Insurance Sector in India - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Insurance Sector in India

Medium⏱️ 8 min read

economy

📖 Introduction

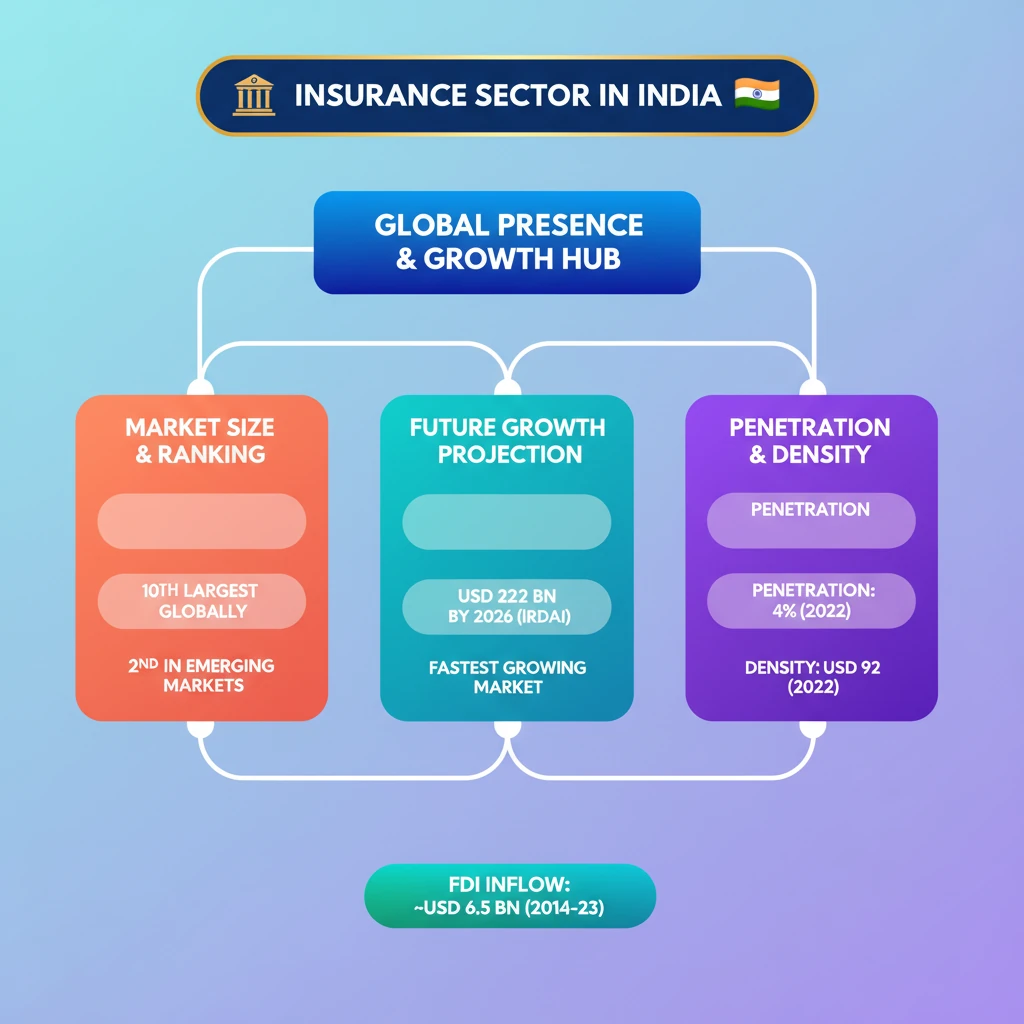

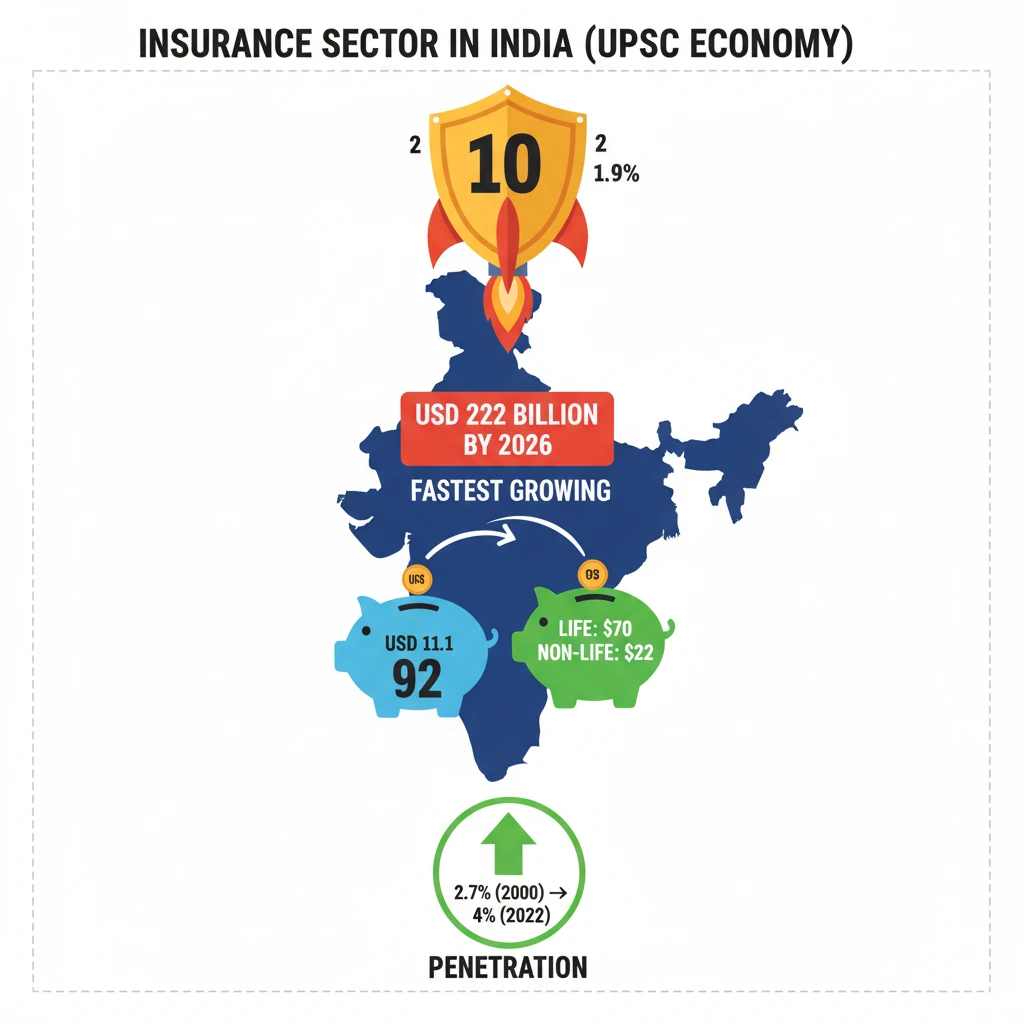

<h4>Introduction to India's Insurance Sector</h4><p>The <strong>Indian insurance sector</strong> is a dynamic and rapidly evolving industry. Recent discussions among heads of general insurance companies highlight both the existing challenges and the immense future potential within this crucial financial segment.</p><div class='key-point-box'><p>The insurance sector plays a vital role in India's economic stability, providing a safety net for individuals and businesses against various risks.</p></div><h4>Global Market Position</h4><p>India holds a significant position in the global insurance landscape. It is currently ranked as the <strong>10th largest insurance market worldwide</strong>.</p><p>Among emerging markets, India's standing is even more prominent, securing the <strong>2nd largest position</strong>. Its estimated global market share is approximately <strong>1.9%</strong>.</p><h4>Future Potential and Growth Trajectory</h4><p>The <strong>Insurance Regulatory and Development Authority of India (IRDAI)</strong> projects a robust future for the sector. India is anticipated to become the <strong>fastest-growing insurance market globally</strong> within the next decade.</p><div class='info-box'><p>This projected growth is expected to outpace developed economies such as <strong>Germany, Canada, Italy, and South Korea</strong>.</p></div><h4>Market Size Projection</h4><p>The overall size of the Indian insurance market is set for substantial expansion. It is projected to reach an impressive <strong>USD 222 billion by 2026</strong>.</p><h4>Understanding Insurance Density</h4><p><strong>Insurance density</strong> is a key metric that measures the average insurance premium per person in a country. It indicates the level of insurance penetration relative to the population's economic capacity.</p><div class='info-box'><p>India's insurance density has shown remarkable growth, increasing from <strong>USD 11.1 in 2001</strong> to <strong>USD 92 in 2022</strong>.