Need of Sovereign Wealth Fund for India - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Need of Sovereign Wealth Fund for India

Medium⏱️ 6 min read

economy

📖 Introduction

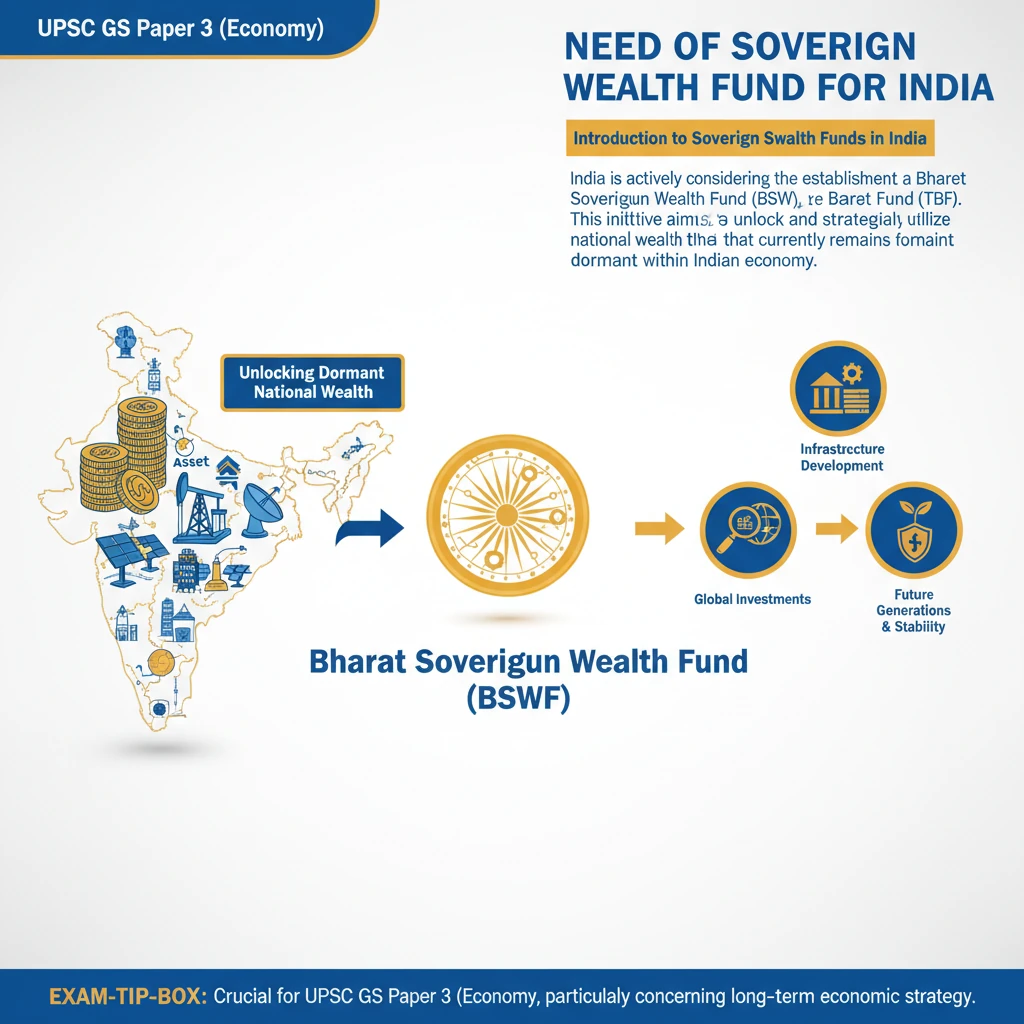

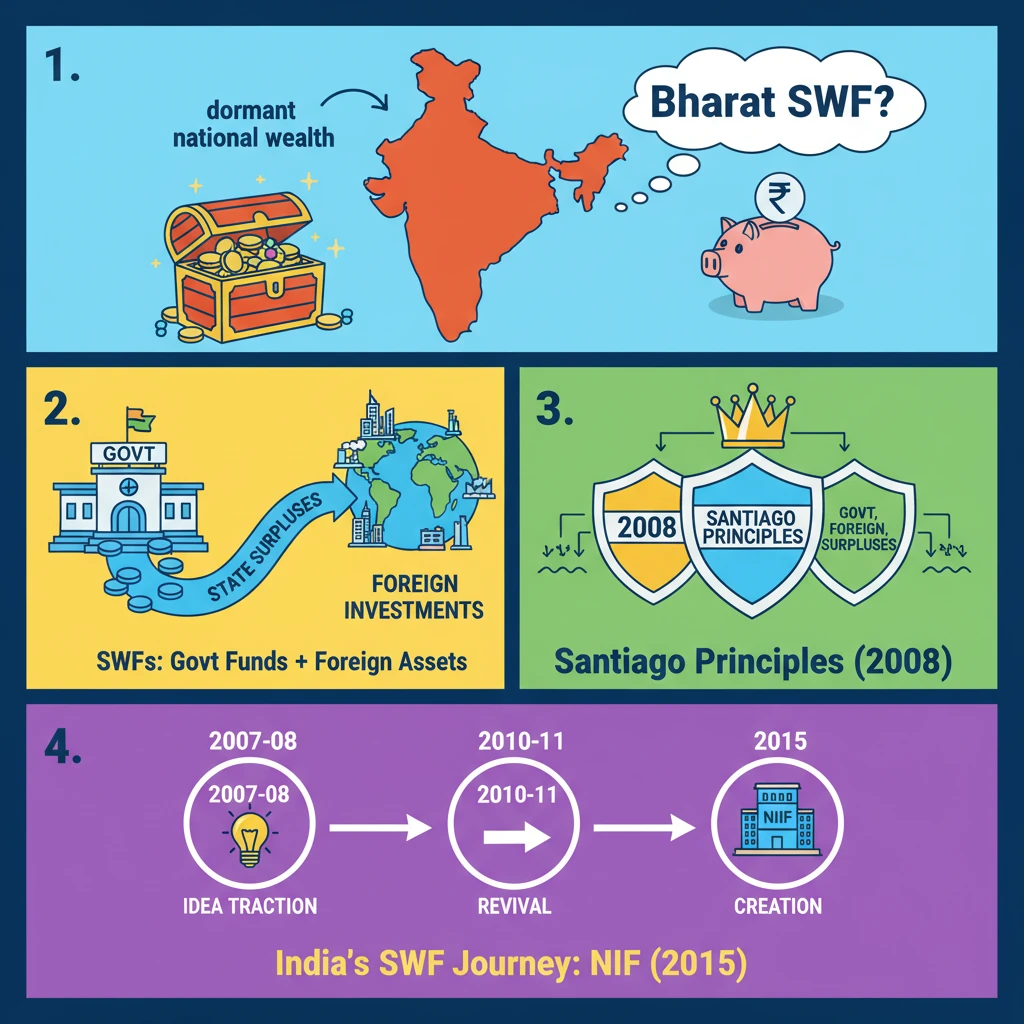

<h4>Introduction to Sovereign Wealth Funds in India</h4><p>India is actively considering the establishment of a <strong>Bharat Sovereign Wealth Fund (BSWF)</strong>, also referred to as <strong>The Bharat Fund (TBF)</strong>. This initiative aims to unlock and strategically utilize the substantial national wealth that currently remains dormant within the Indian economy.</p><div class='exam-tip-box'>This topic is crucial for <strong>UPSC GS Paper 3 (Economy)</strong>, particularly concerning long-term capital mobilization and investment strategies.</div><h4>What is a Sovereign Wealth Fund (SWF)?</h4><p>A <strong>Sovereign Wealth Fund (SWF)</strong> is a government-owned investment fund. These funds are typically established from a nation's surplus wealth, which can originate from various sources.</p><div class='info-box'><strong>Sources of SWF Funds:</strong><ul><li><strong>Natural Resources:</strong> Revenue generated from oil, gas, or mineral exports.</li><li><strong>Trade Surpluses:</strong> Excess funds accumulated from a country's favorable balance of trade.</li><li><strong>Budget Excesses:</strong> Government savings from budget surpluses.</li><li><strong>Foreign Exchange Reserves:</strong> Portions of a country's forex reserves.</li></ul></div><h4>Characteristics of Sovereign Wealth Funds</h4><p>The <strong>Santiago Principles 2008</strong> provide a globally recognized framework defining the key characteristics of SWFs. These principles ensure transparency and good governance.</p><div class='key-point-box'><strong>Key Characteristics of SWFs (as per Santiago Principles):</strong><ul><li><strong>Government Ownership:</strong> The fund must be owned by the general government, encompassing both central and sub-national governmental bodies.</li><li><strong>Foreign Financial Assets:</strong> A significant portion of its investments must be in foreign financial assets.</li><li><strong>State Surpluses:</strong> Funds are typically created from state surpluses, not borrowed capital.