Opposition to NPS - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Opposition to NPS

Medium⏱️ 6 min read

economy

📖 Introduction

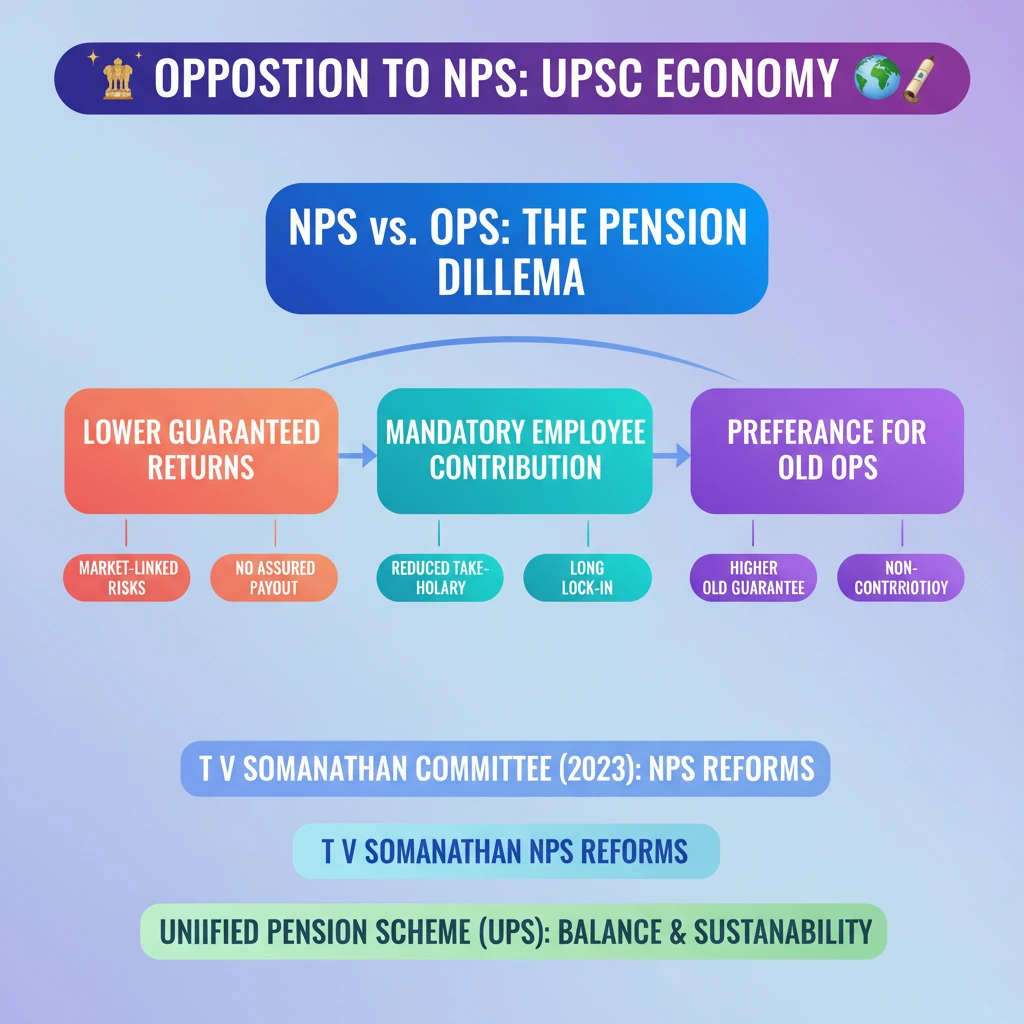

<h4>Introduction to National Pension System (NPS)</h4><p>The <strong>National Pension System (NPS)</strong> is a voluntary, defined contribution retirement savings scheme in India. It was designed to encourage individuals to save for their retirement.</p><p>Under <strong>NPS</strong>, individuals have the flexibility to choose from a range of <strong>schemes</strong>, select various <strong>pension fund managers</strong>, and invest their money through different <strong>private companies</strong>.</p><h4>Reasons for Opposition to NPS</h4><p>Opposition to the <strong>NPS</strong> primarily arose from government employees who perceived its benefits to be less favorable compared to the older pension system.</p><div class='key-point-box'><p>A major concern was that government employees under <strong>NPS</strong> received <strong>lower guaranteed returns</strong> on their pension investments.</p></div><p>Additionally, unlike the previous system, employees were required to make a <strong>personal contribution</strong> to their pension fund, which was a significant change.</p><h4>Comparison with Old Pension Scheme (OPS)</h4><p>The <strong>Old Pension Scheme (OPS)</strong> operated on a different principle, offering distinct advantages that fueled the demand for its return.</p><div class='info-box'><ul><li>Under <strong>OPS</strong>, there were <strong>no employee contributions</strong> required from government personnel.</li><li>The scheme provided <strong>higher guaranteed returns</strong>, ensuring a more predictable and secure post-retirement income.</li></ul></div><p>This contrast highlighted the perceived disadvantages of <strong>NPS</strong> for government employees, leading to widespread calls for a return to <strong>OPS</strong>.</p><h4>Government's Response: TV Somanathan Committee</h4><p>Amid persistent demands for a return to the <strong>OPS</strong>, the <strong>Union Government</strong> took action in <strong>2023</strong> to address the concerns.</p><p>A committee was established, led by <strong>TV Somanathan</strong>, to review the pension system and propose a viable way forward.</p><div class='exam-tip-box'><p>The <strong>TV Somanathan Committee</strong>, formed in <strong>2023</strong>, is a crucial point for UPSC aspirants to note when discussing pension reforms and fiscal policy.</p></div><h4>Introduction of Unified Pension Scheme (UPS)</h4><p>The recommendations put forth by the <strong>TV Somanathan Committee</strong> ultimately led to the introduction of a new framework.</p><p>This new framework has been termed the <strong>Unified Pension Scheme (UPS)</strong>, aiming to balance employee welfare with fiscal sustainability.</p><div class='highlight-box'><p>The <strong>Unified Pension Scheme (UPS)</strong> represents the government's latest effort to evolve the pension system, incorporating lessons from both <strong>NPS</strong> and <strong>OPS</strong> debates.</p></div>

💡 Key Takeaways

- •NPS allows individuals to choose schemes and fund managers, requiring employee contributions.

- •Opposition to NPS stems from lower guaranteed returns and mandatory employee contributions compared to OPS.

- •OPS offered higher guaranteed returns and no employee contributions, making it more attractive to employees.

- •The Union Government formed the TV Somanathan Committee in 2023 to review NPS.

- •The committee's recommendations led to the introduction of the new Unified Pension Scheme (UPS).

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reports on TV Somanathan Committee

•RBI Bulletins on State Finances and Pension Liabilities