Steps to Reform Regulatory Bodies - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Steps to Reform Regulatory Bodies

Medium⏱️ 15 min read

economy

📖 Introduction

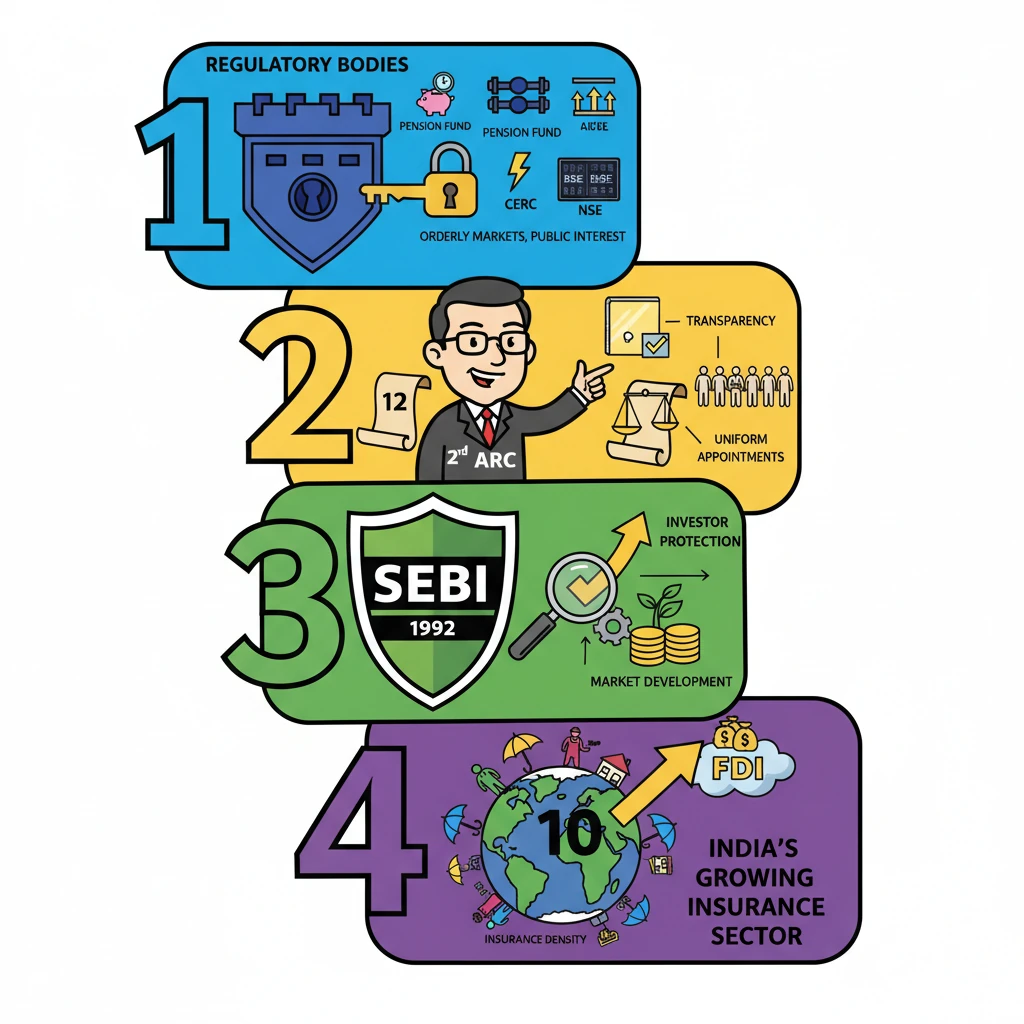

<h4>Introduction to Regulatory Bodies</h4><p><strong>Regulatory bodies</strong> are autonomous or semi-autonomous public authorities responsible for exercising autonomous authority over some area of human activity in a regulatory or supervisory capacity. They are crucial for maintaining order, fairness, and efficiency in various sectors of an economy.</p><p>These institutions ensure that markets operate smoothly, protect consumer interests, and promote sustainable growth. Their independence is vital for effective governance and preventing undue influence.</p><h4>Key Regulatory Bodies in India</h4><p>India has a diverse landscape of regulatory bodies, each with a specific mandate. Understanding their roles is fundamental for UPSC aspirants.</p><h5>Pension Fund Regulatory and Development Authority (PFRDA)</h5><p>The <strong>Pension Fund Regulatory and Development Authority (PFRDA)</strong> is a statutory body established to promote, develop, and regulate the pension sector in India. It plays a pivotal role in ensuring the security of retirement savings.</p><div class='info-box'><ul><li><strong>Oversight:</strong> The <strong>PFRDA</strong> primarily oversees the <strong>National Pension System (NPS)</strong>.</li><li><strong>Mandate:</strong> It is responsible for the overall development and regulation of the pension industry in India.</li></ul></div><h5>Petroleum and Natural Gas Regulatory Board (PNGRB)</h5><p>The <strong>Petroleum and Natural Gas Regulatory Board (PNGRB)</strong> was established to regulate the refining, processing, storage, transportation, distribution, marketing, and sale of petroleum, petroleum products, and natural gas.</p><div class='info-box'><ul><li><strong>Establishment:</strong> Set up under the <strong>PNGRB Act, 2006</strong>.</li><li><strong>Key Function:</strong> Sets <strong>technical and safety standards</strong> for petroleum, petroleum products, natural gas, and related infrastructure projects across the country.</li></ul></div><h5>Central Electricity Regulatory Commission (CERC)</h5><p>The <strong>Central Electricity Regulatory Commission (CERC)</strong> is a key regulator in India's power sector. It ensures fair competition and efficient operation within the electricity market.</p><div class='info-box'><ul><li><strong>Regulation:</strong> Regulates <strong>tariffs</strong> for Central Government-owned electricity generating companies.</li><li><strong>Oversight:</strong> Oversees their <strong>inter-State transmission</strong> of electricity, ensuring smooth power flow across states.</li></ul></div><h4>Recommendations for Regulatory Reforms: 2nd Administrative Reforms Commission (ARC)</h4><p>The <strong>2nd Administrative Reforms Commission (ARC)</strong> provided comprehensive recommendations to improve the functioning and effectiveness of regulatory bodies in India. These reports are crucial for understanding governance reforms.</p><h5>12th Report of the 2nd ARC Suggestions</h5><p>The <strong>12th Report of the 2nd ARC</strong> focused on making regulatory procedures more transparent and citizen-centric. Its suggestions aimed at reducing corruption and enhancing public trust.</p><div class='key-point-box'><ul><li><strong>Simplify Procedures:</strong> Advocate for simplifying, streamlining, and making regulatory procedures transparent.</li><li><strong>Citizen-Friendly:</strong> Emphasize making procedures citizen-friendly and less discretionary to reduce corruption.</li><li><strong>Strengthen Supervision:</strong> Recommend strengthening internal supervision and independent assessments of regulatory agencies.