What is the OECD? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is the OECD?

Medium⏱️ 8 min read

economy

📖 Introduction

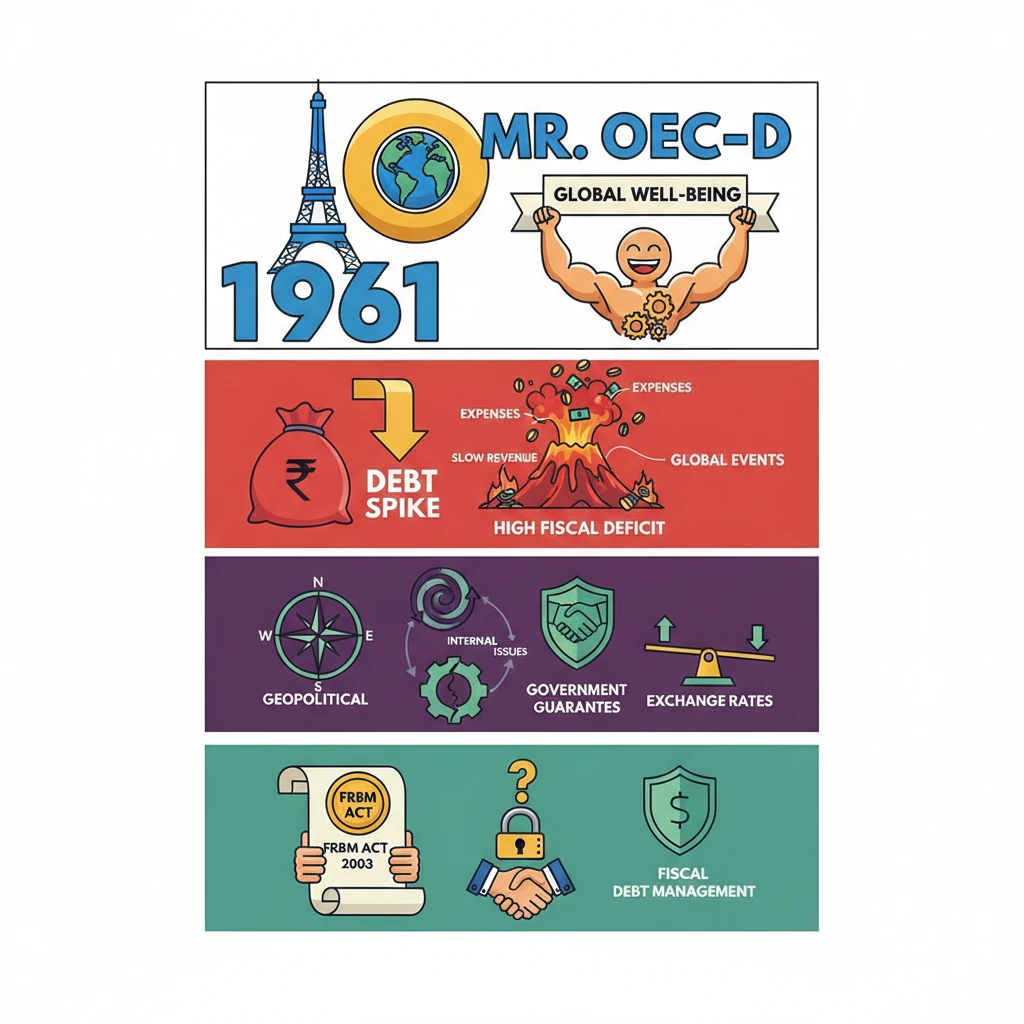

<h4>Understanding the Organisation for Economic Co-operation and Development (OECD)</h4><p>The <strong>Organisation for Economic Co-operation and Development (OECD)</strong> is a pivotal <strong>intergovernmental economic organization</strong>. It serves as a forum for governments to work together, share experiences, and seek solutions to common problems.</p><div class='info-box'><p><strong>Founding Year:</strong> The OECD was officially founded in <strong>1961</strong>, evolving from the Organisation for European Economic Co-operation (OEEC).</p><p><strong>Headquarters:</strong> Its central operations are based in <strong>Paris, France</strong>.📍</p></div><p>The primary goal of the OECD is to foster economic and social well-being worldwide. It achieves this by promoting policies that improve the economic and social conditions of people around the world.</p><h4>Factors Related to India’s Rising Debt Levels</h4><p>India, like many developing economies, faces challenges related to its public debt. Several interconnected factors contribute to the country's rising debt levels.</p><div class='key-point-box'><p><strong>High Fiscal Deficit:</strong> A persistent <strong>fiscal deficit</strong> is a primary driver of increasing debt. This occurs when the government's total expenditure exceeds its total revenue, excluding borrowings.</p></div><p>To bridge this gap, the government often resorts to borrowing, which adds to the national debt. This deficit can stem from various underlying issues:</p><ul><li><strong>High Expenditure Commitments:</strong> Significant government spending on welfare schemes, infrastructure projects, subsidies, and defense can lead to substantial outlays. These commitments, while necessary for development, can strain fiscal resources.</li><li><strong>Slow Revenue Growth:</strong> If tax collections and other non-tax revenues do not grow sufficiently to match expenditure, the fiscal deficit widens. Factors like economic slowdowns or inefficiencies in tax administration can contribute to this.</li><li><strong>Global Geopolitical Events:</strong> External shocks, such as wars, pandemics, or global economic crises, can necessitate increased government spending (e.g., stimulus packages) or reduce revenue, thereby impacting debt levels.</li><li><strong>Internal Economy and Tax Leakage:</strong> Domestic economic challenges, alongside issues like tax evasion or inefficient tax collection mechanisms, can lead to significant <strong>tax leakage</strong>, further exacerbating revenue shortfalls.