IMPS Transactions Surge: February 2024 Data (Rs 5.58 Trillion) - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

IMPS Transactions Surge: February 2024 Data (Rs 5.58 Trillion)

Medium⏱️ 8 min read

economy

📖 Introduction

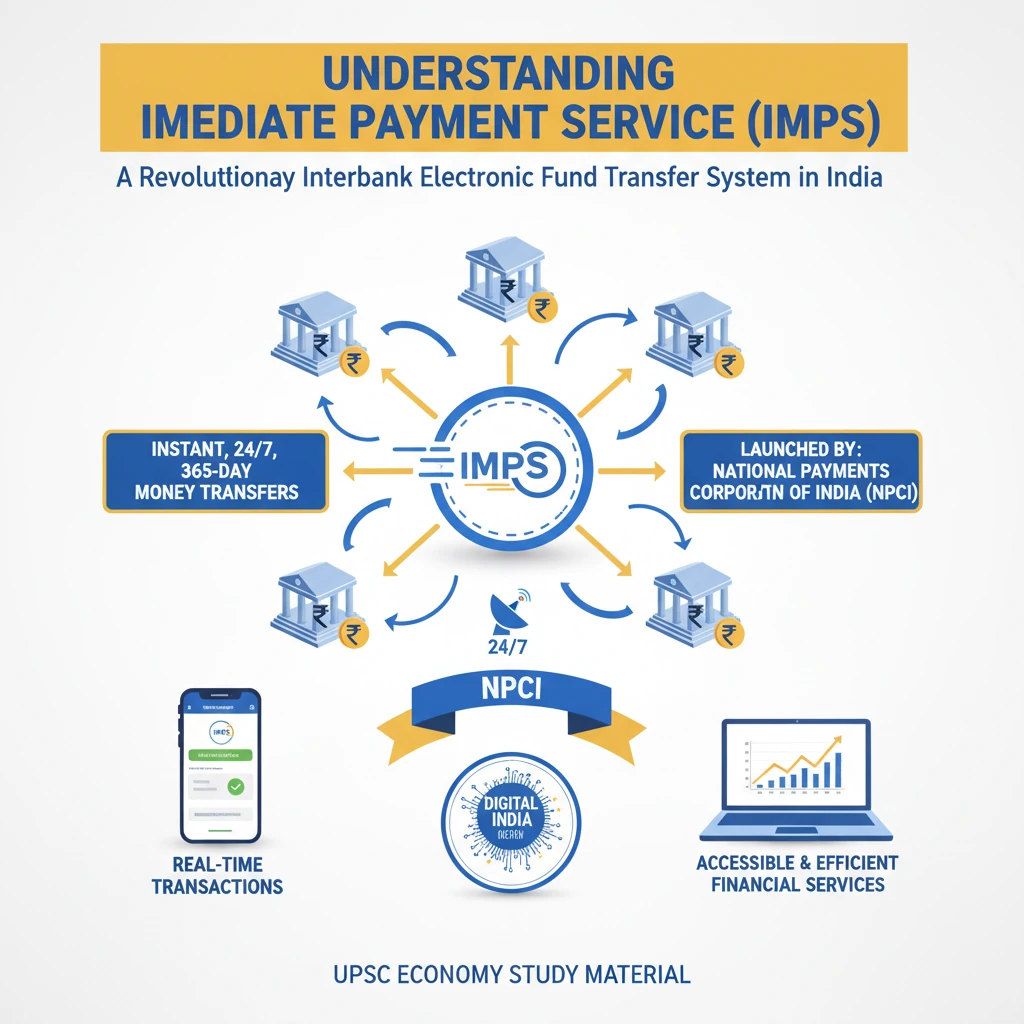

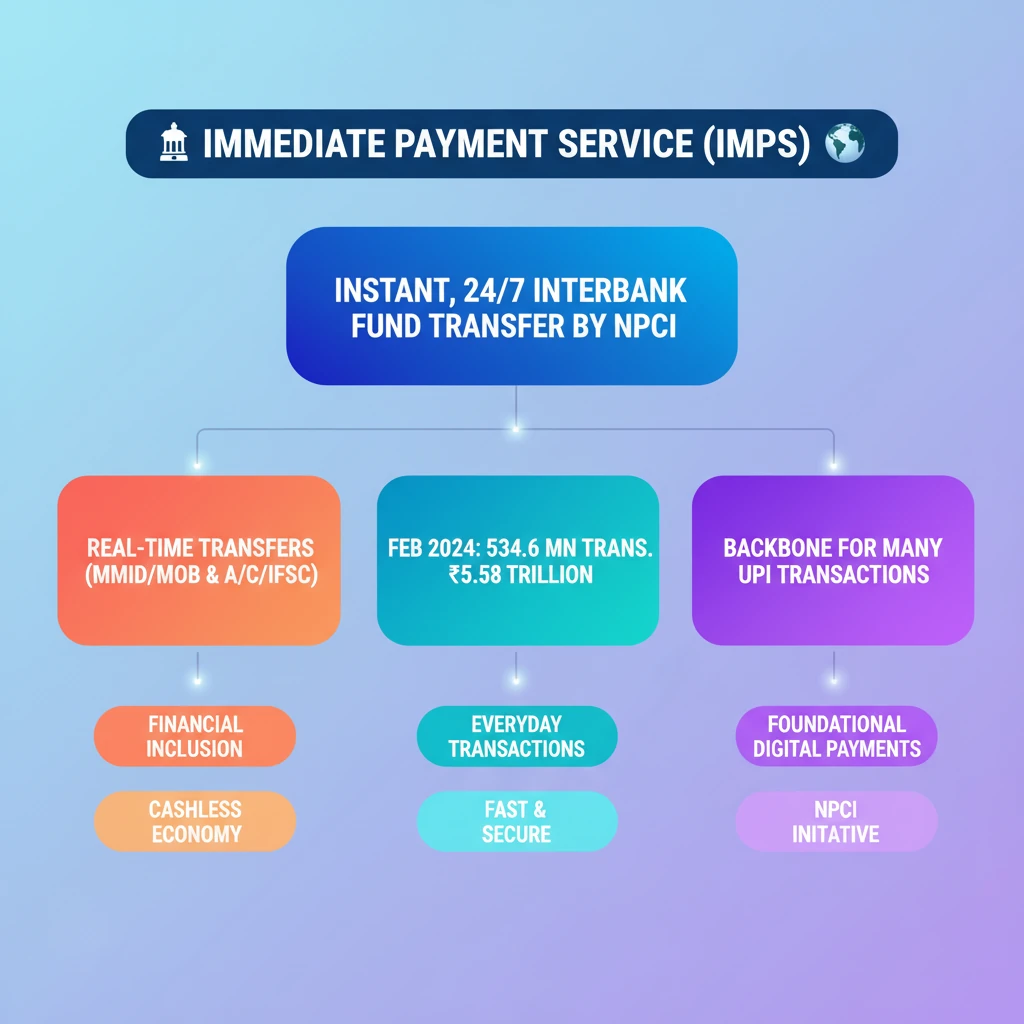

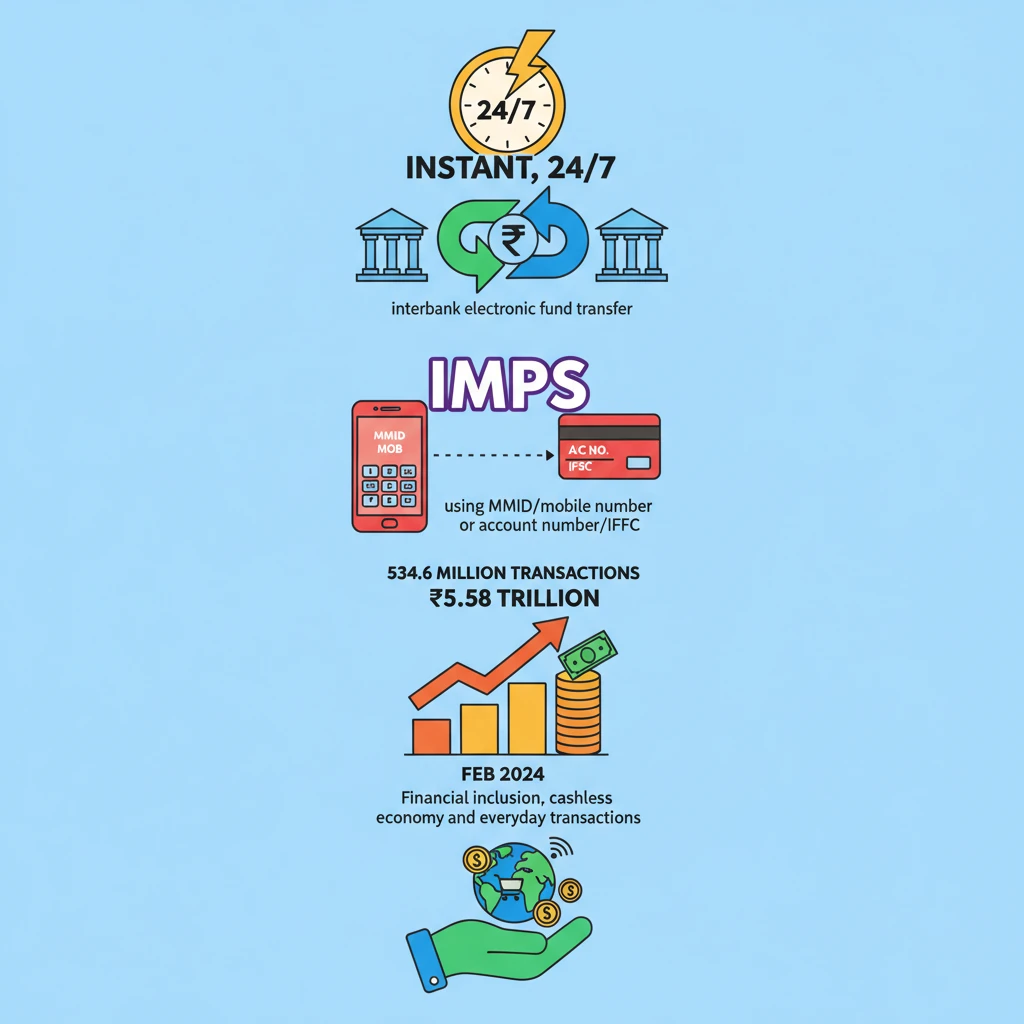

<h4>Understanding Immediate Payment Service (IMPS)</h4><p>The <strong>Immediate Payment Service (IMPS)</strong> is a revolutionary interbank electronic fund transfer system in India. It enables instant, 24/7, 365-day money transfers between bank accounts.</p><p>Launched by the <strong>National Payments Corporation of India (NPCI)</strong>, IMPS has become a cornerstone of India's digital payment ecosystem. It facilitates real-time transactions, making financial services more accessible and efficient.</p><div class='key-point-box'><p><strong>Key Features of IMPS:</strong></p><ul><li><strong>Instant Transfer:</strong> Funds are credited to the beneficiary's account immediately.</li><li><strong>24/7 Availability:</strong> Operates round the clock, including holidays.