What is an Advance Pricing Agreement? - economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is an Advance Pricing Agreement?

Medium⏱️ 7 min read

economy

📖 Introduction

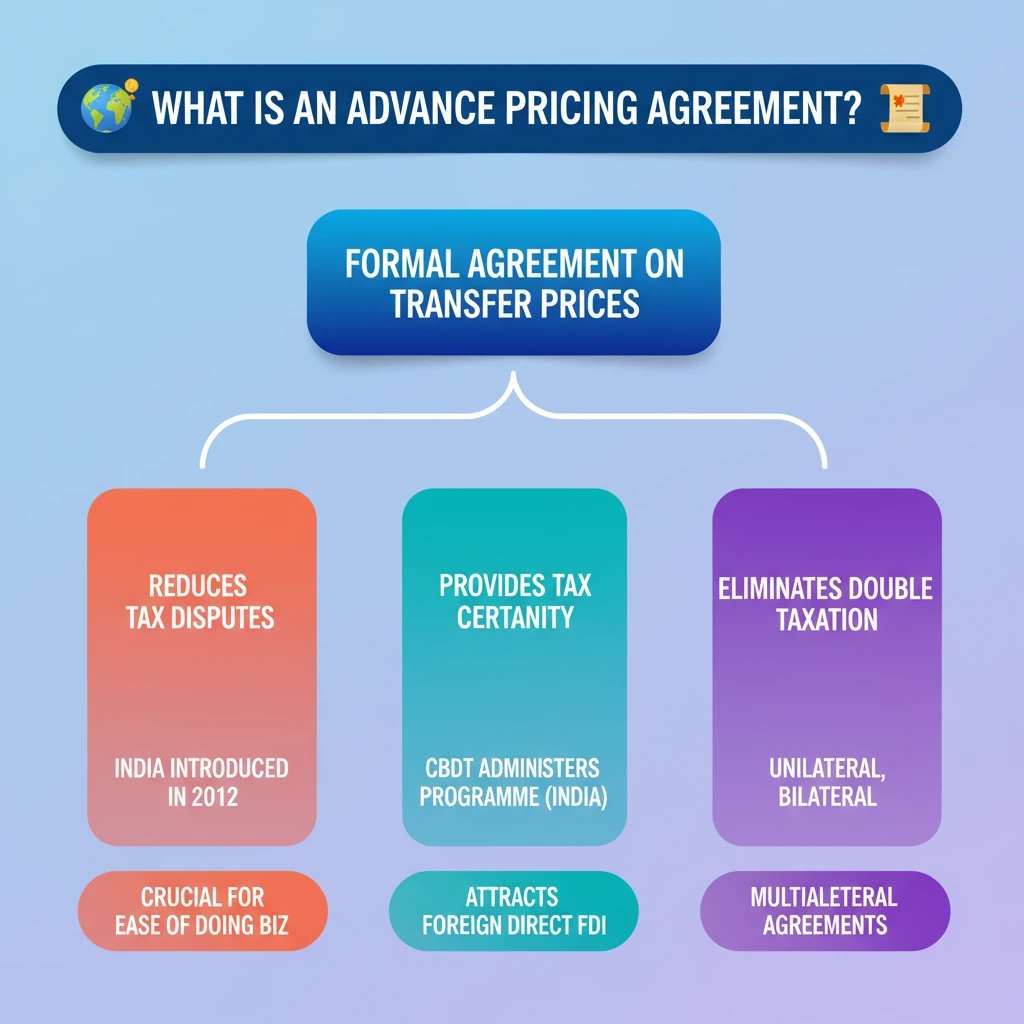

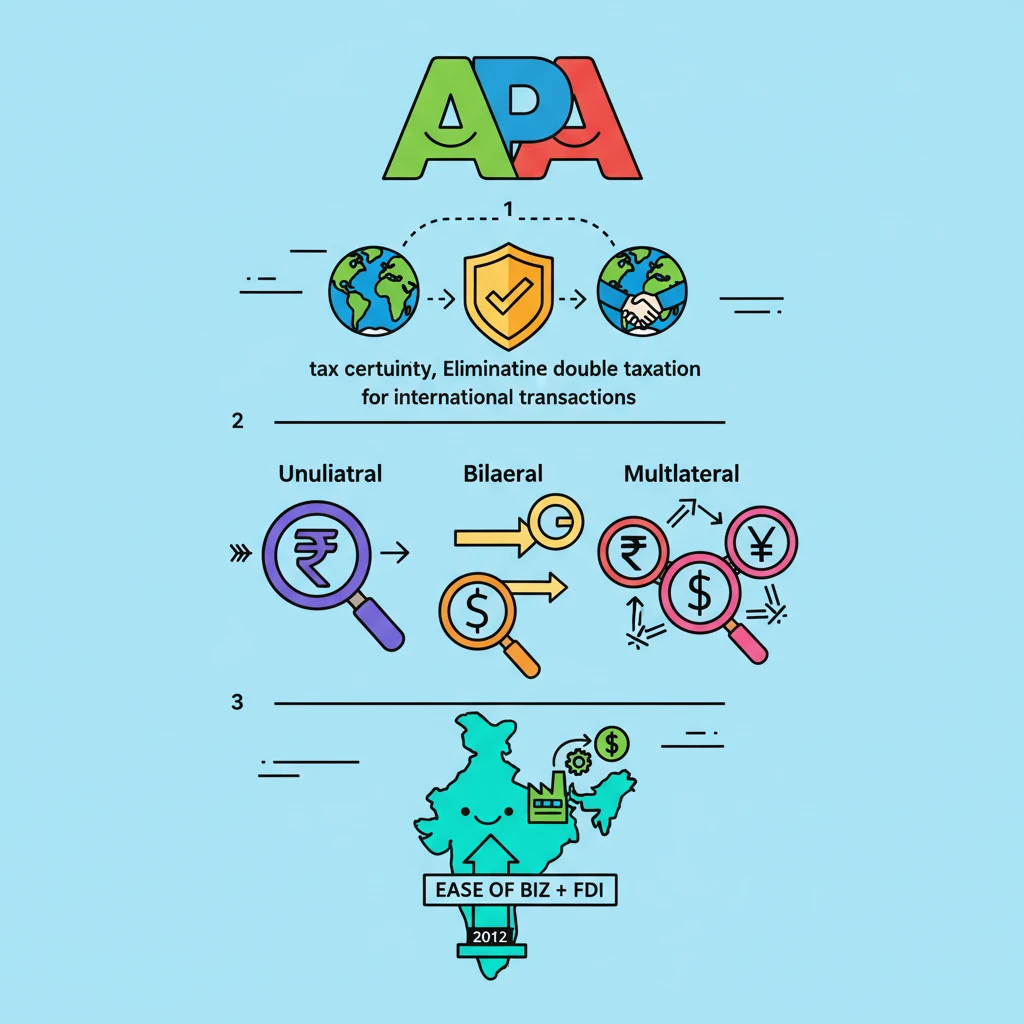

<h4>What is an Advance Pricing Agreement (APA)?</h4><p>An <strong>Advance Pricing Agreement (APA)</strong> is a formal, proactive arrangement established between a <strong>taxpayer</strong> and a <strong>tax authority</strong>. Its primary purpose is to determine the appropriate <strong>transfer prices</strong> or the methodology for calculating such prices for specific future international transactions.</p><div class='info-box'><p>An <strong>APA</strong> helps to provide certainty regarding the tax treatment of <strong>cross-border transactions</strong>. This reduces potential disputes and litigation between multinational enterprises (MNEs) and tax administrations.</p></div><h4>Key Benefits of APAs</h4><p>APAs are designed to allow businesses to significantly reduce the risk of their <strong>transaction prices</strong> being challenged by tax authorities. This creates a more predictable and stable tax environment for international business operations.</p><div class='key-point-box'><p>The <strong>APA programme</strong> has played a crucial role in India's mission to promote <strong>ease of doing business</strong>. It is particularly beneficial for <strong>Multinational Enterprises (MNEs)</strong> that engage in a large volume of <strong>cross-border transactions</strong> among their various group entities.</p></div><h4>Types of Advance Pricing Agreements</h4><p>APAs are categorized based on the number of tax authorities involved in the agreement. Each type offers different levels of protection and involves varying complexities in the negotiation process.</p><table class='info-table'><tr><th>APA Type</th><th>Description</th><th>Risk Mitigation</th><th>Complexity</th></tr><tr><td><strong>Unilateral APAs</strong></td><td>An agreement between the <strong>taxpayer</strong> and the <strong>tax authority</strong> of a single country (e.g., India).</td><td>Limits risks for transactions involving domestic entities or the domestic leg of an international transaction. Does <strong>not guarantee</strong> avoidance of <strong>double taxation</strong> for transactions with foreign entities.