India’s Balance of Payments (BOP) - economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

India’s Balance of Payments (BOP)

Medium⏱️ 10 min read

economy

📖 Introduction

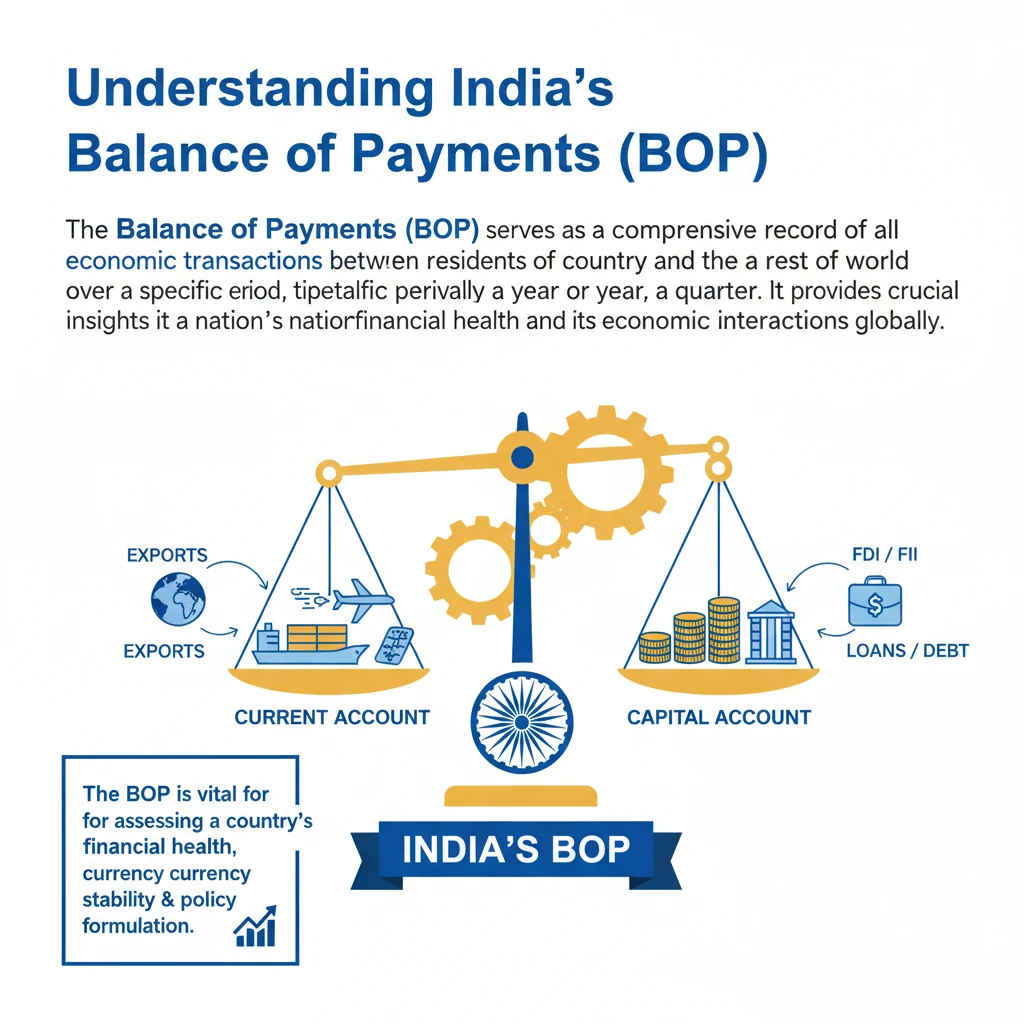

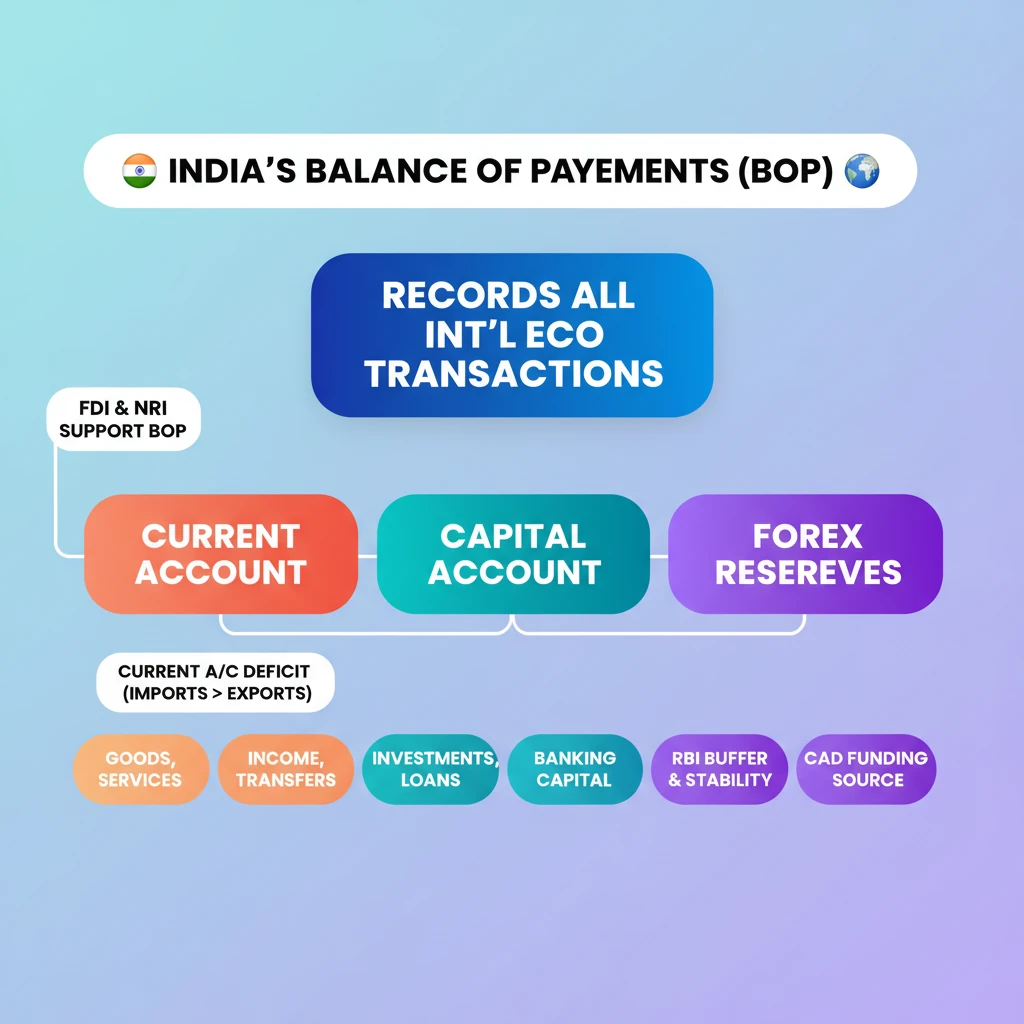

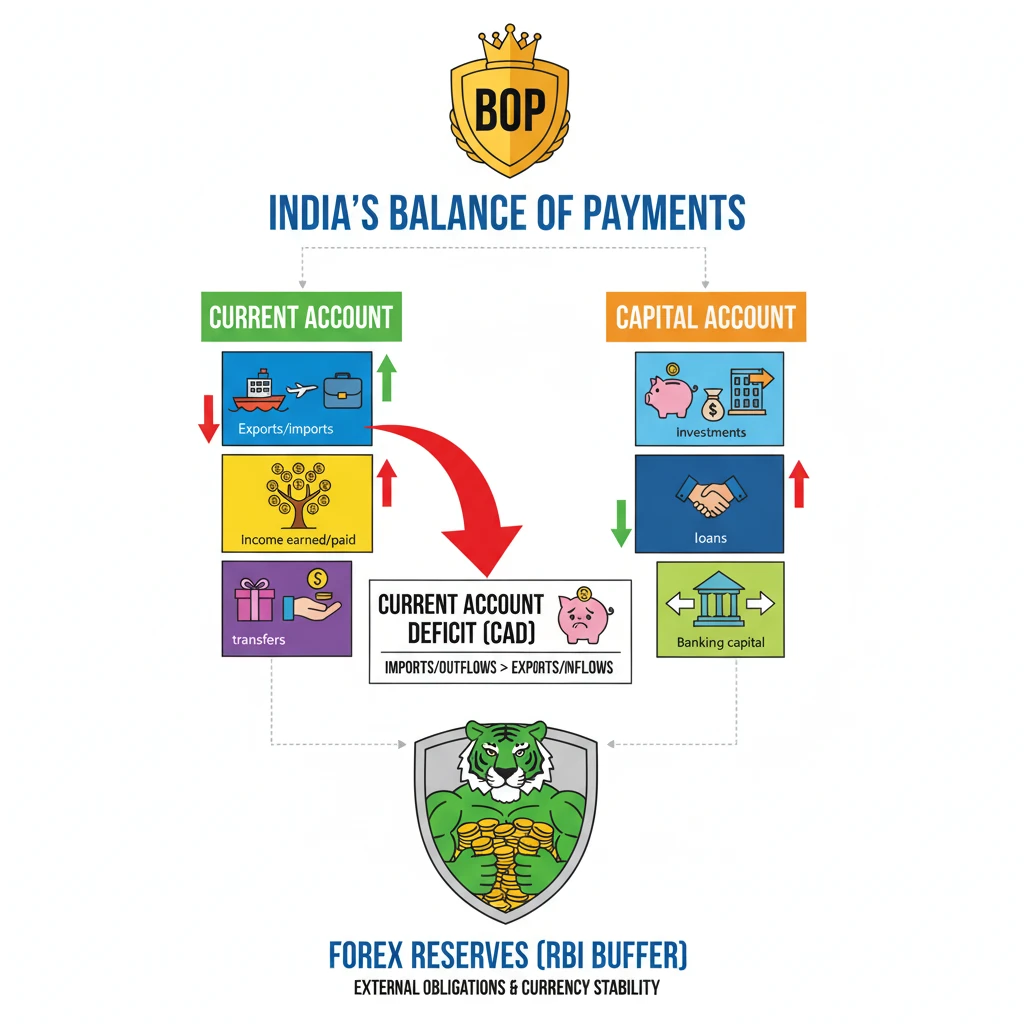

<h4>Understanding India's Balance of Payments (BOP)</h4><p>The <strong>Balance of Payments (BOP)</strong> serves as a comprehensive record of all <strong>economic transactions</strong> between residents of a country and the rest of the world over a specific period, typically a year or a quarter. It provides crucial insights into a nation's financial health and its economic interactions globally.</p><div class='key-point-box'><p>The <strong>BOP</strong> is vital for assessing a country's <strong>economic stability</strong>. It reflects the relative demand for its domestic currency against foreign currencies, directly influencing <strong>exchange rates</strong> and international trade dynamics.</p></div><h4>Recent Trends: India's Current Account Deficit (CAD)</h4><p>According to recent <strong>Reserve Bank of India (RBI) data</strong>, India's <strong>Current Account Deficit (CAD)</strong> experienced a marginal widening. In <strong>Q1 of 2025</strong>, the CAD stood at <strong>USD 9.7 billion</strong>, representing <strong>1.1% of GDP</strong>. This figure is a key indicator reflecting the overall status of India's <strong>Balance of Payments</strong>.</p><div class='info-box'><p>A <strong>Current Account Deficit (CAD)</strong> arises when the total value of <strong>goods and services imported</strong> by a country, along with <strong>net transfers and factor income outflows</strong>, exceeds the total value of its <strong>exports of goods and services</strong> and inflows.