RBI's INR & USD/Euro Swap Windows (2024-27): New Framework - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

RBI's INR & USD/Euro Swap Windows (2024-27): New Framework

Medium⏱️ 4 min read

economy

📖 Introduction

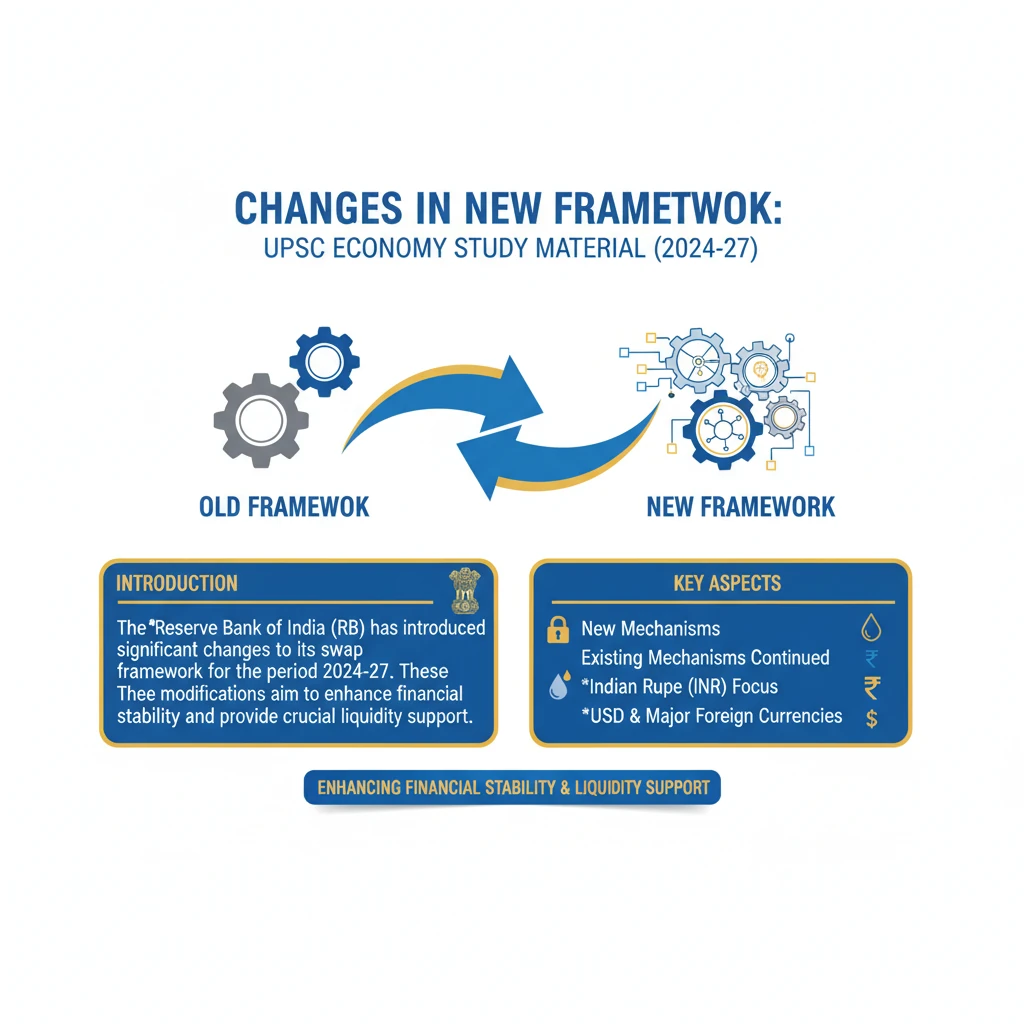

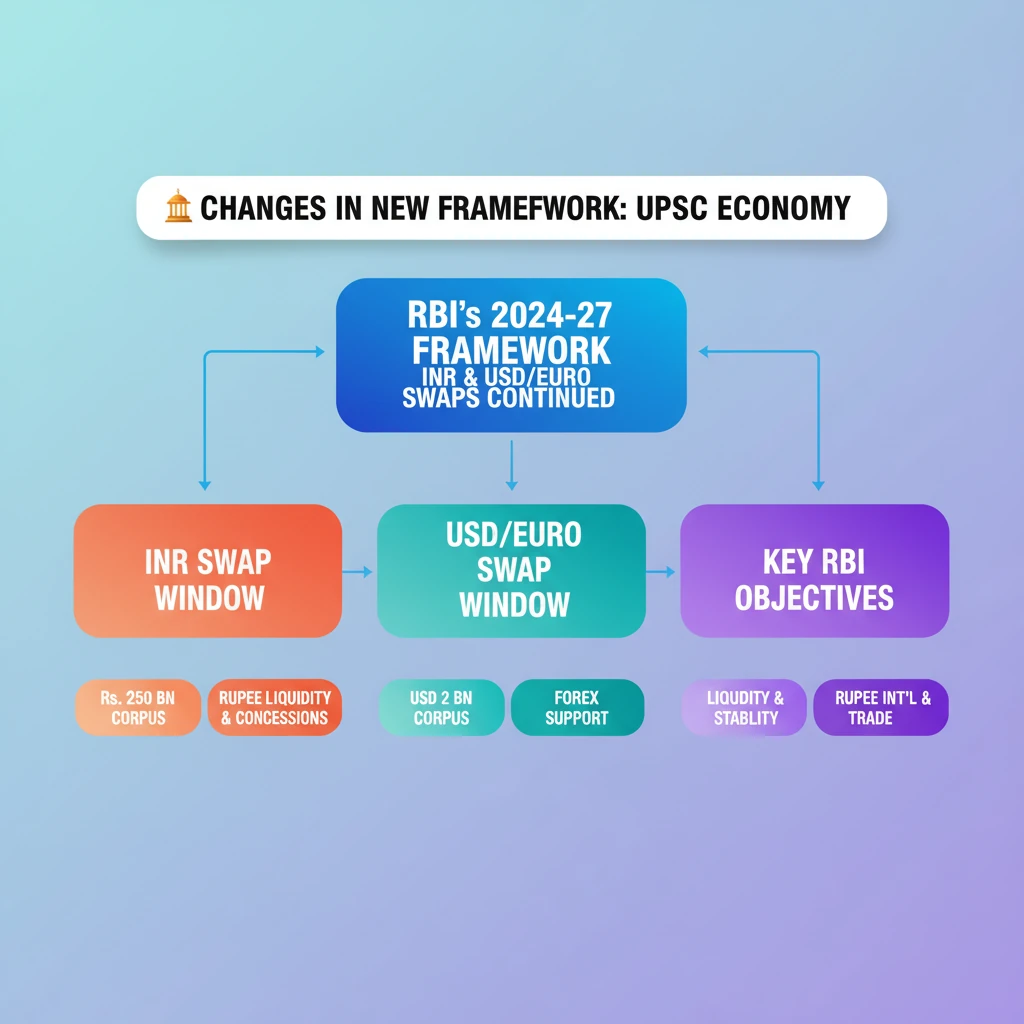

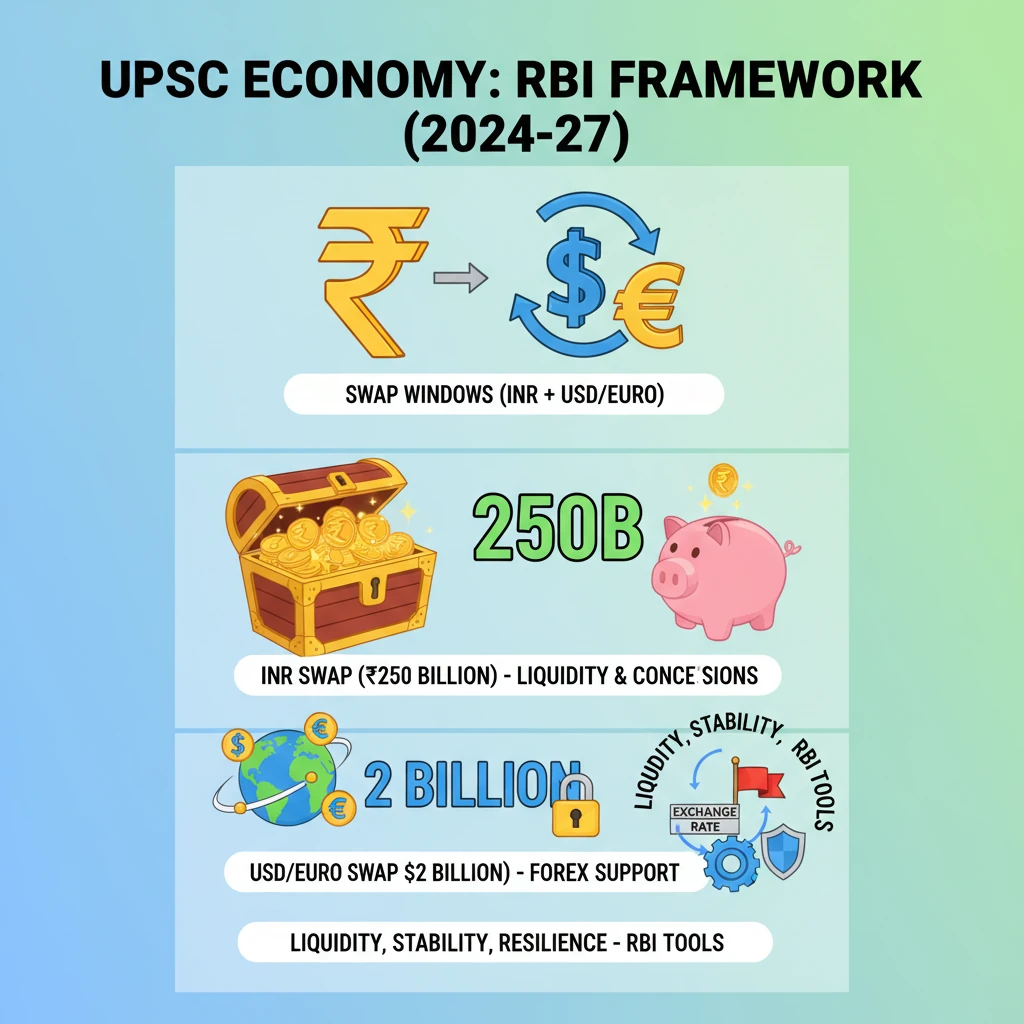

<h4>Introduction to the New Framework (2024-27)</h4><p>The <strong>Reserve Bank of India (RBI)</strong> has introduced significant changes to its <strong>swap framework</strong> for the period <strong>2024-27</strong>. These modifications aim to enhance financial stability and provide crucial liquidity support.</p><p>The updated framework introduces new mechanisms and continues existing ones, focusing on both <strong>Indian Rupee (INR)</strong> and major foreign currencies like <strong>USD</strong> and <strong>Euro</strong>.</p><h4>Indian Rupee (INR) Swap Window</h4><p>A notable addition to the new framework is the establishment of a <strong>separate INR swap window</strong>. This facility is designed to provide specific <strong>swap support in Indian Rupee</strong>.