</li><li><strong>Interbank Transfers:</strong> Supports transactions across various participating banks.</li><li><strong>Mobile-Centric:</strong> Often accessed via mobile banking apps, SMS, or internet banking.</li></ul></div><h4>Performance Snapshot: February 2024</h4><p>IMPS continues to demonstrate robust growth and adoption across India. Its efficiency and accessibility contribute significantly to the volume of digital transactions.</p><div class='info-box'><p>In <strong>February 2024</strong>, IMPS recorded a substantial volume of transactions:</p><ul><li><strong>Total Transactions:</strong> 534.6 million</li><li><strong>Total Value:</strong> Rs 5.58 trillion</li></ul></div><p>These figures highlight the widespread reliance on IMPS for quick and secure fund transfers, underpinning its critical role in the economy.</p><h4>How IMPS Works</h4><p>IMPS transactions typically require the beneficiary's <strong>Mobile Money Identifier (MMID)</strong> and mobile number, or their bank account number and <strong>IFSC code</strong>. This flexibility makes it convenient for users.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understand IMPS not just as a service, but as a critical infrastructure. Its 24/7 availability and instant nature are key differentiators from systems like <strong>NEFT</strong> and <strong>RTGS</strong>, especially for retail payments. Questions often compare these systems.</p></div>

💡 Key Takeaways

- •IMPS is an instant, 24/7 interbank electronic fund transfer service by NPCI.

- •It enables real-time money transfers using MMID/mobile number or account number/IFSC.

- •In February 2024, IMPS recorded 534.6 million transactions worth Rs 5.58 trillion.

- •IMPS is crucial for financial inclusion and a cashless economy, supporting everyday transactions.

- •It forms the backbone for many UPI transactions, highlighting its foundational role in digital payments.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) annual reports and press releases

•Ministry of Finance reports on digital payments

•Press Information Bureau (PIB) releases regarding financial statistics