Digital Public Infrastructure (DPI): RBI's ULI & Financial Inclusion - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Digital Public Infrastructure (DPI): RBI's ULI & Financial Inclusion

Medium⏱️ 8 min read

economy

📖 Introduction

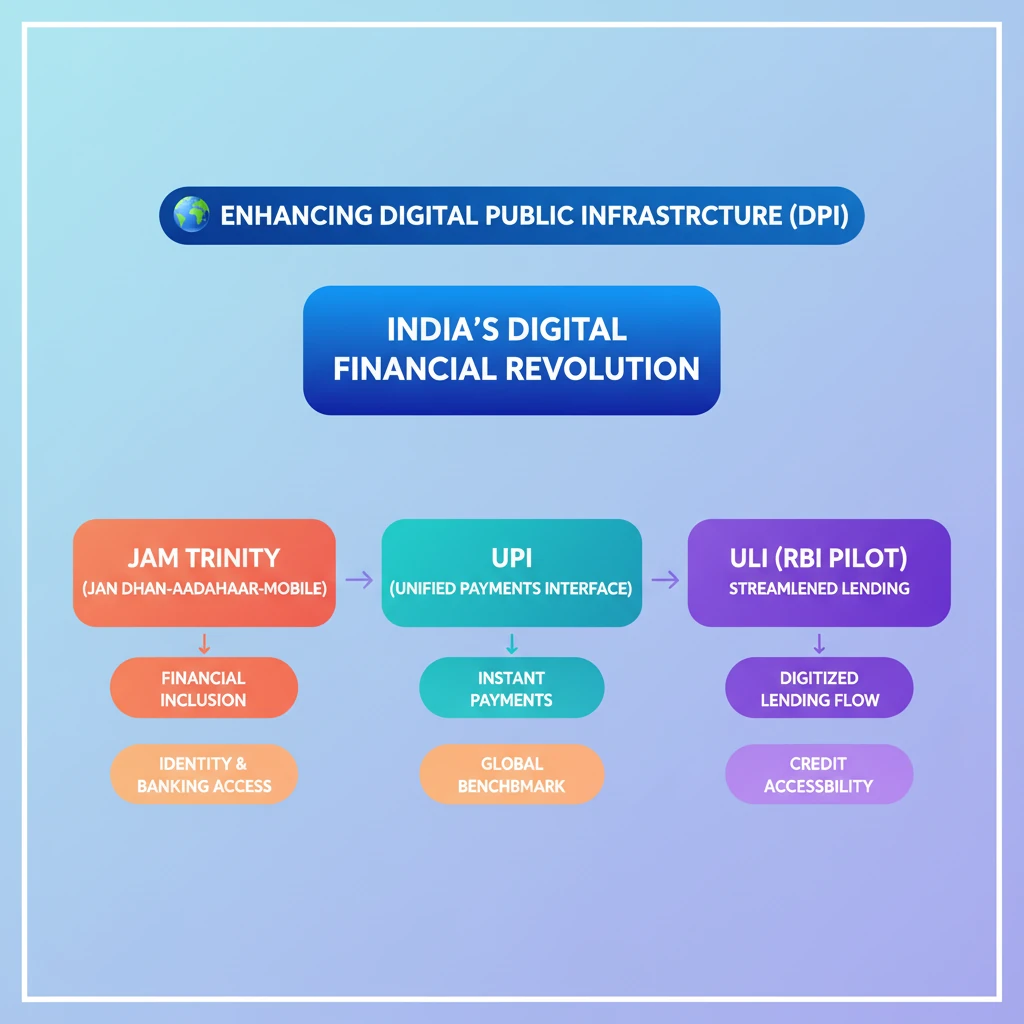

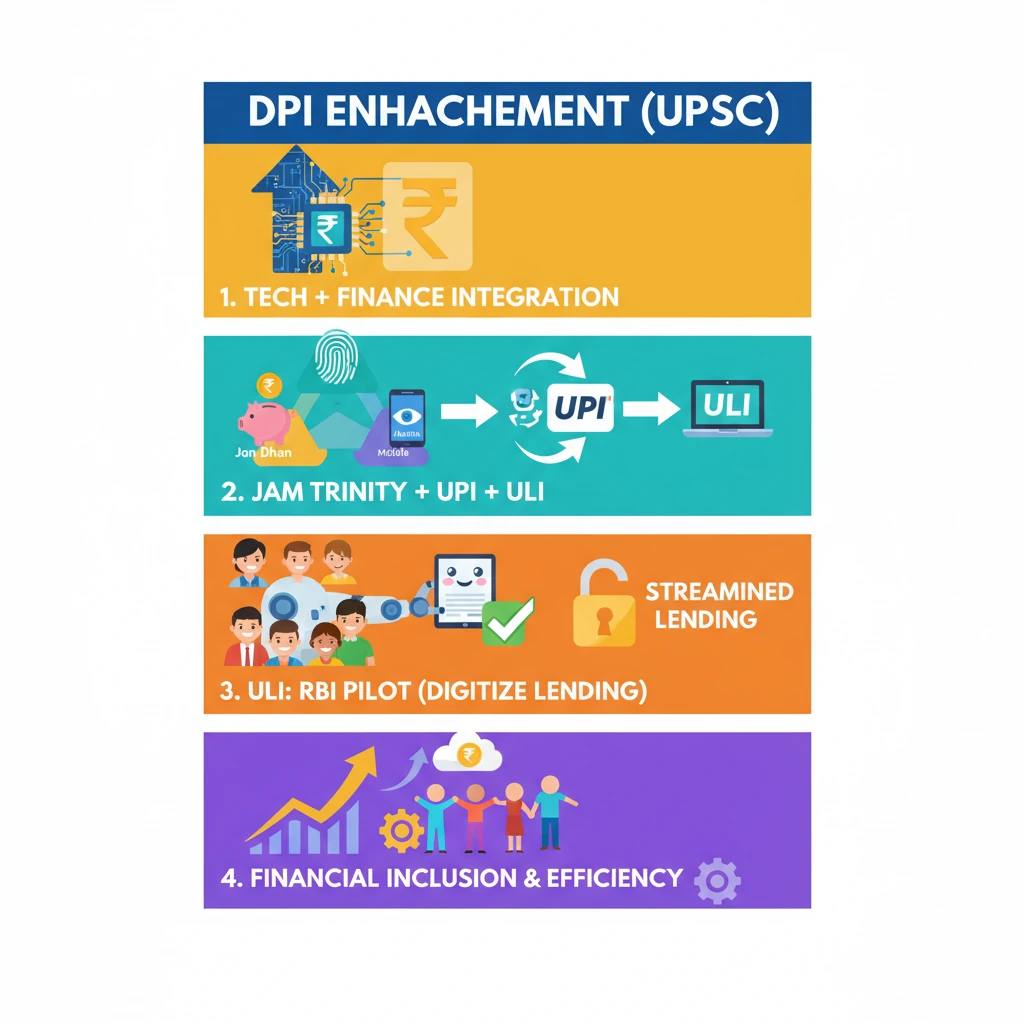

<h4>Introduction to Digital Public Infrastructure (DPI) Enhancement</h4><p>The enhancement of <strong>Digital Public Infrastructure (DPI)</strong> has been identified as a critical priority. This focus underscores its role as a primary catalyst for integrating advanced technologies into India’s financial system.</p><div class='key-point-box'><p><strong>DPI</strong> acts as a foundational layer, enabling seamless digital transactions and data exchange across various sectors. Its robust development is crucial for future economic growth.</p></div><h4>Key Initiatives and Components</h4><p>The <strong>Reserve Bank of India (RBI)</strong> has been at the forefront of this enhancement, piloting significant projects. One such initiative is the <strong>Unified Lending Interface (ULI)</strong>, which is slated for a full-scale launch soon.</p><div class='info-box'><p>The <strong>ULI</strong> project aims to streamline the lending process, making credit more accessible and efficient for individuals and businesses across the country.</p></div><p>This new initiative, <strong>ULI</strong>, is designed to integrate seamlessly with existing powerful digital platforms. These include the widely successful <strong>JAM (Jan Dhan-Aadhaar-Mobile) trinity</strong> and the <strong>Unified Payments Interface (UPI)</strong>.</p><p>The synergistic combination of <strong>ULI</strong> with <strong>JAM</strong> and <strong>UPI</strong> signifies a transformative period. It marks the beginning of a new era in <strong>India's financial journey</strong>, promising greater digital integration.