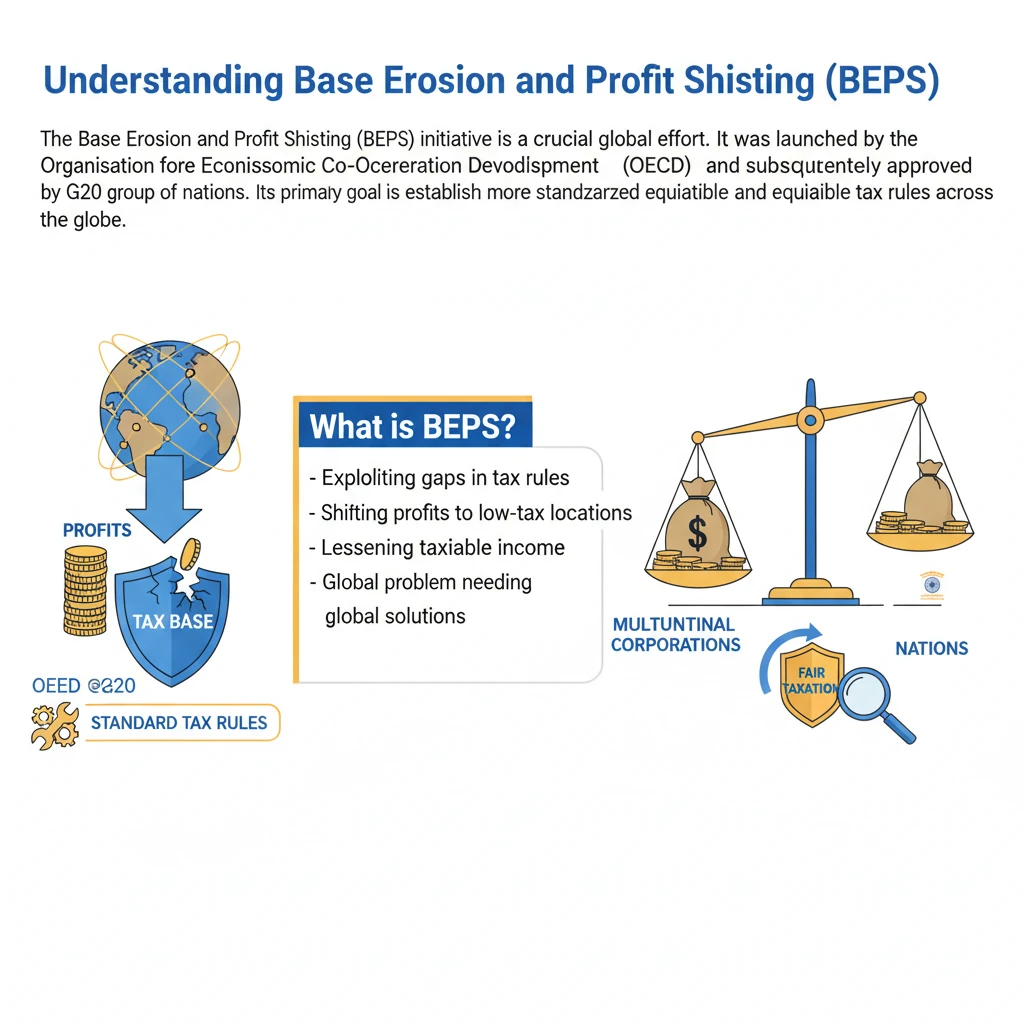

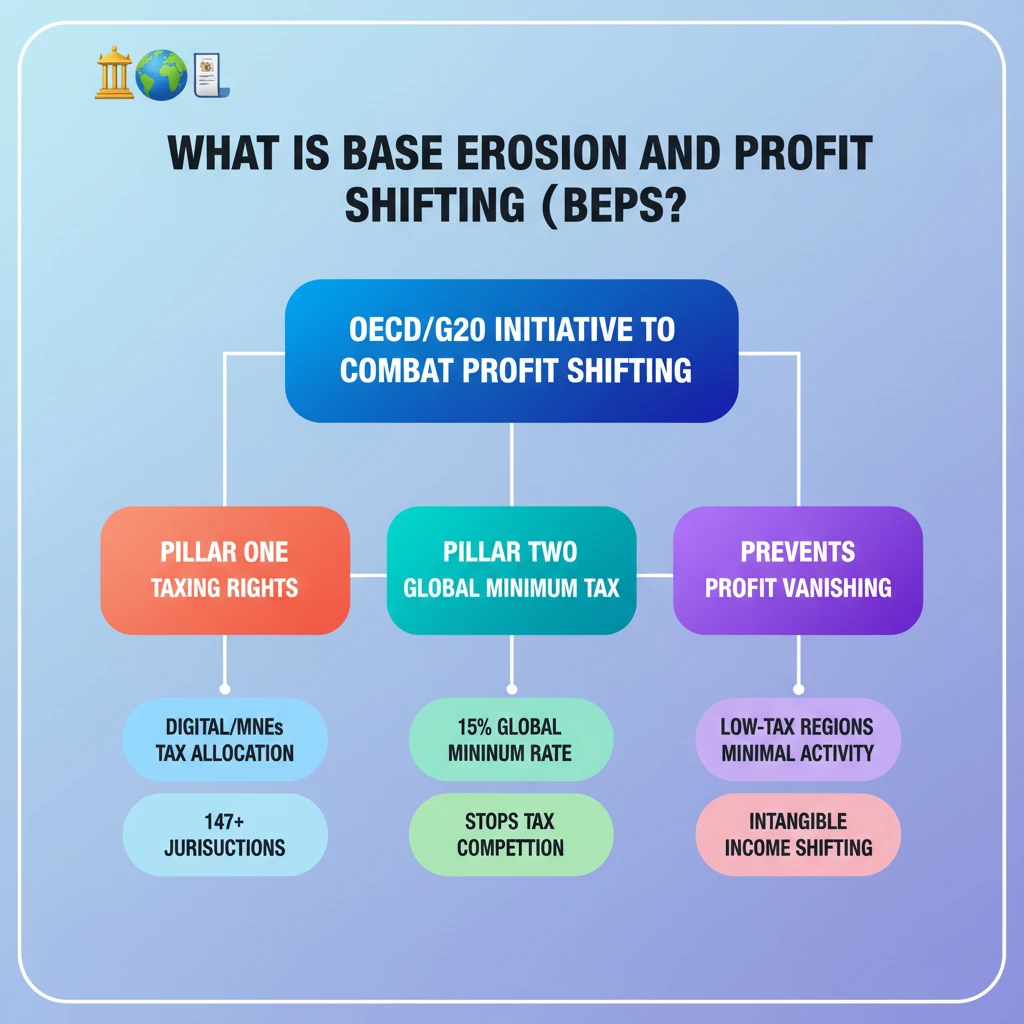

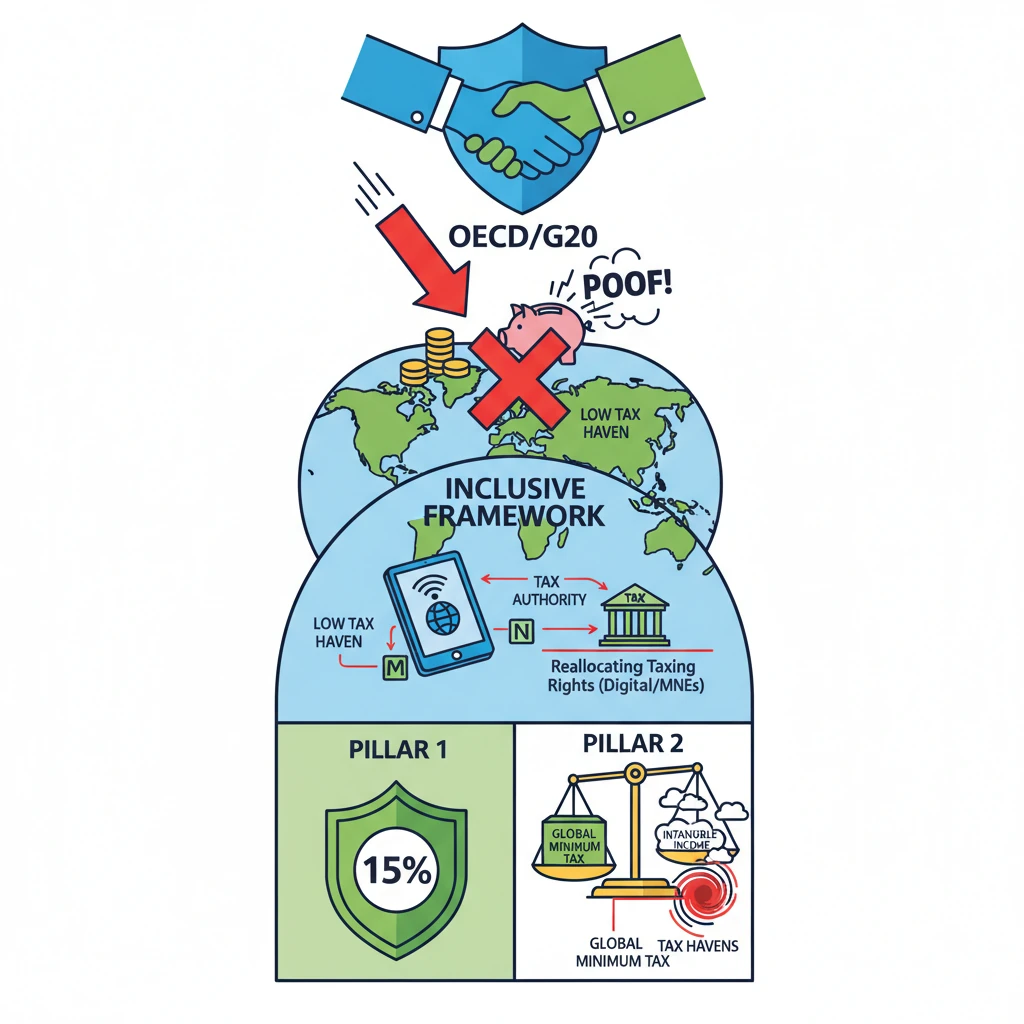

<h4>Understanding Base Erosion and Profit Shifting (BEPS)</h4><p>The <strong>Base Erosion and Profit Shifting (BEPS)</strong> initiative is a crucial global effort. It was launched by the <strong>Organisation for Economic Co-operation and Development (OECD)</strong> and subsequently approved by the <strong>G20</strong> group of nations. Its primary goal is to establish more standardized and equitable tax rules across the globe.</p><div class='info-box'><p><strong>What is BEPS?</strong></p><ul><li><strong>BEPS</strong> refers to tax planning strategies used by multinational enterprises (MNEs) that exploit gaps and mismatches in tax rules.</li><li>These strategies artificially shift profits to low or no-tax locations where there is little or no actual economic activity.</li></ul></div><h4>The Aim of BEPS</h4><p>The core objective of <strong>BEPS</strong> is to counter strategies that reduce overall corporate tax liability. This is achieved by making profits appear to vanish, or by moving them to jurisdictions with minimal real economic activity and low tax rates.</p><p>While often not strictly illegal, these <strong>BEPS tactics</strong> capitalize on variations and loopholes present in international tax regulations. This results in significant revenue losses for governments worldwide.