What is Angel Tax? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is Angel Tax?

Medium⏱️ 6 min read

economy

📖 Introduction

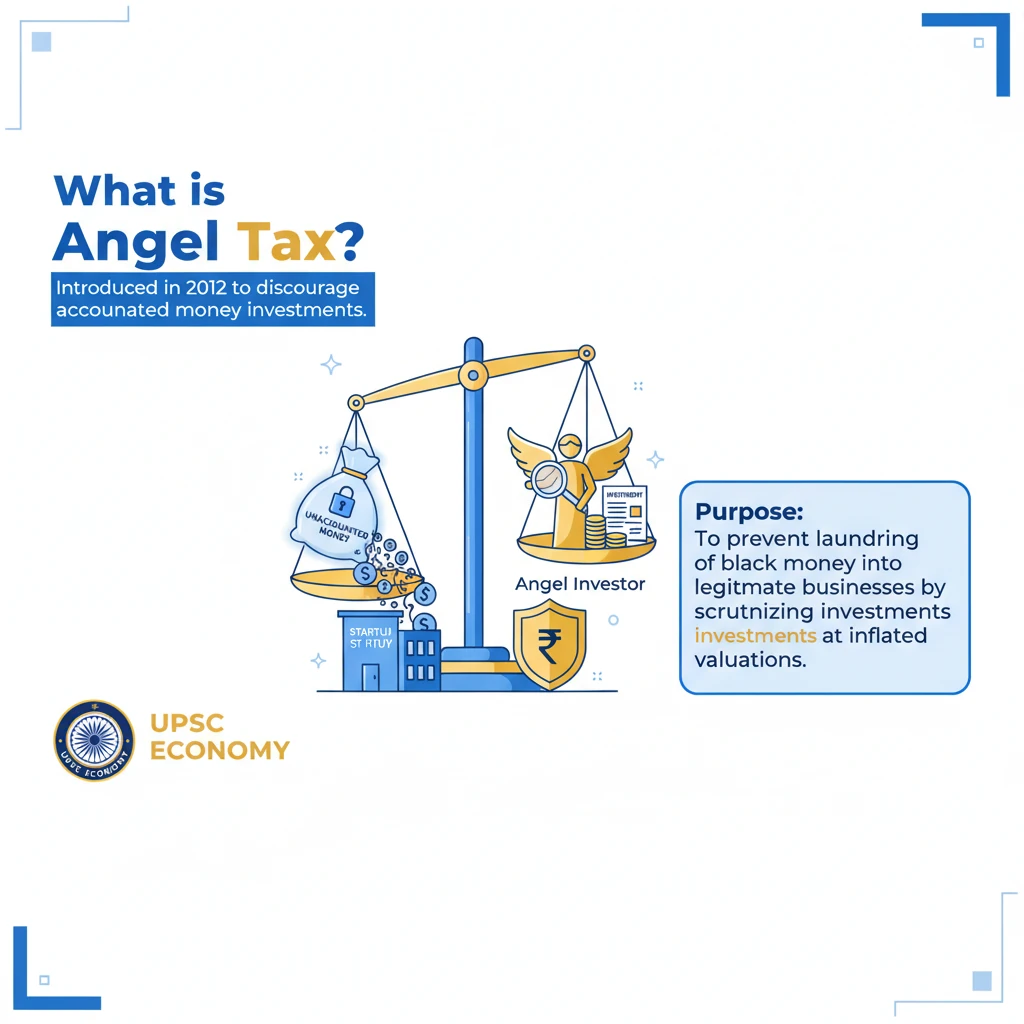

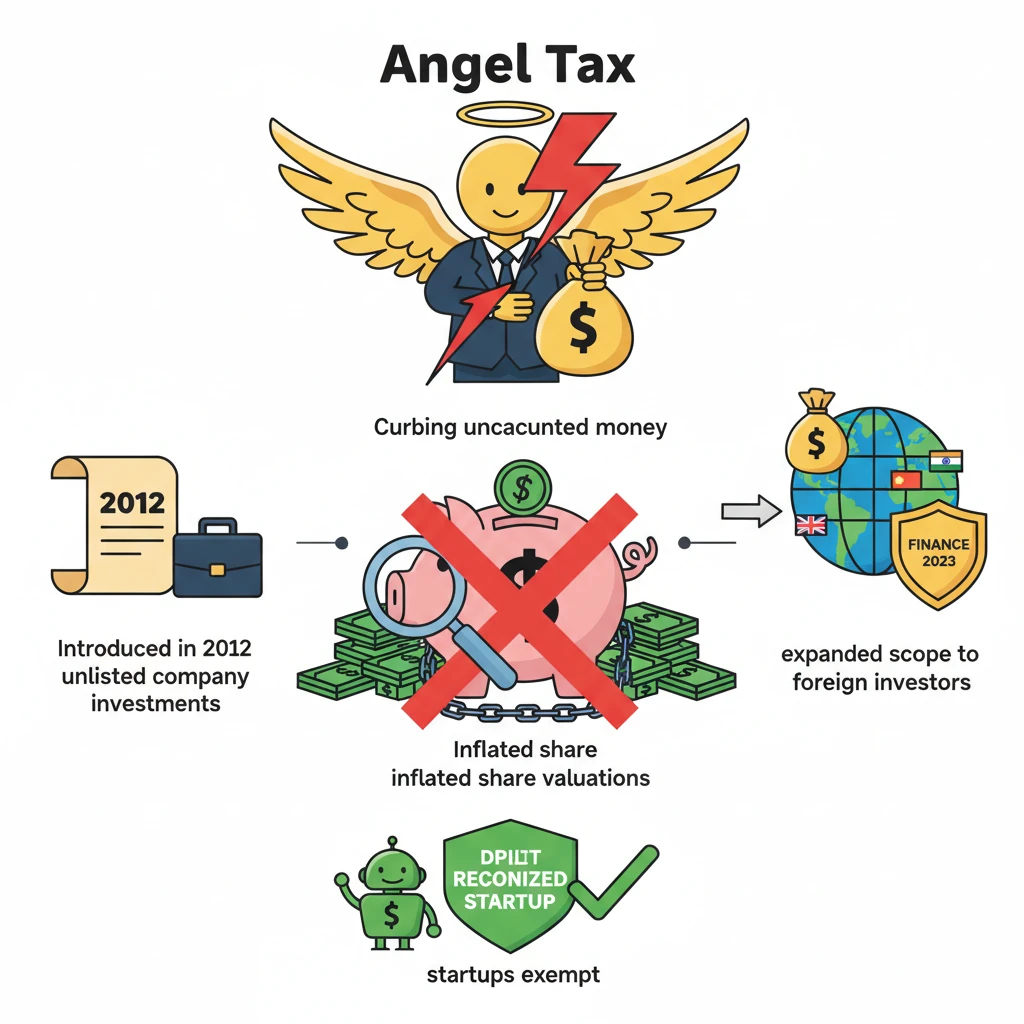

<h4>What is Angel Tax?</h4><p>The term <strong>'Angel tax'</strong> was initially introduced in <strong>2012</strong>. Its primary objective was to discourage the generation and utilisation of <strong>unaccounted money</strong> through investments in closely held companies.</p><div class='key-point-box'><p><strong>Purpose:</strong> The Angel Tax aims to prevent the laundering of black money into legitimate businesses by scrutinizing investments made at inflated valuations.</p></div><p>It is essentially a tax levied on funds raised by <strong>unlisted companies</strong>. This tax applies specifically when shares are issued in <strong>off-market transactions</strong> at a price that exceeds the company's <strong>Fair Market Value (FMV)</strong>.</p><div class='info-box'><p><strong>Definition of Angel Tax:</strong> A tax on capital received by an <strong>unlisted company</strong> from the issuance of shares, if the issue price is higher than the <strong>Fair Market Value (FMV)</strong> of the shares.</p></div><div class='info-box'><p><strong>Definition of Fair Market Value (FMV):</strong> This is the theoretical price at which an asset would change hands between a willing buyer and a willing seller, both having reasonable knowledge of relevant facts and neither being under compulsion to buy or sell.</p></div><h4>Expansion Under Finance Act, 2023</h4><p>The scope of <strong>Angel Tax</strong> was significantly expanded through the <strong>Finance Act of 2023</strong>. A relevant section of the <strong>Income-tax Act</strong> was amended to bring <strong>foreign investors</strong> within the ambit of this provision.