What are Government Initiatives to Increase Insurance Coverage? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are Government Initiatives to Increase Insurance Coverage?

Medium⏱️ 8 min read

economy

📖 Introduction

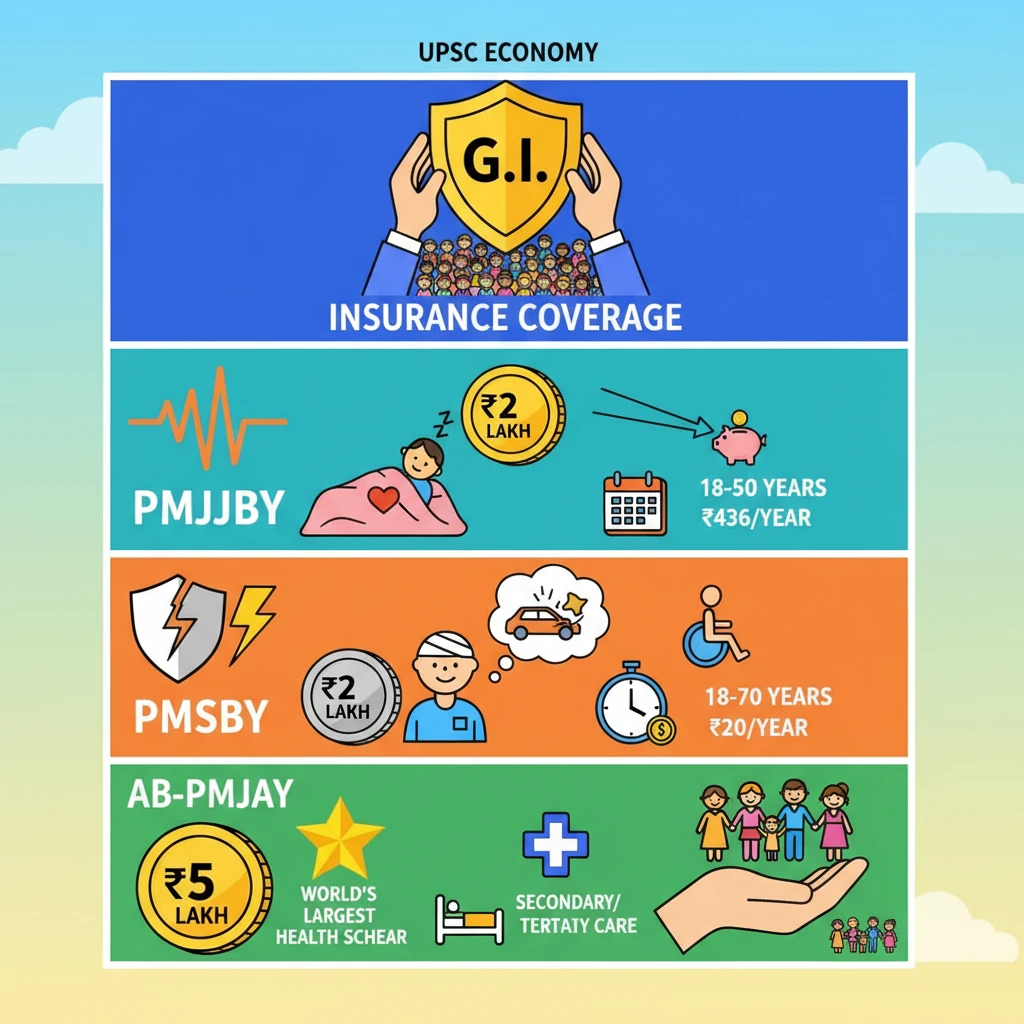

<h4>Understanding Government Initiatives for Insurance Coverage</h4><p>The Government of India has launched several schemes to enhance <strong>insurance penetration</strong> and provide a social safety net to its citizens. These initiatives aim to protect individuals and families against various financial risks, including death, disability, health emergencies, and crop losses.</p><div class='key-point-box'><p>Increasing <strong>insurance coverage</strong> is crucial for fostering financial stability, reducing poverty, and promoting inclusive growth across different segments of society.</p></div><h4>Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)</h4><p>The <strong>Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)</strong> is a government-backed <strong>life insurance scheme</strong>. It offers a renewable one-year term life cover to eligible individuals.</p><div class='info-box'><p><strong>Launch Date:</strong> <strong>May 9, 2015</strong><br><strong>Objective:</strong> To provide life insurance coverage to the economically vulnerable population.<br><strong>Target Group:</strong> Individuals aged <strong>18 to 50 years</strong> having a savings bank account.</p></div><p>The scheme provides a substantial sum assured upon the policyholder's death due to any cause. This offers crucial financial security to the family of the deceased.</p><ul><li><strong>Coverage:</strong> <strong>₹2 Lakh</strong> upon the death of the insured.</li><li><strong>Premium:</strong> <strong>₹436 per annum</strong>, auto-debited from the subscriber's bank account.</li><li><strong>Administration:</strong> Offered by <strong>Life Insurance Corporation (LIC)</strong> and other private life insurance companies through participating banks.</li></ul><h4>Pradhan Mantri Suraksha Bima Yojana (PMSBY)</h4><p>The <strong>Pradhan Mantri Suraksha Bima Yojana (PMSBY)</strong> is an affordable <strong>accident insurance scheme</strong>. It provides cover for accidental death and disability.</p><div class='info-box'><p><strong>Launch Date:</strong> <strong>May 9, 2015</strong><br><strong>Objective:</strong> To provide accidental death and disability cover at a very low premium.<br><strong>Target Group:</strong> Individuals aged <strong>18 to 70 years</strong> having a savings bank account.</p></div><p>This scheme is designed to be highly accessible, ensuring that a wide segment of the population can afford basic accident protection.</p><ul><li><strong>Coverage:</strong> <strong>₹2 Lakh</strong> for accidental death or total permanent disability.</li><li><strong>Coverage:</strong> <strong>₹1 Lakh</strong> for partial permanent disability.</li><li><strong>Premium:</strong> <strong>₹20 per annum</strong>, auto-debited from the subscriber's bank account.</li><li><strong>Administration:</strong> Offered by <strong>General Insurance Companies</strong> through participating banks.</li></ul><h4>Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana (AB-PMJAY)</h4><p><strong>Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana (AB-PMJAY)</strong> is the world's largest government-funded <strong>health insurance scheme</strong>. It aims to provide universal health coverage to the poor and vulnerable.