What are the Provisions of the Unified Pension Scheme? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are the Provisions of the Unified Pension Scheme?

Medium⏱️ 8 min read

economy

📖 Introduction

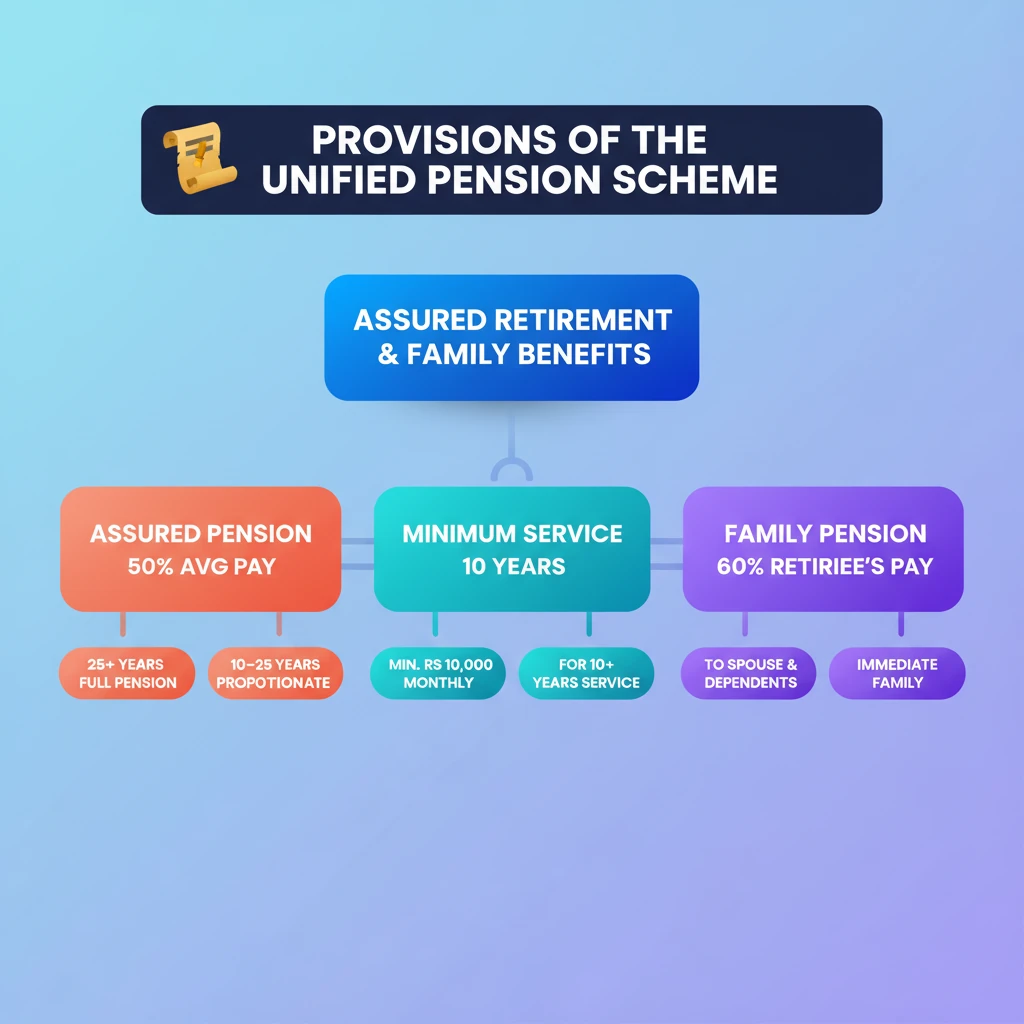

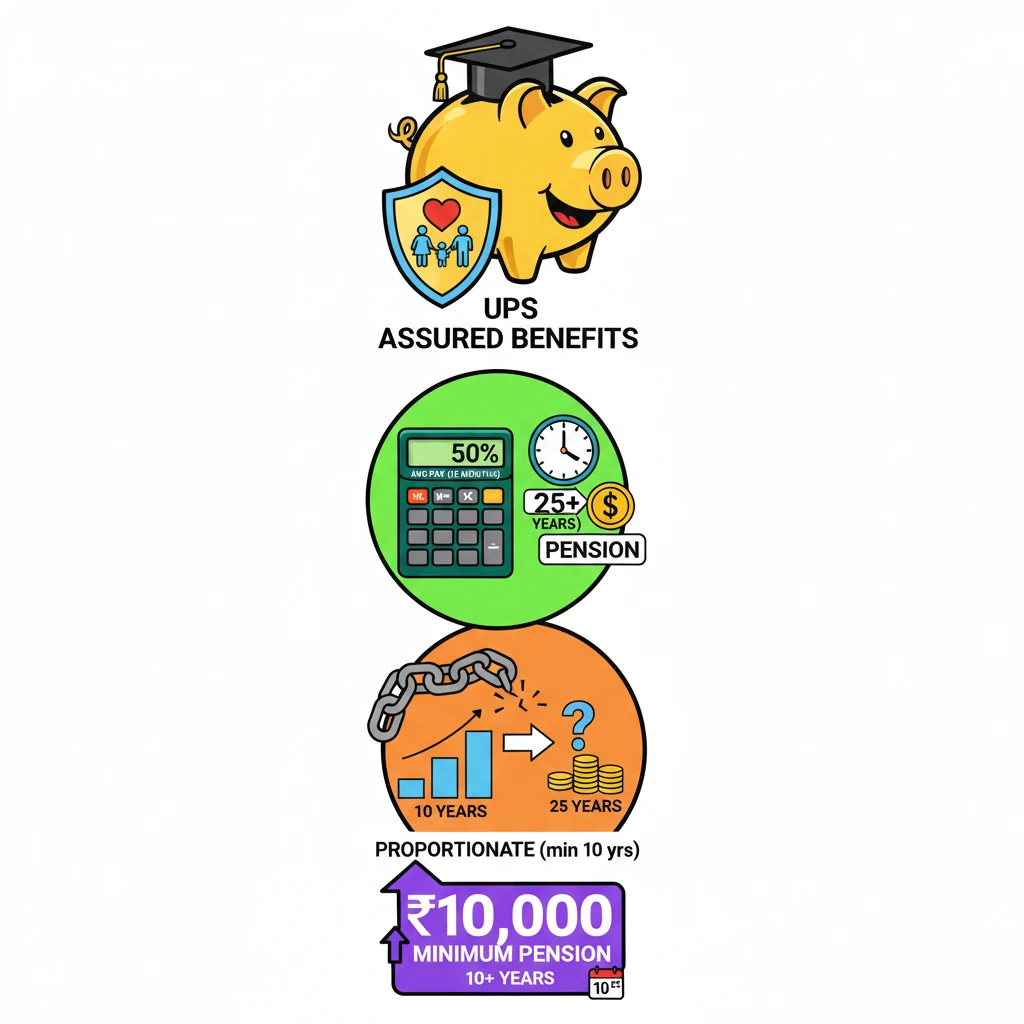

<h4>Understanding the Unified Pension Scheme</h4><p>The <strong>Unified Pension Scheme (UPS)</strong> is designed to provide comprehensive financial security to employees post-retirement and to their families in case of the retiree's demise. It aims to streamline pension benefits, ensuring a predictable income stream.</p><div class='key-point-box'><p>The UPS focuses on providing <strong>assured pension benefits</strong>, linking them to an employee's service period and last-drawn salary, while also incorporating inflation protection.</p></div><h4>Assured Pension Provision</h4><p>Under the UPS, an employee is guaranteed a pension amounting to <strong>50% of their average basic pay</strong>. This average is calculated over the <strong>last 12 months</strong> immediately preceding retirement.</p><p>This benefit is applicable for those with a minimum <strong>qualifying service of 25 years</strong>. It ensures a substantial portion of their working income continues into retirement.</p><div class='info-box'><p><strong>Calculation Basis:</strong> 50% of average <strong>basic pay</strong> from the last 12 months.</p><p><strong>Service Requirement:</strong> Minimum <strong>25 years</strong> of qualifying service.</p></div><p>For employees with a shorter service period, the pension amount will be reduced proportionally. However, there is a lower limit for eligibility.</p><p>The proportionate reduction applies for service periods down to a minimum of <strong>10 years of service</strong>, ensuring that even those with a shorter career span receive some benefit.</p><h4>Assured Minimum Pension</h4><p>The scheme also includes a provision for an <strong>Assured Minimum Pension</strong>, safeguarding retirees with shorter service durations.</p><p>If an employee retires after a minimum of <strong>10 years of service</strong>, they are eligible for a fixed minimum pension amount.</p><div class='info-box'><p><strong>Minimum Pension Amount:</strong> <strong>Rs 10,000 per month</strong>.</p><p><strong>Service Requirement:</strong> Minimum <strong>10 years</strong> of service.