External Sector BoP, Foreign Trade, FDI, Trade Policies, WTO, IMF, etc. - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

External Sector BoP, Foreign Trade, FDI, Trade Policies, WTO, IMF, etc.

Medium⏱️ 15 min read

economy

📖 Introduction

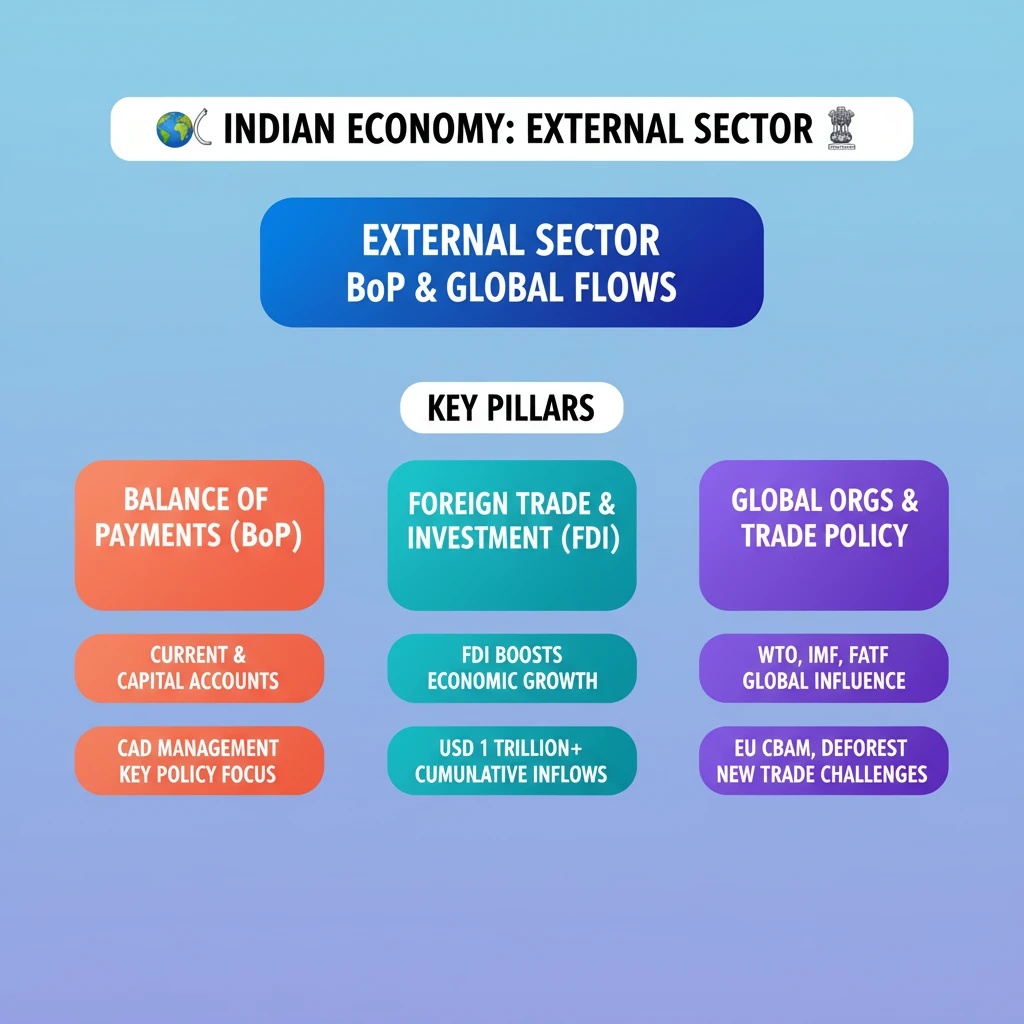

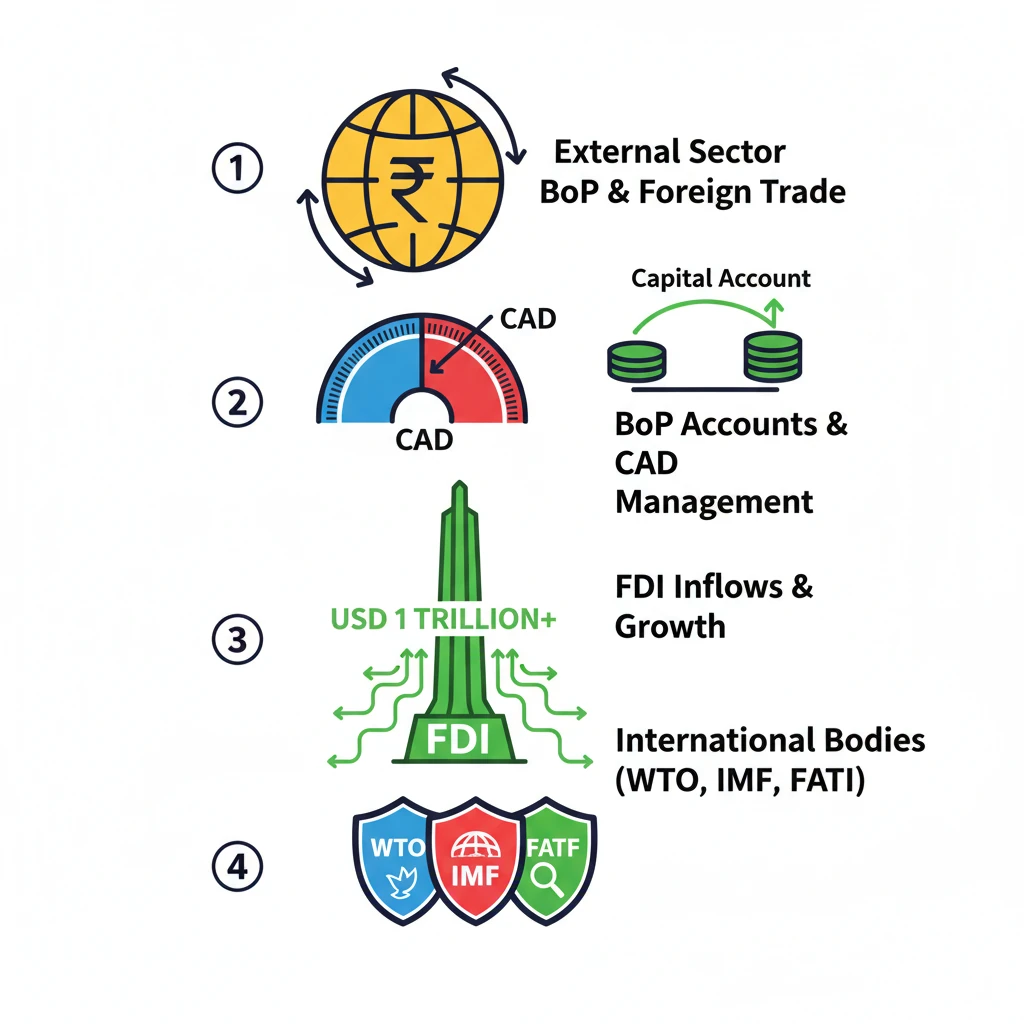

<h4>Understanding India's External Sector</h4><p>India's <strong>external sector</strong> encompasses all economic transactions between its residents and the rest of the world. This includes trade in goods and services, financial flows like investments, and remittances. A robust external sector is crucial for economic stability and growth.</p><div class='key-point-box'><p>The <strong>external sector</strong> is a vital component of a nation's economy, reflecting its integration with the global market and influencing its currency stability and growth trajectory.</p></div><h4>Balance of Payments (BoP)</h4><p>The <strong>Balance of Payments (BoP)</strong> is a comprehensive statement that records all monetary transactions between a country and the rest of the world during a specific period, usually a year. It consists of two main accounts: the <strong>Current Account</strong> and the <strong>Capital Account</strong>.</p><div class='info-box'><p><strong>Current Account:</strong> Records transactions related to goods (visible trade), services (invisible trade), income (e.g., remittances, interest), and current transfers. A deficit implies more imports than exports of goods and services.</p><p><strong>Capital Account:</strong> Records international flows of funds related to investments (FDI, FPI), loans, and banking capital. It reflects changes in a country's foreign assets and liabilities.</p></div><p>India's BoP position is closely monitored, as persistent deficits can indicate underlying economic vulnerabilities. Managing the <strong>current account deficit (CAD)</strong> is a key policy objective.</p><h4>Foreign Trade and Trade Policies</h4><p><strong>Foreign trade</strong> involves the exchange of goods and services across international borders. India's trade policies aim to promote exports, regulate imports, and integrate the economy into global supply chains. These policies are regularly reviewed and updated.</p><div class='exam-tip-box'><p>UPSC often asks about the components of <strong>BoP</strong> and the factors influencing <strong>Current Account Deficit (CAD)</strong>. Understand the difference between visible and invisible trade.</p></div><h4>Foreign Direct Investment (FDI)</h4><p><strong>Foreign Direct Investment (FDI)</strong> refers to investments made by a company or individual in one country into business interests located in another country. It signifies a lasting interest and often involves management participation.</p><div class='info-box'><p><strong>FDI</strong> is considered a stable and desirable form of capital inflow as it brings capital, technology, and management expertise, contributing to long-term economic growth and job creation.</p></div><p>India has consistently liberalized its <strong>FDI policy</strong> to attract more foreign capital across various sectors. This has been a significant driver of economic growth.