It would enable friction-less credit while delivering banking services to farmers and MSME borrowers. - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

It would enable friction-less credit while delivering banking services to farmers and MSME borrowers.

Medium⏱️ 7 min read

economy

📖 Introduction

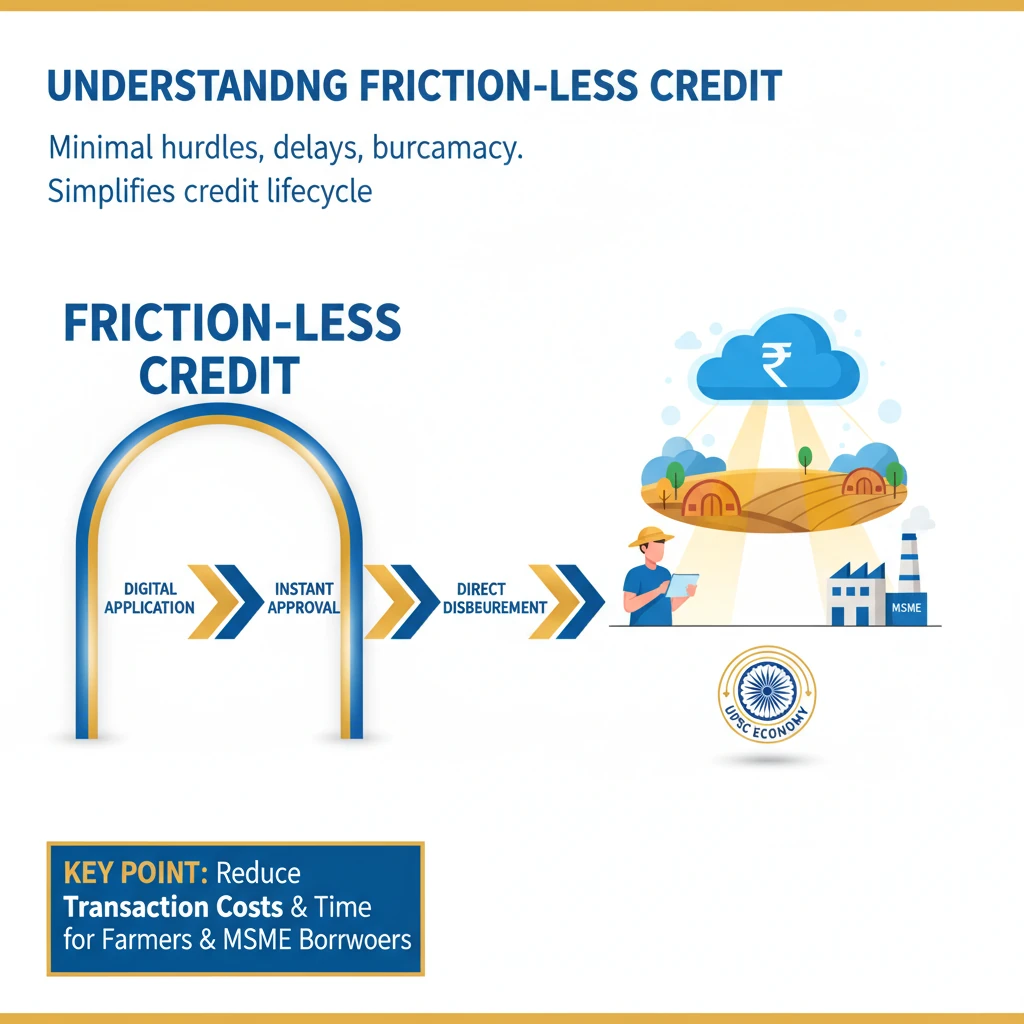

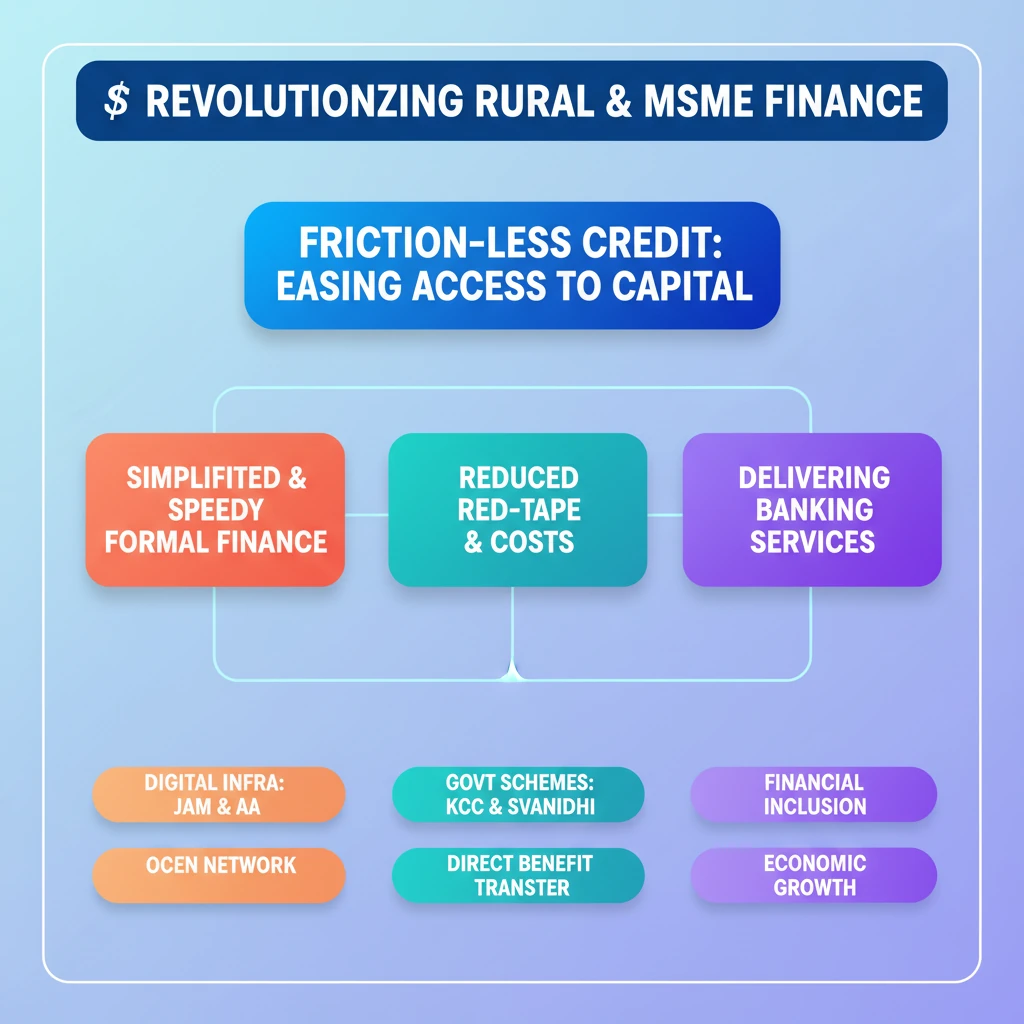

<h4>Understanding Friction-less Credit</h4><p><strong>Friction-less credit</strong> refers to the provision of financial assistance with minimal hurdles, delays, and bureaucratic processes. It aims to simplify the entire credit lifecycle, from application to disbursement and repayment.</p><div class='key-point-box'><p>The core objective is to reduce the <strong>transaction costs</strong> and <strong>time taken</strong> for borrowers, particularly vulnerable groups like <strong>farmers</strong> and <strong>MSMEs</strong>, to access essential funds.</p></div><h4>Challenges Faced by Farmers and MSMEs</h4><p>Traditionally, <strong>farmers</strong> and <strong>Micro, Small, and Medium Enterprises (MSMEs)</strong> have faced significant challenges in accessing formal credit. These include lack of collateral, complex documentation, and long processing times.</p><div class='info-box'><p><strong>Farmers</strong> often rely on informal money lenders due to urgent seasonal needs, leading to high interest rates. <strong>MSMEs</strong> struggle with working capital and expansion finance, hindering their growth potential.</p></div><h4>Enabling Banking Services</h4><p>Delivering effective <strong>banking services</strong> to these sectors involves more than just credit. It encompasses a full suite of financial products, including savings facilities, insurance, payment services, and financial literacy programs.