What are Government Securities (G-Sec)? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are Government Securities (G-Sec)?

Medium⏱️ 8 min read

economy

📖 Introduction

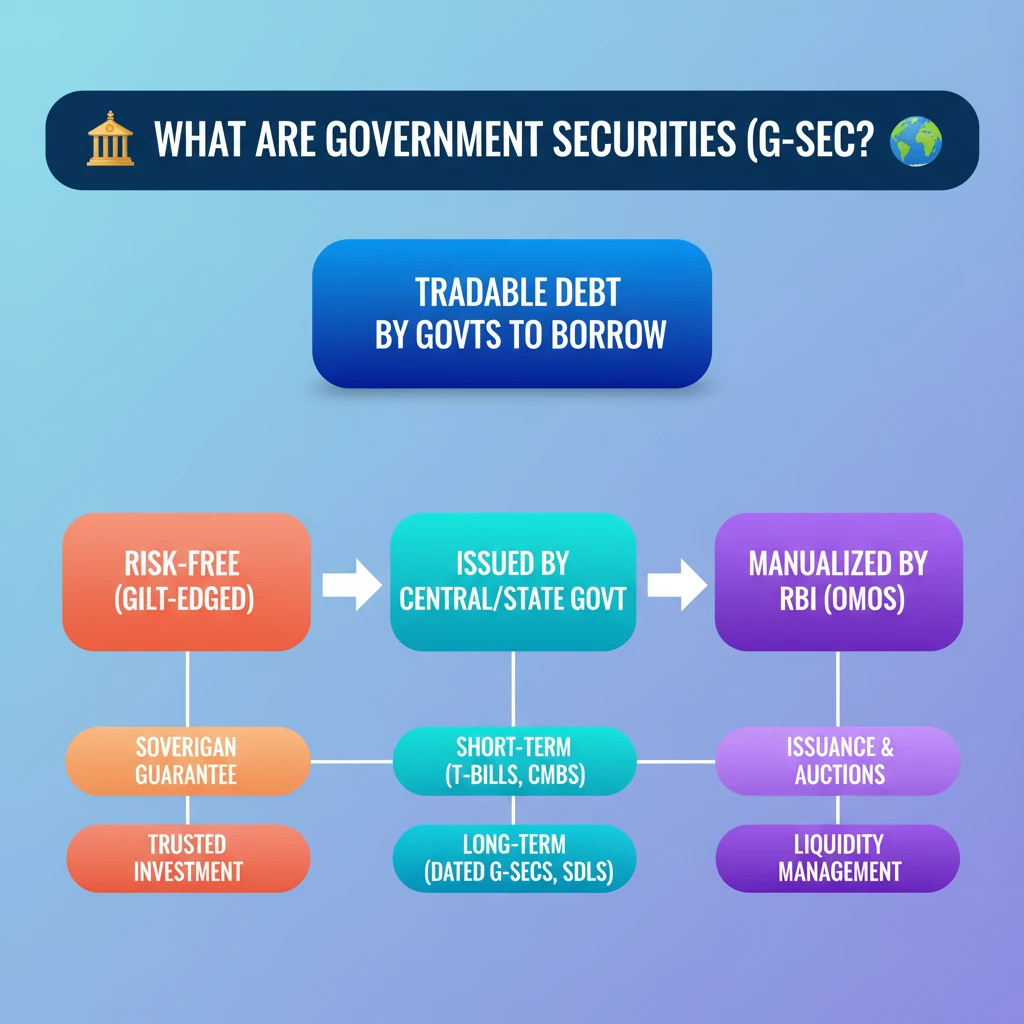

<h4>Introduction to Government Securities (G-Sec)</h4><p>A <strong>Government Security (G-Sec)</strong> is a <strong>tradable instrument</strong> issued by either the <strong>Central Government</strong> or <strong>State Governments</strong>.</p><p>Essentially, a <strong>G-Sec</strong> functions as a <strong>debt instrument</strong> through which the government borrows funds from the market.</p><p>The issuer promises to repay the <strong>principal amount</strong> to the investor on a specified future date, known as the <strong>maturity date</strong>.</p><div class='key-point-box'><p><strong>G-Secs</strong> are widely regarded as <strong>risk-free instruments</strong> due to the sovereign guarantee, earning them the classification of <strong>gilt-edged securities</strong>.</p></div><h4>Classification by Tenor: Short-term vs. Long-term</h4><p><strong>Government Securities</strong> are broadly categorized based on their maturity period or <strong>tenor</strong>.</p><ul><li><strong>Short-term G-Secs</strong>: These instruments typically have a maturity period of less than one year. <strong>Treasury Bills (T-bills)</strong> are prime examples.</li><li><strong>Long-term G-Secs</strong>: These are commonly referred to as <strong>Government Bonds</strong> and have maturities ranging from one year up to 40 years.</li></ul><h4>Issuers of Government Securities</h4><p>Both the <strong>Central Government</strong> and <strong>State Governments</strong> are authorized to issue <strong>Government Securities</strong>, albeit with some distinctions.</p><div class='info-box'><ul><li>The <strong>Central Government</strong> issues both <strong>Treasury Bills (T-bills)</strong> and <strong>Dated G-Secs (Government Bonds)</strong>.</li><li><strong>State Governments</strong> primarily issue their market borrowings through instruments known as <strong>State Development Loans (SDLs)</strong>.</li></ul></div><h4>Types of Government Securities (G-Sec)</h4><h4>Treasury Bills (T-bills)</h4><p><strong>Treasury Bills (T-bills)</strong> are quintessential <strong>short-term G-Secs</strong>, issued for maturities of 91 days, 182 days, or 364 days.</p><div class='info-box'><p>They are known as <strong>zero-coupon securities</strong> because they do not pay any periodic interest (coupon). Instead, they are issued at a <strong>discount</strong> to their face value and redeemed at their <strong>face value</strong> upon maturity.</p></div><p>The return to the investor is the difference between the face value and the discounted issue price.</p><h4>Cash Management Bills (CMBs)</h4><p>Introduced in <strong>2010</strong>, <strong>Cash Management Bills (CMBs)</strong> are another form of <strong>short-term instrument</strong>.