Evolution in Cross-Border Remittances - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Evolution in Cross-Border Remittances

Medium⏱️ 6 min read

economy

📖 Introduction

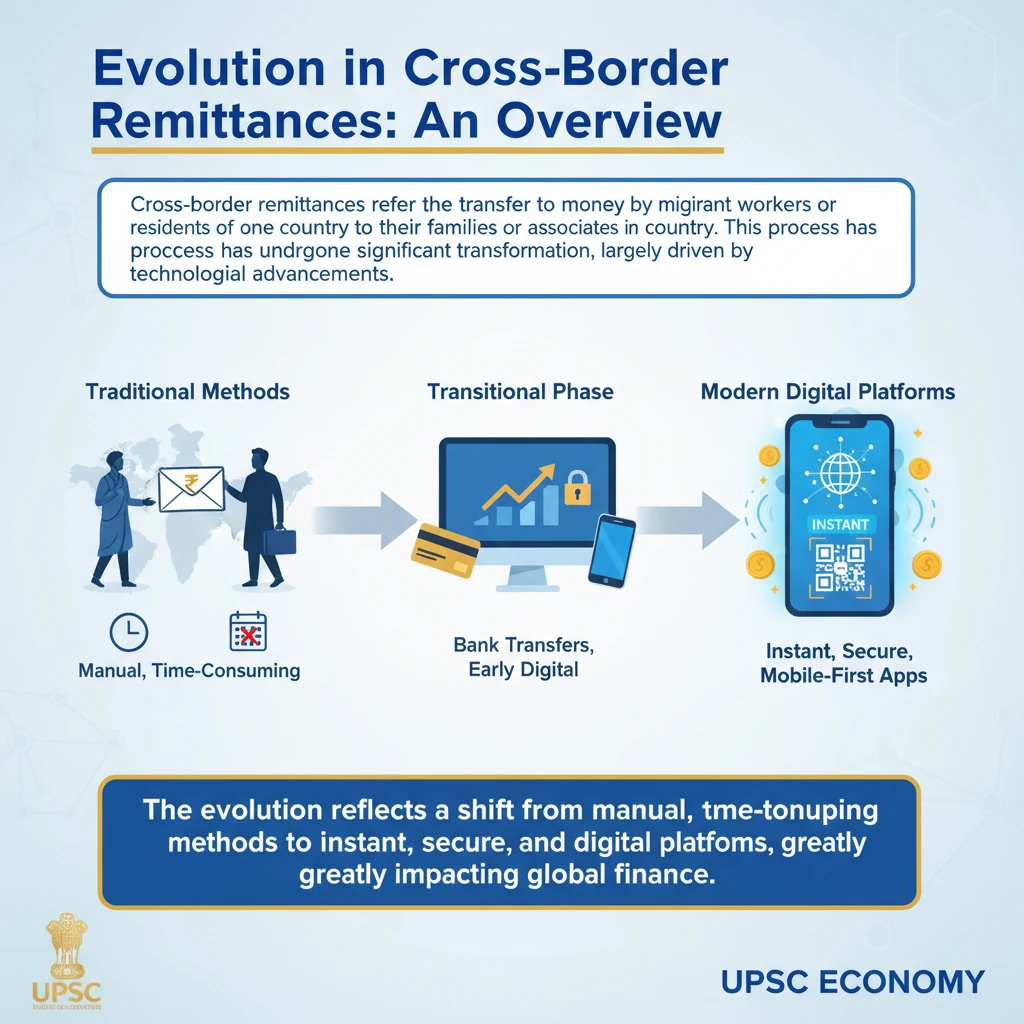

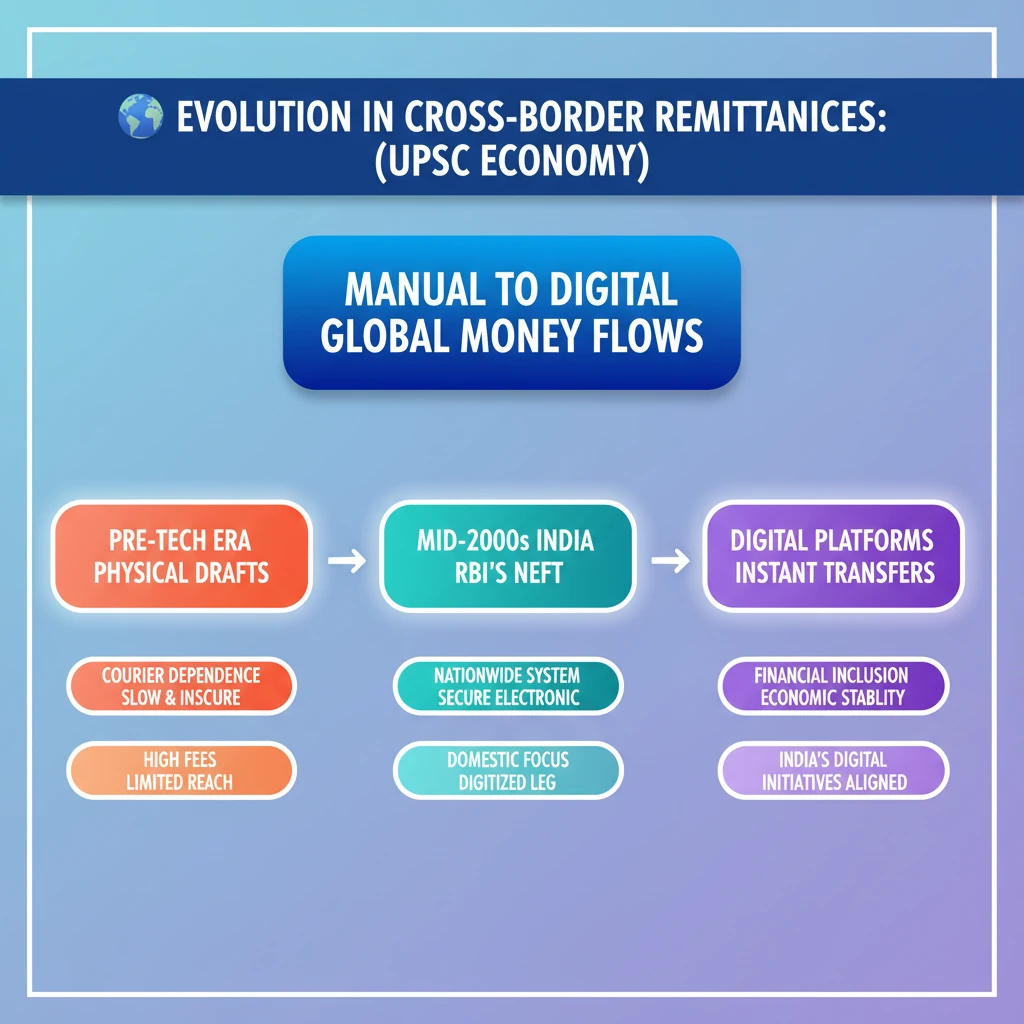

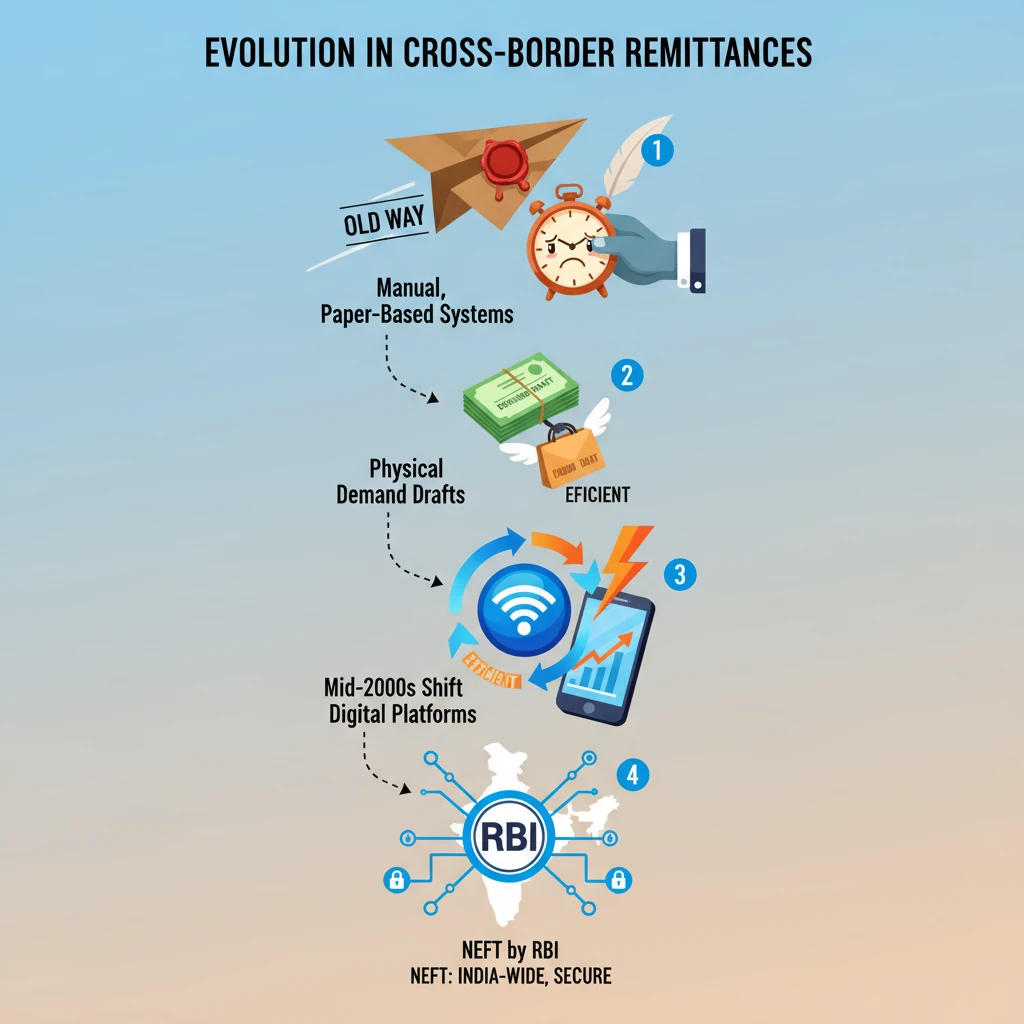

<h4>The Evolution of Cross-Border Remittances in India</h4><p>The landscape of <strong>cross-border remittances</strong> to India has undergone a significant transformation, driven primarily by technological advancements. This evolution has moved from traditional, time-consuming methods to instant, digital transfers, greatly benefiting <strong>Non-Resident Indians (NRIs)</strong> and the Indian economy.</p><div class='key-point-box'><p><strong>Remittances</strong> are funds sent by expatriates to their home country. India is one of the largest recipients of remittances globally, making their efficient transfer crucial.</p></div><h4>The Pre-Technology Era of Remittances</h4><p>Before the advent of widespread digital technology, the process of sending money to India was largely manual and slow. <strong>Non-Resident Indians (NRIs)</strong> relied on conventional banking instruments.</p><p>They typically used <strong>demand drafts</strong>, which were drawn on <strong>federal banks</strong>. These physical instruments then had to be dispatched to India, often through a <strong>courier service</strong>, for the recipient to encash them.</p><div class='info-box'><p><strong>Process in Pre-Tech Era:</strong></p><ul><li><strong>NRI</strong> obtains a <strong>demand draft</strong> from a bank.</li><li>The physical draft is sent to India via <strong>courier</strong>.</li><li>Recipient presents the draft to a bank for <strong>encashment</strong>.