What is Capital Gain Tax? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is Capital Gain Tax?

Easy⏱️ 5 min read

economy

📖 Introduction

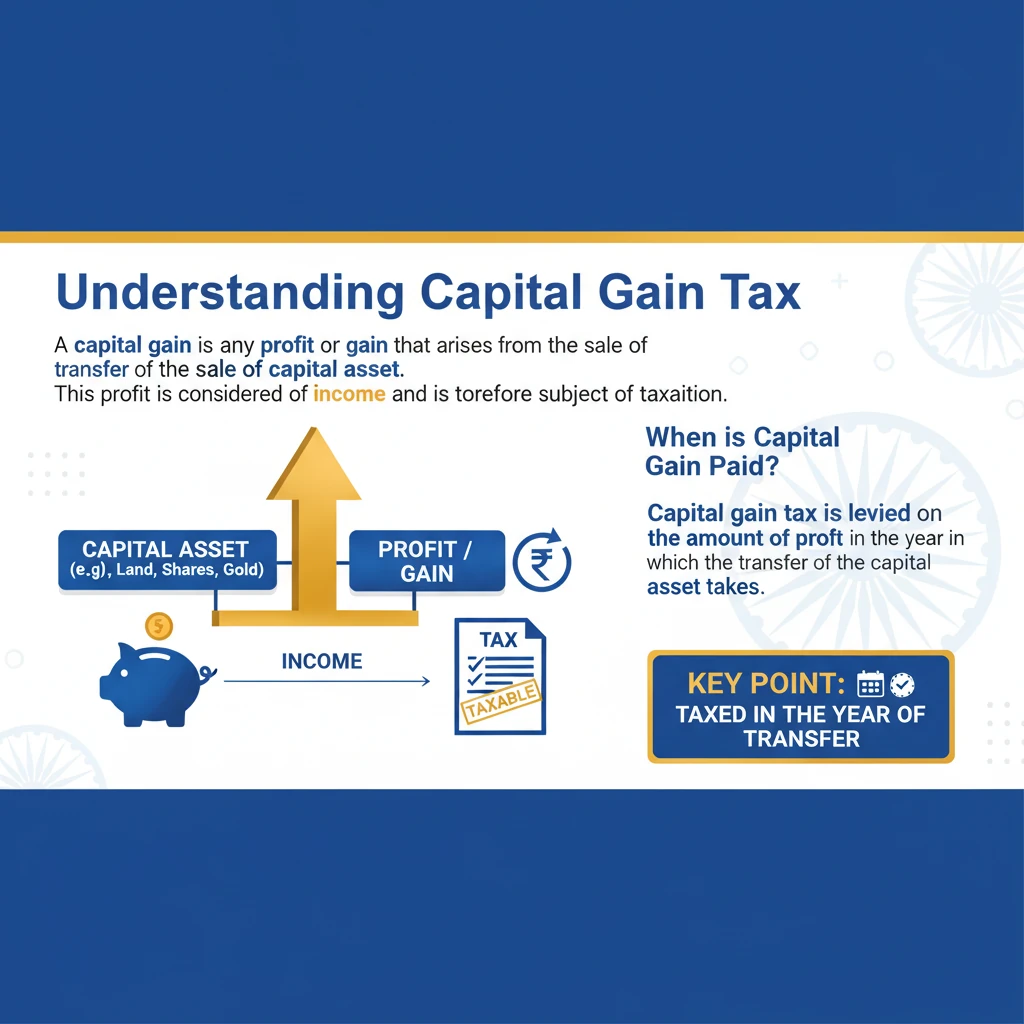

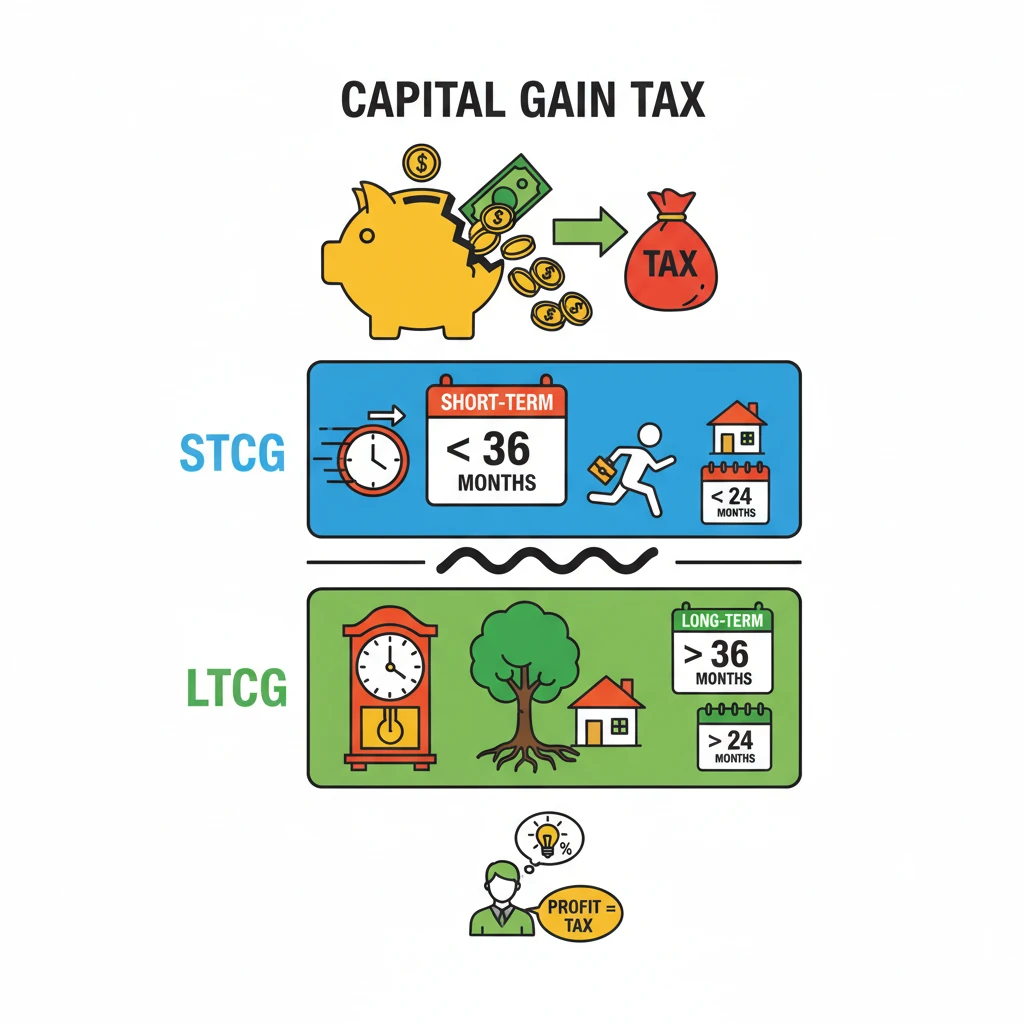

<h4>Understanding Capital Gain Tax</h4><p>A <strong>capital gain</strong> is any profit or gain that arises from the sale or transfer of a <strong>capital asset</strong>.</p><p>This profit is considered a form of <strong>income</strong> and is therefore subject to taxation.</p><h4>When is Capital Gain Tax Paid?</h4><p><strong>Capital gain tax</strong> is levied on the amount of profit in the year in which the transfer of the <strong>capital asset</strong> takes place.</p><div class='key-point-box'><p>Tax on <strong>capital gains</strong> is triggered only when an asset is sold, or "<strong>realised</strong>".</p></div><h4>Types of Capital Gains</h4><p>Capital gains are broadly classified into two categories based on the holding period of the asset:</p><ul><li><strong>Long-Term Capital Gains (LTCG)</strong></li><li><strong>Short-Term Capital Gains (STCG)</strong></li></ul><h4>Long-Term Capital Gains (LTCG)</h4><div class='info-box'><p>This applies to assets held for a <strong>specified period</strong>, which is generally <strong>over 36 months</strong>.</p></div><p>For most assets, if held for <strong>more than 36 months</strong>, the gains are classified as <strong>LTCG</strong>.</p><h4>Short-Term Capital Gains (STCG)</h4><div class='info-box'><p>Any asset held for <strong>less than 36 months</strong> is termed a <strong>short-term asset</strong>.