</td><td>Relatively less complex and faster proceedings as only one tax authority is involved.</td></tr><tr><td><strong>Bilateral APAs</strong></td><td>An agreement involving the <strong>taxpayer</strong> and the <strong>tax authorities</strong> of two countries (e.g., India and USA).</td><td>Limits risks for transactions between a <strong>domestic entity</strong> and a <strong>foreign entity</strong>. Crucially, they aim to <strong>eliminate the risk of double taxation</strong>.</td><td>Longer proceedings are typical, as agreement must be reached between two sovereign states' tax authorities.</td></tr><tr><td><strong>Multilateral APAs</strong></td><td>An agreement involving the <strong>taxpayer</strong> and the <strong>tax authorities</strong> of three or more countries.</td><td>Mitigates risks for complex transactions between related entities operating in <strong>three or more states</strong>. Provides comprehensive protection and ensures safety for all involved parties.</td><td>These are the most complex APAs, with the longest negotiation and proceeding times due to the involvement of multiple jurisdictions.</td></tr></table><div class='exam-tip-box'><p>Understanding the distinctions between <strong>Unilateral</strong>, <strong>Bilateral</strong>, and <strong>Multilateral APAs</strong> is vital for UPSC Mains, especially for questions related to <strong>international taxation</strong> and <strong>FDI policy</strong>. Focus on their scope and double taxation implications.</p></div><h4>Additional Financial Concepts from Source Material (Not Directly Related to APA)</h4><p>The provided source material included several points that appear to pertain to <strong>Non-Banking Financial Companies (NBFCs)</strong> or general financial regulations, rather than <strong>Advance Pricing Agreements</strong>. These points are retained here as per instruction but are presented separately for clarity.</p><ul><li><p><strong>Payment System Exclusion</strong>: Entities referenced (likely NBFCs) do not form part of the <strong>payment and settlement system</strong> and cannot issue cheques drawn on themselves.</p></li><li><p><strong>Licensing Requirements</strong>: The company must be registered under the <strong>Companies Act, 2013</strong>, either as a public or private company.