What is an Exchange Rate? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is an Exchange Rate?

Medium⏱️ 8 min read

economy

📖 Introduction

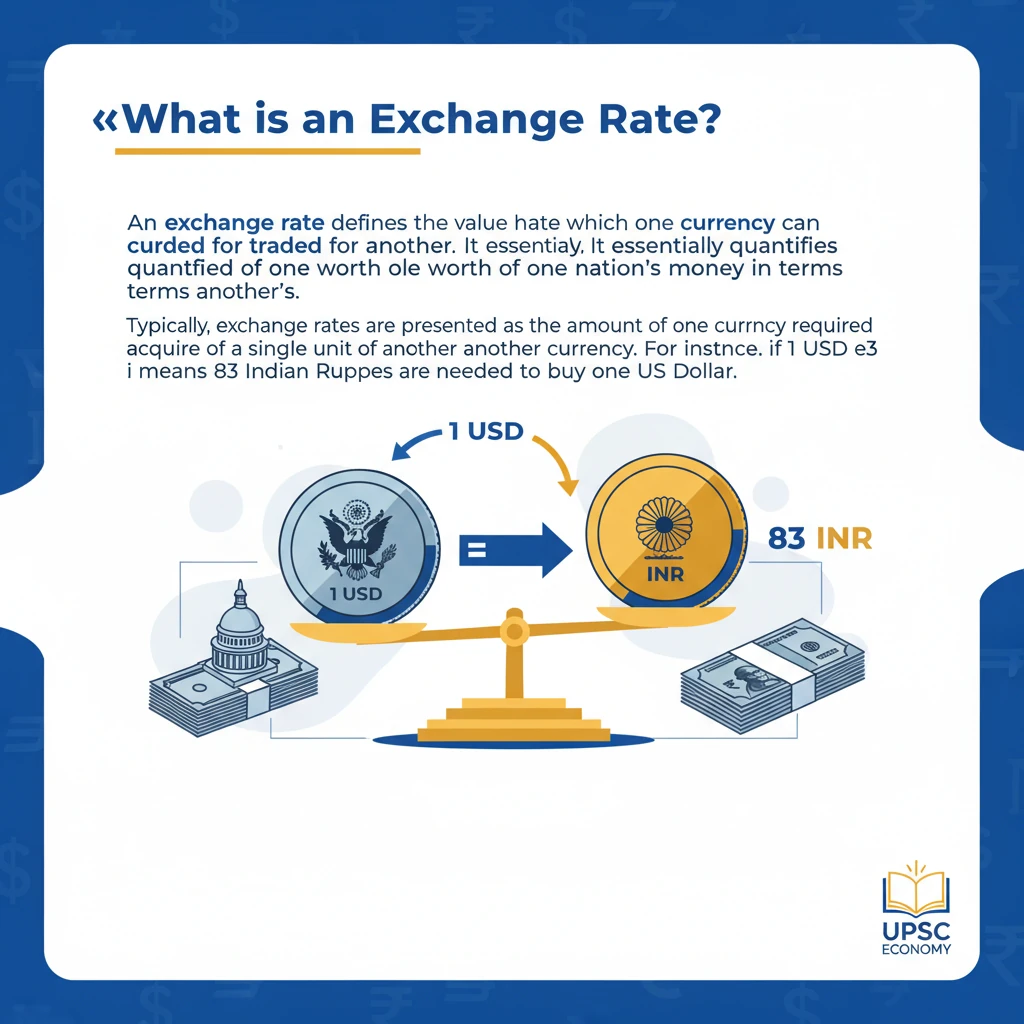

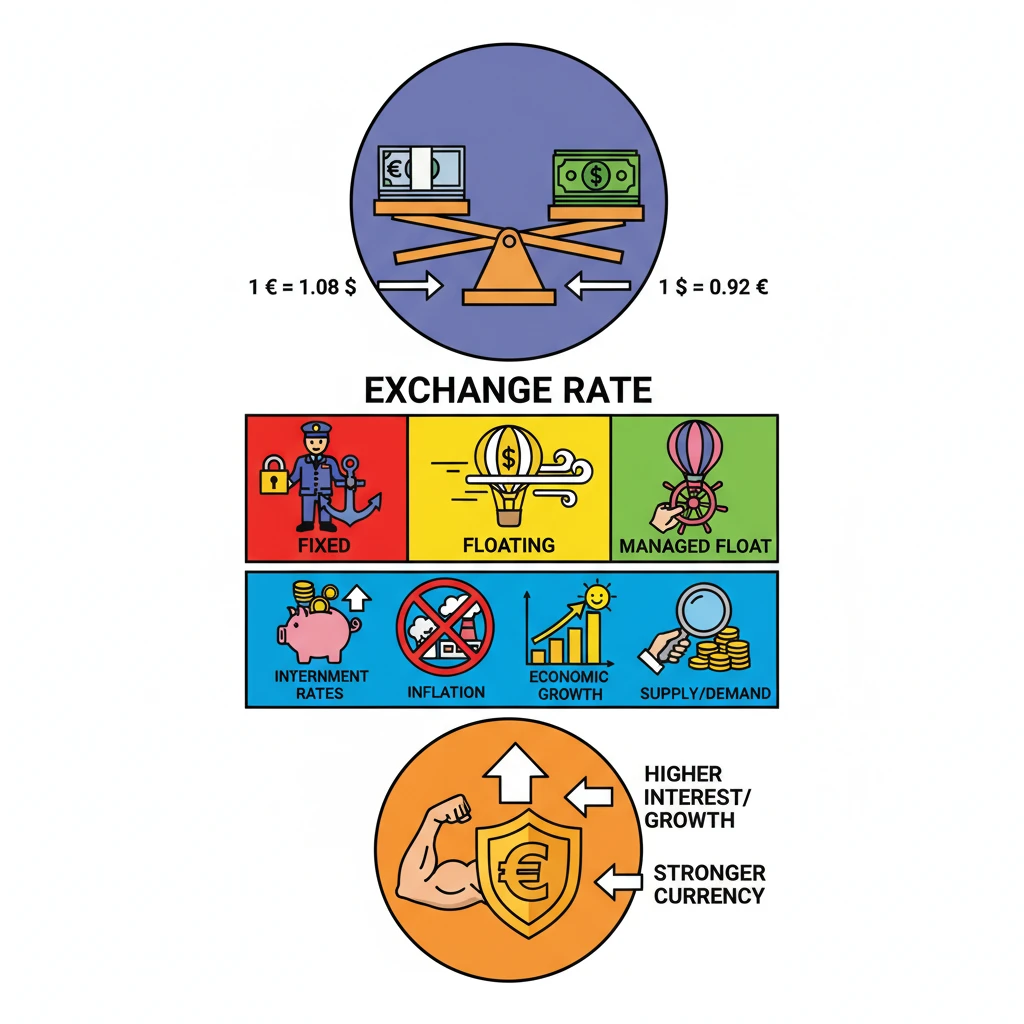

<h4>What is an Exchange Rate?</h4><p>An <strong>exchange rate</strong> defines the value at which one <strong>currency</strong> can be traded for another. It essentially quantifies the worth of one nation's money in terms of another's.</p><p>Typically, exchange rates are presented as the amount of one <strong>currency</strong> required to acquire a single unit of another <strong>currency</strong>. For instance, if 1 USD equals 83 INR, it means 83 Indian Rupees are needed to buy one US Dollar.</p><div class='info-box'><p><strong>Definition:</strong> An <strong>exchange rate</strong> is the rate at which one <strong>currency</strong> is converted into another, reflecting its relative value.</p></div><h4>Types of Exchange Rate Regimes</h4><p>Different countries adopt various systems to determine their <strong>currency's value</strong>. These regimes impact how exchange rates fluctuate and are managed.</p><div class='key-point-box'><p><strong>1. Fixed Exchange Rate:</strong> In this system, governments or central banks establish a specific value for their <strong>currency</strong> relative to other <strong>currencies</strong>. They actively maintain this fixed value by intervening in the <strong>foreign exchange markets</strong>, buying or selling their own <strong>currency</strong> as needed.</p></div><div class='key-point-box'><p><strong>2. Floating Exchange Rate:</strong> Here, the value of a <strong>currency</strong> is primarily determined by the forces of <strong>supply and demand</strong> within the <strong>forex market</strong>. Most major global <strong>currencies</strong>, such as the US Dollar and Euro, operate under this flexible system.</p></div><div class='key-point-box'><p><strong>3. Managed Float:</strong> This system combines elements of both <strong>fixed</strong> and <strong>floating exchange rates</strong>. While the market generally determines the <strong>currency's value</strong>, governments or central banks intervene occasionally to stabilize excessive fluctuations or guide the <strong>currency</strong> towards a desired range.</p></div><h4>Factors Affecting Exchange Rates</h4><p>Several macroeconomic factors can significantly influence a <strong>currency's exchange rate</strong>, leading to appreciation or depreciation.