</p><div class='exam-tip-box'><p>UPSC often asks about <strong>financial inclusion</strong> and the role of technology in economic development. Friction-less credit is a key component of this broader agenda, especially relevant for <strong>GS Paper III: Economy</strong>.</p></div><h4>Benefits of Friction-less Credit</h4><p>Implementing friction-less credit mechanisms offers several advantages. It enhances the speed and efficiency of credit delivery, making finance more accessible to those who need it most.</p><ul><li><strong>Increased Access:</strong> More farmers and MSMEs can obtain formal credit, reducing reliance on informal sources.</li><li><strong>Reduced Costs:</strong> Lower processing fees and interest rates due to streamlined operations.</li><li><strong>Economic Growth:</strong> Improved access to capital fuels agricultural productivity and MSME expansion, contributing to overall economic development.</li><li><strong>Financial Inclusion:</strong> Brings more individuals and small businesses into the formal financial system.</li></ul>

💡 Key Takeaways

- •Friction-less credit aims to simplify and speed up access to formal finance for farmers and MSMEs.

- •It reduces bureaucratic hurdles, documentation, and transaction costs for borrowers.

- •Digital infrastructure like the JAM trinity, Account Aggregators, and OCEN are key enablers.

- •Government schemes like KCC and PM SVANidhi are examples of friction-less credit in action.

- •Enhancing friction-less credit is crucial for boosting financial inclusion, rural development, and overall economic growth.

🧠 Memory Techniques

90% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) publications on financial inclusion and digital payments

•Ministry of Finance reports on MSME and agricultural credit

•NITI Aayog documents on digital public infrastructure