What are Other Major Highlights of the Union Budget 2025-26? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are Other Major Highlights of the Union Budget 2025-26?

Medium⏱️ 5 min read

economy

📖 Introduction

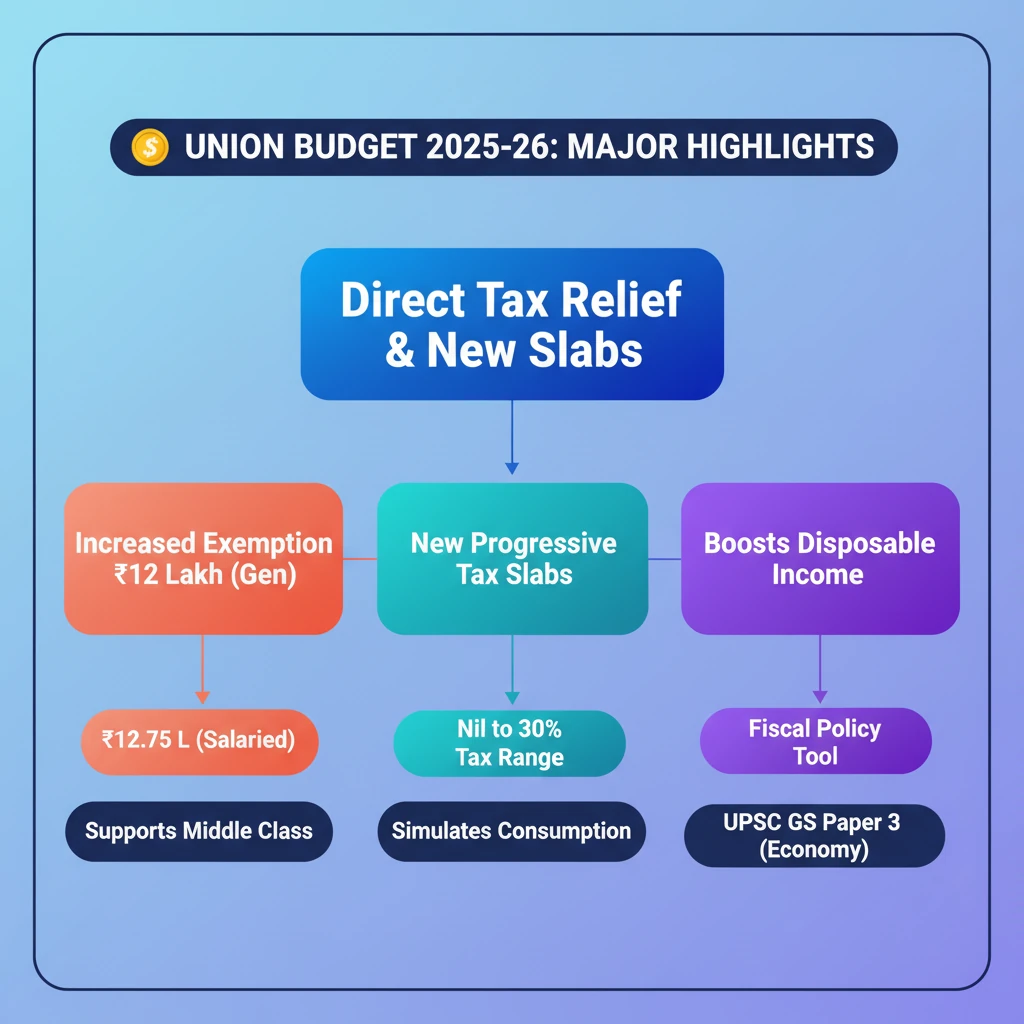

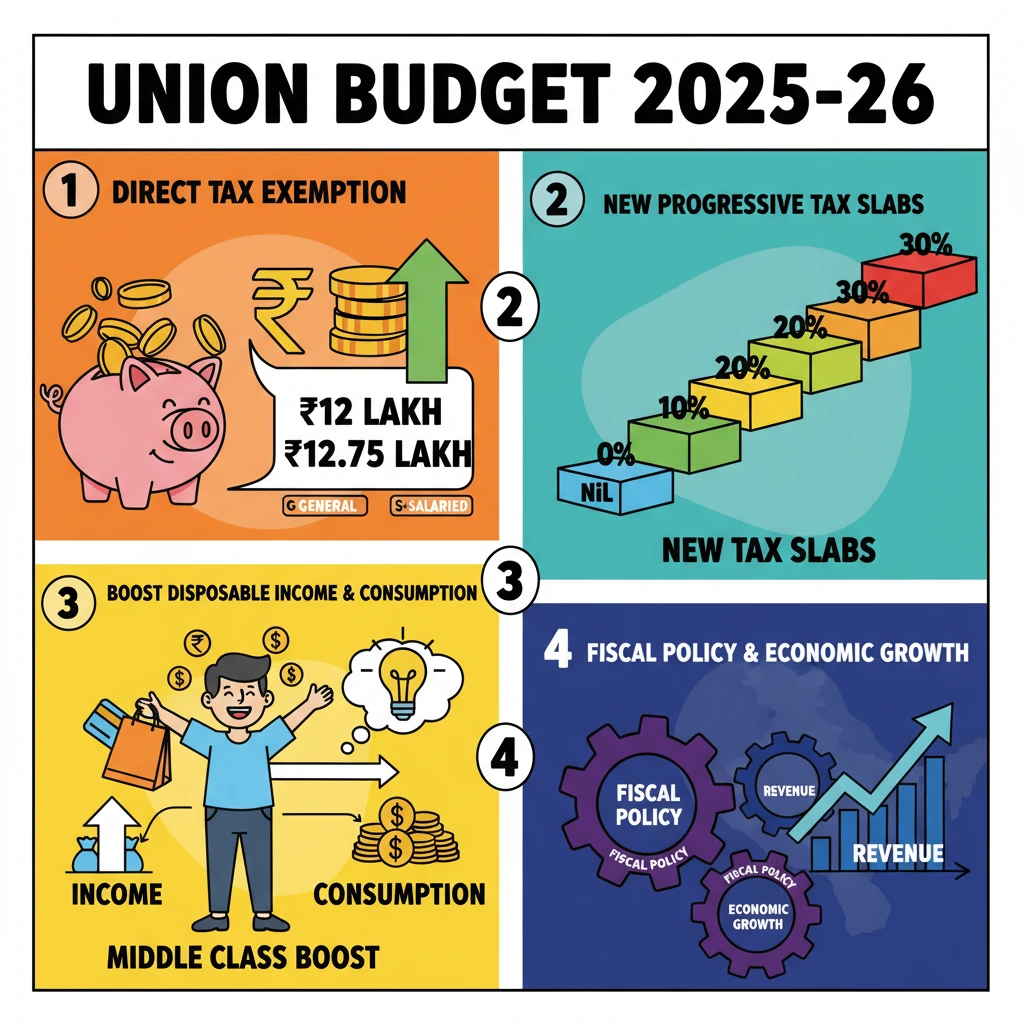

<h4>Direct Tax Reforms in Union Budget 2025-26</h4><p>The <strong>Union Budget 2025-26</strong> introduced significant changes to the <strong>direct tax</strong> regime, aiming to provide relief to taxpayers and simplify the taxation structure. These reforms are crucial for understanding the government's fiscal policy direction.</p><p>A key highlight is the revision of the <strong>income tax exemption limit</strong>. This move is designed to boost disposable income, especially for the middle-income group, thereby stimulating consumption and economic activity.</p><h4>Revised Income Tax Exemption Limits</h4><p>Under the new proposals, individuals with an annual income of up to <strong>₹12 lakh</strong> will be exempt from paying any income tax. This is a substantial increase from previous thresholds, offering considerable relief.</p><p>For <strong>salaried taxpayers</strong>, specifically, this exemption limit is further extended. With permissible deductions, salaried individuals can enjoy <strong>no income tax</strong> liability for incomes up to <strong>₹12.75 lakh</strong> annually.</p><div class='info-box'><p><strong>Key Exemption Limits:</strong></p><ul><li>General Taxpayers: <strong>₹12 lakh</strong> annual income (Nil Tax)</li><li>Salaried Taxpayers (with deductions): <strong>₹12.75 lakh</strong> annual income (Nil Tax)</li></ul></div><h4>New Income Tax Slabs for 