Major Sources of Revenue and the Expenditure from the Budget - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Major Sources of Revenue and the Expenditure from the Budget

Medium⏱️ 8 min read

economy

📖 Introduction

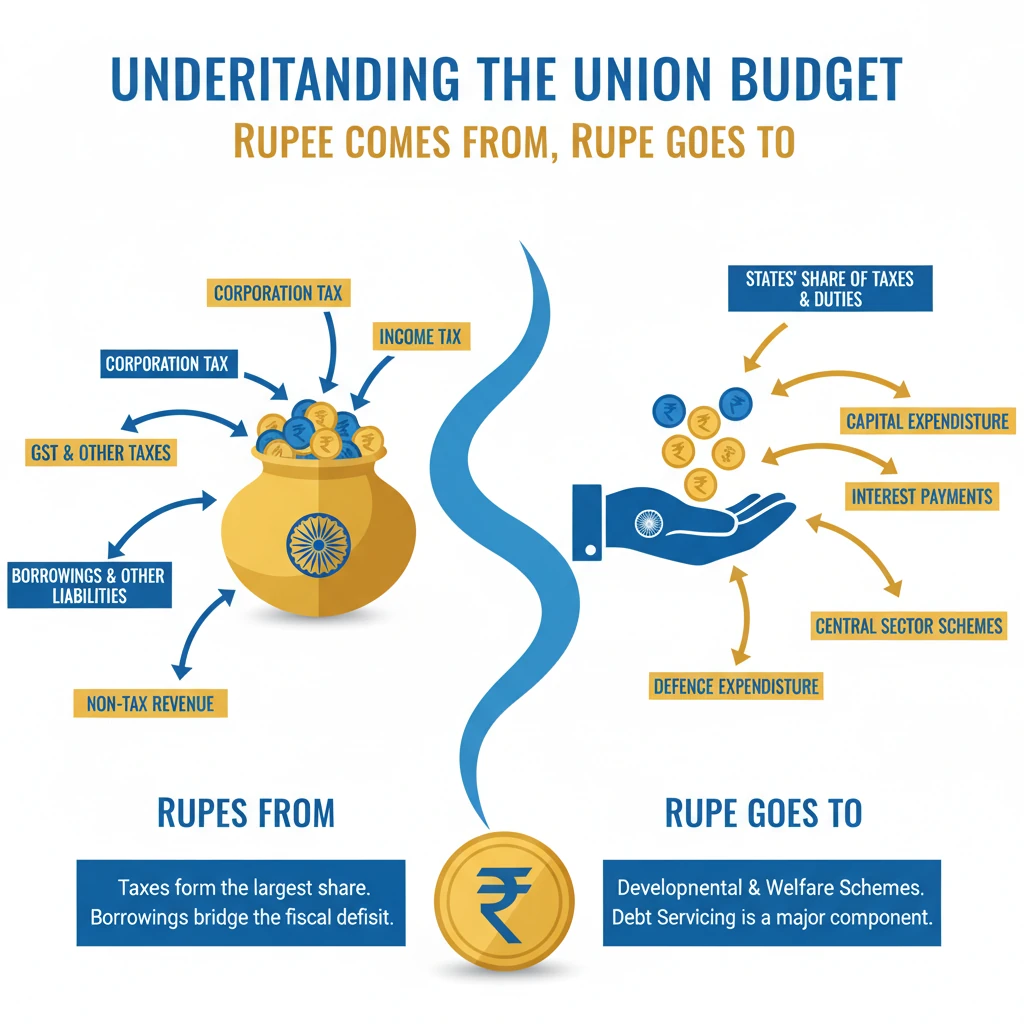

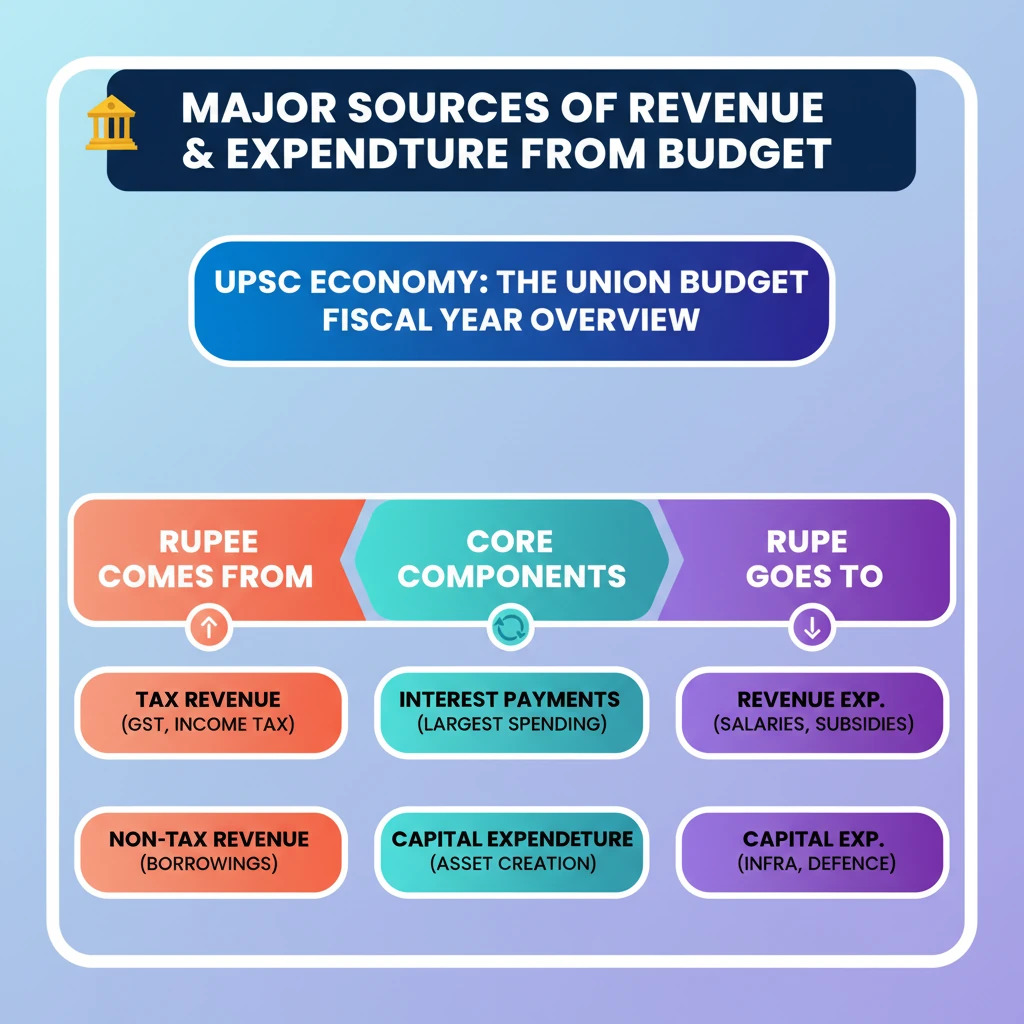

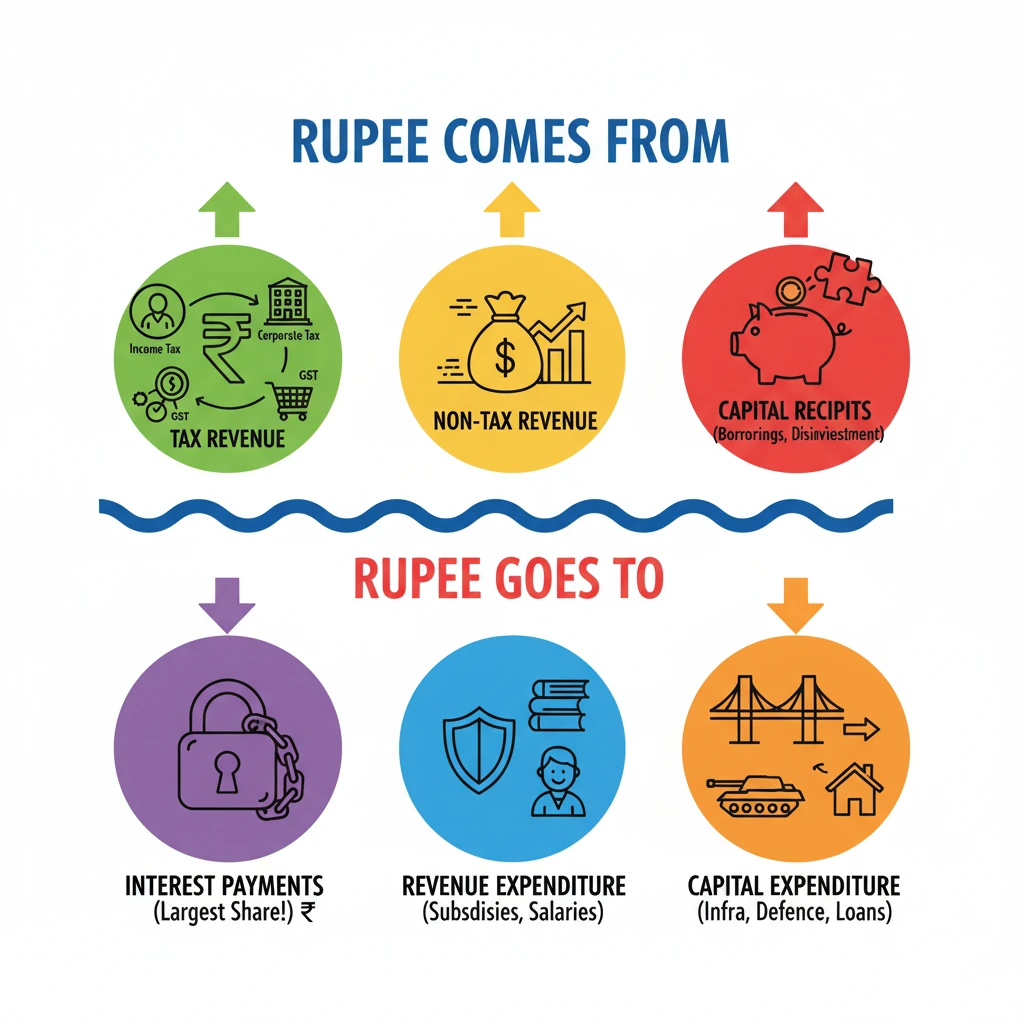

<h4>Understanding the Union Budget: Rupee Comes From, Rupee Goes To</h4><p>The <strong>Union Budget</strong> is an annual financial statement detailing the government's estimated receipts and expenditures for the upcoming fiscal year. It provides a comprehensive overview of how the government plans to raise money and how it intends to spend it.</p><div class='key-point-box'><p>The concepts of '<strong>Rupee Comes From</strong>' and '<strong>Rupee Goes To</strong>' are visual representations often used to simplify the complex financial flows of the Indian government's budget. They highlight the primary sources of government revenue and the major heads of expenditure.</p></div><h4>Sources of Government Revenue: Where the Rupee Comes From</h4><p>The government's revenue primarily stems from various sources, broadly categorized into <strong>Revenue Receipts</strong> and <strong>Capital Receipts</strong>. These funds are crucial for financing public services and development projects.</p><div class='info-box'><p><strong>Revenue Receipts</strong> are those that neither create a liability nor reduce an asset. They are recurring in nature and include both tax and non-tax revenues.</p></div><h5>Tax Revenue</h5><p><strong>Tax Revenue</strong> forms the largest component of the government's income. It includes direct and indirect taxes levied on individuals and corporations.</p><ul><li><strong>Direct Taxes</strong>: These are taxes where the burden cannot be shifted. Key examples include <strong>Corporate Tax</strong> (tax on company profits) and <strong>Income Tax</strong> (tax on individual incomes).