Government Securities - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Government Securities

Medium⏱️ 8 min read

economy

📖 Introduction

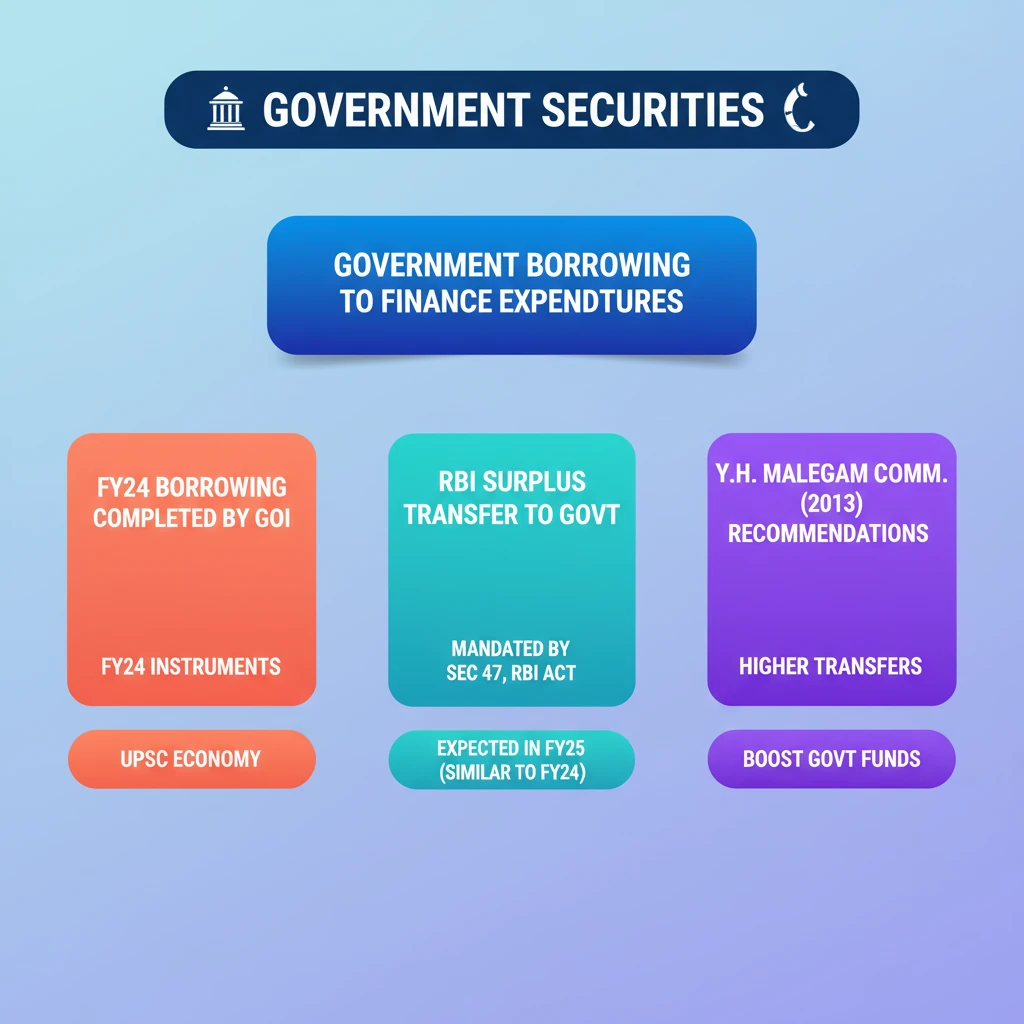

<h4>Current Status of Government Securities Borrowing</h4><p>The <strong>Government of India</strong> has successfully completed its <strong>Government Securities (G-Sec) borrowing</strong> program for the <strong>fiscal year 2023-24</strong>.</p><p>This completion indicates that the government has raised the necessary funds from the market through the issuance of these securities for the current fiscal period.</p><h4>Expected RBI Dividend to Government</h4><p>The government anticipates receiving a significant <strong>dividend</strong> from the <strong>Reserve Bank of India (RBI)</strong> in the upcoming <strong>Financial Year 25 (FY25)</strong>.</p><p>This expectation is based on a similar transfer that occurred in the previous <strong>Financial Year 24 (FY24)</strong>, providing crucial non-tax revenue to the government.</p><div class='key-point-box'><p><strong>RBI's dividend</strong> is a vital source of non-tax revenue for the government, directly impacting its fiscal position and expenditure capacity.</p></div><h4>Legal Framework for RBI Surplus Transfer</h4><p>The mechanism for the <strong>RBI</strong> to transfer its surplus funds to the <strong>Government of India</strong> is governed by specific provisions of the law.</p><p>This transfer is explicitly outlined under <strong>Section 47</strong> of the <strong>Reserve Bank of India Act, 1934</strong>.</p><div class='info-box'><p><strong>Section 47, RBI Act, 1934:</strong> Mandates the <strong>RBI</strong> to transfer its net profits to the <strong>Central Government</strong> after making provisions for reserves and retained earnings.</p></div><h4>Y.H. Malegam Committee Recommendations</h4><p>In <strong>2013</strong>, a technical committee led by <strong>Y.H. Malegam</strong> reviewed the framework for <strong>RBI's surplus transfer</strong>.</p><p>The committee recommended that a higher amount of the <strong>RBI's surplus</strong> should be transferred to the <strong>government</strong>.</p><div class='exam-tip-box'><p>Remember the <strong>Y.H. Malegam Committee (2013)</strong> in the context of <strong>RBI's dividend policy</strong>. It's a key reference for policy discussions on central bank autonomy and government finances in <strong>UPSC GS Paper 3</strong>.