FATF Mutual Evaluation Report on India - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

FATF Mutual Evaluation Report on India

Medium⏱️ 10 min read

economy

📖 Introduction

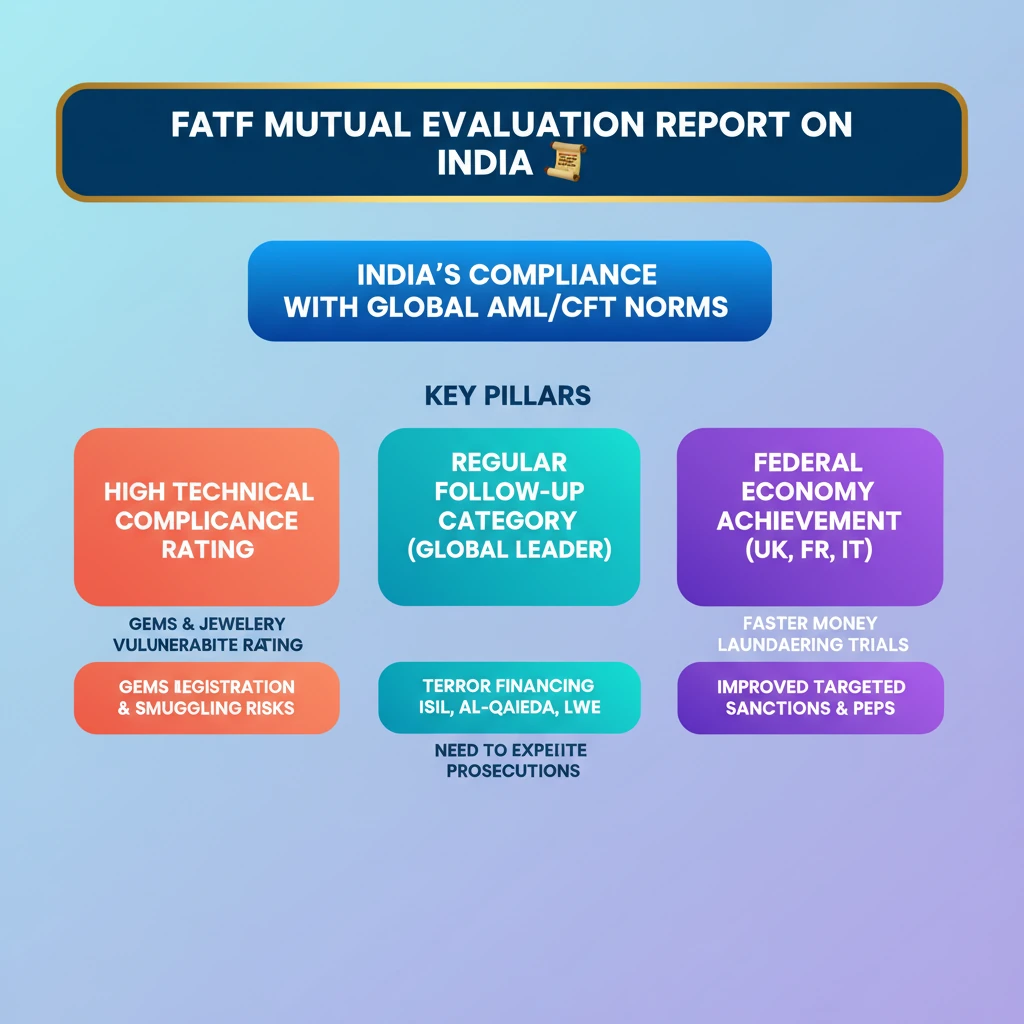

<h4>Introduction to FATF Mutual Evaluation Report</h4><p>The <strong>Financial Action Task Force (FATF)</strong> recently released its <strong>Mutual Evaluation Report on India</strong>. This report assesses a country's compliance with FATF's recommendations to combat <strong>money laundering (ML)</strong> and <strong>terrorist financing (TF)</strong>.</p><p>The report highlights <strong>India's significant progress</strong> in its efforts against illicit finance. This recognition underscores the country's commitment to global financial integrity.</p><h4>India's Achievement: High Level of Technical Compliance</h4><p>During its plenary in <strong>Singapore in June 2024</strong>, the <strong>FATF</strong> adopted India's Mutual Evaluation Report. The report specifically noted that India achieved a <strong>“high level of technical compliance”</strong> with the requirements set by the global money laundering watchdog.</p><div class='info-box'><p><strong>FATF Plenary, June 2024, Singapore:</strong> Officially adopted India's Mutual Evaluation Report, acknowledging its strong technical compliance.</p></div><p>Consequently, the <strong>FATF</strong> placed India in the <strong>“regular follow-up” category</strong>. This is the <strong>highest rating category</strong> awarded by FATF, signifying robust anti-money laundering and counter-terrorist financing frameworks.</p><div class='key-point-box'><p><strong>Regular Follow-Up Category:</strong> India is the <strong>only major economy with a federal structure</strong> to achieve this top status. This places India alongside other G-20 nations like the <strong>UK, France, and Italy</strong> in this esteemed category.</p></div><h4>Key Areas of Concern: Gems and Jewellery Sector</h4><p>The <strong>Gems and Jewellery (G&J) sector</strong> in India was identified as highly vulnerable to <strong>money laundering (ML)</strong> and <strong>terrorist financing (TF)</strong> risks. This sector is particularly susceptible due to its nature and scale.</p><p>The sector encompasses approximately <strong>1,75,000 dealers</strong>. However, only about <strong>9,500</strong> of these are registered with the <strong>Gems and Jewellery Export Promotion Council (GJEPC)</strong>, indicating a significant unregulated segment.</p><div class='info-box'><p><strong>G&J Sector Statistics:</strong></p><ul><li>Total Dealers: <strong>~1,75,000</strong></li><li>Registered with GJEPC: <strong>~9,500</strong></li><li>Vulnerability: High risk for <strong>ML/TF</strong> due to potential for fraud and smuggling.</li></ul></div><p>The <strong>FATF report</strong> also noted that <strong>criminal networks</strong> operating cross-border in the <strong>precious metals and stones (PMS) sector</strong> might be <strong>under-investigated</strong> by law enforcement agencies. This gap needs to be addressed effectively.</p><p>Given India's global significance as a major consumer and producer of <strong>refined diamonds and gems</strong>, continuous monitoring of <strong>fraud and smuggling techniques</strong> is crucial. This is essential to prevent these activities from being exploited for money laundering.