</p><p>Initially, <strong>startups recognized by the Department for Promotion of Industry and Internal Trade (DPIIT)</strong> were excluded from the purview of this provision. This provided a crucial relief to the burgeoning Indian startup ecosystem.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> The expansion to include <strong>foreign investors</strong> under the <strong>Finance Act, 2023</strong>, initially raised concerns about its potential impact on foreign direct investment into Indian startups. This demonstrates the dynamic nature of tax policy.</p></div><p>Following considerable industry pushback and concerns regarding a potential decline in funding for startups, the <strong>Finance Ministry</strong> responded. They subsequently exempted investors from <strong>21 countries</strong>, including major economies like the <strong>US, UK, and France</strong>, from the <strong>Angel Tax levy</strong> for investments in Indian startups.</p>

💡 Key Takeaways

- •Angel Tax was introduced in 2012 to tax unlisted company investments exceeding Fair Market Value (FMV).

- •Its primary purpose is to curb the use of unaccounted money through inflated share valuations.

- •The Finance Act, 2023, expanded its scope to include foreign investors.

- •DPIIT-recognized startups are generally exempt from Angel Tax.

- •Following industry concerns, investors from 21 countries were later exempted from the tax for Indian startups.

- •The tax reflects a balance between preventing tax evasion and fostering a conducive environment for startups and foreign investment.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•The Income-tax Act, 1961 (Section 56(2)(viib))

•The Finance Act, 2023

•Press releases and notifications from the Ministry of Finance and DPIIT regarding Angel Tax exemptions