Government Initiatives to Strengthen Cooperatives - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Government Initiatives to Strengthen Cooperatives

Medium⏱️ 8 min read

economy

📖 Introduction

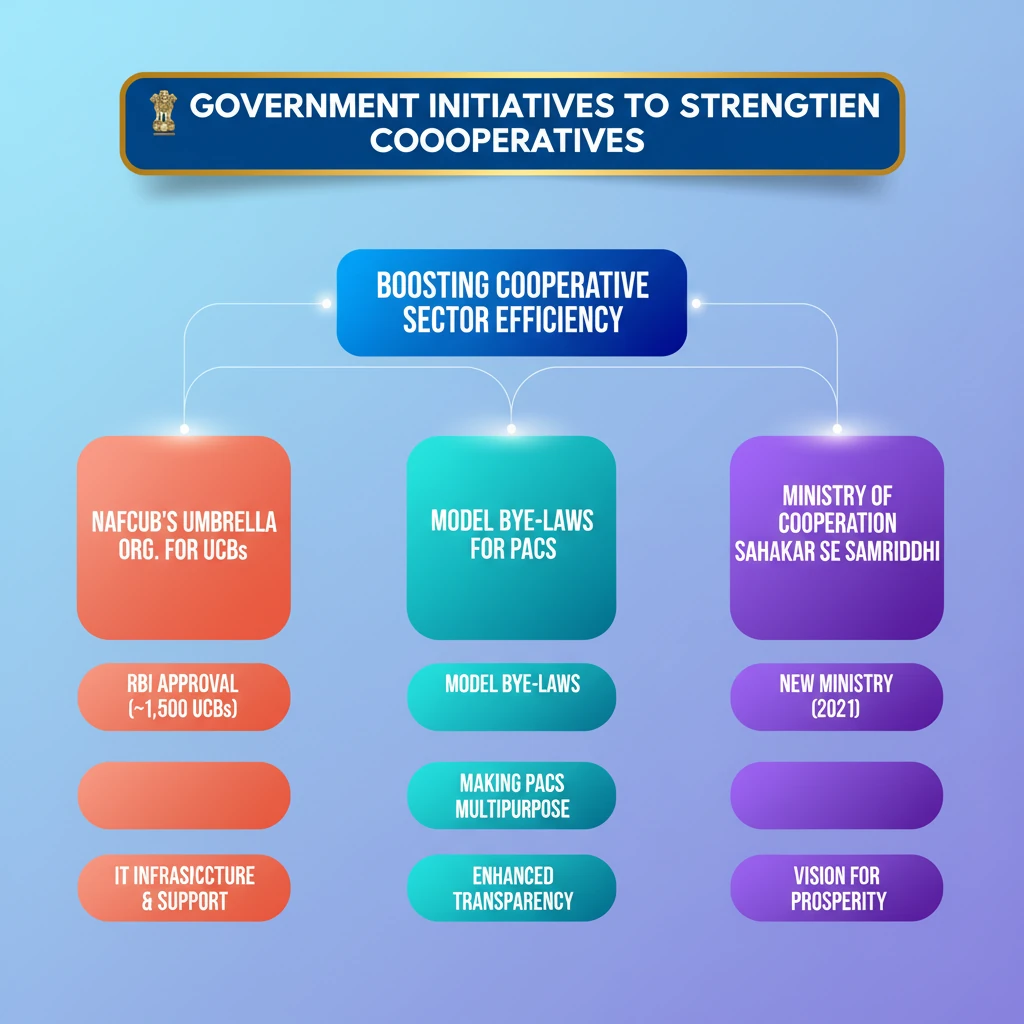

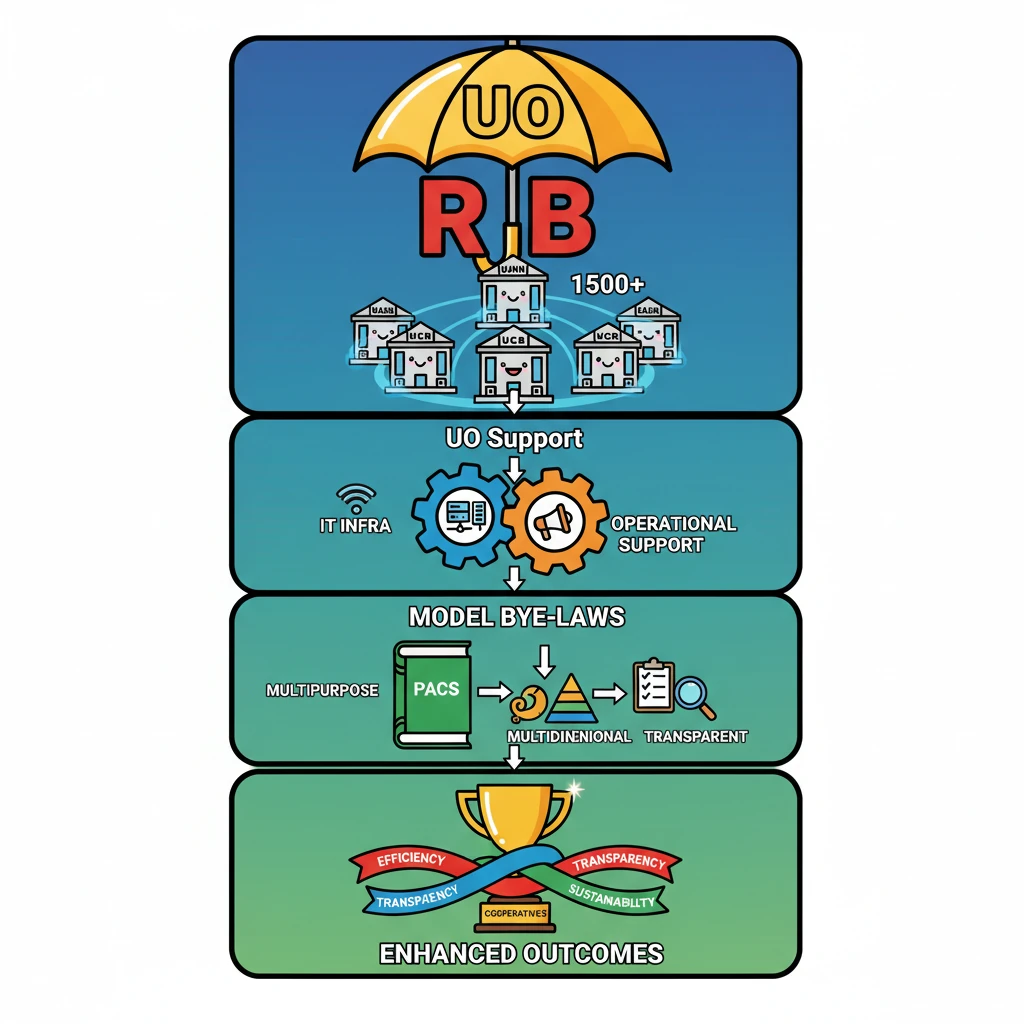

<h4>Government Initiatives to Strengthen Cooperatives</h4><p>The Indian government has been actively pursuing measures to bolster the cooperative sector, recognizing its pivotal role in economic development and financial inclusion. These initiatives aim to enhance the operational efficiency, transparency, and sustainability of cooperative institutions across various sectors.</p><h4>Umbrella Organization for Urban Co-operative Banks (UCBs)</h4><p>The <strong>Reserve Bank of India (RBI)</strong> has granted approval for the establishment of an <strong>Umbrella Organization (UO)</strong> specifically for the <strong>Urban Co-operative Bank (UCB) sector</strong>. This significant step aims to provide centralized support and infrastructure to a large number of UCBs.</p><div class='info-box'><p><strong>Key Entity:</strong> The <strong>National Federation of Urban Co-operative Banks and Credit Societies Ltd. (NAFCUB)</strong> has been approved to form this UO.</p><p><strong>Scope:</strong> The UO is designed to provide essential <strong>IT infrastructure</strong> and operational support to approximately <strong>1,500 UCBs</strong> across the country.</p></div><div class='key-point-box'><p>The formation of the UO is crucial for bringing uniformity in operations, enhancing technological capabilities, and strengthening governance within the diverse UCB sector. It addresses long-standing demands for a robust support system.</p></div><h4>Ensuring Transparency and Sustainability: Model Bye-Laws for PACS</h4><p>To promote greater transparency and ensure the long-term sustainability of primary-level cooperatives, the government has introduced <strong>Model Bye-Laws for Primary Agricultural Credit Societies (PACS)</strong>.