</p><p>It comes with various <strong>concessions</strong>, making it an attractive option for participating entities requiring rupee liquidity or hedging mechanisms.</p><div class="info-box"><p><strong>Total Corpus for INR Support:</strong> The dedicated corpus for this <strong>INR swap window</strong> is set at <strong>Rs. 250 billion</strong>.</p></div><div class="key-point-box"><p>This initiative underscores RBI's commitment to strengthening the <strong>Indian Rupee's international standing</strong> and providing domestic liquidity support.</p></div><h4>US Dollar/Euro Swap Window</h4><p>In addition to the new INR facility, the <strong>RBI</strong> will maintain its existing provisions for foreign currency liquidity. It will continue to offer <strong>swap arrangements</strong> in <strong>US Dollar (USD)</strong> and <strong>Euro</strong>.</p><p>These arrangements are provided under a <strong>separate US Dollar/Euro swap window</strong>, which has been a crucial tool for managing external sector volatility.</p><div class="info-box"><p><strong>Overall Corpus for USD/Euro Support:</strong> The combined corpus for the <strong>US Dollar/Euro swap window</strong> is an aggregate of <strong>USD 2 billion</strong>.</p></div><div class="exam-tip-box"><p><strong>UPSC Insight:</strong> Understand the distinction between the new <strong>INR swap window</strong> and the continuing <strong>USD/Euro swap window</strong>. Note their respective corpuses and strategic objectives for potential questions in <strong>GS Paper III (Economy)</strong>.</p></div>

💡 Key Takeaways

- •RBI's new framework (2024-27) introduces an INR swap window and continues USD/Euro swaps.

- •INR swap window has a corpus of Rs. 250 billion, designed for rupee liquidity and concessions.

- •USD/Euro swap window maintains an overall corpus of USD 2 billion for foreign currency support.

- •These swap arrangements are key tools for RBI in managing liquidity, exchange rate stability, and financial resilience.

- •The INR swap aims to promote rupee internationalization and facilitate regional trade.

🧠 Memory Techniques

98% Verified Content