</p></div><h4>Key Constituents of BOP: Current Account</h4><p>The <strong>Balance of Payments (BOP)</strong> is primarily divided into two major components: the <strong>Current Account</strong> and the <strong>Capital Account</strong>. The <strong>Current Account</strong> records transactions that do not lead to a change in the country's assets or liabilities.</p><ul><li><strong>Merchandise Trade:</strong> This component covers the physical <strong>exports and imports of goods</strong>. The balance of merchandise trade, often referred to as the <strong>Balance of Trade</strong>, indicates whether a country is a net exporter or importer of physical goods. A deficit here suggests higher imports than exports.</li><li><strong>Invisibles:</strong> This broad category includes three sub-components:<ul><li><strong>Services:</strong> Encompasses trade in non-physical items like <strong>banking, insurance, IT services, tourism, and transport</strong>. India is often a net exporter in IT and related services.</li><li><strong>Factor Income:</strong> Refers to income generated from factors of production. This includes <strong>interest</strong> earned on foreign investments, <strong>compensation of employees</strong> working abroad (e.g., remittances from Indian workers), and <strong>dividends</strong> from investments in foreign assets.</li><li><strong>Transfers:</strong> These are one-way transactions, meaning they do not involve any quid pro quo. Examples include <strong>gifts, grants</strong> received or given, and crucial <strong>remittances</strong> sent by non-resident Indians (NRIs) to their families in India.