Government Initiatives for MSMEs, Digital Payments & Financial Inclusion - economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Government Initiatives for MSMEs, Digital Payments & Financial Inclusion

Medium⏱️ 8 min read

economy

📖 Introduction

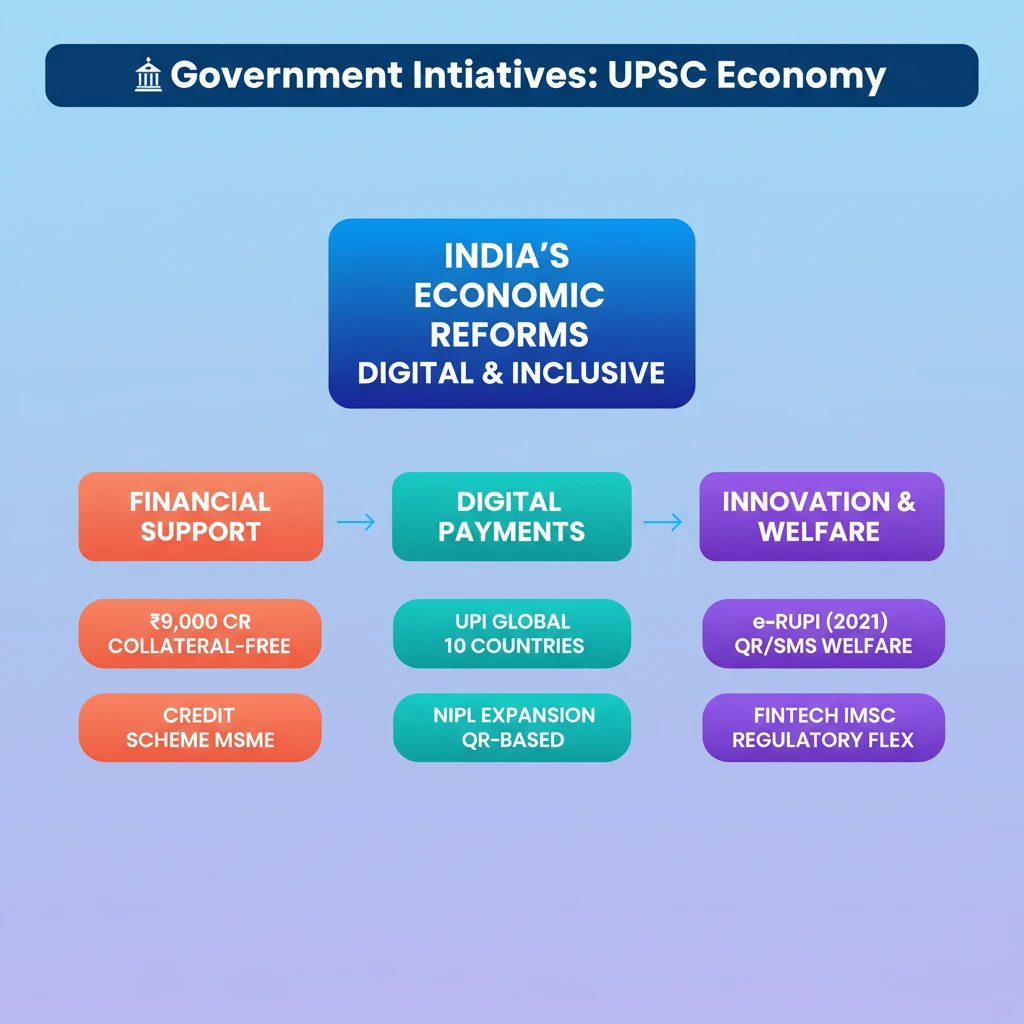

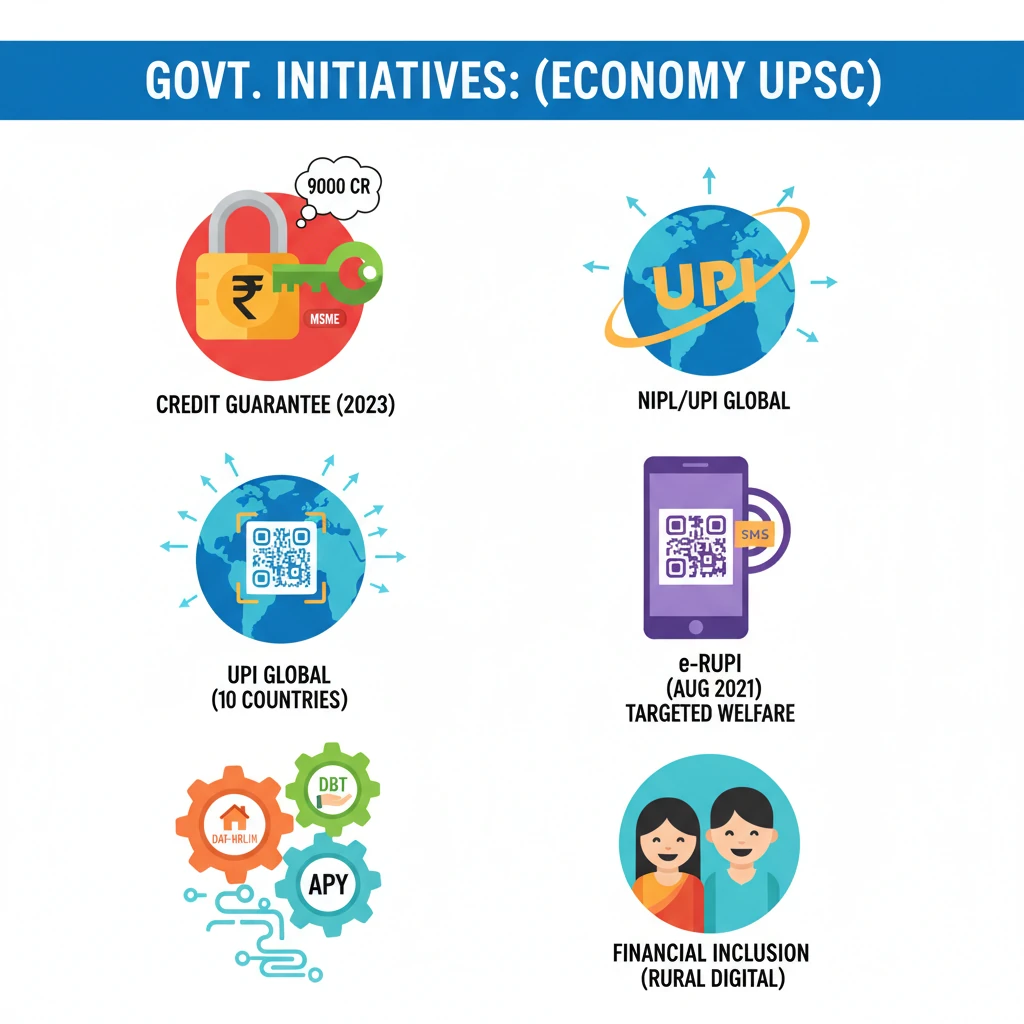

<h4>Credit Guarantee Scheme (CGS) Revamp</h4><p>The <strong>Credit Guarantee Scheme</strong> was significantly revamped in <strong>2023</strong>. This initiative aims to provide crucial financial backing to micro, small, and medium enterprises.</p><div class='info-box'><p>The revamp included an infusion of <strong>Rs 9,000 crore</strong>. This capital injection is designed to strengthen the scheme's capacity to support a larger number of MSMEs.</p></div><p>A primary objective of the CGS is to facilitate <strong>collateral-free loans</strong> for <strong>MSMEs</strong>. This reduces the burden on small businesses, enabling easier access to credit for growth and expansion.</p><h4>International Payments via NPCI International Payments (NIPL)</h4><p><strong>NPCI International Payments (NIPL)</strong>, the international arm of the National Payments Corporation of India, has been actively expanding its global footprint. This expansion is crucial for promoting India's indigenous payment technologies worldwide.</p><div class='info-box'><p>NIPL has forged a strategic partnership with <strong>Liquid Group</strong>. This collaboration is instrumental in enabling the use of <strong>QR-based UPI payments</strong> in multiple international markets.</p></div><p>The partnership extends <strong>UPI payment</strong> capabilities to <strong>10 countries</strong>. These nations include <strong>Malaysia, Thailand, Philippines, Vietnam, Singapore, Cambodia, South Korea, Japan, Taiwan, and Hong Kong</strong>, enhancing convenience for Indian travelers and businesses.