India’s Taxation System - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

India’s Taxation System

Medium⏱️ 8 min read

economy

📖 Introduction

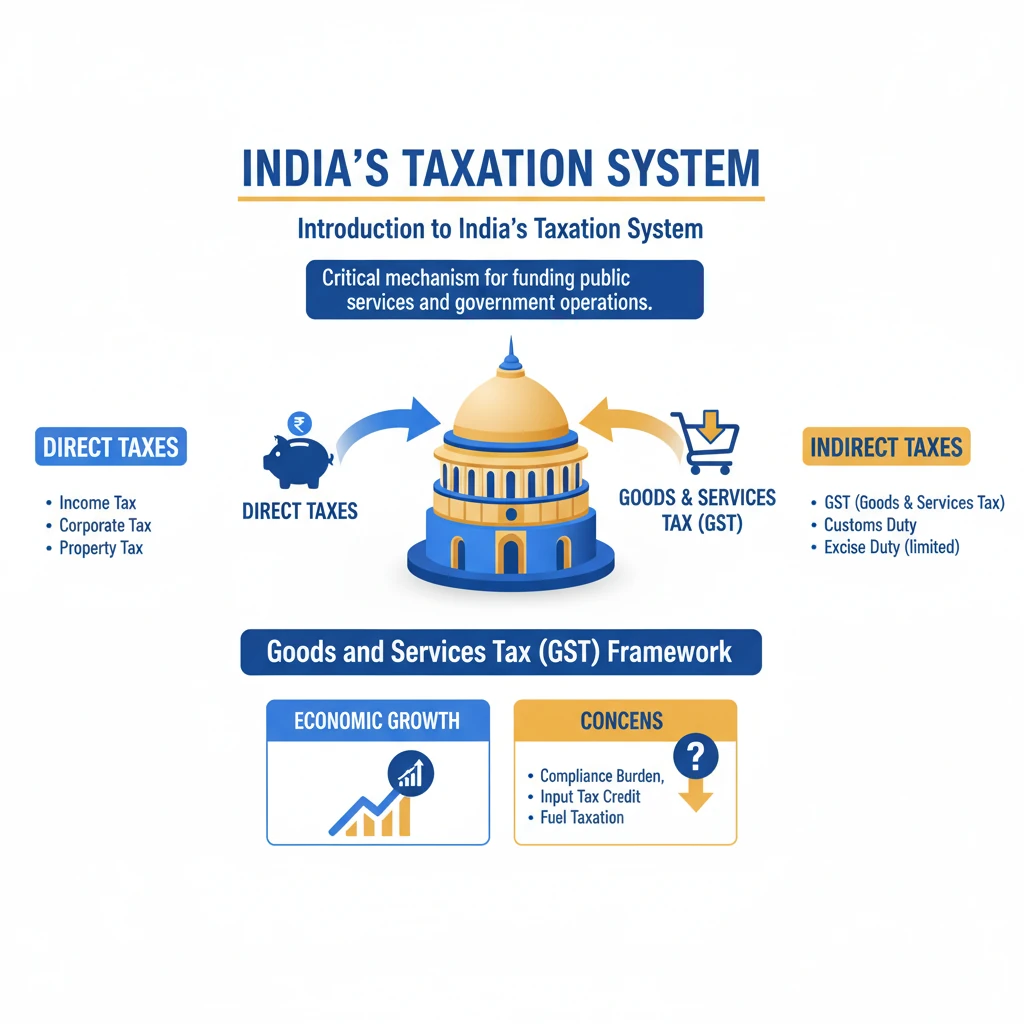

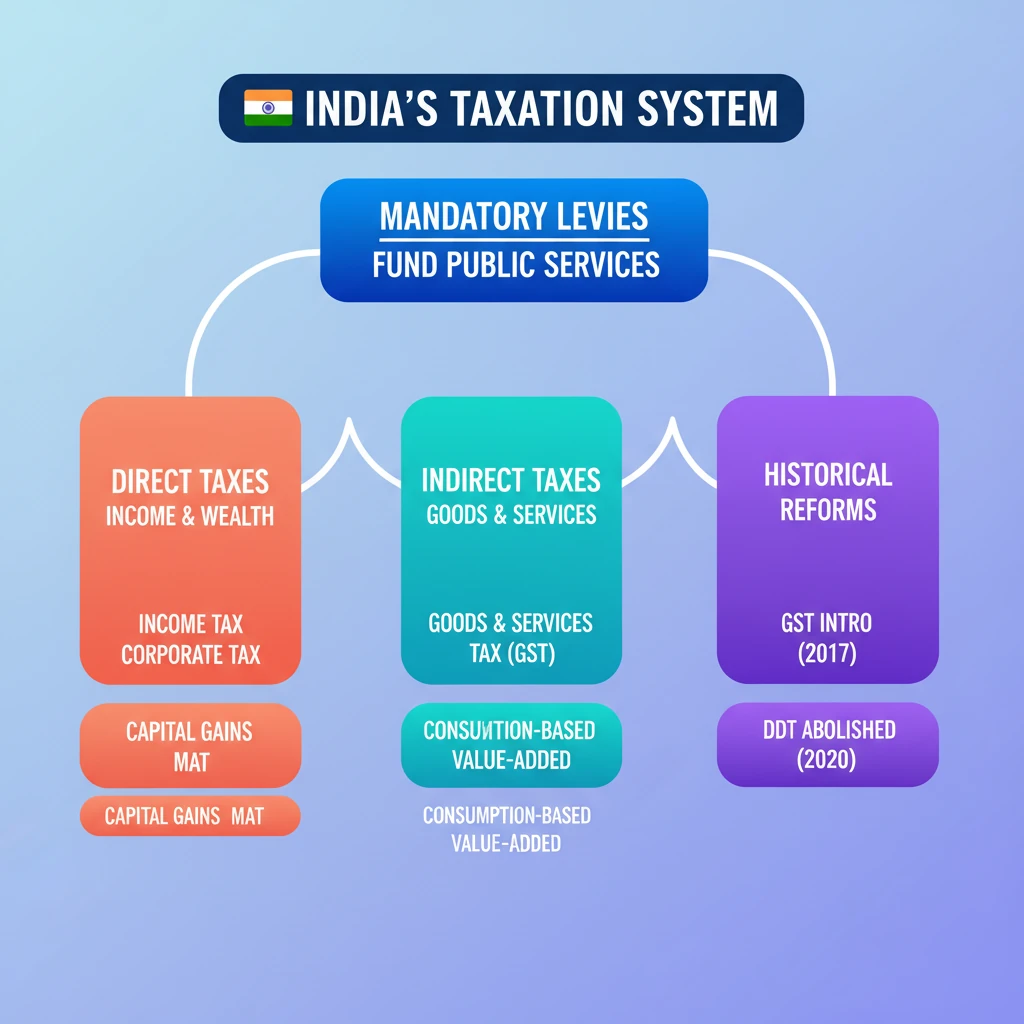

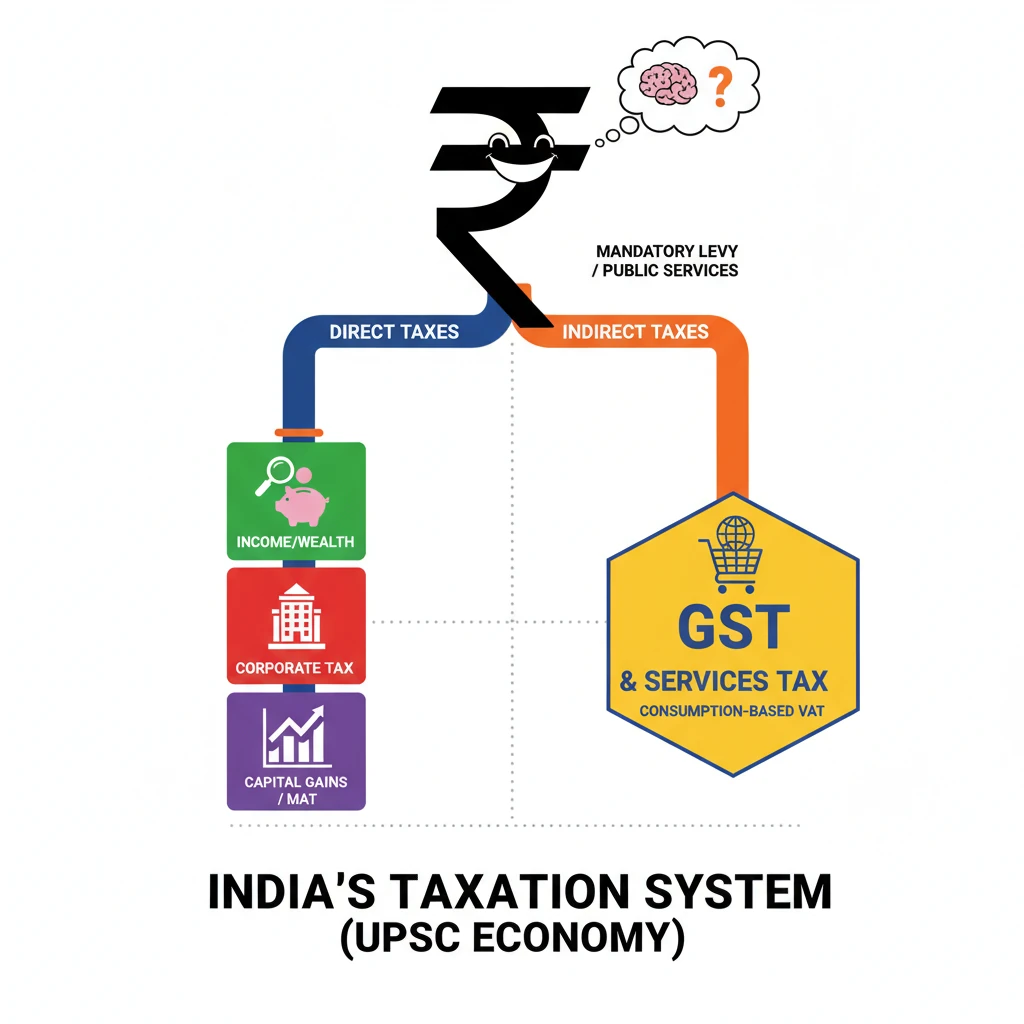

<h4>Introduction to India's Taxation System</h4><p>India's taxation system is a critical mechanism for funding public services and government operations. It comprises a mix of <strong>direct</strong> and <strong>indirect taxes</strong>, designed to collect revenue from various economic activities.</p><p>The contemporary system, particularly under the <strong>Goods and Services Tax (GST)</strong> framework, faces scrutiny regarding its impact on <strong>economic growth</strong>. Concerns include potential hindrances to <strong>business development</strong>, suppression of <strong>consumption</strong>, and damage to India's <strong>investment reputation</strong>.</p><div class='exam-tip-box'><p>Understanding the structure and impact of India's taxation system is vital for <strong>UPSC Mains GS Paper III (Economy)</strong>. Focus on both the theoretical aspects and their real-world implications.</p></div><h4>Understanding Taxes: The Core Concept</h4><div class='info-box'><p><strong>Definition of Tax:</strong> Taxes are <strong>mandatory financial charges</strong> or <strong>levies</strong> imposed by a government on individuals, businesses, or property. Their primary purpose is to fund <strong>public services</strong> and <strong>government operations</strong>.