What is the Current State of India’s Financial Services Industry? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is the Current State of India’s Financial Services Industry?

Medium⏱️ 8 min read

economy

📖 Introduction

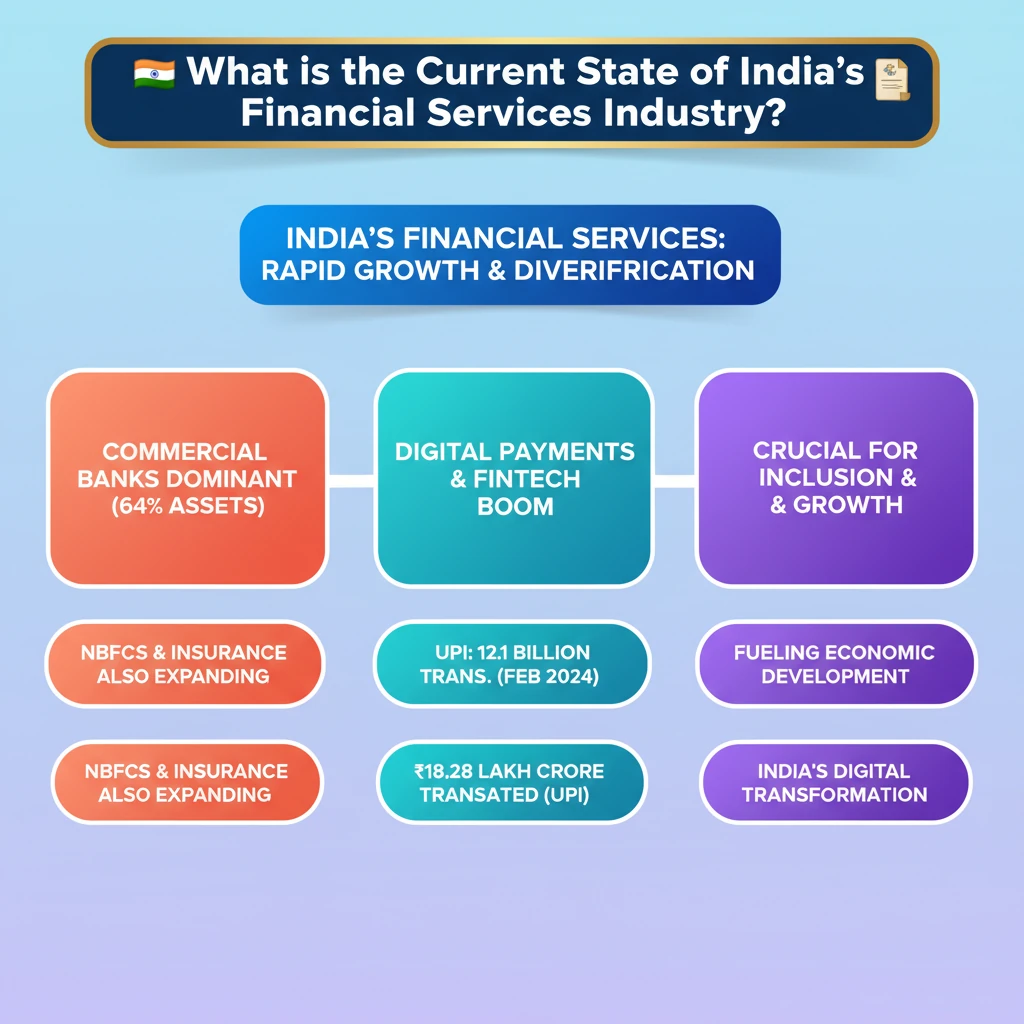

<h4>Introduction to India's Financial Services Industry</h4><p>India's <strong>financial services industry</strong> is a dynamic and crucial sector of the economy. It is currently characterized by significant <strong>rapid expansion</strong> and extensive <strong>diversification</strong> across various segments.</p><div class='key-point-box'><p>This growth reflects the increasing financialization of the Indian economy and the rising demand for diverse financial products and services from both urban and rural populations.</p></div><h4>Key Components of the Financial Services Sector</h4><p>The sector encompasses a broad spectrum of institutions that facilitate financial transactions and provide various financial services. These entities cater to different needs, from basic banking to complex investment and insurance solutions.</p><ul><li><strong>Commercial Banks:</strong> These are the largest players, offering a wide range of services including deposits, loans, and payment solutions.</li><li><strong>Insurance Companies:</strong> Provide risk coverage for life, health, and general assets.</li><li><strong>Non-Banking Financial Companies (NBFCs):</strong> Offer specialized financial services like credit, asset financing, and investment.</li><li><strong>Cooperatives:</strong> Focus on financial inclusion, particularly in rural and semi-urban areas.</li><li><strong>Pension Funds:</strong> Manage retirement savings for individuals.</li><li><strong>Mutual Funds:</strong> Pool money from investors to invest in securities like stocks and bonds.</li><li><strong>Smaller Financial Entities:</strong> Include microfinance institutions and other niche service providers.</li></ul><h4>Dominance of Commercial Banks</h4><p>Despite the diversification and emergence of new players, <strong>commercial banks</strong> continue to hold a commanding position within the industry. Their extensive network and broad service offerings make them central to India's financial system.</p><div class='info-box'><p><strong>Commercial banks</strong> currently account for <strong>over 64%</strong> of the total assets held within India's financial services industry, underscoring their systemic importance.</p></div><h4>Recent Developments and New Entities</h4><p>The industry has witnessed significant innovations and the introduction of new financial entities aimed at enhancing financial inclusion and digital payments. These developments are reshaping the landscape of financial service delivery.</p><ul><li>Introduction of <strong>Payment Banks:</strong> These entities focus on small savings accounts and payments/remittance services, expanding access to basic banking.</li><li>Emergence of <strong>FinTech companies:</strong> Driving innovation in various financial services through technology.</li></ul><h4>The Rise of Unified Payments Interface (UPI)</h4><p>One of the most transformative developments has been the widespread adoption and success of the <strong>Unified Payments Interface (UPI)</strong>. It has revolutionized digital payments in India, making transactions instant, seamless, and interoperable.</p><div class='info-box'><p>In <strong>February 2024</strong>, <strong>UPI</strong> recorded an impressive <strong>12.10 billion transactions</strong>, amounting to a total value of <strong>Rs 18.28 lakh crore</strong>. This highlights its immense popularity and critical role in the digital economy.</p></div><div class='exam-tip-box'><p>For <strong>UPSC Mains (GS Paper 3)</strong>, understanding the structure and recent developments in the financial services industry, especially digital payment systems like <strong>UPI</strong>, is crucial for questions on <strong>economic growth</strong>, <strong>financial inclusion</strong>, and <strong>digital India initiatives</strong>.</p></div>

💡 Key Takeaways

- •India's financial services industry is rapidly expanding and diversifying, encompassing banks, NBFCs, insurance, and more.

- •Commercial banks remain dominant, holding over 64% of total assets.

- •Recent developments include new entities like payment banks and significant growth in digital payments.

- •UPI is a major success, recording 12.10 billion transactions worth Rs 18.28 lakh crore in February 2024.

- •The sector is crucial for financial inclusion, economic growth, and India's digital transformation agenda.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) Annual Reports

•National Payments Corporation of India (NPCI) official data

•Ministry of Finance reports