</p><div class='info-box'><p>These are issued by the <strong>Government of India</strong> in consultation with the <strong>Reserve Bank of India (RBI)</strong> to address temporary mismatches in the government's cash flow.</p></div><p>Like T-bills, <strong>CMBs</strong> are also <strong>zero-coupon securities</strong>, issued at a discount and redeemed at face value.</p><h4>Dated G-Secs (Government Bonds)</h4><p><strong>Dated G-Secs</strong> are <strong>long-term securities</strong> that carry a specified <strong>coupon rate (interest rate)</strong>.</p><p>This interest is paid on the <strong>face value</strong> of the security, typically on a <strong>half-yearly basis</strong>.</p><div class='info-box'><p>The <strong>tenor</strong> of <strong>dated securities</strong> generally ranges from <strong>5 years to 40 years</strong>, making them suitable for long-term investment horizons.</p></div><p>The coupon rate can be either <strong>fixed</strong> or <strong>floating</strong>, depending on the terms of issuance.</p><h4>State Development Loans (SDLs)</h4><p><strong>State Development Loans (SDLs)</strong> are debt instruments issued by <strong>State Governments</strong> to raise funds from the market.</p><p>These are similar to <strong>dated G-Secs</strong> issued by the Central Government, carrying a <strong>fixed or floating coupon rate</strong> and having varying maturities.</p><div class='exam-tip-box'><p>Understanding <strong>SDLs</strong> is crucial for topics related to <strong>fiscal federalism</strong> and <strong>state finances</strong> in <strong>UPSC Mains Paper III</strong>.</p></div><h4>Issue Mechanism and Role of RBI</h4><p>The <strong>Reserve Bank of India (RBI)</strong> plays a pivotal role in the issuance and management of <strong>Government Securities</strong>.</p><p>The <strong>RBI</strong> conducts <strong>Open Market Operations (OMOs)</strong> for the sale or purchase of <strong>G-Secs</strong>.</p><div class='info-box'><ul><li>When the <strong>RBI sells G-Secs</strong> in the market, it effectively <strong>removes liquidity</strong> from the financial system.</li><li>Conversely, when the <strong>RBI buys back G-Secs</strong>, it <strong>infuses liquidity</strong> into the market.</li></ul></div><p>These <strong>OMOs</strong> are a key tool for the <strong>RBI</strong> to manage <strong>money supply conditions</strong> and influence <strong>interest rates</strong> in the economy.</p>

💡 Key Takeaways

- •G-Secs are tradable debt instruments issued by Central/State Governments to borrow funds.

- •They are considered risk-free (gilt-edged) due to sovereign guarantee.

- •Types include short-term (Treasury Bills, Cash Management Bills) and long-term (Dated G-Secs, State Development Loans).

- •T-bills and CMBs are zero-coupon, issued at a discount; Dated G-Secs and SDLs pay half-yearly interest.

- •RBI manages G-Sec issuance and uses Open Market Operations (OMOs) for liquidity management in the economy.

🧠 Memory Techniques

95% Verified Content