</p><div class='info-box'><p><strong>Launch Date:</strong> <strong>September 23, 2018</strong><br><strong>Objective:</strong> To provide cashless and paperless access to health services for secondary and tertiary care hospitalization.<br><strong>Target Group:</strong> Over <strong>10.74 crore poor and vulnerable families</strong> (approximately 50 crore beneficiaries) based on the Socio-Economic Caste Census (SECC) 2011 data.</p></div><p>The scheme significantly reduces out-of-pocket expenditure on healthcare for eligible families.</p><ul><li><strong>Coverage:</strong> <strong>₹5 Lakh per family per year</strong> for secondary and tertiary hospitalization.</li><li><strong>Benefits:</strong> Covers pre-hospitalization expenses, diagnostics, medicines, and post-hospitalization care.</li><li><strong>Key Feature:</strong> Provides <strong>portability</strong>, allowing beneficiaries to avail services across empaneled hospitals nationwide.</li></ul><h4>Pradhan Mantri Fasal Bima Yojana (PMFBY)</h4><p>The <strong>Pradhan Mantri Fasal Bima Yojana (PMFBY)</strong> is a comprehensive <strong>crop insurance scheme</strong>. It provides financial support to farmers suffering crop loss/damage arising out of unforeseen events.</p><div class='info-box'><p><strong>Launch Date:</strong> <strong>January 13, 2016</strong><br><strong>Objective:</strong> To provide comprehensive insurance cover against the failure of notified crops, thereby stabilizing farmers' income.<br><strong>Target Group:</strong> All farmers growing notified crops in notified areas.</p></div><p>PMFBY aims to reduce the financial burden on farmers due to crop failures caused by natural calamities.</p><ul><li><strong>Risks Covered:</strong> Non-preventable natural risks like drought, floods, pests, diseases, hailstorms, landslides, etc.</li><li><strong>Farmer's Premium:</strong> <strong>1.5%</strong> for <strong>Rabi crops</strong>, <strong>2%</strong> for <strong>Kharif crops</strong>, and <strong>5%</strong> for <strong>commercial/horticultural crops</strong>. The remaining premium is borne by the government.</li><li><strong>Key Feature:</strong> Use of technology like drones and satellite imagery for faster assessment of crop losses.</li></ul><div class='exam-tip-box'><p>For UPSC, understand the <strong>specific objectives</strong>, <strong>target beneficiaries</strong>, and <strong>key features</strong> of each scheme. Questions often test the differences between similar schemes (e.g., PMJJBY vs. PMSBY) or the impact of schemes like AB-PMJAY on social welfare.</p></div>

💡 Key Takeaways

- •Government schemes like PMJJBY, PMSBY, AB-PMJAY, and PMFBY are crucial for increasing insurance coverage in India.

- •PMJJBY offers life insurance (₹2 Lakh) for 18-50 years at ₹436/year.

- •PMSBY provides accidental death/disability cover (₹2 Lakh) for 18-70 years at ₹20/year.

- •AB-PMJAY is the world's largest health scheme, offering ₹5 Lakh/family/year for secondary/tertiary care to vulnerable families.

- •PMFBY provides crop insurance to farmers against natural calamities, with subsidized premiums.

- •These initiatives enhance financial inclusion, reduce poverty, and strengthen social security for diverse segments of the population.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•National Health Authority (NHA), Government of India (for AB-PMJAY)

•Ministry of Agriculture & Farmers Welfare, Government of India (for PMFBY)

•Press Information Bureau (PIB), Government of India releases