</p></div><p>A key characteristic of taxation is the absence of a direct <strong>quid pro quo</strong>. This means there is no direct, immediate exchange of goods or services between the <strong>taxpayer</strong> and the <strong>public authority</strong> for the tax paid.</p><h4>Direct Taxes in India</h4><p><strong>Direct taxes</strong> are levied directly on the income or wealth of individuals and corporations. The burden of these taxes cannot be shifted to another person.</p><ul><li><strong>Income Tax:</strong> This tax is imposed on an individual's income. It is generally <strong>progressive</strong> in nature, meaning higher income earners pay a larger percentage of their income as tax, with different <strong>slabs</strong> for various taxpayer categories.</li><li><strong>Capital Gains Tax:</strong> This tax is levied on the profit or gain realized from the sale of an investment or property. Different rates apply for <strong>short-term</strong> and <strong>long-term holdings</strong>, depending on the asset's holding period.</li><li><strong>Securities Transaction Tax (STT):</strong> A tax imposed on transactions involving the purchase and sale of <strong>securities</strong> traded on recognized stock exchanges.</li><li><strong>Perquisite Tax:</strong> This refers to the tax on benefits or amenities provided by an employer to employees, often in addition to their salary. Examples include company-provided housing or cars.</li><li><strong>Corporate Tax:</strong> This is the tax paid by companies on their net earnings or profits. Like income tax, it often features different <strong>slabs</strong> or rates based on the company's income level.</li><li><strong>Minimum Alternative Tax (MAT):</strong> Introduced to ensure that profitable companies, which might otherwise pay little or no tax due to various exemptions and incentives, pay a minimum amount of tax. Currently, <strong>MAT</strong> is set at <strong>18.5%</strong> of book profits.</li></ul><div class='info-box'><p><strong>Abolished Direct Taxes:</strong></p><ul><li><strong>Fringe Benefit Tax (FBT):</strong> A tax on non-cash benefits provided by employers, <strong>abolished in 2009</strong>.</li><li><strong>Dividend Distribution Tax (DDT):</strong> A tax levied on companies distributing dividends, <strong>abolished in 2020</strong>.</li><li><strong>Banking Cash Transaction Tax (BCTT):</strong> A tax on certain banking transactions, <strong>abolished in 2009</strong>.</li></ul></div><h4>Indirect Taxes in India</h4><p><strong>Indirect taxes</strong> are levied on goods and services, and their burden can be shifted from the payer to the consumer. These taxes are typically included in the price of goods and services.