</p><p>There is a recognized need for a better <strong>risk understanding</strong> and deeper <strong>quantitative and qualitative data</strong>. This data is vital for assessing the <strong>ML/TF risks</strong> specifically associated with <strong>gold and diamond smuggling</strong>.</p><h4>Terrorist Financing Threats</h4><p>India confronts significant <strong>terrorism threats</strong>, primarily from groups such as the <strong>Islamic State of Iraq and the Levant (ISIL)</strong> and <strong>Al-Qaeda-linked groups</strong>. These groups are notably active in and around <strong>Jammu and Kashmir</strong>.</p><p>Additional terrorism risks stem from <strong>regional insurgencies</strong> in the <strong>Northeast</strong> and various <strong>Left-Wing Extremist groups</strong> operating within the country. These diverse threats necessitate a comprehensive approach.</p><p>While India places strong emphasis on the <strong>prevention and disruption of terrorist financing</strong>, more concerted efforts are required. Specifically, there is a need to expedite the <strong>conclusion of prosecutions</strong> and secure <strong>convictions for terrorist financiers</strong>.</p><h4>FATF's Key Recommendations for India</h4><p>The <strong>FATF report</strong> provided several crucial recommendations for India to further strengthen its anti-money laundering and counter-terrorist financing framework.</p><ul><li><strong>Pending Trials:</strong> India needs to <strong>expedite the conclusion of pending money laundering trials</strong>. It also needs to improve its handling of crimes such as <strong>human trafficking</strong> and <strong>drug-related offences</strong>, which are often linked to illicit finance.</li><li><strong>Targeted Financial Sanctions:</strong> India must enhance its framework to ensure the <strong>freezing of funds and assets without delay</strong>. Furthermore, communication regarding sanctions needs to be <strong>streamlined</strong> for greater effectiveness.</li><li><strong>Domestic Politically Exposed Persons (PEPs):</strong> India needs to clearly <strong>define domestic PEPs</strong> under its existing anti-money laundering laws. Once defined, it must implement <strong>risk-based enhanced measures</strong> for these individuals to mitigate potential ML/TF risks.</li></ul><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding FATF's recommendations is crucial for <strong>GS Paper 3 (Internal Security & Economy)</strong>. Be prepared to discuss India's compliance and areas for improvement in your answers.</p></div>

💡 Key Takeaways

- •India achieved 'high level of technical compliance' in FATF's Mutual Evaluation Report, placed in 'regular follow-up' category.

- •India is the only major federal economy to achieve the highest FATF rating, alongside UK, France, Italy.

- •Key vulnerabilities identified in Gems and Jewellery sector due to low registration and cross-border smuggling risks.

- •Significant terrorist financing threats from ISIL, Al-Qaeda, NE insurgencies, and LWE groups; need to expedite prosecutions.

- •FATF recommendations include faster money laundering trials, improved targeted financial sanctions, and defining domestic PEPs.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•FATF Official Website (General information on FATF and Mutual Evaluations)

•Publicly available information on FATF's 2024 Plenary and India's status (inferred from the summary)