</p><ul><li><strong>Life insurance density</strong> contributed <strong>USD 70</strong> to this figure.</li><li><strong>Non-life insurance density</strong> accounted for <strong>USD 22</strong>.</li></ul></div><h4>Understanding Insurance Penetration</h4><p><strong>Insurance penetration</strong> is another critical indicator, defined as the total insurance premiums as a percentage of a country's <strong>Gross Domestic Product (GDP)</strong>. It reflects the extent to which insurance is utilized within the economy.</p><div class='info-box'><p>India's insurance penetration has steadily improved, rising from <strong>2.7% in 2000</strong> to <strong>4% in 2022</strong>.</p></div><h4>Foreign Direct Investment (FDI) in Insurance</h4><p>The Indian insurance sector has attracted significant foreign capital, underscoring its appeal to international investors. <strong>Foreign Direct Investment (FDI)</strong> plays a crucial role in injecting capital and expertise into the industry.</p><div class='info-box'><p>Between <strong>2014 and 2023</strong>, the sector received nearly <strong>Rs. 54,000 crore (USD 6.5 billion)</strong> in FDI.</p></div><div class='exam-tip-box'><p>For UPSC, understanding the difference between <strong>insurance density</strong> and <strong>insurance penetration</strong>, along with their trends, is crucial for both <strong>Prelims (factual questions)</strong> and <strong>Mains (economic analysis)</strong>. Note the growth figures and India's global standing.</p></div>

💡 Key Takeaways

- •India is the 10th largest insurance market globally, 2nd among emerging markets, with 1.9% share.

- •Projected to be the fastest-growing insurance market by IRDAI, reaching USD 222 billion by 2026.

- •Insurance density increased from USD 11.1 (2001) to USD 92 (2022); life insurance at USD 70, non-life at USD 22.

- •Insurance penetration rose from 2.7% (2000) to 4% (2022).

- •Received ~Rs. 54,000 crore (USD 6.5 billion) in FDI between 2014-23.

- •Key metrics: Insurance density (premium per person) and Insurance penetration (premium as % of GDP).

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Insurance Regulatory and Development Authority of India (IRDAI) Annual Reports (general knowledge for figures and projections)