What is Unified Lending Interface (ULI)? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is Unified Lending Interface (ULI)?

Medium⏱️ 6 min read

economy

📖 Introduction

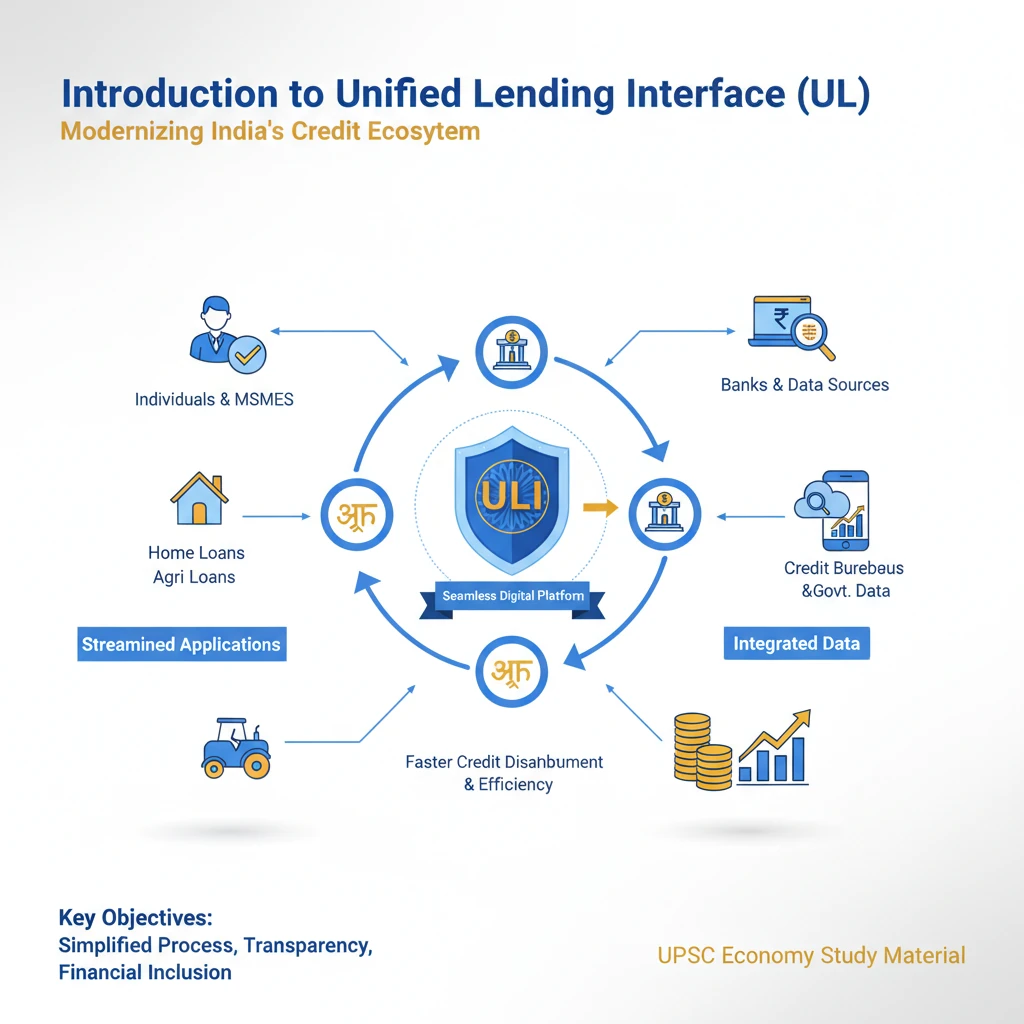

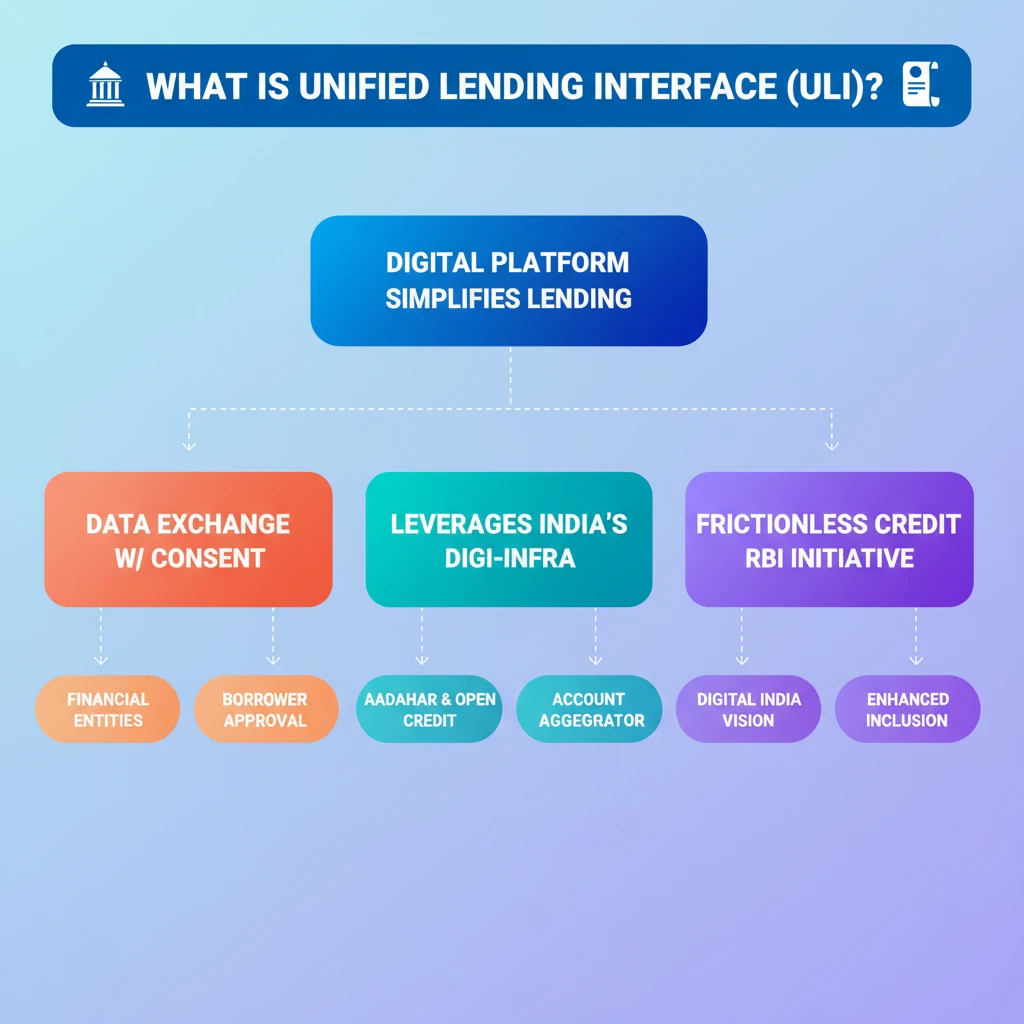

<h4>Introduction to Unified Lending Interface (ULI)</h4><p>The <strong>Unified Lending Interface (ULI)</strong> represents a significant step towards modernizing India's credit ecosystem. It is envisioned as a <strong>digital platform</strong> designed to streamline and simplify the entire lending process for both borrowers and lenders.</p><p>The primary objective of ULI is to create a seamless and efficient mechanism for credit disbursement. By integrating various stakeholders and data sources, it aims to reduce friction and accelerate the loan application and approval journey.</p><div class='key-point-box'><p><strong>Key Concept:</strong> ULI is not just a single app but a foundational framework. It aims to unify diverse digital lending initiatives and data points under one interoperable umbrella.</p></div><h4>Core Functionality of ULI</h4><p>ULI is expected to facilitate the easy exchange of information among financial institutions, government bodies, and data providers. This interoperability is crucial for enabling faster and more informed lending decisions.</p><p>It leverages advanced digital infrastructure to ensure that borrowers can access credit more readily. This includes features like digital KYC, consent-based data sharing, and automated credit assessment.</p><h4>Benefits for Borrowers and Lenders</h4><p>For borrowers, ULI promises enhanced convenience and quicker access to credit. It aims to reduce the paperwork and multiple visits typically associated with loan applications, making the process significantly less cumbersome.