Increasing Real Effective Exchange Rate in India - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Increasing Real Effective Exchange Rate in India

Medium⏱️ 7 min read

economy

📖 Introduction

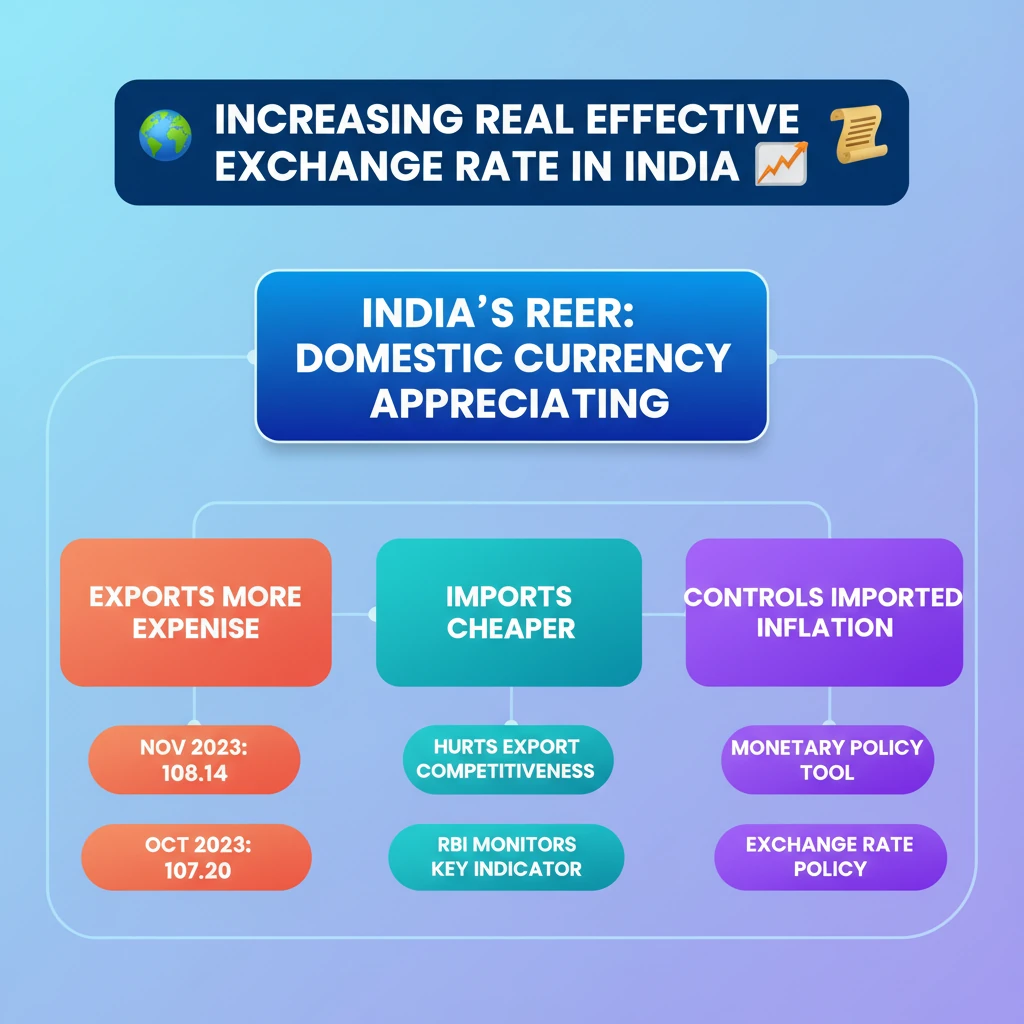

<h4>Understanding the Real Effective Exchange Rate (REER)</h4><p>The <strong>Real Effective Exchange Rate (REER)</strong> is a crucial economic indicator that measures the weighted average of a country's currency against a basket of major foreign currencies, adjusted for the effects of inflation.</p><p>It provides a more accurate picture of a country's international competitiveness compared to the nominal exchange rate, as it accounts for price level differences between countries.</p><div class='key-point-box'><p>A <strong>rise in REER</strong> indicates that a country's exports are becoming more expensive and its imports are becoming cheaper, potentially affecting its trade balance and competitiveness.</p></div><h4>Recent Trends in India's REER</h4><p>The <strong>Reserve Bank of India (RBI)</strong> recently reported a significant increase in India's <strong>Real Effective Exchange Rate (REER)</strong> for the <strong>rupee</strong>.</p><p>This upward trend reflects changes in both the nominal exchange rate of the rupee against its trading partners' currencies and the relative inflation rates.</p><div class='info-box'><p>In <strong>November 2023</strong>, the <strong>REER</strong> of the rupee reached <strong>108.14</strong>.</p><p>This marked an increase from <strong>107.20</strong> recorded in <strong>October 2023</strong>.</p><p>The <strong>November 2023</strong> figure represents the <strong>highest level</strong> for the rupee's REER in that year.</p></div><div class='exam-tip-box'><p>Understanding <strong>REER fluctuations</strong> is vital for analyzing India's trade dynamics, export competitiveness, and the overall health of its external sector for <strong>UPSC Mains GS Paper 3 (Economy)</strong>.</p></div>

💡 Key Takeaways

- •<strong>REER (Real Effective Exchange Rate)</strong> measures a currency's weighted average against a basket of currencies, adjusted for inflation.

- •A <strong>rising REER</strong> indicates the domestic currency is appreciating in real terms, making exports more expensive and imports cheaper.

- •In <strong>November 2023</strong>, India's REER reached <strong>108.14</strong>, its highest level for the year, up from <strong>107.20</strong> in <strong>October 2023</strong>.

- •An increasing REER can hurt <strong>export competitiveness</strong> but may help <strong>control imported inflation</strong>.

- •The <strong>RBI</strong> monitors REER as a crucial indicator for <strong>monetary and exchange rate policy</strong> decisions.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) Publications and Reports (as referenced by the source)