Deposit Insurance: Need and Relevance (PMC, Yes Bank Cases) - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Deposit Insurance: Need and Relevance (PMC, Yes Bank Cases)

Medium⏱️ 6 min read

economy

📖 Introduction

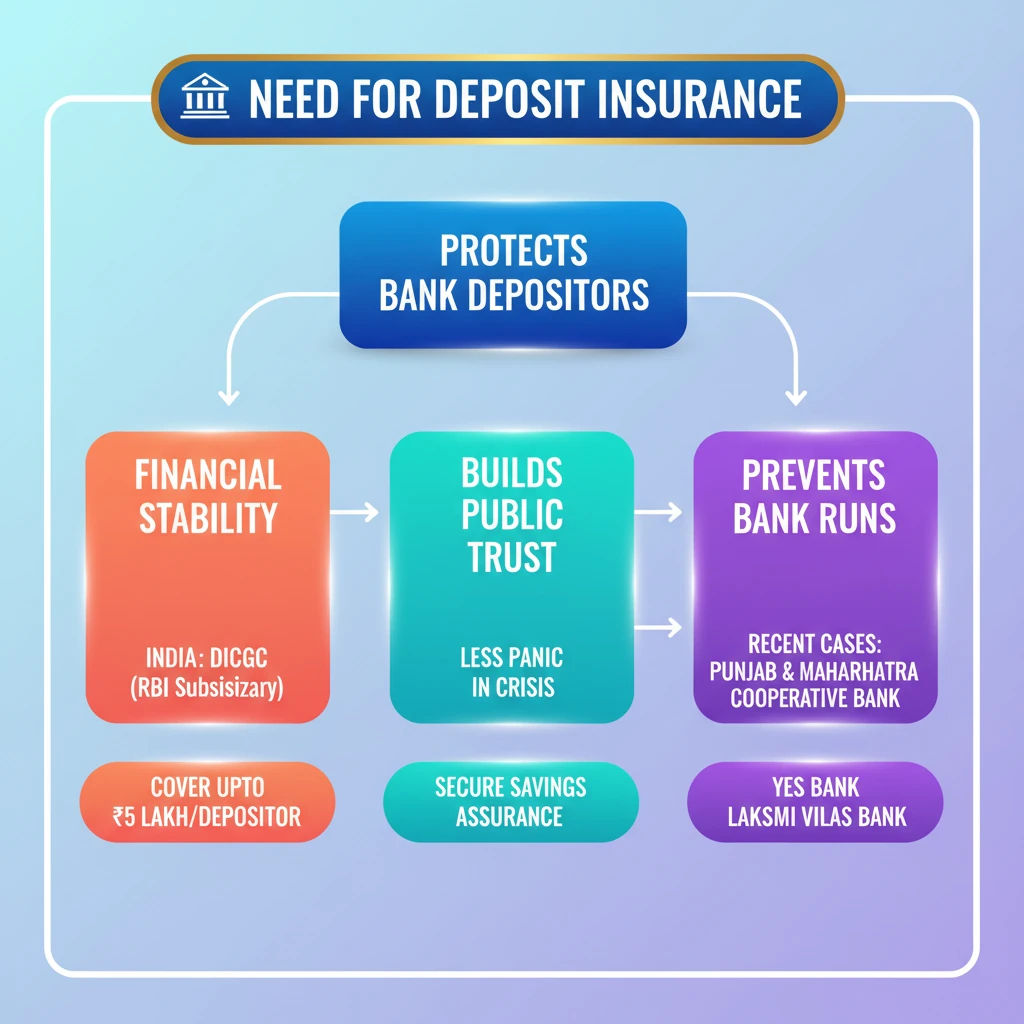

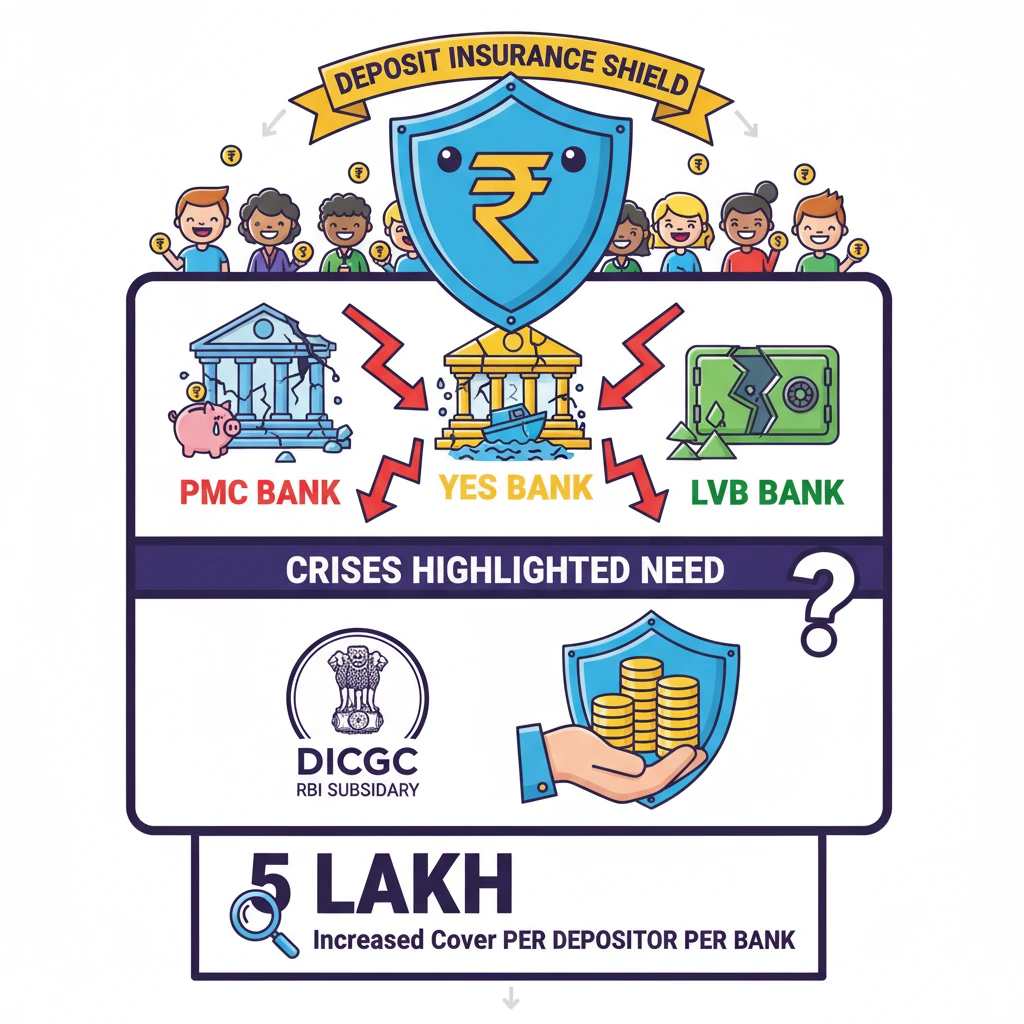

<h4>Introduction to Deposit Insurance</h4><p>The concept of <strong>deposit insurance</strong> has gained significant attention, particularly in the wake of recent challenges faced by various banks in India. It serves as a crucial safety net for depositors.</p><p>This mechanism is designed to protect depositors' funds, ensuring they can access their money even if a bank faces financial distress or collapses.</p><h4>The Need for Deposit Insurance: Recent Cases</h4><p>The immediate need for robust <strong>deposit insurance</strong> was sharply highlighted by difficulties experienced by depositors in accessing their funds from several banks.</p><p>These incidents underscored the vulnerability of public savings and the critical role of an effective insurance system to maintain public trust in the banking sector.</p><div class='info-box'><p>Recent cases that brought <strong>deposit insurance</strong> into the spotlight include:</p><ul><li><strong>Punjab & Maharashtra Co-operative (PMC) Bank</strong></li><li><strong>Yes Bank</strong></li><li><strong>Lakshmi Vilas Bank</strong></li></ul></div><h4>Impact on Depositors</h4><p>In these instances, depositors faced significant hurdles and delays in withdrawing their own money. This created widespread panic and eroded confidence in the stability of financial institutions.