Microfinance Institutions - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Microfinance Institutions

Medium⏱️ 7 min read

economy

📖 Introduction

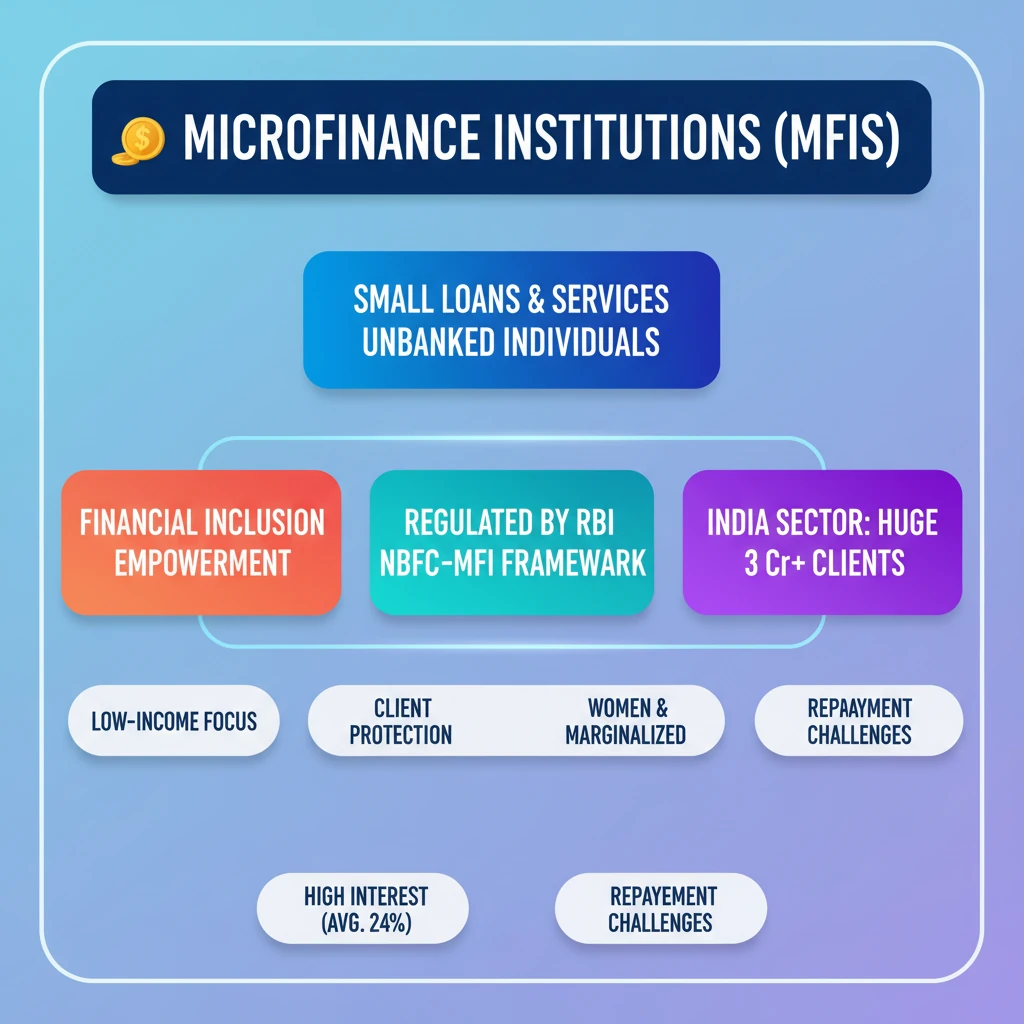

<h4>Introduction to Microfinance Institutions (MFIs)</h4><p>The <strong>Financial Services Secretary</strong> has highlighted the critical role of <strong>Microfinance Institutions (MFIs)</strong> in advancing <strong>financial inclusion</strong> across the country.</p><p>Despite their significant positive impact, the Secretary stressed the importance of <strong>avoiding reckless lending</strong> practices by these institutions to ensure sustainable growth.</p><h4>Understanding Microfinance Institutions</h4><div class='info-box'><p><strong>Definition:</strong> <strong>MFIs</strong> are financial companies that extend <strong>small loans</strong> and provide other financial services.</p><p>They cater specifically to individuals and groups who typically <strong>lack access to conventional banking facilities</strong>.</p></div><p>The primary objective of <strong>microfinance</strong> is to empower <strong>low-income</strong> and <strong>unemployed individuals</strong>, helping them achieve <strong>self-sufficiency</strong>.</p><p>MFIs serve as a vital instrument for <strong>financial inclusion</strong>, particularly benefiting <strong>marginalized groups</strong> and <strong>women</strong>, thereby fostering <strong>social equity</strong> and <strong>empowerment</strong>.</p><h4>Regulatory Framework for MFIs in India</h4><p>The <strong>Reserve Bank of India (RBI)</strong> is the primary regulator for <strong>MFIs</strong> in India, ensuring systematic operation and client protection.</p><p>Regulation is carried out under the <strong>NBFC-MFI framework</strong>, which was established in <strong>2014</strong> to formalize oversight.</p><div class='info-box'><p>The <strong>NBFC-MFI framework</strong> covers crucial aspects such as:</p><ul><li><strong>Client protection</strong> and borrower safeguards.</li><li>Ensuring <strong>privacy</strong> of clients' financial data.</li><li>Guidelines for transparent <strong>credit pricing</strong> and fee structures.</li></ul></div><h4>Current Status and Growth of MFIs in India</h4><p>The <strong>microfinance sector in India</strong> has experienced substantial growth, becoming a significant component of the financial landscape.