What are Financial Trends and Budgetary Estimates (2023-24 & 2024-25)? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are Financial Trends and Budgetary Estimates (2023-24 & 2024-25)?

Medium⏱️ 7 min read

economy

📖 Introduction

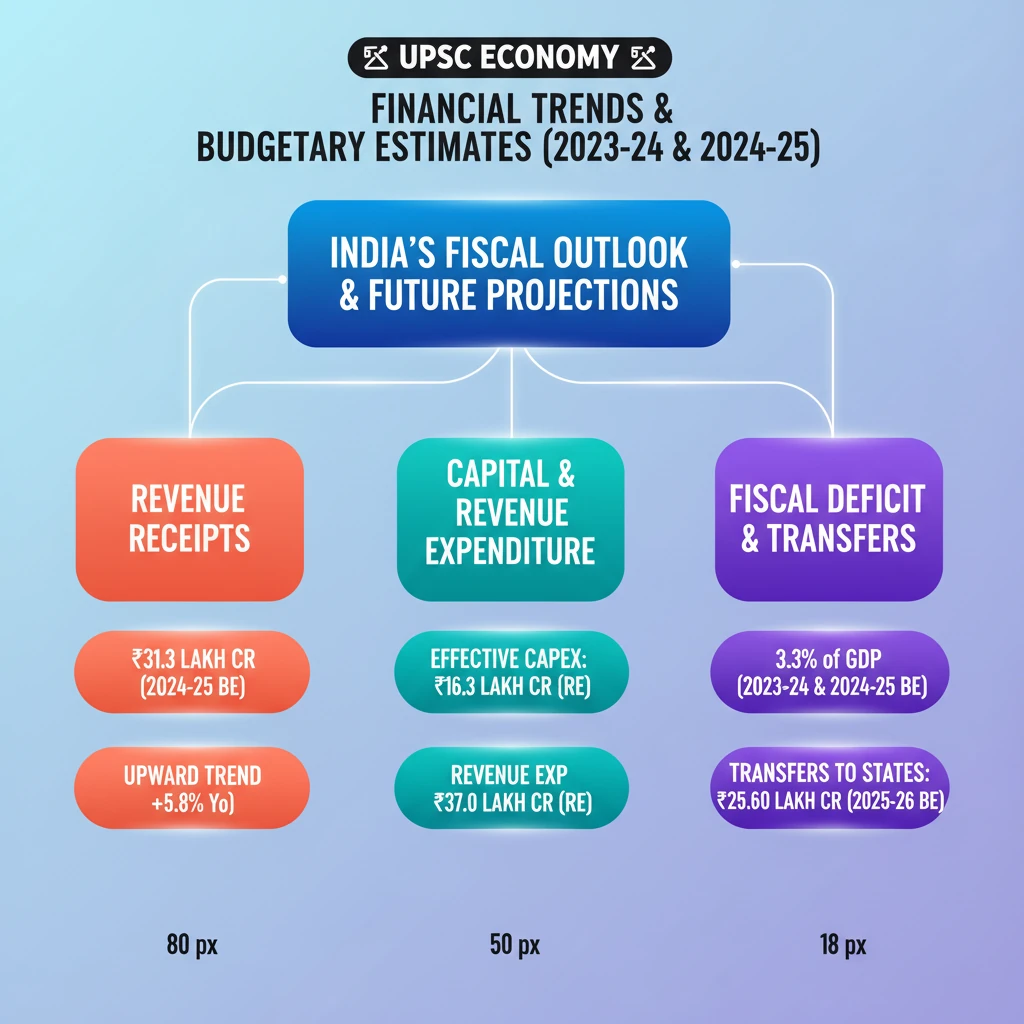

<h4>Understanding Financial Trends and Budgetary Estimates (2023-24 & 2024-25)</h4><p>The <strong>Union Budget</strong> is a crucial document that outlines the government's financial plans for the upcoming fiscal year. It includes projections for <strong>receipts</strong> and <strong>expenditure</strong>, reflecting the nation's economic health and policy direction.</p><div class='key-point-box'><p>Understanding <strong>Financial Trends</strong> involves analyzing the past and present performance of key economic indicators. <strong>Budgetary Estimates (BE)</strong> are initial projections for the next fiscal year, while <strong>Revised Estimates (RE)</strong> are updated figures based on actual performance during the current year.</p></div><h4>Key Financial Trends: Receipts and Expenditure Dynamics</h4><p>The government's financial health is primarily assessed through its <strong>receipts</strong> (money coming in) and <strong>expenditure</strong> (money going out). These figures are critical for understanding fiscal policy and economic management.</p><div class='info-box'><p><strong>Revenue Receipts:</strong></p><ul><li><strong>2023-24:</strong> ₹27.3 lakh crore</li><li><strong>2024-25 (BE):</strong> ₹31.3 lakh crore (projected increase)</li></ul></div><div class='info-box'><p><strong>Effective Capital Expenditure:</strong></p><ul><li><strong>Initial:</strong> ₹17.1 lakh crore</li><li><strong>Revised (RE):</strong> Fell to ₹16.3 lakh crore</li></ul></div><p><strong>Revenue expenditure</strong>, which covers the day-to-day running of the government, saw an increase. This category includes salaries, interest payments, and subsidies.</p><div class='info-box'><p><strong>Revenue Expenditure:</strong></p><ul><li><strong>Initial:</strong> ₹34.9 lakh crore</li><li><strong>Revised (RE):</strong> Increased to ₹37.0 lakh crore</li></ul></div><p><strong>Capital expenditure</strong>, which is vital for creating long-term assets like infrastructure, also saw significant changes between estimates.</p><div class='info-box'><p><strong>Capital Expenditure:</strong></p><ul><li><strong>Initial (BE):</strong> ₹12.5 lakh crore</li><li><strong>Projected (BE):</strong> Rose to ₹15.0 lakh crore</li><li><strong>Later Revised:</strong> ₹13.2 lakh crore</li></ul></div><h4>Deficit Trends as a Percentage of GDP</h4><p><strong>Deficits</strong> indicate the gap between government expenditure and receipts. Expressed as a percentage of <strong>Gross Domestic Product (GDP)</strong>, they provide a measure of fiscal health relative to the economy's size.</p><div class='info-box'><p><strong>Fiscal Deficit:</strong></p><ul><li><strong>2023-24:</strong> 3.3% of GDP</li><li><strong>2024-25 (BE):</strong> Remains unchanged at 3.3% of GDP</li></ul></div><p>The <strong>revenue deficit</strong> highlights the shortfall in revenue receipts compared to revenue expenditure, indicating the government's reliance on borrowing for its day-to-day operations.