</li></ul></li></ul><h4>Key Constituents of BOP: Capital Account</h4><p>The <strong>Capital Account</strong> reflects the net change in a nation's <strong>assets and liabilities</strong> over a specific period. It records all international transactions that involve the acquisition or disposal of financial assets and liabilities.</p><ul><li><strong>Foreign Investment:</strong> This is a significant driver of capital flows, reflecting investments that are essential for economic growth and stability. It includes:<ul><li><strong>Foreign Direct Investment (FDI):</strong> Long-term investments in physical assets and controlling stakes in domestic companies.</li><li><strong>Foreign Portfolio Investment (FPI):</strong> Short-term, liquid investments in stocks, bonds, and other financial assets.</li></ul></li><li><strong>Loans:</strong> This category covers various forms of international borrowing and lending, such as <strong>External Commercial Borrowings (ECBs)</strong> by Indian companies from foreign sources.</li><li><strong>Banking Capital:</strong> Includes transactions related to the banking sector, prominently featuring <strong>Non-Resident Indian (NRI) deposits</strong> held in Indian banks, which are a crucial source of foreign currency.</li></ul><div class='exam-tip-box'><p>For <strong>UPSC Mains (GS Paper III - Economy)</strong>, understanding the components of <strong>Current Account</strong> and <strong>Capital Account</strong> is crucial. Be prepared to analyze how different global events (e.g., oil price hikes, global recessions, interest rate changes) impact specific sub-components and the overall <strong>BOP</strong>.</p></div><h4>India's Forex Reserves: A Vital Cushion</h4><p><strong>Indian forex reserves</strong> are essential assets held by the <strong>Reserve Bank of India (RBI)</strong> primarily in foreign currencies. They act as a critical financial buffer for the nation.