</p><p>Lenders stand to benefit from improved operational efficiency and reduced costs. The platform provides access to verified data, enabling more accurate risk assessment and potentially expanding their reach to underserved segments.</p><div class='info-box'><p><strong>ULI's Promise:</strong> The platform is expected to make the <strong>lending process easy</strong>, fostering greater financial inclusion and supporting economic growth by ensuring timely credit availability.</p></div><h4>ULI and Digital Public Infrastructure</h4><p>ULI is a crucial component of India's broader <strong>Digital Public Infrastructure (DPI)</strong> strategy. It aligns with initiatives like the <strong>Account Aggregator (AA) framework</strong> and the <strong>Public Tech Platform for Frictionless Credit</strong>, creating a robust digital financial ecosystem.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understand ULI in the context of India's digital transformation. Questions may link it to financial inclusion, MSME credit, or the role of technology in governance (<strong>GS-II, GS-III</strong>).</p></div>

💡 Key Takeaways

- •ULI is a digital platform aimed at simplifying and accelerating the lending process.

- •It promotes seamless data exchange among financial entities with borrower consent.

- •ULI leverages India's digital public infrastructure like Aadhaar and Account Aggregator.

- •Key benefits include enhanced financial inclusion, improved MSME credit, and operational efficiency for lenders.

- •It aligns with RBI's initiatives for frictionless credit and the broader Digital India vision.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•NITI Aayog reports on Digital Public Infrastructure and financial inclusion

•Economic Survey of India (various years) on financial sector reforms

•News articles from reputable financial media (e.g., Livemint, Economic Times) discussing ULI and related initiatives.