</p></div><h4>Factors Determining RBI's Surplus</h4><p>The actual amount of surplus that the <strong>RBI</strong> transfers to the government is a function of its income and expenditures during a financial year.</p><p>Understanding these components is crucial to comprehending the variability of the dividend amount.</p><h5>Sources of RBI's Income:</h5><ul><li><strong>Interest on Securities:</strong> Earnings from holding government securities and other investments.</li><li><strong>Fees:</strong> Charges for various services provided to banks and the government.</li><li><strong>Profits from Foreign Exchange Transactions:</strong> Gains from buying and selling foreign currencies.</li><li><strong>Returns from Subsidiaries:</strong> Income generated by its wholly-owned subsidiaries like the <strong>Deposit Insurance and Credit Guarantee Corporation (DICGC)</strong>.</li></ul><h5>RBI's Expenditures:</h5><ul><li><strong>Costs for Printing Currency:</strong> Expenses incurred in printing banknotes and minting coins.</li><li><strong>Interest Payments:</strong> Interest paid on deposits from commercial banks.</li><li><strong>Staff Salaries:</strong> Wages and benefits for its employees.</li><li><strong>Operational Expenses:</strong> Day-to-day administrative and operational costs.</li><li><strong>Provisions for Contingencies:</strong> Funds set aside for unforeseen events and risks, including the <strong>Contingency Fund</strong> and <strong>Asset Development Fund</strong>.</li></ul>

💡 Key Takeaways

- •Government Securities (G-Secs) are key instruments for government borrowing to finance expenditures.

- •The Government of India completed G-Sec borrowing for FY 2023-24.

- •RBI is expected to transfer a dividend to the government in FY25, similar to FY24.

- •RBI's surplus transfer to the government is mandated by Section 47 of the RBI Act, 1934.

- •The Y.H. Malegam Committee (2013) recommended higher transfers of RBI's surplus to the government.

- •RBI's surplus is determined by its income (interest on securities, fees, forex profits) minus expenditures (printing currency, salaries, provisions).

- •RBI's dividend provides crucial non-tax revenue, impacting the government's fiscal deficit and overall borrowing needs.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India Act, 1934

•Reports of Y.H. Malegam Committee (2013)

•General economic news and analysis on RBI dividend and government finances