</p><p>The situations at <strong>PMC Bank</strong>, <strong>Yes Bank</strong>, and <strong>Lakshmi Vilas Bank</strong> demonstrated that even regulated entities can face severe liquidity or solvency issues, directly impacting ordinary citizens.</p><div class='key-point-box'><p><strong>Key Point:</strong> The troubles faced by depositors in these banks made the subject of <strong>deposit insurance</strong> a central topic of discussion regarding financial security and consumer protection.</p></div><h4>Maintaining Financial Stability</h4><p>A strong <strong>deposit insurance</strong> system is vital for preventing systemic risks. It assures depositors that their money is safe, thereby preventing bank runs and maintaining overall financial stability.</p><p>Without such a safety net, any perceived weakness in a bank could trigger mass withdrawals, potentially leading to a cascading failure across the banking system.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the 'Need' of deposit insurance is crucial for <strong>GS Paper III (Indian Economy)</strong>. Focus on the underlying reasons, recent examples, and its role in financial stability and consumer confidence. Link it to the role of <strong>DICGC</strong>.</p></div>

💡 Key Takeaways

- •Deposit insurance protects depositors' funds in case of bank failure.

- •Recent bank crises (PMC, Yes, LVB) highlighted its critical need.

- •In India, DICGC provides deposit insurance coverage.

- •The insurance cover was recently increased to ₹5 lakh per depositor per bank.

- •It is essential for maintaining financial stability and public confidence in the banking system.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) official communications

•Deposit Insurance and Credit Guarantee Corporation (DICGC) official website

•Union Budget 2020-21 documents