</li><li><strong>Promote Self-Regulation:</strong> Suggest promoting <strong>self-regulation</strong> in sectors like taxation and public health to ease enforcement burdens.</li></ul></div><h5>13th Report of the 2nd ARC Recommendations</h5><p>The <strong>13th Report of the 2nd ARC</strong> focused on structural and oversight improvements for regulatory bodies. These recommendations are critical for ensuring consistency and accountability.</p><div class='key-point-box'><ul><li><strong>Management Statement:</strong> Ministries should create a <strong>‘Management Statement’</strong> outlining regulators’ objectives and roles.</li><li><strong>Uniformity in Appointments:</strong> Ensure uniformity in the appointment, tenure, and removal of regulatory authorities for consistency and independence.</li><li><strong>Parliamentary Oversight:</strong> Strengthen <strong>parliamentary oversight</strong> of regulators through <strong>Standing Committees</strong> for enhanced accountability.</li></ul></div><h4>Securities and Exchange Board of India (SEBI)</h4><p>The <strong>Securities and Exchange Board of India (SEBI)</strong> is the primary regulator for the securities market in India. It plays a vital role in protecting investor interests and fostering market development.</p><h5>About SEBI</h5><div class='info-box'><ul><li><strong>Nature:</strong> <strong>SEBI</strong> is a <strong>Statutory Body</strong> (a Non-Constitutional body).</li><li><strong>Establishment:</strong> Established under the <strong>SEBI Act, 1992</strong>.</li><li><strong>Initial Constitution:</strong> It was initially constituted as a non-statutory body on <strong>April 12, 1988</strong>, through a Government of India resolution.</li><li><strong>Predecessor:</strong> Prior to <strong>SEBI</strong>, the <strong>Controller of Capital Issues</strong>, governed under the <strong>Capital Issues (Control) Act, 1947</strong>, was the regulatory authority for capital markets.</li><li><strong>Main Functions:</strong> To protect the interests of investors in securities and to promote and regulate the securities market in India.</li></ul></div><h5>SEBI's Structure</h5><p>The organizational structure of <strong>SEBI</strong> is designed to ensure effective governance and decision-making in the complex securities market.</p><div class='info-box'><ul><li><strong>Board Composition:</strong> <strong>SEBI’s board</strong> includes a <strong>Chairman</strong>, and other <strong>whole-time</strong>, and <strong>part-time members</strong>.</li><li><strong>Appeals Mechanism:</strong> The <strong>Securities Appellate Tribunal (SAT)</strong> handles appeals against <strong>SEBI’s decisions</strong>.</li><li><strong>SAT Powers:</strong> <strong>SAT</strong> possesses powers similar to those of a <strong>civil court</strong>, ensuring judicial review of regulatory orders.</li></ul></div><h5>Key Responsibilities of SEBI</h5><p><strong>SEBI</strong> carries out a broad range of responsibilities to maintain a fair and efficient securities market. These functions are critical for market integrity and investor confidence.</p><div class='key-point-box'><ul><li><strong>Facilitating Finance:</strong> Enables issuers to raise finance efficiently from the market.</li><li><strong>Investor Protection:</strong> Ensures safety and accurate information for investors, safeguarding their interests.</li><li><strong>Market Promotion:</strong> Promotes a competitive market for intermediaries, fostering innovation and efficiency.</li></ul></div><h4>The Insurance Sector in India</h4><p>India's insurance sector is a dynamic and growing industry, playing a crucial role in financial security and economic development. Recent discussions among industry leaders highlight its challenges and future trajectory.</p><h5>Current State of the Insurance Sector</h5><p>The Indian insurance market is experiencing significant growth and holds a prominent position globally. Its potential for expansion is recognized by international bodies and domestic regulators.