Cross-Border Payments: Wholesale vs. Retail - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Cross-Border Payments: Wholesale vs. Retail

Medium⏱️ 7 min read

economy

📖 Introduction

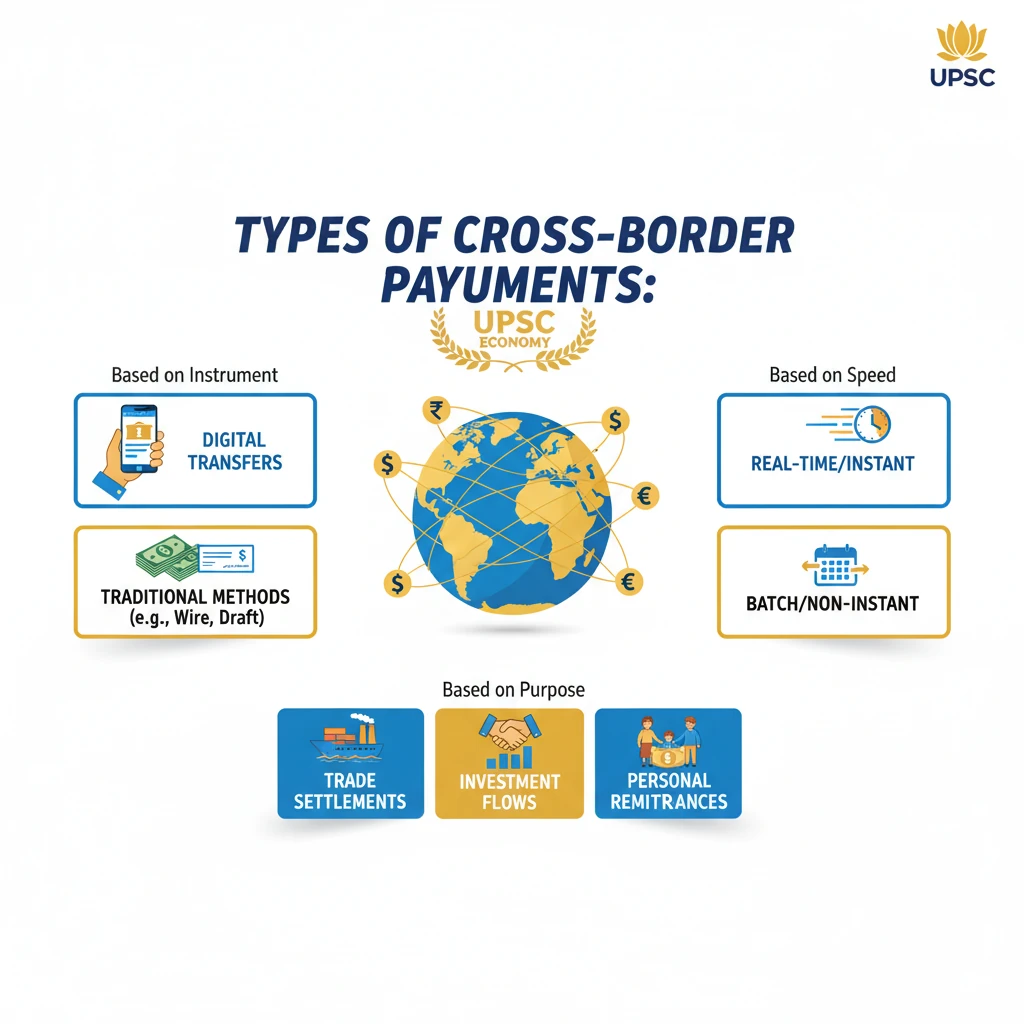

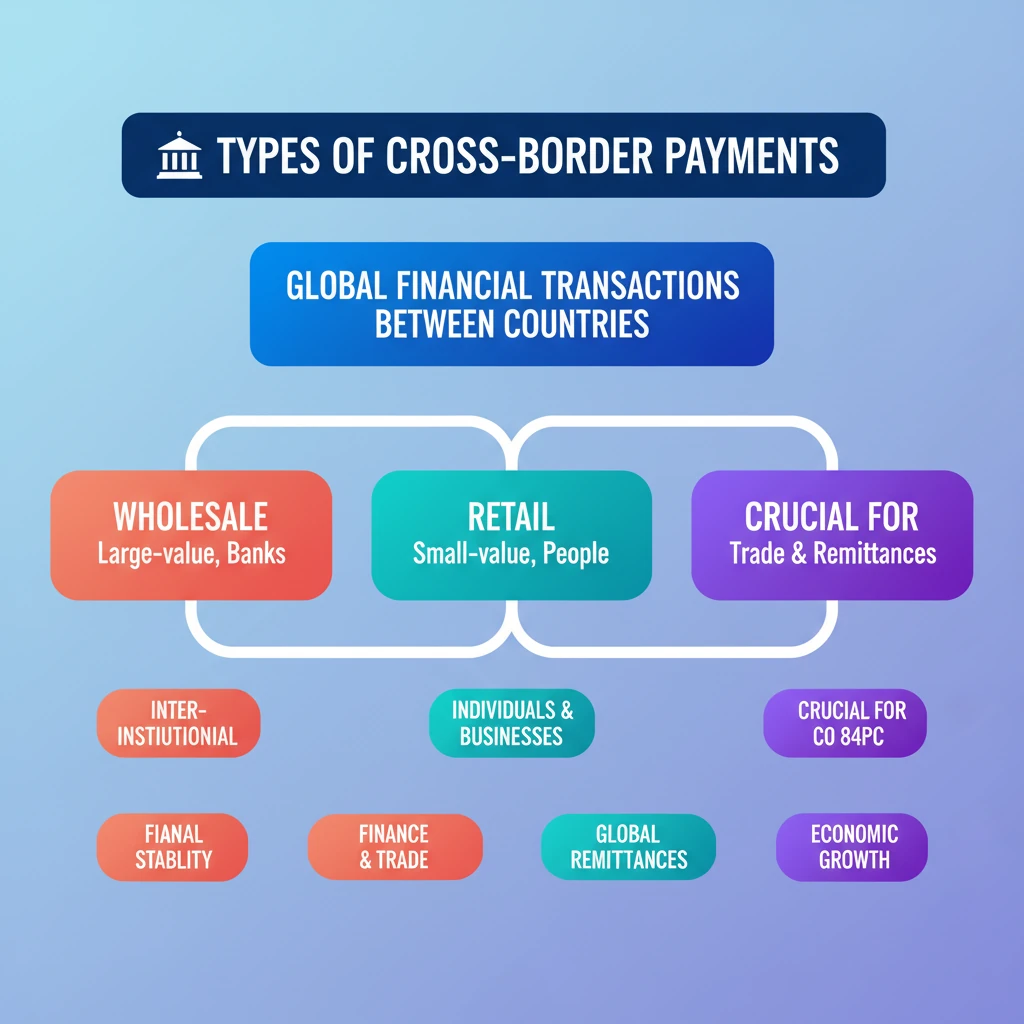

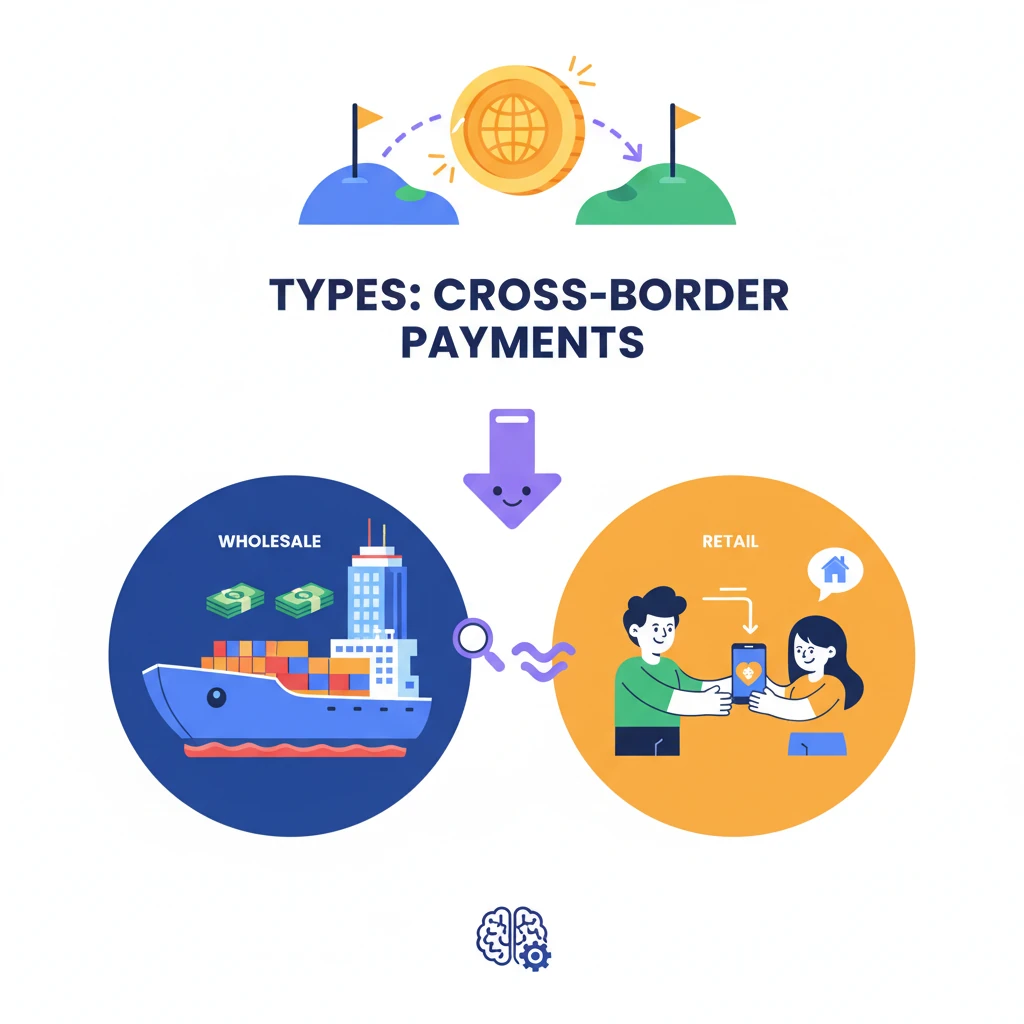

<h4>Introduction to Cross-border Payments</h4><p><strong>Cross-border payments</strong> refer to financial transactions where the payer and the payee are located in different countries. These payments are crucial for facilitating international trade, investment, and personal remittances, forming the backbone of the global economy.</p><p>The efficiency and security of these payment systems significantly impact economic growth and financial stability worldwide. Understanding their various types is fundamental for UPSC aspirants.</p><h4>Types of Cross-border Payments</h4><p>Cross-border payments can be broadly categorized into two main types based on the nature of the transaction and the parties involved: <strong>Wholesale Cross-border Payments</strong> and <strong>Retail Cross-border Payments</strong>.</p><div class='key-point-box'><p>The distinction primarily lies in the scale, participants, and purpose of the financial transaction across international borders.</p></div><h4>Wholesale Cross-border Payments</h4><p><strong>Wholesale Cross-border Payments</strong> typically involve large-value transactions between financial institutions. These payments are integral to the functioning of global financial markets and interbank operations.