</p><h4>World Trade Organisation (WTO)</h4><p>The <strong>World Trade Organisation (WTO)</strong> is an intergovernmental organization that regulates international trade. It provides a framework for negotiating trade agreements and a dispute resolution process aimed at ensuring fair and open trade.</p><div class='key-point-box'><p>The <strong>WTO's</strong> core principles include <strong>Most Favoured Nation (MFN)</strong> treatment and <strong>National Treatment</strong>, ensuring non-discrimination among trading partners and between domestic and imported goods.</p></div><p>India is a founding member of the <strong>WTO</strong> and actively participates in its deliberations, advocating for the interests of developing countries, particularly in agriculture and services trade.</p><h4>International Monetary Fund (IMF)</h4><p>The <strong>International Monetary Fund (IMF)</strong> is an international organization that promotes global monetary cooperation, secures financial stability, facilitates international trade, promotes high employment and sustainable economic growth, and reduces poverty around the world.</p><div class='info-box'><p>The <strong>IMF</strong> provides financial assistance to countries facing balance of payments problems, often with conditionalities attached to policy reforms. It also monitors global economic trends.</p></div><p>India is a member of the <strong>IMF</strong> and benefits from its surveillance functions and technical assistance. Its relationship with the IMF has evolved significantly since the 1991 economic reforms.</p><h4>Trade-Related Aspects of Intellectual Property Rights (TRIPS)</h4><p>The <strong>Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS)</strong> is an international legal agreement between all the member nations of the <strong>World Trade Organisation (WTO)</strong>. It sets minimum standards for the regulation by national governments of different forms of intellectual property (IP).</p><div class='key-point-box'><p><strong>TRIPS</strong> covers various forms of IP, including copyright, trademarks, geographical indications, industrial designs, patents, and layout designs of integrated circuits. It aims to balance IP protection with public welfare.</p></div><p>For India, <strong>TRIPS</strong> has significant implications, particularly for its pharmaceutical sector, impacting drug patenting and access to affordable medicines. India has often advocated for flexibilities within the TRIPS framework.</p><h4>Base Erosion and Profit Shifting (BEPS)</h4><p><strong>Base Erosion and Profit Shifting (BEPS)</strong> refers to tax planning strategies used by multinational enterprises (MNEs) that exploit gaps and mismatches in tax rules to avoid paying tax. This leads to a significant loss of tax revenue for governments worldwide.</p><div class='info-box'><p>The <strong>OECD/G20 Inclusive Framework on BEPS</strong> is working to implement a 15-point action plan to address BEPS, ensuring that profits are taxed where economic activity occurs and value is created.</p></div><p>India has been actively involved in international efforts to combat <strong>BEPS</strong>, as it significantly impacts its tax revenues from large multinational corporations operating within its borders.</p><h4>Debt Sustainability and Exchange Rate Management</h4><p><strong>Debt sustainability</strong> refers to a country's ability to meet its current and future debt service obligations without recourse to exceptional financial assistance or without unduly compromising economic growth. It's crucial for long-term economic health.