</li></ul></div><h4>Santiago Principles 2008 Explained</h4><p>The <strong>Santiago Principles</strong> comprise <strong>24 voluntary guidelines</strong> designed to promote best practices for SWFs. They emphasize crucial aspects such as transparency, robust governance, accountability, and prudent investment strategies.</p><div class='info-box'>The <strong>International Forum of Sovereign Wealth Funds (IFSWF)</strong>, a voluntary global organization of SWFs, established these principles in <strong>2008</strong>.</div><h4>Historical Context of SWF Discussions in India</h4><p>The idea of an SWF in India has surfaced multiple times, reflecting evolving economic conditions and policy priorities.</p><ol><li><strong>2007-08:</strong> The concept gained significant momentum due to a substantial surge in <strong>capital inflows</strong>, which exceeded <strong>USD 108 billion</strong> in a single year.</li><li><strong>Post-Global Financial Crisis 2008:</strong> The momentum for an SWF in India diminished following the global economic downturn.</li><li><strong>2010-11:</strong> The <strong>Planning Commission</strong> revitalized the SWF proposal, suggesting a fund of approximately <strong>USD 10 billion</strong>. Potential funding sources included foreign exchange reserves, Public Sector Undertakings (PSUs), or direct budget allocations.</li><li><strong>2015:</strong> India established the <strong>National Investment and Infrastructure Fund (NIIF)</strong>, which currently serves as the country's primary structured investment fund, aligning with some SWF objectives.</li></ol>

💡 Key Takeaways

- •India is considering a Bharat Sovereign Wealth Fund (BSWF) to utilize dormant national wealth.

- •SWFs are government-owned funds from state surpluses, investing in foreign financial assets.

- •The Santiago Principles (2008) define SWF characteristics: government ownership, foreign investments, state surpluses.

- •India's SWF idea gained traction in 2007-08, revived in 2010-11, and led to NIIF in 2015.

- •NIIF is India's main structured investment fund, focusing on infrastructure, similar to SWF objectives.

- •BSWF aims to unlock domestic capital for long-term strategic investments and economic growth.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•International Forum of Sovereign Wealth Funds (IFSWF) - Santiago Principles

•Reports from the Ministry of Finance, Government of India on NIIF