NITI Aayog Report on Seaweed Value Chain Development - Agriculture Allied Sector | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

NITI Aayog Report on Seaweed Value Chain Development

Medium⏱️ 8 min read

agriculture allied sector

📖 Introduction

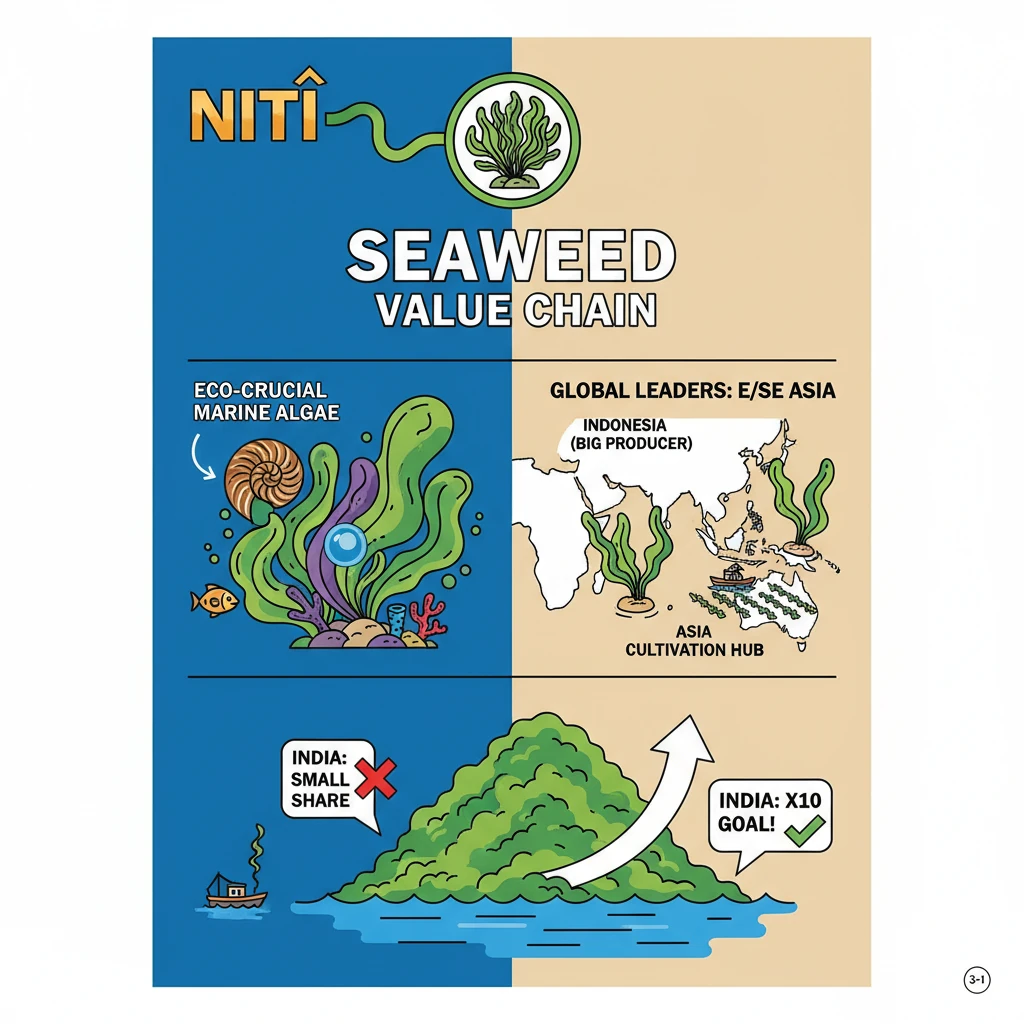

<h4>NITI Aayog's Initiative for Seaweed Development</h4><p>The <strong>NITI Aayog</strong> has published a comprehensive report titled “<strong>Strategy for the development of Seaweed Value Chain</strong>”. This report lays down a detailed roadmap to promote <strong>seaweed cultivation</strong> across India.</p><div class="exam-tip-box">This report highlights a key area of focus for the government in diversifying the agricultural and marine sectors, crucial for <strong>UPSC Mains GS-III (Agriculture, Economy, Environment)</strong>.</div><h4>Understanding Seaweeds: Definition and Ecology</h4><p><strong>Seaweeds</strong> are primitive, marine <strong>non-flowering algae</strong> that lack true roots, stems, and leaves. They play a fundamental role in marine ecosystems, contributing significantly to biodiversity and marine health.</p><div class="info-box"><strong>Key Characteristics of Seaweeds:</strong><ul><li><strong>Primitive Algae:</strong> Belong to the group of non-flowering marine algae.</li><li><strong>Basic Structure:</strong> No differentiated roots, stems, or leaves.</li><li><strong>Ecological Role:</strong> Form dense underwater forests (<strong>kelp forests</strong>) which serve as nurseries for fish, snails, and sea urchins.</li></ul></div><p>Common species found include <strong>Gelidiella acerosa</strong>, <strong>Gracilaria edulis</strong>, <strong>Gracilaria crassa</strong>, <strong>Gracilaria verrucosa</strong>, <strong>Sargassum spp.</strong>, and <strong>Turbinaria spp.</strong> Seaweeds are broadly classified into three main groups based on their pigmentation:</p><ul><li><strong>Green Algae (Chlorophyta)</strong></li><li><strong>Brown Algae (Phaeophyta)</strong></li><li><strong>Red Algae (Rhodophyta)</strong></li></ul><h4>Global Seaweed Production Scenario</h4><p>The global seaweed industry is a significant marine economic activity. In <strong>2019</strong>, the total global seaweed production (combining cultivation and wild collection) reached approximately <strong>35.8 million tonnes</strong>.</p><div class="info-box"><strong>Global Production Snapshot (2019):</strong><ul><li><strong>Total Production:</strong> 35.8 million tonnes</li><li><strong>Wild Collection:</strong> 1.1 million tonnes</li><li><strong>Dominant Regions (Cultivation):</strong> Eastern and Southeastern Asia (account for 97.4% of global production).</li><li><strong>Dominant Regions (Wild Collection):</strong> Americas and Europe.</li><li><strong>Leading Producer Nation:</strong> <strong>Indonesia</strong>.</li><li><strong>Key Farmed Species:</strong> <strong>Kappaphycus alvarezii</strong> and <strong>Eucheuma denticulatum</strong> (27.8% of farmed production).</li></ul></div><p>The seaweed industry is projected to experience continued growth, with a Compound Annual Growth Rate (CAGR) of <strong>2.3%</strong> from <strong>2022 to 2030</strong>.</p><h4>Indian Seaweed Production and Economic Contribution</h4><p>India possesses substantial potential for seaweed cultivation, though its current contribution to global production is modest. Annually, India harvests approximately <strong>33,345 tonnes</strong> (wet weight) of seaweeds.</p><div class="info-box"><strong>Indian Seaweed Statistics:</strong><ul><li><strong>Annual Harvest:</strong> ~33,345 tonnes (wet weight) from natural beds.</li><li><strong>Primary Harvesting State:</strong> <strong>Tamil Nadu</strong>, involving around 5,000 families.</li><li><strong>Annual Revenue:</strong> Approximately <strong>Rs 200 crores</strong>.</li><li><strong>Global Share:</strong> Less than <strong>1%</strong> of global production.