</p><div class='info-box'><ul><li><strong>Participants:</strong> Primarily <strong>financial institutions</strong> such as banks, central banks, and large corporations.</li><li><strong>Purpose:</strong> Used for activities like <strong>borrowing</strong>, <strong>lending</strong>, and <strong>trading</strong> in various financial instruments.</li></ul></div><p>These transactions facilitate operations in <strong>foreign exchange</strong>, <strong>equities</strong>, and <strong>commodities</strong> markets. They ensure liquidity and stability within the international financial system.</p><p>Furthermore, <strong>governments</strong> and <strong>large corporations</strong> utilize wholesale payment systems for significant transactions. This includes payments related to substantial <strong>imports</strong>, <strong>exports</strong>, and managing their financial market activities.</p><div class='exam-tip-box'><p>Understanding wholesale payments is crucial for topics like <strong>monetary policy</strong>, <strong>financial market regulation</strong>, and <strong>international finance</strong> in <strong>UPSC GS Paper 3</strong>.</p></div><h4>Retail Cross-border Payments</h4><p><strong>Retail Cross-border Payments</strong> generally involve smaller-value transactions carried out by individuals or businesses. These payments cater to everyday needs and commercial activities across borders.</p><div class='info-box'><ul><li><strong>Participants:</strong> Primarily <strong>individuals</strong> or <strong>businesses</strong>.</li><li><strong>Categories:</strong> Include <strong>person-to-person (P2P)</strong>, <strong>person-to-business (P2B)</strong>, and <strong>business-to-business (B2B)</strong> transactions.</li></ul></div><p>A prominent example of retail cross-border payments is <strong>remittances</strong>. These are funds sent by <strong>migrants</strong> back to their home countries, playing a vital role in the economies of many developing nations.</p><p>Other examples include online purchases from international vendors, subscription payments for global services, and small-scale business transactions between SMEs in different countries.</p>

💡 Key Takeaways

- •Cross-border payments are financial transactions between different countries, vital for the global economy.

- •They are categorized into Wholesale and Retail based on scale and participants.

- •Wholesale payments are large-value, inter-institutional transactions for finance and trade.

- •Retail payments are smaller-value, involving individuals or businesses, like remittances.

- •Efficient cross-border payments are crucial for global trade, remittances, and financial stability.

- •Modernization efforts aim for faster, cheaper, more transparent, and accessible systems.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) publications on Payment Systems

•Bank for International Settlements (BIS) reports on Cross-border Payments

•World Bank reports on Remittances