Regulatory Changes - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Regulatory Changes

Medium⏱️ 6 min read

economy

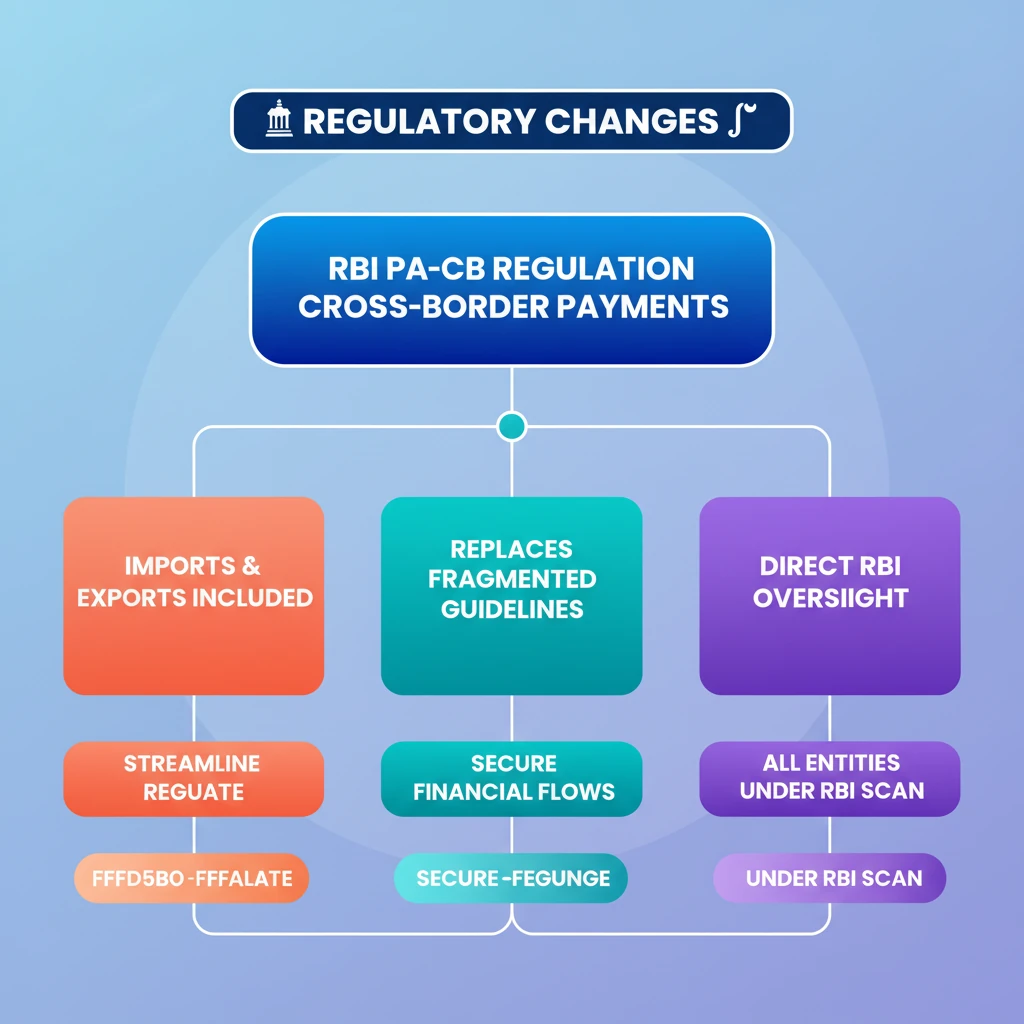

📖 Introduction

<h4>Introduction to Regulatory Changes in Cross-Border Payments</h4><p>The <strong>Reserve Bank of India (RBI)</strong> has proactively introduced significant regulatory changes to enhance the oversight of international financial transactions. These changes specifically target the domain of <strong>cross-border payments</strong>, which are crucial for global trade and economic integration.</p><div class='info-box'><p><strong>Cross-border payments</strong> refer to financial transactions where the payer and the recipient are located in different countries. These include both incoming (exports) and outgoing (imports) remittances.</p></div><h4>The Payment Aggregators of Cross-Border Transactions (PA-CB) Regulation</h4><p>A pivotal step in this regulatory evolution is the introduction of the <strong>Payment Aggregators of Cross-Border Transactions (PA-CB Regulation)</strong>. This framework is designed to bring greater structure and accountability to the entities facilitating these complex transactions.</p><div class='key-point-box'><p>The primary objective of the <strong>PA-CB Regulation</strong> is to <strong>streamline and regulate</strong> the entire process of cross-border payments. This includes a comprehensive approach to managing both <strong>import and export transactions</strong>, ensuring smoother and more secure financial flows.</p></div><h4>Replacement of Previous Guidelines</h4><p>The new <strong>PA-CB framework</strong> does not operate in isolation; it explicitly <strong>replaces previous guidelines</strong> that governed cross-border payment facilitators. This indicates a move towards a more consolidated and robust regulatory regime, adapting to the evolving landscape of digital payments.</p><h4>Direct RBI Oversight</h4><p>One of the most critical aspects of the <strong>PA-CB Regulation</strong> is its provision for <strong>direct RBI oversight</strong>. Under this new framework, all entities involved in facilitating cross-border payments are now directly accountable to the central bank. This enhances regulatory control and mitigates risks associated with international financial flows.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the shift to <strong>direct RBI oversight</strong> is crucial. It signifies a move towards greater transparency, risk management, and prevention of illicit financial activities in cross-border transactions, a common theme in <strong>GS-III Economy</strong> questions.</p></div>

💡 Key Takeaways

- •RBI introduced PA-CB Regulation for cross-border payments.

- •The regulation covers both import and export transactions.

- •It replaces previous, fragmented guidelines.

- •All entities involved now fall under direct RBI oversight.

- •Aims to streamline, regulate, and secure international financial flows.

- •Enhances financial stability and supports digital economy initiatives.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) official notifications and press releases regarding Payment Aggregators for Cross-Border Transactions