</p><h4>e-RUPI: Digital Voucher System</h4><p><strong>e-RUPI</strong> represents a significant step towards a more efficient and targeted digital payment ecosystem in India. It was introduced to streamline welfare delivery and specific-purpose payments.</p><div class='info-box'><p>Launched in <strong>August 2021</strong>, <strong>e-RUPI</strong> functions as a <strong>digital payment solution</strong>. It operates primarily through <strong>QR codes</strong> or <strong>SMS strings</strong>, making it accessible even on basic mobile phones.</p></div><p>This system facilitates <strong>one-time payments</strong> for specific purposes. It ensures that funds are utilized for their intended objective, enhancing transparency and reducing leakages in welfare schemes.</p><h4>Accelerating Financial Inclusion</h4><p>Government programs have played a pivotal role in accelerating <strong>financial inclusion</strong> across India. These initiatives aim to bring a wider population, especially in rural areas, into the formal financial system.</p><div class='key-point-box'><p>Key programs driving this change include <strong>Deendayal Antyodaya Yojana - National Rural - Livelihoods Mission (DAY-NRLM)</strong>, <strong>Direct Benefit Transfer (DBT)</strong>, and <strong>Atal Pension Yojana (APY)</strong>.</p></div><p>These initiatives have significantly boosted the <strong>digital transition</strong>. They have enabled more citizens to access and utilize <strong>digital financial services</strong>, fostering economic empowerment.</p><h4>Inter-Ministerial Steering Committee (IMSC)</h4><p>To navigate the evolving landscape of financial technology, a dedicated committee was established. This body focuses on strategic oversight and policy coordination for fintech development.