</p><p>Currently, there are <strong>184 Microfinance Institutions (MFIs)</strong> operating across a wide geographical expanse in the country.</p><div class='info-box'><p><strong>Geographical Reach:</strong> MFIs are present in:</p><ul><li><strong>29 States</strong></li><li><strong>4 Union Territories</strong></li><li><strong>563 districts</strong></li></ul><p>These institutions collectively serve a vast client base of <strong>over 3 crore individuals</strong>, demonstrating their extensive outreach.</p></div><h4>Challenges and Scrutiny Faced by MFIs</h4><p>Many <strong>MFIs</strong> have come under scrutiny due to concerns regarding their lending practices, particularly concerning cost to borrowers.</p><p>One major issue is the charging of <strong>excessive interest rates</strong>, which average around <strong>24% per annum</strong>, making repayments challenging for the poor.</p><div class='key-point-box'><p>Concerns also include <strong>high processing fees</strong> and instances of <strong>non-compliance</strong> in accurately assessing borrowers’ income and repayment capacities, potentially leading to over-indebtedness.</p></div><p>A report by <strong>Sa-Dhan</strong> indicates that minor reductions in interest rates would not significantly alleviate the repayment burden for <strong>low-income households</strong>, suggesting deeper structural issues.</p><div class='exam-tip-box'><p>UPSC often asks about the <strong>challenges of financial inclusion</strong> and the role of various institutions. Understanding the dual role of MFIs – promoting inclusion while facing scrutiny – is crucial for a balanced answer in <strong>GS Paper III (Economy)</strong>.</p></div>

💡 Key Takeaways

- •MFIs provide small loans and financial services to low-income, unbanked individuals, promoting self-sufficiency.

- •Their core goal is financial inclusion, particularly empowering marginalized groups and women.

- •MFIs are regulated by the RBI under the 2014 NBFC-MFI framework, which covers client protection and credit pricing.

- •India's microfinance sector is significant, with 184 MFIs serving over 3 crore clients across 29 States and 4 UTs.

- •Key challenges include high interest rates (avg. 24%), high processing fees, and non-compliance in assessing borrower repayment capacity.

- •There is a crucial need to balance financial outreach with responsible lending practices and robust regulatory oversight.

🧠 Memory Techniques

100% Verified Content