</p><div class='key-point-box'><p><strong>Exchange rate management</strong> involves policies and actions taken by a central bank (like the <strong>RBI</strong> in India) to influence the value of its currency relative to other currencies. This impacts trade competitiveness and capital flows.</p></div><p>A stable and competitive exchange rate is vital for India's external sector. The <strong>Reserve Bank of India (RBI)</strong> intervenes in the foreign exchange market to manage volatility and ensure orderly conditions.</p><h4>Strengthening of Rupee</h4><p>The <strong>strengthening of the Rupee</strong> implies that its value is increasing relative to other currencies, meaning fewer rupees are needed to buy a unit of foreign currency. This can be influenced by various factors.</p><div class='info-box'><p>Factors contributing to a <strong>stronger Rupee</strong> include robust FDI/FPI inflows, strong export performance, lower crude oil prices, and positive domestic economic outlook. While good for importers, it can make exports less competitive.</p></div><p>The <strong>RBI's</strong> exchange rate policy aims to maintain stability, allowing market forces to determine the exchange rate while intervening to curb excessive volatility.</p><h4>Switzerland Suspends MFN Status to India</h4><p>The suspension of <strong>Most Favoured Nation (MFN) status</strong> by <strong>Switzerland</strong> to India is a significant development in bilateral trade relations. <strong>MFN status</strong> ensures that a country treats all its trading partners equally.</p><div class='key-point-box'><p>Under <strong>WTO rules</strong>, granting <strong>MFN status</strong> means any trade concession (like lower tariffs) offered to one country must be extended to all other WTO members. Suspension indicates a deviation from this principle, usually due to specific trade disputes or retaliatory measures.</p></div><p>This move by <strong>Switzerland</strong> likely stems from specific disagreements over trade practices or market access, impacting certain Indian exports to the Swiss market.</p><h4>India's Concerns on EU's CBAM and Deforestation Norms</h4><p>India has expressed significant concerns regarding the <strong>European Union's (EU) Carbon Border Adjustment Mechanism (CBAM)</strong> and its proposed <strong>deforestation norms</strong>. These policies could have substantial implications for Indian exports.</p><div class='info-box'><p>The <strong>CBAM</strong> aims to put a carbon price on imports of certain carbon-intensive goods into the EU, ensuring that climate action taken by the EU is not undermined by 'carbon leakage' from countries with less ambitious climate policies.</p><p>The <strong>EU Deforestation Regulation (EUDR)</strong> requires companies to prove that products like coffee, soy, and palm oil were not produced on deforested land after 2020, impacting agricultural and related exports.</p></div><p>India views these measures as potentially protectionist and discriminatory, arguing they could disadvantage developing countries and violate <strong>WTO principles</strong>. Discussions are ongoing to find mutually acceptable solutions.