</p></div><p>This provision acts as a crucial social safety net, ensuring a basic standard of living for retirees who might not qualify for the full assured pension.</p><h4>Assured Family Pension</h4><p>The UPS extends its benefits to the immediate family of the retiree after their death, through the <strong>Assured Family Pension</strong> provision.</p><p>Upon the demise of a retiree, their eligible immediate family members become entitled to a portion of the pension that the retiree was receiving.</p><div class='info-box'><p><strong>Family Pension Rate:</strong> <strong>60% of the pension last drawn</strong> by the deceased retiree.</p><p><strong>Beneficiaries:</strong> Immediate family of the retiree.</p></div><p>This ensures continued financial support for the family, mitigating the economic impact of the loss of the primary pensioner.</p><h4>Inflation Indexation (Dearness Relief)</h4><p>To protect the purchasing power of pensioners against rising costs, the Unified Pension Scheme incorporates <strong>Inflation Indexation</strong>.</p><p>This is provided in the form of <strong>Dearness Relief (DR)</strong>, which is available on all three types of pensions mentioned above: Assured Pension, Assured Minimum Pension, and Assured Family Pension.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding <strong>Dearness Relief</strong> and its role in pension schemes is vital for questions on social security and government welfare measures in <strong>GS Paper 2</strong> and <strong>GS Paper 3</strong>.</p></div><p><strong>Dearness Relief</strong> adjustments are made periodically, typically twice a year, to compensate for inflation and ensure the real value of the pension is maintained.</p>

💡 Key Takeaways

- •Unified Pension Scheme (UPS) offers assured retirement and family benefits.

- •Assured Pension: 50% of average basic pay (last 12 months) for 25+ years service.

- •Proportionate pension for 10-25 years service, with a minimum of 10 years required.

- •Assured Minimum Pension: Rs 10,000/month for 10+ years service.

- •Assured Family Pension: 60% of retiree's last drawn pension to immediate family.

- •Inflation Indexation (Dearness Relief) applies to all three pension types to protect purchasing power.

🧠 Memory Techniques

100% Verified Content