</p><div class='info-box'><p>The <strong>Inter-Ministerial Steering Committee (IMSC)</strong> was established in <strong>2018</strong>. It operates under the aegis of the <strong>Department of Economic Affairs (DEA)</strong>.</p></div><p>The IMSC's mandate includes addressing various <strong>fintech development issues</strong>. It also works to enhance <strong>regulatory flexibility</strong>, ensuring that regulations keep pace with technological advancements.</p><h4>Joint Working Groups (JWGs) for Fintech Collaboration</h4><p>International collaboration is vital for advancing fintech and digital payment systems. <strong>Joint Working Groups</strong> serve as a mechanism to foster such partnerships.</p><div class='key-point-box'><p>These <strong>JWGs</strong> are designed to promote <strong>fintech collaboration</strong> between India and other nations. They facilitate discussions and initiatives aimed at mutual growth and technological integration.</p></div><p>Their key functions include facilitating <strong>faster remittances</strong> and exploring direct connectivity. Specifically, they work on linking <strong>India’s UPI</strong> with various <strong>international payment platforms</strong>, simplifying cross-border transactions.</p>

💡 Key Takeaways

- •Credit Guarantee Scheme (2023 revamp) provides Rs 9,000 cr for collateral-free MSME loans.

- •NIPL expanded QR-based UPI payments to 10 countries, enhancing global digital transactions.

- •e-RUPI (Aug 2021) offers QR/SMS-based one-time digital payment solutions for targeted welfare.

- •Financial inclusion programs (DAY-NRLM, DBT, APY) accelerate digital transition for rural citizens.

- •IMSC (2018, DEA) addresses fintech development and regulatory flexibility.

- •Joint Working Groups foster fintech collaboration and UPI international connectivity.

🧠 Memory Techniques

95% Verified Content