</p><div class='info-box'><p><strong>Revenue Deficit:</strong></p><ul><li><strong>2023-24:</strong> 0.3% of GDP</li><li><strong>2024-25 (RE):</strong> Increased slightly to 0.8% of GDP</li></ul></div><p>The <strong>effective revenue deficit</strong> is the revenue deficit minus grants for the creation of capital assets. It provides a more accurate picture of the deficit in the government's current account.</p><div class='info-box'><p><strong>Effective Revenue Deficit:</strong></p><ul><li><strong>2023-24:</strong> 0.3% of GDP</li><li><strong>2024-25 (RE):</strong> Stood at 0.8% of GDP</li></ul></div><h4>Total Transfers to States and Union Territories</h4><p><strong>Transfers to States and Union Territories (UTs)</strong> are a critical aspect of <strong>cooperative federalism</strong>, ensuring financial support and resource distribution across the country.</p><div class='info-box'><p><strong>Total Transfers to States & UTs:</strong></p><ul><li><strong>2023-24:</strong> ₹20.65 lakh crore</li><li><strong>2024-25 (RE):</strong> Revised to ₹22.76 lakh crore</li><li><strong>2025-26 (BE):</strong> Projected to increase further to ₹25.60 lakh crore</li></ul></div><div class='exam-tip-box'><p>UPSC often asks about the trend and implications of <strong>fiscal transfers</strong>. Note the consistent increase, which supports state-level development initiatives.</p></div><h4>Central Government's Net Receipts Breakdown</h4><p>Understanding the components of the central government's receipts is essential for analyzing its revenue-generating capacity and fiscal strategy.</p><p>The <strong>net tax revenue</strong> is the portion of taxes collected by the Centre after devolution to states. This forms the largest part of the government's income.</p><div class='info-box'><p><strong>Net Tax Revenue (Central Government):</strong></p><ul><li><strong>2024-25 (RE):</strong> ₹28.4 lakh crore</li></ul></div><p><strong>Non-tax revenue</strong> includes income from sources other than taxes, such as dividends from public sector undertakings, interest receipts, and services provided by the government.</p><div class='info-box'><p><strong>Non-Tax Revenue:</strong></p><ul><li><strong>2024-25 (RE):</strong> ₹5.8 lakh crore</li></ul></div><p><strong>Non-debt capital receipts</strong> are crucial for the government as they do not add to the national debt. These primarily include proceeds from <strong>disinvestment</strong> and <strong>recoveries of loans</strong>.</p><div class='info-box'><p><strong>Non-Debt Capital Receipts:</strong></p><ul><li><strong>2024-25 (RE):</strong> ₹0.8 lakh crore (including disinvestment proceeds and loan recoveries)</li></ul></div>

💡 Key Takeaways

- •Revenue receipts projected to rise to ₹31.3 lakh crore (2024-25 BE).

- •Effective capital expenditure revised to ₹16.3 lakh crore (RE).

- •Revenue expenditure increased to ₹37.0 lakh crore (RE).

- •Fiscal deficit maintained at 3.3% of GDP for both 2023-24 and 2024-25 (BE).

- •Transfers to States & UTs show a consistent increase, reaching ₹25.60 lakh crore (2025-26 BE).

- •Net tax revenue for Centre at ₹28.4 lakh crore (2024-25 RE), with ₹0.8 lakh crore from non-debt capital receipts.

🧠 Memory Techniques

95% Verified Content