</p><h4>Potential Impact and Benefits</h4><p>The comprehensive enhancement of <strong>DPI</strong> holds immense potential to revolutionize financial services throughout India. It is expected to drive significant improvements in how financial transactions are conducted.</p><div class='key-point-box'><p>A primary benefit of a strengthened <strong>DPI</strong> is the promotion of greater <strong>financial inclusion</strong>. This means extending access to financial services to a broader segment of the population, especially in underserved areas.</p></div><p>Furthermore, <strong>DPI</strong> enhancement is projected to significantly improve <strong>efficiency</strong> across the financial sector. This includes faster transaction processing, reduced costs, and improved service delivery.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the components (<strong>JAM, UPI, ULI</strong>) and benefits (<strong>financial inclusion, efficiency</strong>) of <strong>DPI</strong> is crucial for Mains GS-III, particularly topics related to <strong>Indian Economy</strong> and <strong>Digital India</strong> initiatives. Be prepared to discuss its role in economic development.</p></div>

💡 Key Takeaways

- •DPI enhancement is a key priority for integrating advanced technologies into India's financial system.

- •Key components of India's DPI include the JAM Trinity (Jan Dhan-Aadhaar-Mobile), UPI, and the upcoming ULI.

- •The Unified Lending Interface (ULI) is an RBI pilot project to streamline and digitize lending.

- •DPI aims to revolutionize financial services, driving greater financial inclusion and efficiency.

- •India's DPI model (e.g., UPI) is a global benchmark for digital transformation and economic development.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) official statements on ULI

•National Payments Corporation of India (NPCI) data on UPI

•Ministry of Finance reports on Jan Dhan Yojana and DBT