</li><li>This process was time-consuming and involved significant logistical effort.</li></ul></div><h4>Introduction of Online Remittances: NEFT</h4><p>The mid-2000s marked a pivotal shift with the launch of <strong>National Electronic Fund Transfer (NEFT)</strong>. This system introduced a secure and direct way to transfer funds digitally to bank accounts across India.</p><p><strong>NEFT</strong> revolutionized the process by eliminating the need for physical instruments and couriers, making transfers faster and more reliable.</p><div class='info-box'><p><strong>Key Facts about NEFT:</strong></p><ul><li><strong>Launched:</strong> Mid-2000s</li><li><strong>Purpose:</strong> Direct and secure transfers to accounts in India.</li><li><strong>Nature:</strong> Nation-wide centralised payment system.</li><li><strong>Ownership & Operation:</strong> <strong>Reserve Bank of India (RBI)</strong>.</li></ul></div><h4>Enhancing Speed with IMPS Integration</h4><p>Further improvements in remittance efficiency came with the introduction of the <strong>Immediate Payment Service (IMPS)</strong>. This service significantly reduced the time taken for fund credits.</p><p>Launched by the <strong>National Payments Corporation of India (NPCI)</strong>, <strong>IMPS</strong> enabled near real-time transfers, with credits typically completed in under <strong>3 minutes</strong>.</p><div class='info-box'><p><strong>IMPS Features:</strong></p><ul><li><strong>Launch:</strong> By <strong>NPCI</strong>.</li><li><strong>Speed:</strong> Credits completed in under <strong>3 minutes</strong>.</li><li><strong>Availability:</strong> 24x7, including holidays.