</li><li><strong>Indirect Taxes</strong>: These are taxes where the burden can be shifted. The most significant indirect tax is the <strong>Goods and Services Tax (GST)</strong>, which subsumed many previous indirect taxes. Other examples include <strong>Customs Duty</strong> and <strong>Union Excise Duty</strong>.</li></ul><h5>Non-Tax Revenue</h5><p><strong>Non-Tax Revenue</strong> comprises government income from sources other than taxes. These are also recurring in nature.</p><ul><li><strong>Interest Receipts</strong>: Income from loans extended by the central government to states, Union Territories, and public sector undertakings.</li><li><strong>Dividends and Profits</strong>: Earnings from government investments in public sector enterprises (PSUs) and the Reserve Bank of India (RBI).</li><li><strong>External Grants</strong>: Aid received from foreign governments and international organizations.</li><li><strong>Miscellaneous Receipts</strong>: Includes fees, penalties, and receipts from services provided by the government.</li></ul><div class='info-box'><p><strong>Capital Receipts</strong> are those that either create a liability or reduce a financial asset. They are generally non-recurring and are used to finance long-term investments or repay debt.</p></div><h5>Capital Receipts</h5><p>These are crucial for funding large-scale projects and managing the government's financial position.</p><ul><li><strong>Borrowings and Other Liabilities</strong>: This is the largest component, including market borrowings (government securities), external loans from international agencies, and small savings schemes.</li><li><strong>Recovery of Loans and Advances</strong>: Funds received back from loans previously granted by the central government.</li><li><strong>Disinvestment</strong>: Proceeds from the sale of government equity in Public Sector Undertakings (PSUs).