</p><div class='key-point-box'><p><strong>1. Interest Rates:</strong> Higher <strong>interest rates</strong> in a country tend to make its financial assets more attractive to foreign investors. This increased demand for the country's <strong>currency</strong> to invest leads to a stronger <strong>exchange rate</strong>.</p></div><div class='key-point-box'><p><strong>2. Inflation:</strong> If a country experiences higher <strong>inflation</strong> compared to its trading partners, its goods and services become relatively more expensive. This reduces the <strong>purchasing power</strong> of its <strong>currency</strong>, causing it to weaken and its <strong>exchange rate</strong> to depreciate.</p></div><div class='key-point-box'><p><strong>3. Economic Growth:</strong> A robust and growing economy fosters investor confidence and attracts foreign direct investment (FDI). This positive sentiment boosts demand for the country's <strong>currency</strong>, resulting in a stronger <strong>exchange rate</strong>.</p></div><div class='key-point-box'><p><strong>4. Supply and Demand:</strong> The fundamental economic principle of <strong>supply and demand</strong> is crucial. If there is higher demand for a particular <strong>currency</strong> (e.g., due to increased exports or investment), its <strong>exchange rate</strong> will strengthen. Conversely, increased supply or reduced demand will weaken it.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the interplay of these factors is vital for questions on <strong>Balance of Payments</strong>, <strong>Monetary Policy</strong>, and <strong>International Trade</strong>. Be prepared to analyze scenarios where multiple factors influence the <strong>exchange rate</strong> simultaneously.</p></div>

💡 Key Takeaways

- •Exchange rate is the value of one currency in terms of another.

- •Three main types: Fixed (government set), Floating (market determined), and Managed Float (mix of both).

- •Key factors influencing exchange rates include interest rates, inflation, economic growth, and supply/demand.

- •Higher interest rates and strong economic growth typically strengthen a currency.

- •Higher inflation generally weakens a currency.

- •Central banks often intervene in managed float systems to stabilize currency volatility.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•NCERT Class 12 Macroeconomics - Chapter 6: Open Economy Macroeconomics

•Reserve Bank of India (RBI) publications on Foreign Exchange Management

•IMF (International Monetary Fund) articles on Exchange Rate Regimes