MFN Status to India - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

MFN Status to India

Medium⏱️ 8 min read

economy

📖 Introduction

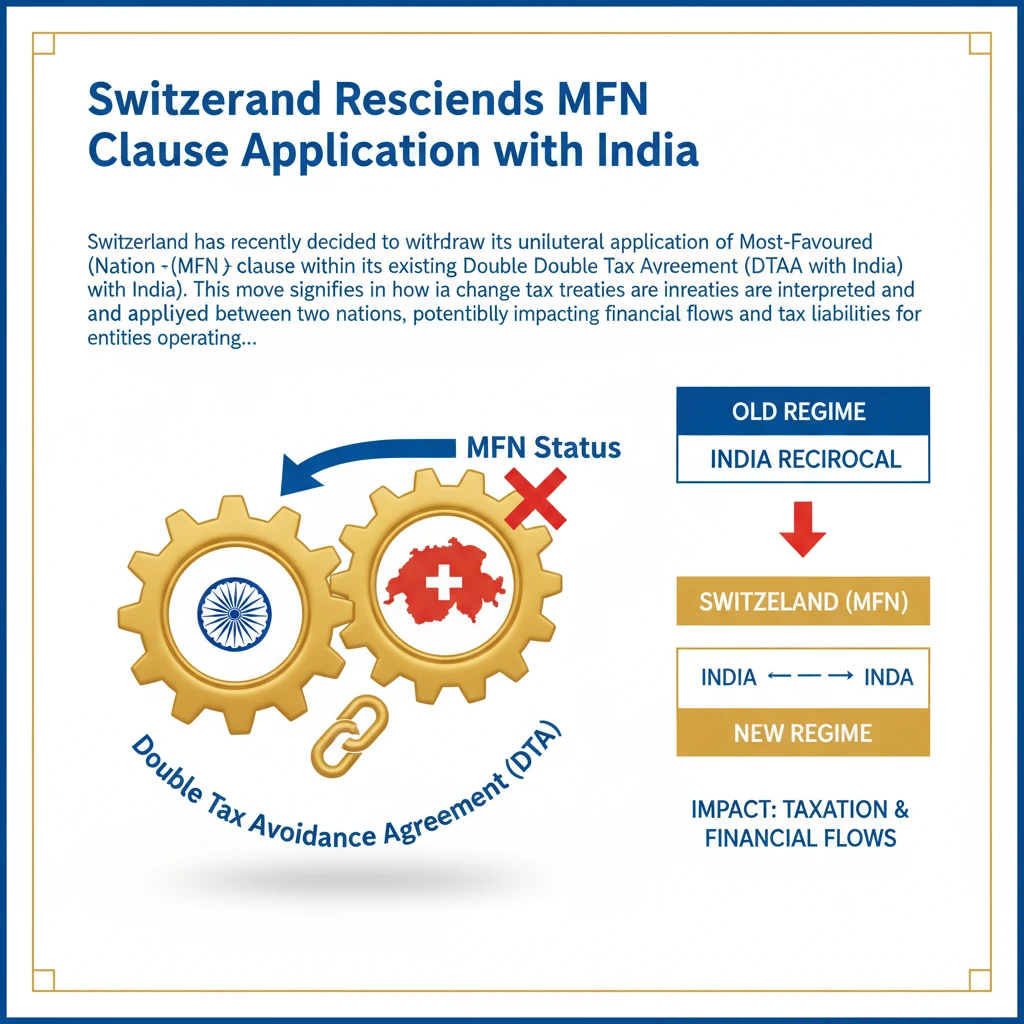

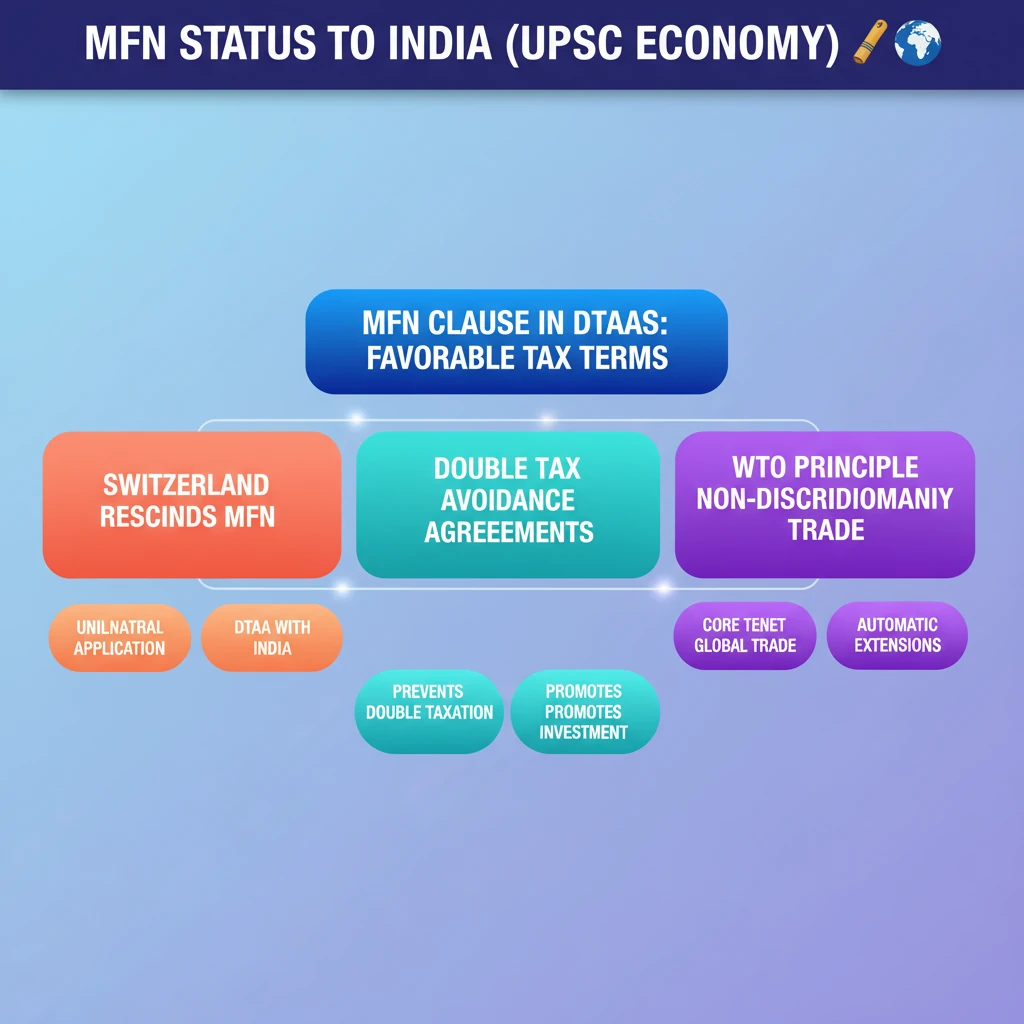

<h4>Switzerland Rescinds MFN Clause Application with India</h4><p><strong>Switzerland</strong> has recently decided to withdraw its unilateral application of the <strong>Most-Favoured-Nation (MFN) clause</strong> within its existing <strong>Double Tax Avoidance Agreement (DTAA)</strong> with <strong>India</strong>.</p><p>This move signifies a change in how tax treaties are interpreted and applied between the two nations, potentially impacting financial flows and tax liabilities for entities operating across both jurisdictions.</p><div class='key-point-box'><p>The <strong>MFN clause</strong> in a <strong>DTAA</strong> ensures that if one contracting state grants more favorable tax treatment to a third state, the same favorable treatment is automatically extended to the other contracting state.</p></div><h4>Understanding Switzerland</h4><p><strong>Switzerland</strong>, officially known as the <strong>Swiss Confederation</strong>, is a small, landlocked country located in <strong>Central Europe</strong>. It is renowned for its picturesque <strong>Alps mountains</strong>, serene lakes, and expansive valleys.