What is a Double Tax Avoidance Agreement (DTAA)? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is a Double Tax Avoidance Agreement (DTAA)?

Medium⏱️ 8 min read

economy

📖 Introduction

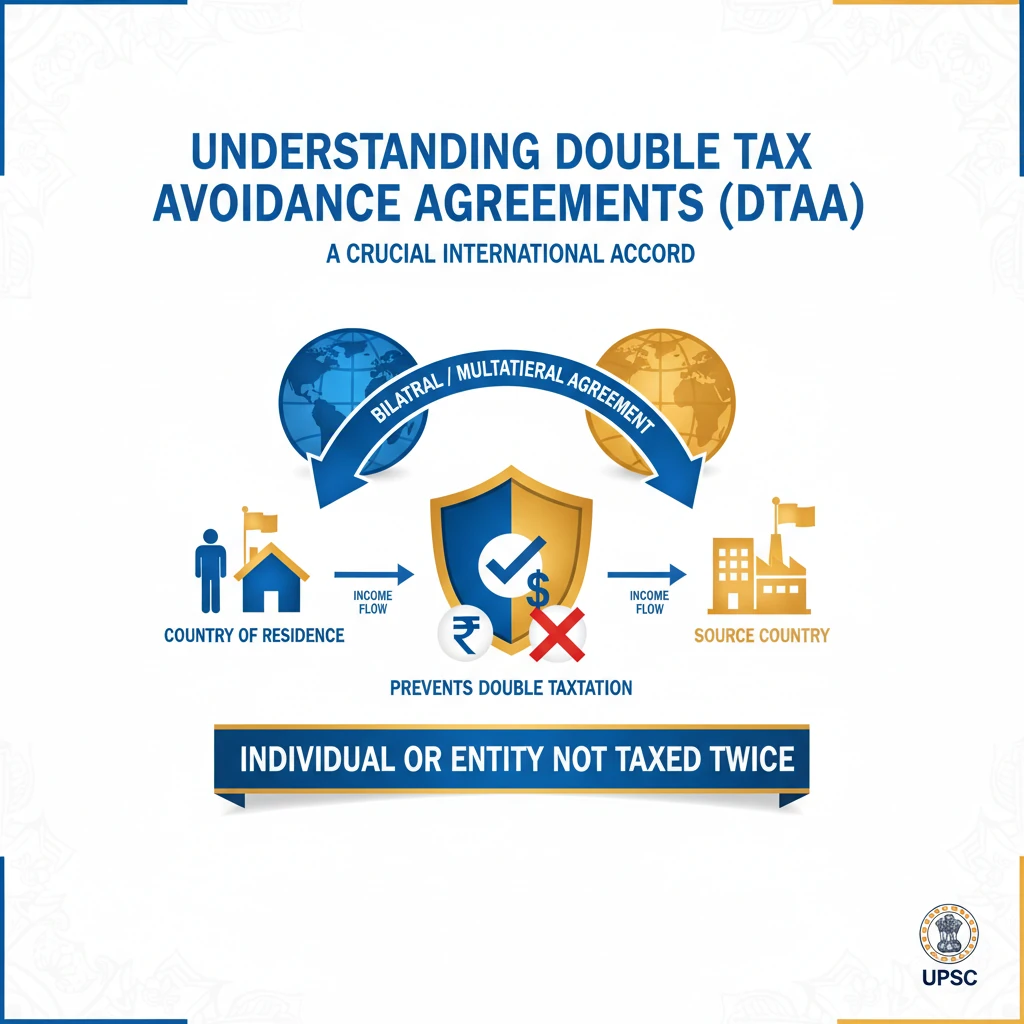

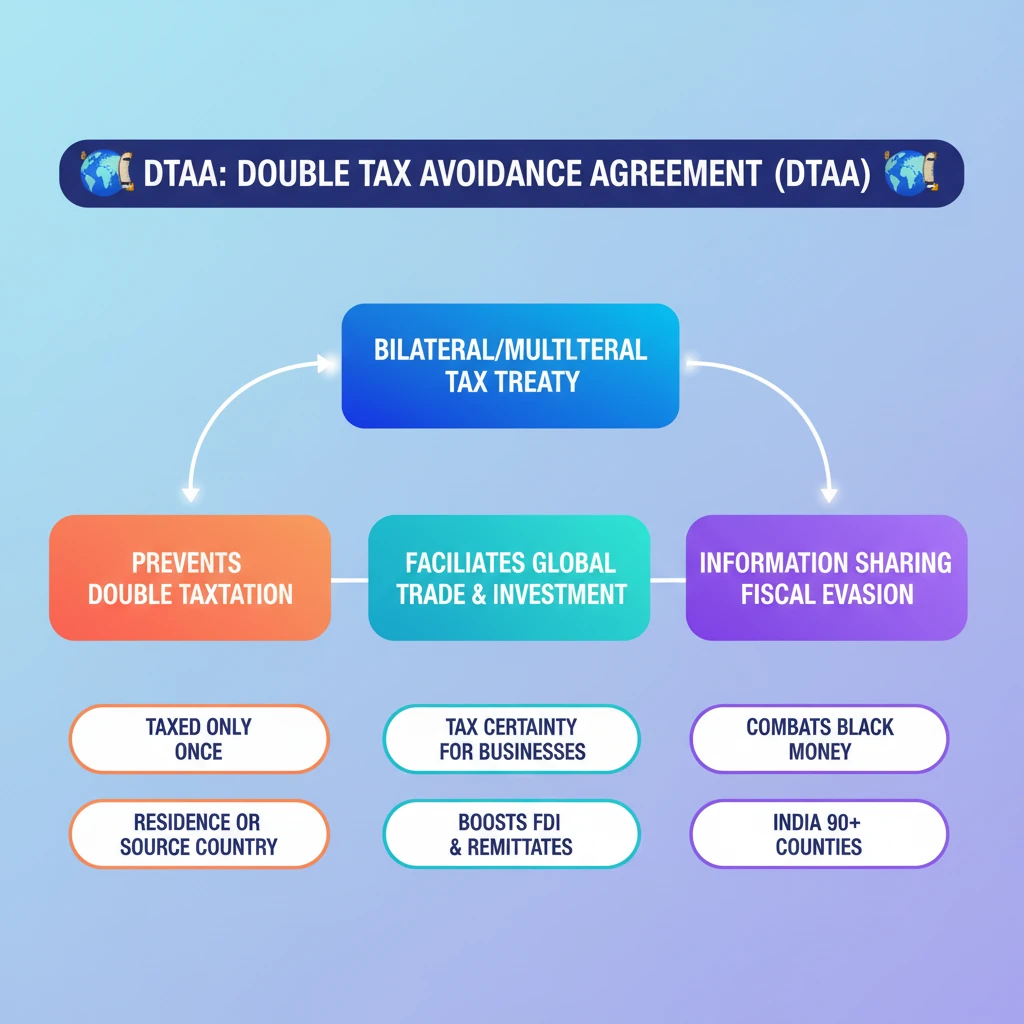

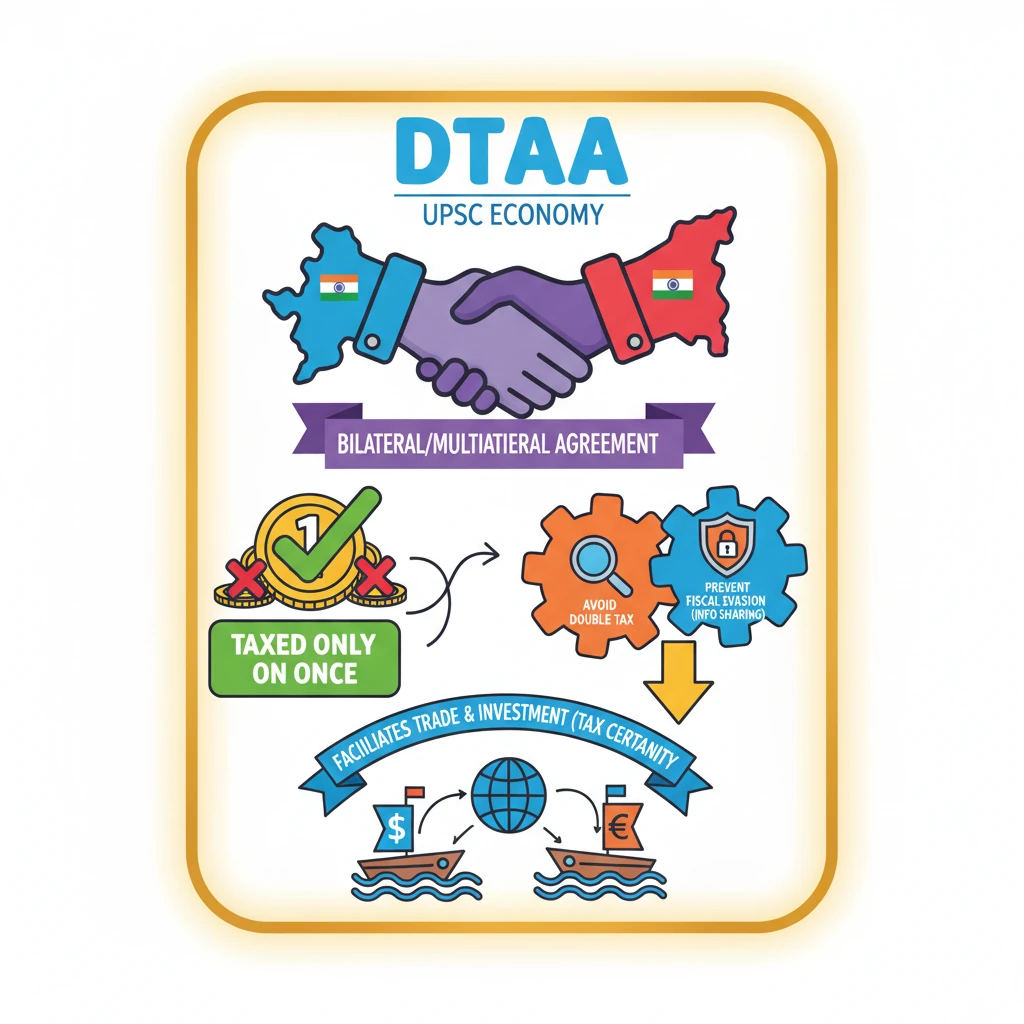

<h4>Understanding Double Tax Avoidance Agreements (DTAA)</h4><p>A <strong>Double Tax Avoidance Agreement (DTAA)</strong> is a crucial international accord. It is a <strong>bilateral</strong> or sometimes <strong>multilateral agreement</strong> established between two or more countries.</p><p>The primary aim of a DTAA is to prevent the same income from being taxed twice. This ensures that an individual or entity is not subjected to taxation by both their <strong>country of residence</strong> and the <strong>country of source</strong> where the income was generated.