</p><h4>The Inclusive Framework on BEPS</h4><p>To effectively combat tax avoidance, the <strong>OECD</strong> and <strong>G20</strong> established the <strong>Inclusive Framework on BEPS</strong> in <strong>2016</strong>. This framework represents a significant step towards global tax cooperation.</p><p>It currently unites <strong>147 countries and jurisdictions</strong>. Their collective aim is to combat tax avoidance and promote fairer, more equitable tax practices globally.</p><div class='key-point-box'><p><strong>Two Pillars of the Inclusive Framework:</strong></p><p>The Inclusive Framework operates on two main pillars, addressing different aspects of profit shifting:</p><ul><li><strong>First Pillar:</strong> Focuses on reallocating taxing rights for multinational and digital companies.</li><li><strong>Second Pillar:</strong> Aims to establish a global minimum corporate tax rate.</li></ul></div><h4>First Pillar: Reallocation of Profit</h4><p>The <strong>First Pillar</strong> specifically addresses the challenges of cross-border profit shifting by large <strong>multinational and digital companies</strong>. It seeks to ensure that profits are taxed where economic activities occur and value is created.</p><p>This pillar has the potential to reallocate over <strong>USD 100 billion annually</strong> in taxing rights to <strong>market jurisdictions</strong>. This means countries where goods or services are consumed, regardless of where the company is physically headquartered.