</p><div class='info-box'><ul><li><strong>Global Market Position:</strong> India ranks as the <strong>10th largest insurance market worldwide</strong>.</li><li><strong>Emerging Markets:</strong> Holds the <strong>2nd largest position</strong> among emerging markets, with an estimated market share of <strong>1.9%</strong>.</li><li><strong>Growth Potential:</strong> As per the <strong>Insurance Regulatory and Development Authority of India (IRDAI)</strong>, India is projected to be the <strong>fastest-growing insurance market</strong> within a decade.</li><li><strong>Future Outlook:</strong> Expected to outgrow major economies like <strong>Germany, Canada, Italy, and South Korea</strong>.</li><li><strong>Market Size Projection:</strong> The insurance market in India is expected to reach <strong>USD 222 billion by 2026</strong>.</li></ul></div><h5>Insurance Density and Penetration</h5><p><strong>Insurance density</strong> and <strong>penetration</strong> are key metrics used to assess the development and reach of the insurance sector within an economy. These indicators reflect the extent of insurance coverage among the population.</p><div class='info-box'><ul><li><strong>Insurance Density:</strong> Measures the <strong>average insurance premium per person</strong>.<ul><li>Increased from <strong>USD 11.1 in 2001</strong> to <strong>USD 92 in 2022</strong>.</li><li>Breakdown in 2022: <strong>Life insurance density of USD 70</strong> and <strong>non-life insurance density of USD 22</strong>.</li></ul></li><li><strong>Insurance Penetration:</strong> Defined as <strong>premiums as a percentage of GDP</strong>.<ul><li>Steadily risen from <strong>2.7% in 2000</strong> to <strong>4% in 2022</strong>.</li></ul></li></ul></div><h5>Foreign Direct Investment (FDI) in Insurance</h5><p>The influx of <strong>Foreign Direct Investment (FDI)</strong> into the insurance sector signifies growing international confidence and contributes to capital infusion and market development.</p><div class='info-box'><p>Between <strong>2014-23</strong>, the insurance sector has received nearly <strong>Rs. 54,000 crore (USD 6.5 billion)</strong> in <strong>FDI</strong>.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the roles of various regulatory bodies like <strong>PFRDA, PNGRB, CERC, and SEBI</strong> is crucial for <strong>GS Paper III (Economy)</strong>. Pay attention to their founding acts, mandates, and recent reforms. The <strong>2nd ARC recommendations</strong> are frequently asked in <strong>GS Paper II (Governance)</strong> and can be used to enrich answers on administrative reforms.</p><p>For the insurance sector, focus on key metrics like <strong>density and penetration</strong>, and the reasons behind India's growth potential. This data can be used to substantiate arguments in both mains and prelims.</p></div>

💡 Key Takeaways

- •Regulatory bodies like PFRDA, PNGRB, CERC, and SEBI are vital for orderly market functioning and protecting public interest in specific sectors.

- •The 2nd ARC (12th and 13th Reports) provided key recommendations for regulatory reforms, focusing on transparency, accountability, and uniformity in appointments.

- •SEBI, established in 1992, is the primary regulator for India's securities market, ensuring investor protection and market development.

- •India's insurance sector is rapidly growing, ranking 10th globally, with increasing insurance density and penetration, attracting significant FDI.

- •Reforms aim to simplify procedures, strengthen oversight, and promote self-regulation, balancing autonomy with accountability for effective governance.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•SEBI Act, 1992

•PNGRB Act, 2006

•Reports of the 2nd Administrative Reforms Commission (12th & 13th Reports)

•IRDAI Annual Reports/Statistics