</li></ul><div class='exam-tip-box'><p><strong>UPSC Insight</strong>: Understanding the relative share of different revenue sources (e.g., GST vs. Income Tax) and the trend of <strong>fiscal deficit</strong> (largely financed by borrowings) is vital for Mains <strong>GS Paper III (Economy)</strong> and Prelims.</p></div><h4>Government Expenditure: Where the Rupee Goes To</h4><p>The government's expenditure is broadly categorized into <strong>Revenue Expenditure</strong> and <strong>Capital Expenditure</strong>. These outlays fund various government functions, welfare schemes, and development initiatives.</p><div class='info-box'><p><strong>Revenue Expenditure</strong> refers to expenses that do not create any assets or reduce any liabilities. They are generally recurring and are incurred for the normal functioning of the government.</p></div><h5>Major Heads of Revenue Expenditure</h5><p>These expenditures are essential for day-to-day governance and social welfare.</p><ul><li><strong>Interest Payments</strong>: This is often the single largest component of government expenditure, representing the cost of servicing past borrowings.</li><li><strong>Subsidies</strong>: Financial assistance provided to various sectors and beneficiaries, such as food, fertilizer, and petroleum subsidies.</li><li><strong>Defence Revenue Expenditure</strong>: Includes salaries, maintenance, and operational costs of the armed forces.</li><li><strong>Pensions</strong>: Payments to retired government employees.</li><li><strong>Grants to States and Union Territories</strong>: Financial transfers to state governments to support their budgets and specific schemes.</li><li><strong>Administrative Expenses</strong>: Costs associated with running government departments and services.</li></ul><div class='info-box'><p><strong>Capital Expenditure</strong> refers to expenses that lead to the creation of physical or financial assets or the reduction of financial liabilities. These are long-term investments that enhance the productive capacity of the economy.