</li></ul></div><p>The Indian government aims to significantly increase the contribution of the allied sector to agriculture. The target is to raise the allied sector’s share of <strong>Gross Value Added (GVA)</strong> in agriculture to <strong>9% by 2024-25</strong>, up from 7.26% in 2018-19.</p><h4>Global Seaweed Trade Dynamics</h4><p>The global seaweed market is a thriving sector, valued at <strong>USD 9.9 billion in 2021</strong>. International trade in seaweed and its derivatives is dominated by a few key players.</p><div class="info-box"><strong>Major Trading Nations (2021):</strong><ul><li><strong>Key Exporters/Importers:</strong> China, Indonesia, the Philippines, the Republic of Korea, and Malaysia.</li><li><strong>Leading Exporter:</strong> <strong>Republic of Korea</strong> (over 30% market share).</li><li><strong>Leading Producer of Hydrocolloids:</strong> <strong>China</strong> (over 30% market share).</li></ul></div><p><strong>Hydrocolloids</strong> are thickening and gelling agents derived from various types of seaweed, widely used in food, pharmaceutical, and cosmetic industries.</p><h4>Major Seaweed Beds in India</h4><p>India's extensive coastline and island territories host abundant seaweed resources. These natural beds are crucial for both wild collection and potential cultivation expansion.</p><div class="info-box"><strong>Key Seaweed Resource Locations in India:</strong><ul><li><strong>Mainland Coasts:</strong> <strong>Tamil Nadu</strong> and <strong>Gujarat</strong>.</li><li><strong>Island Territories:</strong> <strong>Lakshadweep</strong> and the <strong>Andaman & Nicobar Islands</strong>.</li><li><strong>Specific Notable Beds:</strong> Mumbai, Ratnagiri, Goa, Karwar, Varkala, Vizhinjam, Pulicat (Tamil Nadu), Andhra Pradesh, and Chilka (Orissa).</li></ul></div><h4>Government Initiatives for Seaweed Development</h4><p>Recognizing the potential of the seaweed sector, the Indian government has launched several initiatives to promote its cultivation, processing, and commercialization.</p><ul><li><strong>Seaweed Mission (Launched 2021):</strong><p>This mission aims to <strong>commercialize seaweed farming and processing</strong>, focusing on value addition. It also seeks to expand cultivation along India’s extensive <strong>7,500-kilometre coastline</strong>.</p></li><li><strong>Pradhan Mantri Matsya Sampada Yojana (PMMSY):</strong><p>The government is leveraging the existing <strong>PMMSY</strong> scheme to promote seaweed cultivation across the country, integrating it into broader fisheries development goals.</p></li><li><strong>Commercialisation of Seaweed Products by ICAR-CMFRI:</strong><p>The <strong>Indian Council of Agricultural Research (ICAR) - Central Marine Fisheries Research Institute (CMFRI)</strong> has successfully commercialized two significant seaweed-based nutraceutical products:</p><ul><li><strong>Cadalmin<sup>TM</sup> Immunalgin extract (Cadalmin<sup>TM</sup> IMe)</strong></li><li><strong>Cadalmin<sup>TM</sup> Antihypercholesterolemic extract (Cadalmin<sup>TM</sup> Ace)</strong></li></ul></li></ul><div class="key-point-box">These initiatives underscore India's commitment to harnessing its marine resources for economic growth, livelihood generation, and nutritional security.</div>

💡 Key Takeaways

- •NITI Aayog has outlined a strategy for developing India's seaweed value chain.

- •Seaweeds are primitive marine algae crucial for marine ecosystems and biodiversity.

- •Globally, East and Southeast Asia dominate seaweed cultivation, with Indonesia as a major producer.

- •India currently harvests a small fraction of global seaweed but aims to significantly increase its contribution.

- •Seaweeds offer diverse applications in food, nutraceuticals, and industrial hydrocolloids.

- •Government initiatives like the Seaweed Mission and PMMSY are actively promoting seaweed cultivation.

- •Developing the seaweed sector can boost coastal livelihoods, economic growth, and environmental sustainability.

🧠 Memory Techniques

95% Verified Content