</p></li><li><p><strong>Minimum Net Owned Fund</strong>: The company should have a minimum <strong>net owned fund</strong> of at least <strong>Rs. 10 crores</strong>.</p></li><li><p><strong>Credit Track Record</strong>: A good track record with <strong>CIBIL (Credit Information Bureau India Limited)</strong> is required.</p></li><li><p><strong>Regulatory Compliance</strong>: The company must comply with all regulations, norms, and guidelines prescribed under <strong>Capital Compliance</strong> and the <strong>Foreign Exchange Management Act (FEMA) laws</strong>.</p></li><li><p><strong>RBI Regulation</strong>: The <strong>RBI</strong> has powers under the <strong>RBI Act 1934</strong> to register, lay down policy, issue directions, inspect, regulate, supervise, and exercise surveillance over <strong>NBFCs</strong> that meet the <strong>50-50 criteria of principal business</strong>.</p></li></ul><div class='info-box'><p><strong>Demand Deposits</strong>: These refer to funds deposited in banks or financial institutions that can be withdrawn by the account holder on demand without any prior notice. They are highly liquid and accessible for day-to-day transactions, making them a preferred choice for individuals and businesses needing frequent access to their funds.</p></div>

💡 Key Takeaways

- •An Advance Pricing Agreement (APA) is a formal agreement between a taxpayer and tax authority on transfer prices for future international transactions.

- •APAs aim to reduce tax disputes, provide tax certainty, and eliminate the risk of double taxation for multinational enterprises (MNEs).

- •There are three types: Unilateral (one tax authority), Bilateral (two tax authorities, eliminates double taxation), and Multilateral (three or more tax authorities, most complex).

- •Introduced in India in 2012, APAs have been crucial for improving India's ease of doing business and attracting FDI.

- •The Central Board of Direct Taxes (CBDT) administers the APA programme in India.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Income Tax Act, 1961 (Sections 92CC and 92CD related to APAs)

•Central Board of Direct Taxes (CBDT) Annual Reports and Press Releases on APA Programme

•Ministry of Finance, Government of India publications on tax reforms

•OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations