What are the Other Platforms that Facilitate Lending in India? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are the Other Platforms that Facilitate Lending in India?

Medium⏱️ 7 min read

economy

📖 Introduction

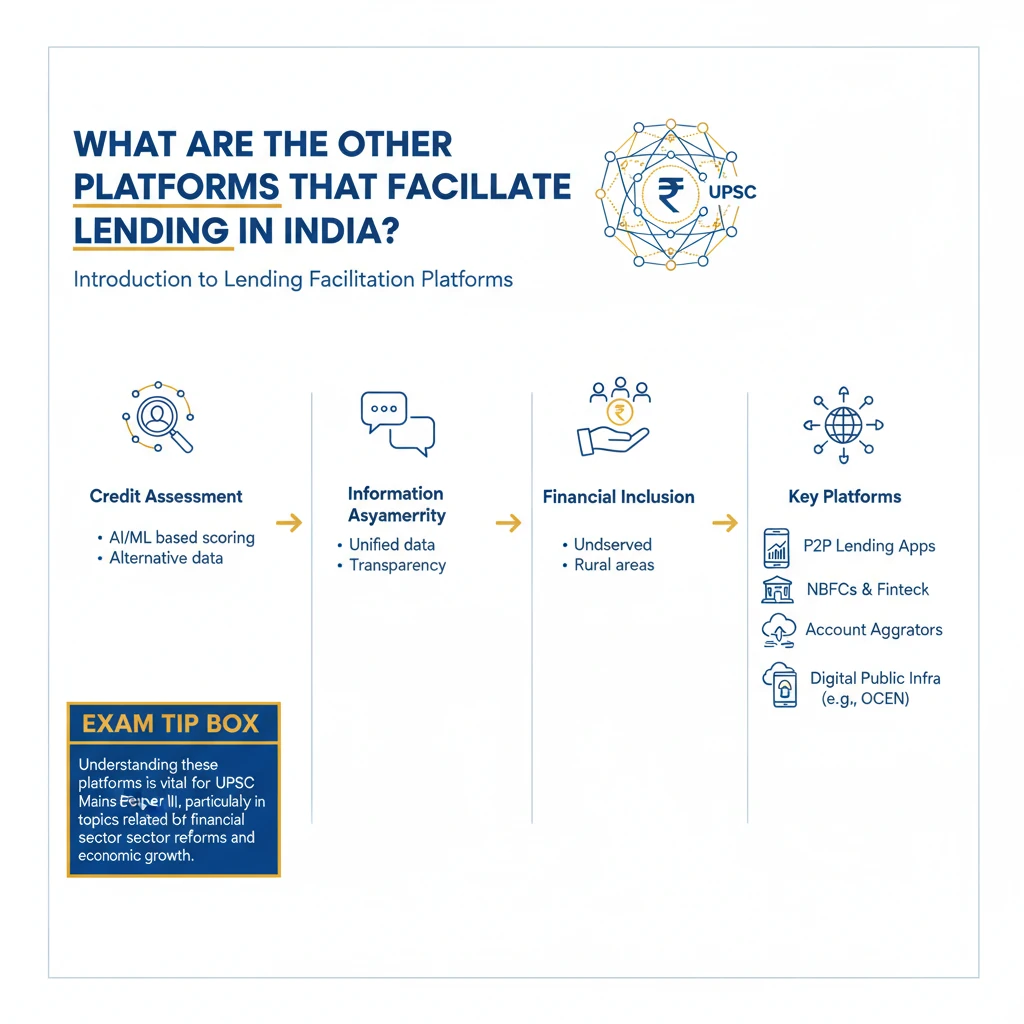

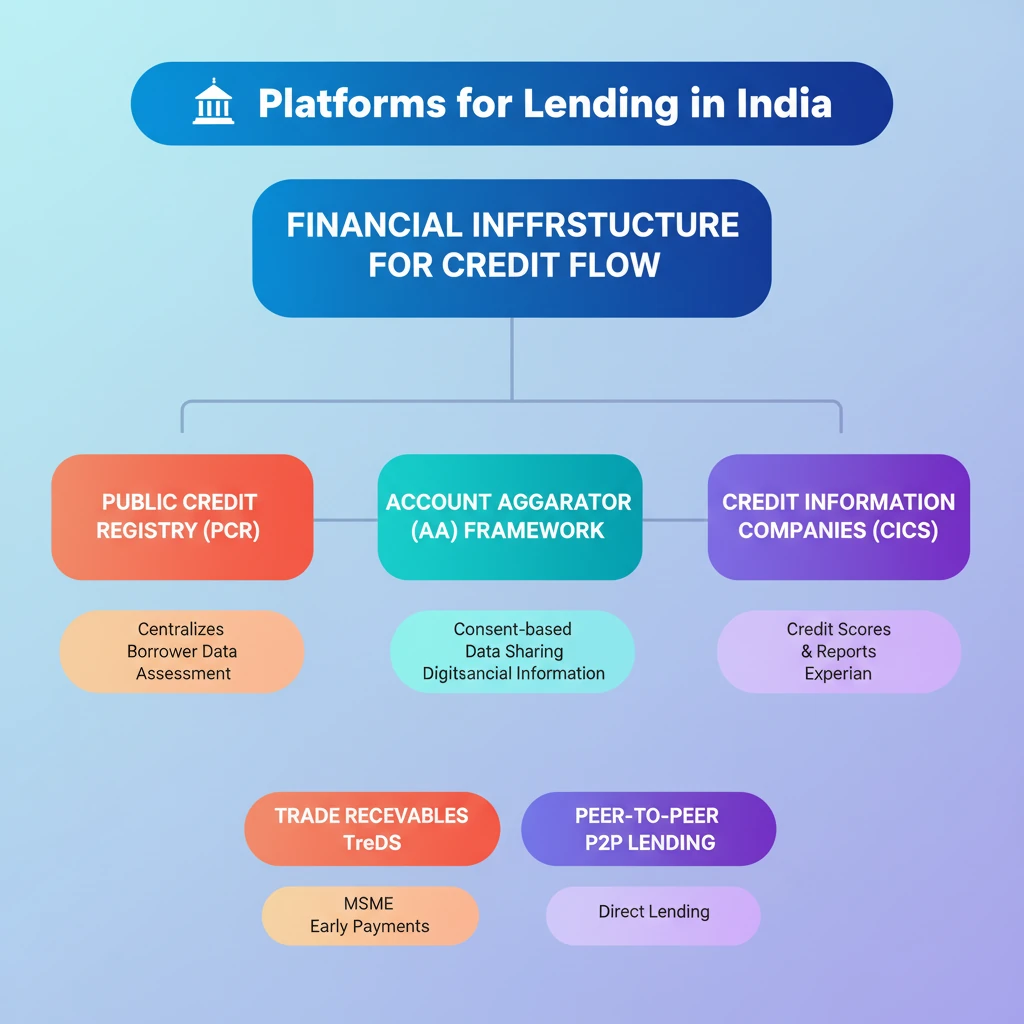

<h4>Introduction to Lending Facilitation Platforms</h4><p>India's financial ecosystem is evolving, with various platforms emerging to streamline and enhance the lending process. These platforms play a crucial role in improving <strong>credit assessment</strong>, reducing <strong>information asymmetry</strong>, and fostering financial inclusion.</p><div class='exam-tip-box'><p>Understanding these platforms is vital for <strong>UPSC Mains GS Paper III</strong>, particularly in topics related to the <strong>Indian Economy</strong>, <strong>financial markets</strong>, and <strong>MSME development</strong>. Focus on their functions and impact.</p></div><h4>Public Credit Registry (PCR)</h4><p>The <strong>Public Credit Registry (PCR)</strong> is a centralized database designed to store comprehensive credit information of borrowers. Its primary objective is to assist lenders in accurately assessing the <strong>creditworthiness</strong> of applicants.</p><div class='info-box'><p><strong>Function:</strong> The <strong>PCR</strong> aggregates data from various sources, providing a holistic view of a borrower's credit history. This reduces the problem of <strong>information asymmetry</strong> in the credit market.</p></div><h4>Account Aggregator (AA) Framework</h4><p>The <strong>Account Aggregator (AA) Framework</strong> is an innovative, consent-based platform regulated by the <strong>Reserve Bank of India (RBI)</strong>. It empowers customers to securely share their financial information across different financial institutions.</p><div class='info-box'><p><strong>Key Feature:</strong> This framework streamlines access to financial data for lenders, facilitating quicker and more informed lending decisions. It operates on a principle of explicit <strong>customer consent</strong> for data sharing.</p></div><h4>Credit Information Companies (CICs)</h4><p><strong>Credit Information Companies (CICs)</strong> are specialized entities responsible for collecting and maintaining the credit information of both individuals and businesses. Prominent examples include <strong>CIBIL</strong>, <strong>Equifax</strong>, and <strong>Experian</strong>.</p><div class='key-point-box'><p><strong>Role:</strong> <strong>CICs</strong> generate <strong>credit scores</strong> and reports, which are indispensable tools for banks and other lending institutions to evaluate the credit risk associated with potential borrowers.</p></div><h4>Trade Receivables Discounting System (TReDS)</h4><p>The <strong>Trade Receivables Discounting System (TReDS)</strong> is an electronic platform specifically designed to address the working capital needs of <strong>Micro, Small, and Medium Enterprises (MSMEs)</strong>. It enables them to convert their trade receivables into liquid funds.</p><div class='info-box'><p><strong>Mechanism:</strong> Through <strong>TReDS</strong>, MSMEs can auction their <strong>trade receivables</strong> (invoices) to multiple financiers (banks, NBFCs) at competitive rates, ensuring timely access to finance and improving cash flow.</p></div><h4>Peer-to-Peer (P2P) Lending Platforms</h4><p><strong>Peer-to-Peer (P2P) Lending Platforms</strong> are online marketplaces that directly connect individuals who wish to lend money with those who seek to borrow. This disintermediates traditional financial institutions to some extent.</p><div class='info-box'><p><strong>Examples:</strong> Platforms like <strong>Faircent</strong> and <strong>Lendbox</strong> facilitate these direct transactions, offering an alternative channel for both borrowing and investing. They are regulated by the <strong>RBI</strong> to ensure consumer protection.</p></div>

💡 Key Takeaways

- •Various platforms like PCR, AA Framework, CICs, TReDS, and P2P lending facilitate credit in India.

- •Public Credit Registry (PCR) centralizes borrower credit data for better risk assessment.

- •Account Aggregator (AA) Framework enables consent-based digital sharing of financial information.

- •Credit Information Companies (CICs) provide credit scores and reports (e.g., CIBIL).

- •Trade Receivables Discounting System (TReDS) helps MSMEs get early payments for invoices.

- •Peer-to-Peer (P2P) Lending Platforms connect individual lenders and borrowers directly.

- •These platforms collectively reduce information asymmetry, enhance financial inclusion, and improve credit flow efficiency.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) official publications and press releases regarding PCR, AA Framework, and P2P Lending regulations

•National Credit Information Company Limited (NCICL) and other Credit Information Companies (CICs) official websites for their operational details

•SIDBI and Ministry of MSME reports on Trade Receivables Discounting System (TReDS)