RBI & Sustainable Finance: Green Bonds, AI, and Expansion - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

RBI & Sustainable Finance: Green Bonds, AI, and Expansion

Medium⏱️ 7 min read

economy

📖 Introduction

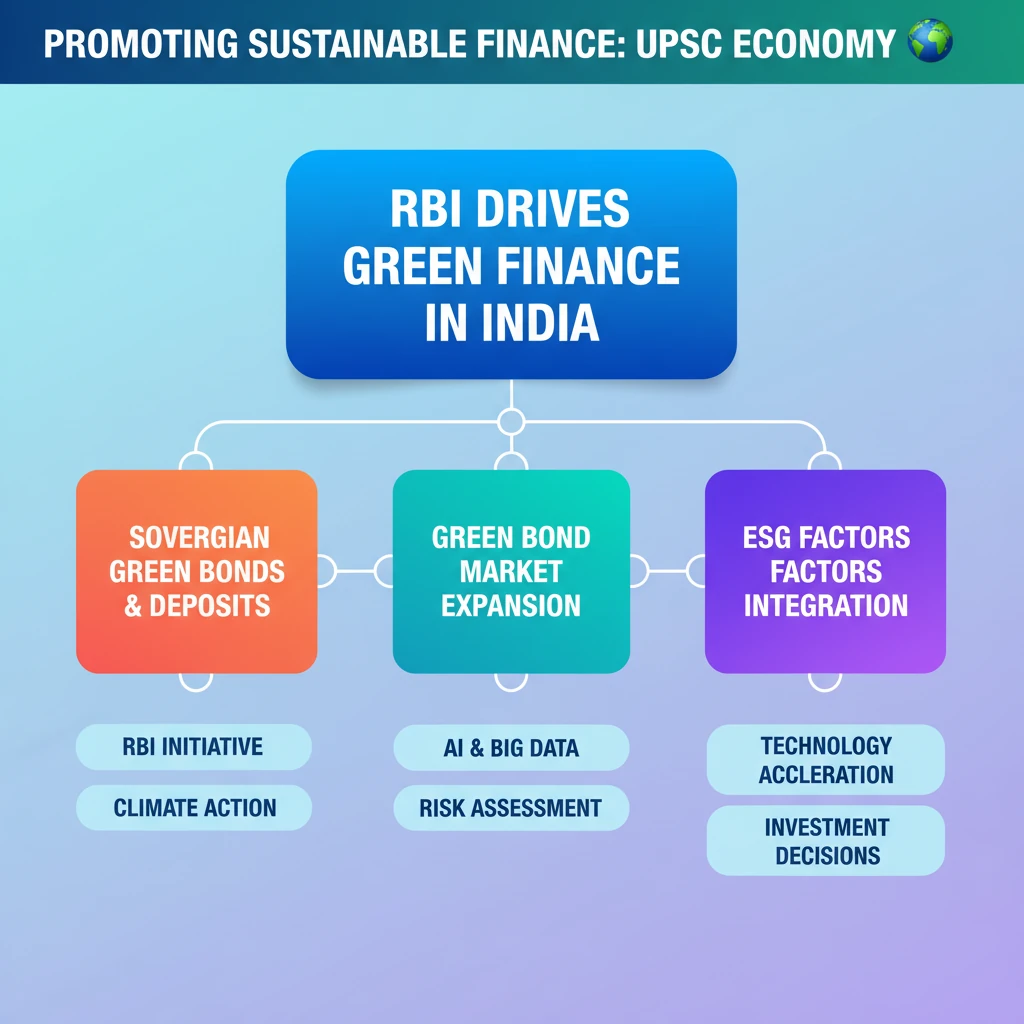

<h4>RBI's Stance on Sustainable Finance</h4><p>The <strong>Reserve Bank of India (RBI) Governor</strong> has underscored the central bank's commitment to fostering <strong>sustainable finance</strong> within the Indian financial sector.</p><p>This commitment is evident through various proactive measures taken by the <strong>RBI</strong> to integrate environmental considerations into financial practices.</p><h4>Key Initiatives by RBI</h4><p>Among the significant steps highlighted are the introduction of <strong>sovereign green bonds</strong> and the promotion of <strong>green deposits</strong>.</p><div class='info-box'><p><strong>Sovereign green bonds</strong> are debt instruments issued by a national government to raise capital specifically for environmentally friendly projects.</p></div><div class='info-box'><p><strong>Green deposits</strong> are financial products offered by banks where the deposited funds are earmarked for financing green projects or businesses.</p></div><h4>Expanding the Green Bond Market</h4><p>Despite these initiatives, the <strong>RBI Governor</strong> acknowledged the crucial need for further expansion of the <strong>green bond market</strong> in India.</p><p>A larger market would facilitate greater capital mobilization towards sustainable development goals and environmental protection.</p><div class='key-point-box'><p>Expanding the <strong>green bond market</strong> is vital for channeling significant investment into India's climate action and sustainability agenda.</p></div><h4>Technology's Transformative Role</h4><p>A key aspect emphasized is the <strong>transformative role of technology</strong> in advancing sustainable finance.</p><p>Specifically, <strong>Artificial Intelligence (AI)</strong> and <strong>big data analytics</strong> are identified as powerful tools.</p><div class='exam-tip-box'><p>UPSC often asks about the intersection of technology and economic development. Understanding how <strong>AI</strong> and <strong>big data</strong> aid <strong>sustainable finance</strong> is crucial for <strong>GS Paper III</strong>.</p></div><h4>Assessing Environmental Risks and Accelerating Transition</h4><p>These technologies can significantly enhance the ability to assess and manage <strong>environmental risks</strong> associated with financial investments.</p><p>They also play a pivotal role in accelerating the overall transition towards a more <strong>sustainable financial system</strong>.</p><ul><li><strong>AI</strong> can analyze vast datasets to identify climate-related financial risks in portfolios.</li><li><strong>Big data</strong> can track environmental performance of companies and projects, ensuring transparency and accountability.</li></ul>

💡 Key Takeaways

- •RBI promotes sustainable finance through sovereign green bonds and green deposits.

- •Expansion of India's green bond market is crucial for climate action.

- •Artificial Intelligence (AI) and big data are transformative in assessing environmental risks.

- •Technology accelerates the transition to a sustainable financial system.

- •Sustainable finance integrates Environmental, Social, and Governance (ESG) factors into investment decisions.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) official statements and publications on green finance

•Ministry of Finance reports on Sovereign Green Bonds

•SEBI regulations and guidelines on ESG disclosures