2025-26</h4><p>The budget also outlined a revised structure for <strong>income tax slabs</strong>, which dictates the percentage of tax applicable at different income levels. This new structure aims for a progressive taxation system while ensuring ease of compliance.</p><div class='info-box'><p><strong>Income Tax Slabs (Union Budget 2025-26):</strong></p><table class='info-table'><tr><th>Income (in ₹)</th><th>Tax Rate</th></tr><tr><td>₹0 - ₹4 lakh</td><td><strong>Nil</strong></td></tr><tr><td>₹4 - ₹8 lakh</td><td><strong>5%</strong></td></tr><tr><td>₹8 - ₹12 lakh</td><td><strong>10%</strong></td></tr><tr><td>₹12 - ₹16 lakh</td><td><strong>15%</strong></td></tr><tr><td>₹16 - ₹20 lakh</td><td><strong>20%</strong></td></tr><tr><td>₹20 - ₹24 lakh</td><td><strong>25%</strong></td></tr><tr><td>Above ₹24 lakh</td><td><strong>30%</strong></td></tr></table></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the <strong>direct tax reforms</strong> is vital for GS Paper 3 (Economy). Questions may focus on the <strong>impact on consumption</strong>, <strong>government revenue</strong>, or comparison with previous tax regimes. Be prepared to analyze the rationale behind such changes.</p></div>

💡 Key Takeaways

- •Union Budget 2025-26 increased direct tax exemption to ₹12 lakh (general) and ₹12.75 lakh (salaried with deductions).

- •New progressive income tax slabs introduced, ranging from Nil to 30%.

- •Aims to boost disposable income, stimulate consumption, and support the middle class.

- •Part of government's fiscal policy to manage economic growth and revenue.

- •Understanding these changes is crucial for UPSC GS Paper 3 (Economy).

🧠 Memory Techniques

95% Verified Content