</p><ul><li><strong>Goods and Services Tax (GST):</strong> This is a comprehensive, multi-stage, destination-based <strong>consumption tax</strong>. It is an <strong>ad valorem tax</strong>, meaning it is levied as a percentage of the value, and is applied at each stage of the <strong>supply chain</strong> on the value addition.</li><li><strong>Value Added Tax (VAT):</strong> Prior to GST, <strong>VAT</strong> was a major indirect tax on goods sold. It was also applied at each stage of the supply chain, taxing only the value added at that stage.</li></ul><div class='key-point-box'><p>The shift from multiple indirect taxes (like VAT, excise duty, service tax) to <strong>GST</strong> was a landmark reform aimed at simplifying the tax structure and reducing the cascading effect of taxes.</p></div>

💡 Key Takeaways

- •Taxes are mandatory government levies to fund public services, without direct quid pro quo.

- •India's system includes Direct Taxes (on income/wealth) and Indirect Taxes (on goods/services).

- •Key Direct Taxes: Income Tax, Corporate Tax, Capital Gains Tax, Minimum Alternative Tax (MAT).

- •Key Indirect Tax: Goods and Services Tax (GST), a consumption-based, value-added tax.

- •Historical reforms include the abolition of FBT/BCTT (2009) and DDT (2020), and the introduction of GST (2017).

- •The current GST framework's impact on growth, business, consumption, and investment reputation is a key area of discussion.

🧠 Memory Techniques

95% Verified Content