SEBI Introduced Specialised Investment Funds (SIFs) - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

SEBI Introduced Specialised Investment Funds (SIFs)

Medium⏱️ 8 min read

economy

📖 Introduction

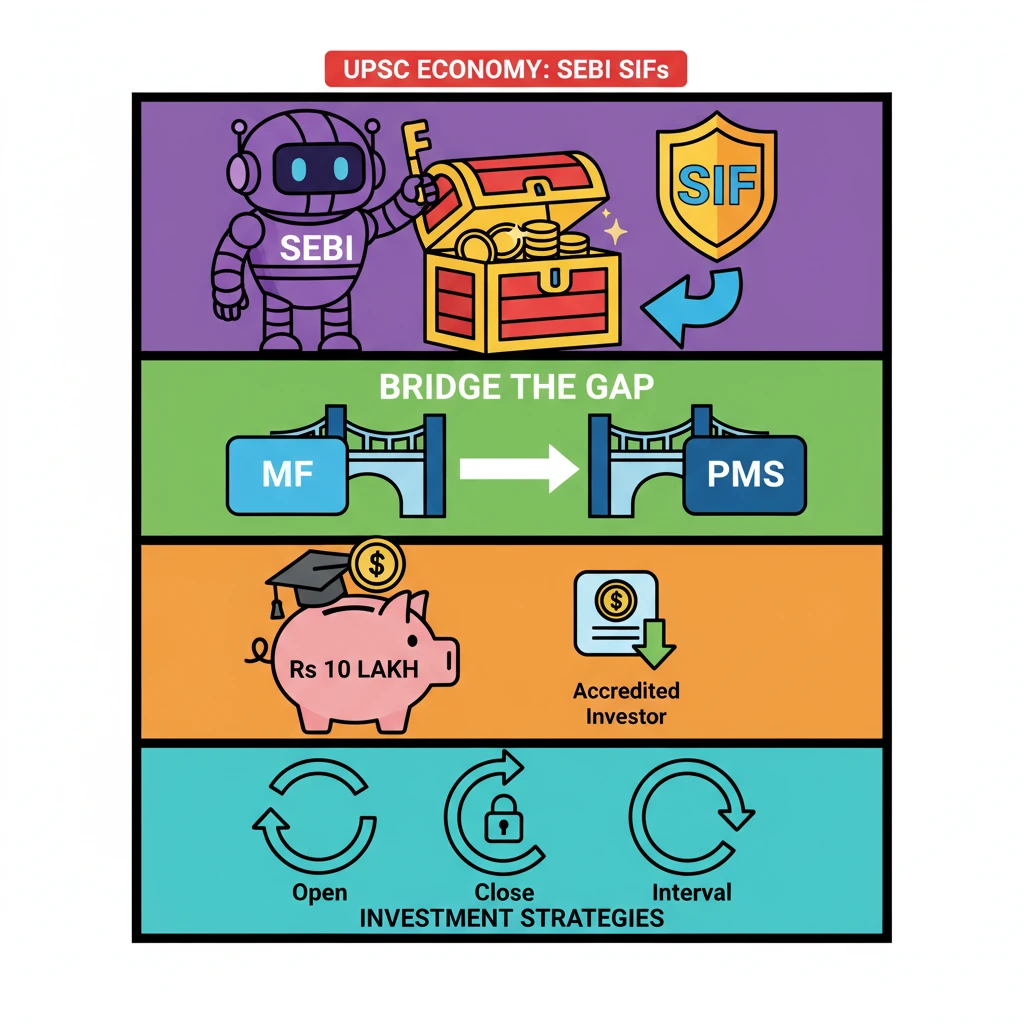

<h4>SEBI Introduces Specialised Investment Funds (SIFs)</h4><p>The <strong>Securities and Exchange Board of India (SEBI)</strong> has recently unveiled a new category of investment vehicles known as <strong>Specialised Investment Funds (SIFs)</strong>. This introduction aims to broaden the investment landscape for sophisticated investors in India.</p><div class='key-point-box'><p><strong>SIFs</strong> are specifically designed for <strong>informed investors</strong> who possess a higher risk appetite and are willing to engage in more complex and potentially higher-yielding investment opportunities.</p></div><h4>Bridging the Investment Gap</h4><p><strong>SIFs</strong> are strategically positioned to bridge the existing gap between traditional <strong>Mutual Funds (MFs)</strong> and bespoke <strong>Portfolio Management Services (PMS)</strong>. They offer a middle ground, combining elements of both to cater to a specific segment of the market.</p><p>While <strong>Mutual Funds</strong> are generally accessible to retail investors with diverse risk profiles, <strong>PMS</strong> offers highly customized portfolios for high-net-worth individuals. <strong>SIFs</strong> provide a structured yet flexible alternative for those seeking specialized strategies.</p><h4>Investment Requirements and Strategies</h4><p>To invest in a <strong>Specialised Investment Fund</strong>, a minimum investment of <strong>Rs 10 lakh</strong> is typically required. This threshold ensures that only investors with substantial capital and understanding participate.</p><div class='info-box'><p><strong>Lower Thresholds for Accredited Investors:</strong> For <strong>accredited investors</strong>, SEBI may allow for lower minimum investment thresholds, acknowledging their expertise and financial capacity.</p></div><p><strong>SIFs</strong> will offer a variety of investment strategies to suit different market conditions and investor preferences. These include <strong>open-ended</strong>, <strong>close-ended</strong>, and <strong>interval investment strategies</strong>, providing flexibility in liquidity and fund structure.</p><h4>Understanding Asset Classes</h4><p>An <strong>asset class</strong> refers to a group of investments that share similar financial characteristics and are typically governed by the same regulations. Understanding different asset classes is fundamental to portfolio diversification.</p><div class='info-box'><p><strong>Definition:</strong> An <strong>asset class</strong> is a category of investments with similar risk and return characteristics, often subject to common regulatory frameworks.</p></div><p>Examples of common <strong>asset classes</strong> include <strong>equities (stocks)</strong>, <strong>fixed income (bonds)</strong>, <strong>cash and cash equivalents</strong>, <strong>real estate</strong>, <strong>commodities</strong>, and <strong>currencies</strong>. <strong>SIFs</strong> can potentially invest across these, or specialize in particular ones.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Differentiate between various investment vehicles like <strong>Mutual Funds</strong>, <strong>PMS</strong>, <strong>AIFs (Alternative Investment Funds)</strong>, and now <strong>SIFs</strong>. Focus on their target investors, minimum investment, and regulatory oversight under <strong>SEBI</strong>.</p></div>

💡 Key Takeaways

- •SEBI introduced Specialised Investment Funds (SIFs) for informed, risk-taking investors.

- •SIFs bridge the gap between Mutual Funds and Portfolio Management Services (PMS).

- •Minimum investment is Rs 10 lakh, with lower thresholds for accredited investors.

- •They offer open-ended, close-ended, and interval investment strategies.

- •An asset class is a group of investments with similar characteristics and regulations (e.g., equities, bonds, real estate).

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•SEBI (Securities and Exchange Board of India) official notifications and press releases (general knowledge of SEBI's role and regulations)

•Financial market news and analysis on investment funds in India