</p><div class='info-box'><p><strong>Objective:</strong> These Model Bye-Laws are designed to transform PACS into <strong>multipurpose, multidimensional, and transparent entities</strong>.</p><p><strong>Impact:</strong> By adopting these bye-laws, PACS can diversify their activities beyond traditional credit functions, offering a wider range of services to their members and local communities.</p></div><div class='key-point-box'><p>This initiative is vital for revitalizing PACS, making them more resilient and relevant in the contemporary rural economy. Enhanced transparency builds trust and improves operational efficiency.</p></div><div class='exam-tip-box'><p>For UPSC, understand the distinction between <strong>UCBs</strong> and <strong>PACS</strong> and the specific government initiatives targeting each. Questions often focus on the 'why' behind such reforms and their potential impact on financial inclusion and rural development. Remember the role of <strong>RBI</strong> and <strong>NAFCUB</strong>.</p></div>

💡 Key Takeaways

- •RBI approved NAFCUB to form an Umbrella Organization (UO) for ~1,500 Urban Co-operative Banks (UCBs).

- •UO will provide critical IT infrastructure and operational support to UCBs.

- •Model Bye-Laws for Primary Agricultural Credit Societies (PACS) aim to make them multipurpose, multidimensional, and transparent.

- •These initiatives enhance efficiency, transparency, and sustainability of cooperatives.

- •Government's renewed focus on cooperatives is evident with the Ministry of Cooperation and 'Sahakar Se Samriddhi' vision.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) circulars and press releases on UCBs

•Ministry of Cooperation, Government of India official website

•National Federation of Urban Co-operative Banks and Credit Societies Ltd. (NAFCUB) publications