</p><div class='info-box'><p>These reserves ensure <strong>liquidity</strong> to meet external obligations, such as import payments and debt servicing. They also play a pivotal role in <strong>stabilizing the nation's currency</strong> (the Rupee) and the broader economy by allowing the RBI to intervene in the foreign exchange market.</p></div><p>The primary components of India's <strong>Forex Reserves</strong> include:</p><ul><li><strong>Foreign Currencies:</strong> Predominantly strong currencies such as the <strong>US Dollar, Euro, and British Pound</strong>. These provide the necessary liquidity for international trade and financial transactions.</li><li>Other components, though not detailed in the source, typically include <strong>Gold, Special Drawing Rights (SDRs)</strong>, and <strong>Reserve Tranche Position (RTP)</strong> with the IMF.</li></ul>

💡 Key Takeaways

- •<strong>Balance of Payments (BOP)</strong> records all international economic transactions of a country.

- •The two main components are the <strong>Current Account</strong> (goods, services, income, transfers) and <strong>Capital Account</strong> (investments, loans, banking capital).

- •A <strong>Current Account Deficit (CAD)</strong> occurs when imports and outflows exceed exports and inflows in the current account.

- •<strong>Forex Reserves</strong> held by the RBI act as a crucial buffer for external obligations and currency stability.

- •<strong>FDI</strong> and <strong>NRI remittances</strong> are significant sources of capital and current account inflows, respectively, supporting India's BOP.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Economic Survey of India (Ministry of Finance)

•International Monetary Fund (IMF) Reports on India

•Drishti IAS Economy Notes (provided source)