</p><div class='info-box'><p><strong>Definition:</strong> A <strong>DTAA</strong> is a treaty between nations designed to prevent taxpayers from paying taxes on the same income to two different countries.</p></div><h4>Objectives of DTAA</h4><p>DTAAs serve several vital objectives in the realm of international taxation and economic relations.</p><div class='key-point-box'><ul><li><strong>Double Taxation Avoidance:</strong> The most direct objective is to prevent taxpayers from having to pay taxes twice on the same income or capital. This creates a more predictable and fair tax environment.</li><li><strong>Fiscal Evasion Prevention:</strong> DTAAs facilitate the sharing of financial information between signatory countries. This information exchange is a powerful tool in combating <strong>tax evasion</strong> and illicit financial flows.</li></ul></div>

💡 Key Takeaways

- •DTAA is a bilateral/multilateral agreement to prevent double taxation.

- •Ensures income is taxed only once by either country of residence or source.

- •Key objectives: avoid double taxation and prevent fiscal evasion through information sharing.

- •Facilitates international trade and investment by providing tax certainty.

- •India has signed DTAAs with over 90 countries, crucial for its global economic engagement.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Central Board of Direct Taxes (CBDT)

•OECD Model Tax Convention Commentary

•UN Model Double Taxation Convention between Developed and Developing Countries