</li><li><strong>Guarantees and Contingencies:</strong> Government guarantees for public sector undertakings or specific projects, while not direct debt, represent potential liabilities that could materialize, adding to the debt burden.</li><li><strong>Exchange Rate Fluctuations:</strong> For external debt, adverse <strong>exchange rate fluctuations</strong> can increase the rupee equivalent of foreign currency denominated debt, making repayment more expensive.</li></ul><h4>Legislation for Debt Management in India</h4><p>To address the challenges of fiscal discipline and debt management, India enacted a significant piece of legislation.</p><div class='info-box'><p>The <strong>Fiscal Responsibility and Budget Management Act, 2003 (FRBM Act)</strong> is a crucial law. It aims to institutionalize financial discipline, reduce fiscal deficit, and improve macro-economic management by setting targets for government debt and deficits.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the interplay between global economic organizations like <strong>OECD</strong> and domestic fiscal policies (like the <strong>FRBM Act</strong>) is crucial for <strong>GS Paper 3 (Economy)</strong>. Be prepared to analyze their impact on India's economic stability and growth.</p></div>

💡 Key Takeaways

- •The <strong>OECD</strong> is a Paris-headquartered intergovernmental economic organization founded in <strong>1961</strong>, promoting global economic and social well-being.

- •India's rising debt is primarily driven by <strong>high fiscal deficits</strong>, stemming from high expenditure, slow revenue growth, and global events.

- •Factors like <strong>geopolitical events</strong>, internal economy issues, government guarantees, and exchange rate fluctuations also contribute to India's debt.

- •The <strong>Fiscal Responsibility and Budget Management Act, 2003 (FRBM Act)</strong> is India's key legislation for ensuring fiscal discipline and managing debt.

- •India is a <strong>Key Partner</strong> of the OECD, participating in its initiatives despite not being a full member.

- •Understanding these dynamics is crucial for analyzing India's economic stability and its global economic engagements.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Official OECD Website (www.oecd.org)

•Ministry of Finance, Government of India (Union Budget documents, FRBM Act details)

•Reserve Bank of India (RBI) publications on public debt and fiscal indicators