</p><h4>FATF Mutual Evaluation Report on India</h4><p>The <strong>Financial Action Task Force (FATF)</strong> conducts mutual evaluations of its members to assess their compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) standards. India recently underwent such an evaluation.</p><div class='key-point-box'><p>A positive <strong>FATF evaluation report</strong> enhances a country's reputation in the global financial system, facilitating international financial transactions and attracting foreign investment. Conversely, a negative report can lead to financial sanctions and increased scrutiny.</p></div><p>India's performance in the <strong>FATF evaluation</strong> is crucial for its standing in the international financial community and its ability to combat illicit financial flows effectively.</p><h4>Eased FDI Policy for Space Sector</h4><p>India has significantly <strong>eased its FDI policy for the space sector</strong>, opening up more avenues for foreign investment in satellite manufacturing, launch vehicles, and related services. This is part of broader reforms to boost private participation.</p><div class='info-box'><p>The revised policy allows up to <strong>100% FDI</strong> in satellite manufacturing and operations under the automatic route for certain activities, and higher limits for others, reducing the need for government approval.</p></div><p>This liberalization aims to attract advanced technology, capital, and expertise, positioning India as a global hub for space technology and applications.</p><h4>Revised Currency Swap Framework for SAARC</h4><p>The <strong>Reserve Bank of India (RBI)</strong> has revised its <strong>Currency Swap Framework for SAARC countries</strong>, offering a safety net for member nations to meet short-term foreign exchange liquidity requirements. This promotes regional financial stability.</p><div class='key-point-box'><p>A <strong>currency swap</strong> involves exchanging principal and/or interest payments in one currency for equivalent payments in another currency. For <strong>SAARC nations</strong>, this framework helps manage temporary BoP issues without relying on more stringent IMF conditions.</p></div><p>This initiative underscores India's commitment to regional cooperation and its role as a key economic player in South Asia, fostering greater financial integration and stability.</p>

💡 Key Takeaways

- •India's external sector is vital for economic stability, covering BoP, trade, and capital flows.

- •BoP comprises Current and Capital Accounts; managing CAD is a key policy goal.

- •FDI is crucial for growth, with India surpassing USD 1 trillion in cumulative inflows.

- •WTO, IMF, and FATF are key international bodies influencing India's external sector policies.

- •Recent issues like EU's CBAM and deforestation norms pose challenges to India's trade.

- •Policy reforms like eased FDI in space and SAARC currency swaps highlight India's proactive approach.

- •Exchange rate management and debt sustainability are critical for macroeconomic stability.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Ministry of Finance, Government of India Economic Survey

•Ministry of Commerce and Industry, Government of India Reports

•World Trade Organisation (WTO) Official Website

•International Monetary Fund (IMF) Official Publications

•OECD Reports on Base Erosion and Profit Shifting (BEPS)

•Financial Action Task Force (FATF) Official Website