</p></div><p>There is a specific duration for <strong>immovable properties</strong> that differs from the general rule.</p><div class='info-box'><p>In the case of <strong>immovable properties</strong> (e.g., land, building), the duration for it to be considered short-term is <strong>24 months</strong>.</p></div><h4>Reducing Capital Gains Tax Liability</h4><p>The total amount of <strong>capital gains</strong> can be reduced by offsetting <strong>capital losses</strong>.</p><div class='info-box'><p>A <strong>capital loss</strong> occurs when a taxable asset is sold for less than its original purchase price.</p></div><p>The final taxable amount is known as the "<strong>net capital gains</strong>," which is calculated by deducting any <strong>capital losses</strong> from the total <strong>capital gains</strong>.</p>

💡 Key Takeaways

- •Capital Gain Tax is levied on profit from selling a capital asset.

- •It's classified as Short-Term (STCG) or Long-Term (LTCG) based on asset holding period.

- •General holding period for STCG is less than 36 months; for LTCG, it's over 36 months.

- •For immovable property, STCG applies if held for less than 24 months.

- •Capital losses can be offset against capital gains to reduce tax liability.

- •Tax is triggered only when the asset is sold or 'realised'.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•The Income Tax Act, 1961 (relevant sections on Capital Gains)

•Ministry of Finance, Government of India publications