</p><p>It shares borders with <strong>France</strong>, <strong>Italy</strong>, <strong>Austria</strong>, <strong>Germany</strong>, and <strong>Liechtenstein</strong>. Importantly, <strong>Switzerland</strong> is not a member of the <strong>European Union (EU)</strong> or <strong>NATO</strong>.</p><div class='info-box'><p><strong>Switzerland</strong> is historically recognized for its robust and often secretive <strong>banking sector</strong>, which has played a significant role in global finance.</p></div>

💡 Key Takeaways

- •Switzerland rescinded its unilateral MFN application in its DTAA with India.

- •MFN clause in DTAAs ensures automatic extension of more favorable tax terms from third-country agreements.

- •Double Tax Avoidance Agreements (DTAAs) prevent double taxation and promote cross-border investment.

- •Switzerland is a landlocked Central European country known for its banking sector, not part of EU/NATO.

- •The MFN principle is a core tenet of the WTO, promoting non-discriminatory trade.

- •Changes in DTAA clauses can impact investment flows and bilateral economic relations.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•World Trade Organization (WTO) Official Website - MFN Principle

•Organisation for Economic Co-operation and Development (OECD) - Model Tax Convention

•Ministry of Finance, Government of India - DTAA Information

•Press Information Bureau (PIB) - India-Pakistan MFN Status