</p><h4>Second Pillar: Global Minimum Corporate Tax</h4><p>The <strong>Second Pillar</strong> proposes the implementation of a <strong>global minimum corporate tax rate</strong>. This is a groundbreaking initiative designed to prevent harmful tax competition among countries.</p><div class='info-box'><p><strong>Current Proposal:</strong> The suggested global minimum corporate tax rate is <strong>15%</strong>. This rate aims to ensure that large multinational corporations pay a fair share of tax wherever they operate.</p></div><h4>What is the Global Minimum Tax (GMT)?</h4><p>The <strong>Global Minimum Tax (GMT)</strong> is a globally agreed minimum tax rate, currently proposed at <strong>15%</strong>. Its purpose is to mitigate tax base erosion without placing companies at a financial disadvantage compared to competitors.</p><p>Through <strong>GMT</strong>, leading nations aim to curb the practice of profit shifting by multinationals to low-tax jurisdictions. This applies irrespective of where their actual sales and revenue generation occur.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> The concept of <strong>GMT</strong> is highly relevant for <strong>GS Paper 3 (Economy)</strong>, particularly topics related to fiscal policy, international trade, and taxation. Understand its implications for India's tax revenues and investment climate.</p></div><p>There is a growing trend of companies moving income derived from <strong>intangibles</strong>, such as <strong>patents, software, and intellectual property (IP) royalties</strong>, to tax havens. This allows them to sidestep higher taxes in their home countries, a practice the GMT seeks to address.</p><h4>About the OECD</h4><p>The <strong>Organisation for Economic Co-operation and Development (OECD)</strong> is a key intergovernmental economic organization. It was founded in <strong>1961</strong> and plays a significant role in global economic policy discussions.</p><div class='info-box'><p><strong>OECD Headquarters:</strong> Paris, France 🇫🇷</p></div>

💡 Key Takeaways

- •BEPS is an OECD/G20 initiative to standardize global tax rules and combat profit shifting by MNEs.

- •It aims to prevent profits from 'vanishing' or moving to low-tax regions with minimal economic activity.

- •The Inclusive Framework (147+ jurisdictions) has two pillars: Pillar One (reallocating taxing rights for digital/multinational companies) and Pillar Two (global minimum corporate tax).

- •The Global Minimum Tax (GMT) is proposed at 15% to stop tax competition and prevent shifting of intangible income to tax havens.

- •OECD, founded in 1961 (Paris), is a key intergovernmental economic organization driving these reforms.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•OECD website (for BEPS details, Inclusive Framework, Pillars)

•G20 official communications (for approval of BEPS initiatives)