</p></div><h5>Major Heads of Capital Expenditure</h5><p>These investments are critical for economic growth and development.</p><ul><li><strong>Capital Outlay for Infrastructure</strong>: Spending on roads, railways, ports, power projects, and other public infrastructure.</li><li><strong>Defence Capital Expenditure</strong>: Investments in new equipment, weaponry, and infrastructure for defence.</li><li><strong>Loans and Advances to States and Union Territories</strong>: Funds provided to states for their capital projects.</li><li><strong>Investment in Public Sector Undertakings (PSUs)</strong>: Equity infusions into government-owned companies.</li></ul><div class='exam-tip-box'><p><strong>UPSC Strategy</strong>: Analyze the budget documents for the latest percentages of 'Rupee Comes From' and 'Rupee Goes To'. This data is frequently tested in Prelims and can be used to substantiate arguments in Mains answers on <strong>fiscal policy</strong> and <strong>public finance</strong>.</p></div>

💡 Key Takeaways

- •The Union Budget details government's estimated revenue and expenditure for a fiscal year.

- •'Rupee Comes From' includes Tax Revenue (Income Tax, Corporate Tax, GST) and Non-Tax Revenue (interest, dividends), and Capital Receipts (borrowings, disinvestment).

- •'Rupee Goes To' covers Revenue Expenditure (interest payments, subsidies, salaries) and Capital Expenditure (infrastructure, defence capital, loans to states).

- •Interest payments are typically the largest component of revenue expenditure, impacting fiscal space.

- •Capital expenditure is crucial for asset creation, economic growth, and job creation.

- •Understanding budget components is vital for analyzing fiscal policy, economic health, and UPSC exam questions.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Economic Survey (various years)

•Reserve Bank of India (RBI) publications on Public Finance

•Ministry of Finance, Government of India official website

•Drishti IAS Economy Notes (for initial prompt context)