</li><li><strong>Impact:</strong> Enhanced efficiency and immediacy of fund transfers.</li></ul></div><h4>Revolutionizing Remittances with UPI for FIR</h4><p>The latest and most significant innovation in cross-border remittances is the integration of the <strong>Unified Payments Interface (UPI)</strong> for <strong>Foreign Inward Remittance (FIR)</strong>. This has profoundly streamlined the entire process.</p><p><strong>UPI for FIR</strong> leverages the robust and user-friendly <strong>UPI</strong> platform, making it exceptionally easy for <strong>NRIs</strong> to send money directly to beneficiaries' <strong>UPI IDs</strong> or bank accounts in India.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understand the chronological evolution and the specific contributions of <strong>NEFT</strong>, <strong>IMPS</strong>, and <strong>UPI</strong>. Questions often test the features and impact of these payment systems on financial inclusion and economic growth. Focus on keywords like <strong>'centralised'</strong>, <strong>'immediate'</strong>, and <strong>'streamlined'</strong>.</p></div>

💡 Key Takeaways

- •Cross-border remittances evolved from slow, manual demand drafts to instant digital transfers.

- •NEFT (mid-2000s) introduced secure, direct online transfers operated by RBI.

- •IMPS (2010) by NPCI brought near real-time (under 3 mins) 24x7 transfers.

- •UPI for FIR (recent) revolutionized remittances, making them as simple as domestic UPI payments.

- •This evolution boosts India's digital economy, financial inclusion, and foreign exchange reserves.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) official publications on NEFT and IMPS

•National Payments Corporation of India (NPCI) official website for IMPS and UPI